- United States

- /

- Metals and Mining

- /

- NYSEAM:IDR

Undiscovered Gems In The US Market Featuring Three Promising Small Caps

Reviewed by Simply Wall St

As the U.S. stock market navigates renewed trade tensions with China, resulting in significant weekly losses for major indices, investors are increasingly turning their attention to small-cap stocks as potential opportunities amidst broader market volatility. In this climate, identifying promising small-cap companies can be crucial, as these often-overlooked gems may offer unique growth prospects and resilience despite economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 117.38% | 8.87% | 4.89% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| First Northern Community Bancorp | NA | 8.05% | 12.27% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| NameSilo Technologies | 14.73% | 14.50% | -1.32% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Power Solutions International (PSIX)

Simply Wall St Value Rating: ★★★★★★

Overview: Power Solutions International, Inc. designs, engineers, manufactures, markets, and sells engines and power systems globally with a market cap of approximately $1.97 billion.

Operations: PSIX generates revenue primarily from its Engineered Integrated Electrical Power Generation Systems, amounting to $597.49 million. The company's financial performance is influenced by its cost structure and market dynamics.

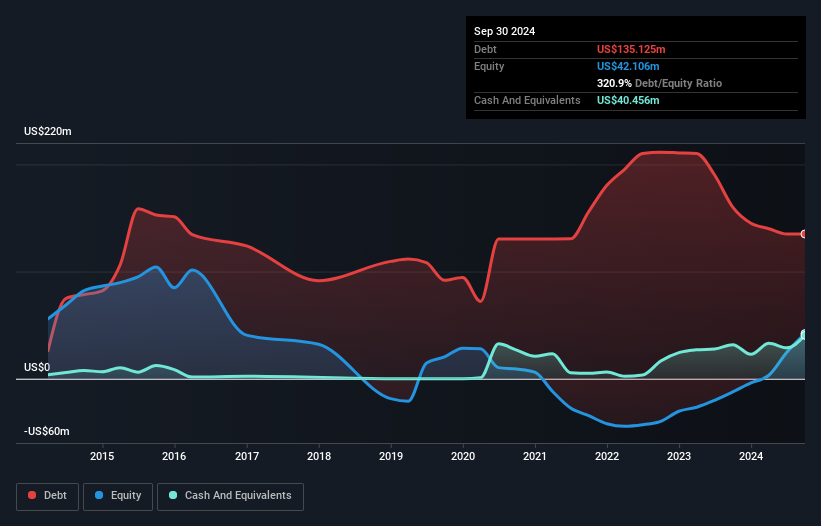

Power Solutions International (PSI) has been making waves with its impressive earnings growth of 147.5% over the past year, outpacing the Electrical industry's 7.5%. The company has also reduced its debt to equity ratio significantly from 1259.1% to a satisfactory 72.1% over five years, indicating improved financial health. Trading at a price-to-earnings ratio of 17.8x, PSI is considered good value compared to the US market's average of 18.5x. Recent strategic moves include a new agreement with HD Hyundai Infracore and an increase in borrowing capacity to $135 million through an amended credit agreement, enhancing financial flexibility and growth potential.

- Take a closer look at Power Solutions International's potential here in our health report.

Understand Power Solutions International's track record by examining our Past report.

Puma Biotechnology (PBYI)

Simply Wall St Value Rating: ★★★★★★

Overview: Puma Biotechnology, Inc. is a biopharmaceutical company that develops and commercializes products to enhance cancer care both in the United States and internationally, with a market cap of $257.90 million.

Operations: Puma Biotechnology generates revenue of $238.06 million from its cancer care products. The company's net profit margin trends provide insights into its financial performance.

