- United States

- /

- Real Estate

- /

- NYSE:FPH

Discovering Promising US Penny Stocks In November 2024

Reviewed by Simply Wall St

The U.S. stock market continues to show resilience, with the S&P 500 and Nasdaq Composite experiencing gains as part of an ongoing rally, while the Dow Jones Industrial Average sees mixed performance amid varied earnings reports. Despite being viewed as a relic from past trading eras, penny stocks remain relevant by offering potential growth opportunities through smaller or newer companies with strong financials. In this article, we explore several promising penny stocks that combine affordability with robust fundamentals, presenting potential hidden gems for investors seeking value in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.79 | $6.1M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $143.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.83 | $2.29B | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2376 | $8.57M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.40 | $557.36M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.55 | $51.15M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8999 | $80.04M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $4.08 | $445.26M | ★★★★☆☆ |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Puma Biotechnology (NasdaqGS:PBYI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Puma Biotechnology, Inc. is a biopharmaceutical company that develops and commercializes cancer care products in the United States and internationally, with a market cap of approximately $147.26 million.