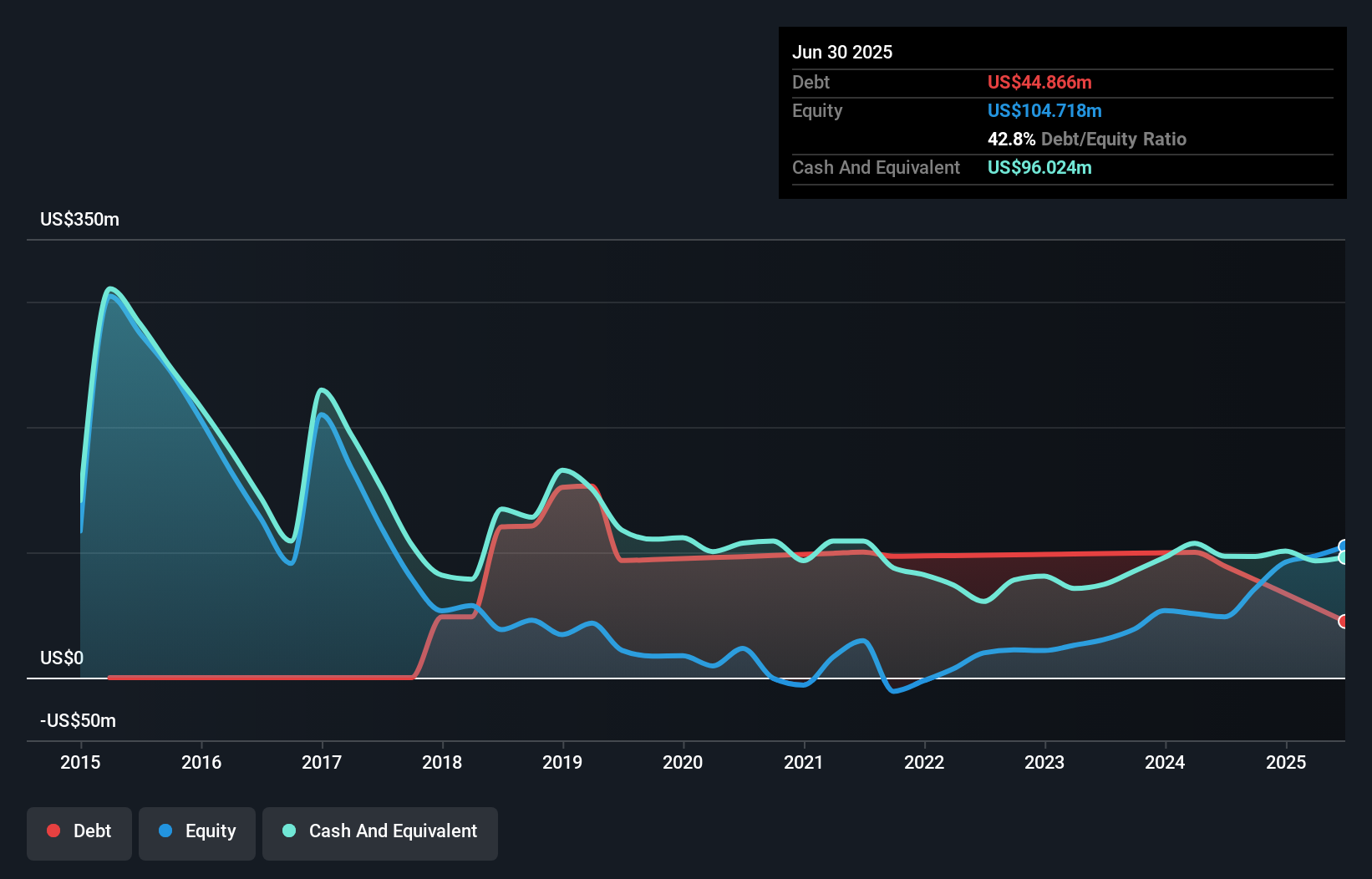

Puma Biotechnology, a player in the cancer care sector, has shown impressive earnings growth of 455.6% over the past year, outpacing its industry peers. Trading at 76.2% below its estimated fair value and with a debt-to-equity ratio reduced from 412.7% to 42.8% in five years, it presents an intriguing investment case despite challenges ahead. The company reported US$52 million in Q2 revenue for 2025 and turned a net income of US$5.86 million from a loss last year, but faces future earnings decline forecasts averaging 34.1% annually due to rising costs and reliance on NERLYNX sales alone.

Idaho Strategic Resources (IDR)

Simply Wall St Value Rating: ★★★★★★

Overview: Idaho Strategic Resources, Inc. is a resource-based company focused on the exploration, development, and extraction of gold, silver, and base metal mineral resources in North Idaho with a market cap of $636.06 million.

Operations: The company's revenue of $30.50 million is derived from exploring and developing gold, silver, and base metal mineral resources.

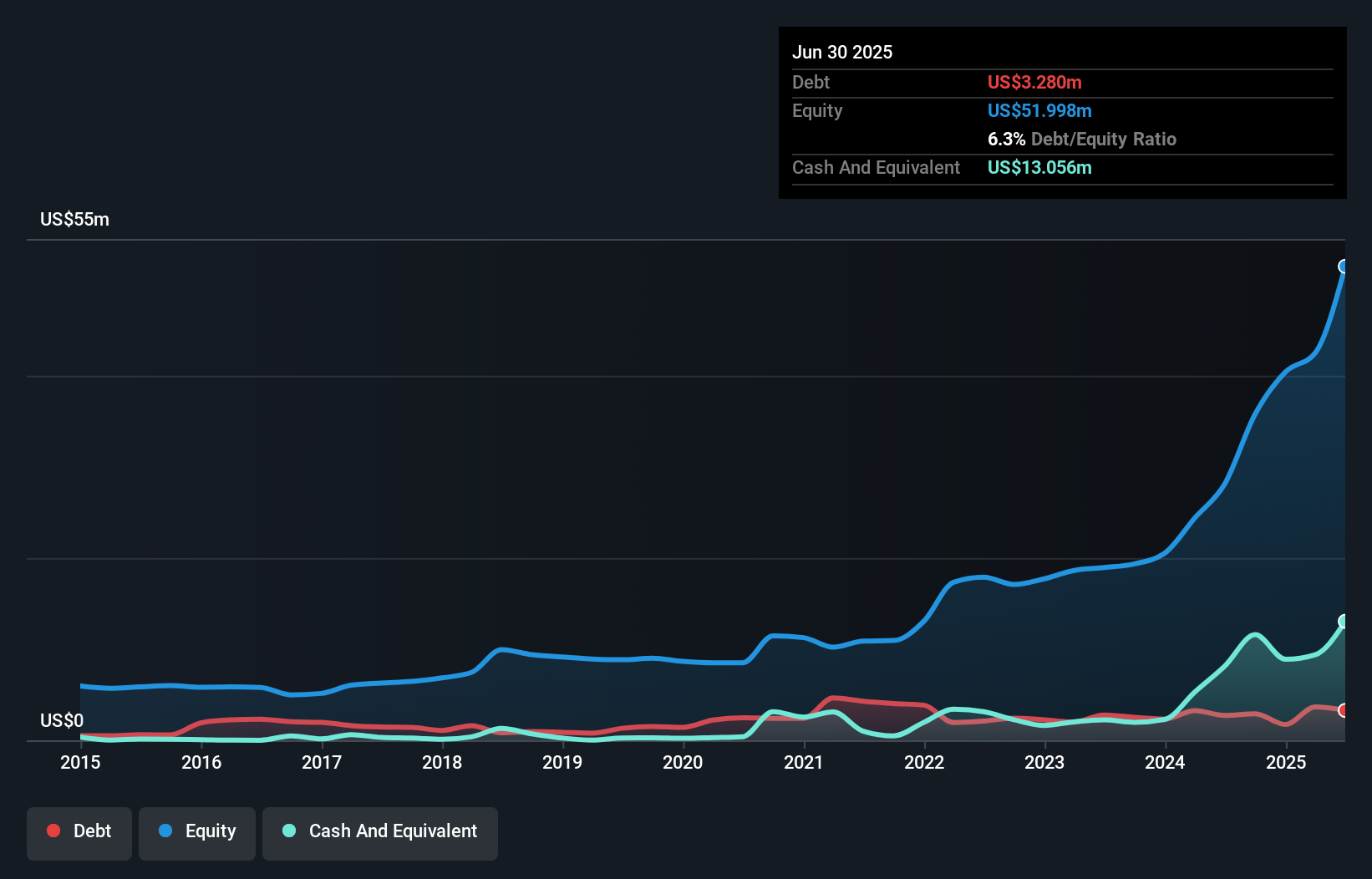

Idaho Strategic Resources has been making waves with its impressive financial performance, showcasing a 74% earnings growth over the past year, significantly outpacing the Metals and Mining industry. The company has managed to reduce its debt-to-equity ratio from 29.2% to 6.3% over five years, indicating strong financial management. Recent earnings reports reveal a net income of US$2.77 million for the second quarter, up from US$2.16 million the previous year. Despite a volatile share price, Idaho Strategic remains profitable, with sufficient cash to cover its debts, and has been added to the S&P/TSX Global Mining Index.

Where To Now?

- Navigate through the entire inventory of 291 US Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:IDR

Idaho Strategic Resources

A resource-based company, engages in the exploration, development, and extraction of gold, silver, and base metal mineral resources in the North Idaho.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success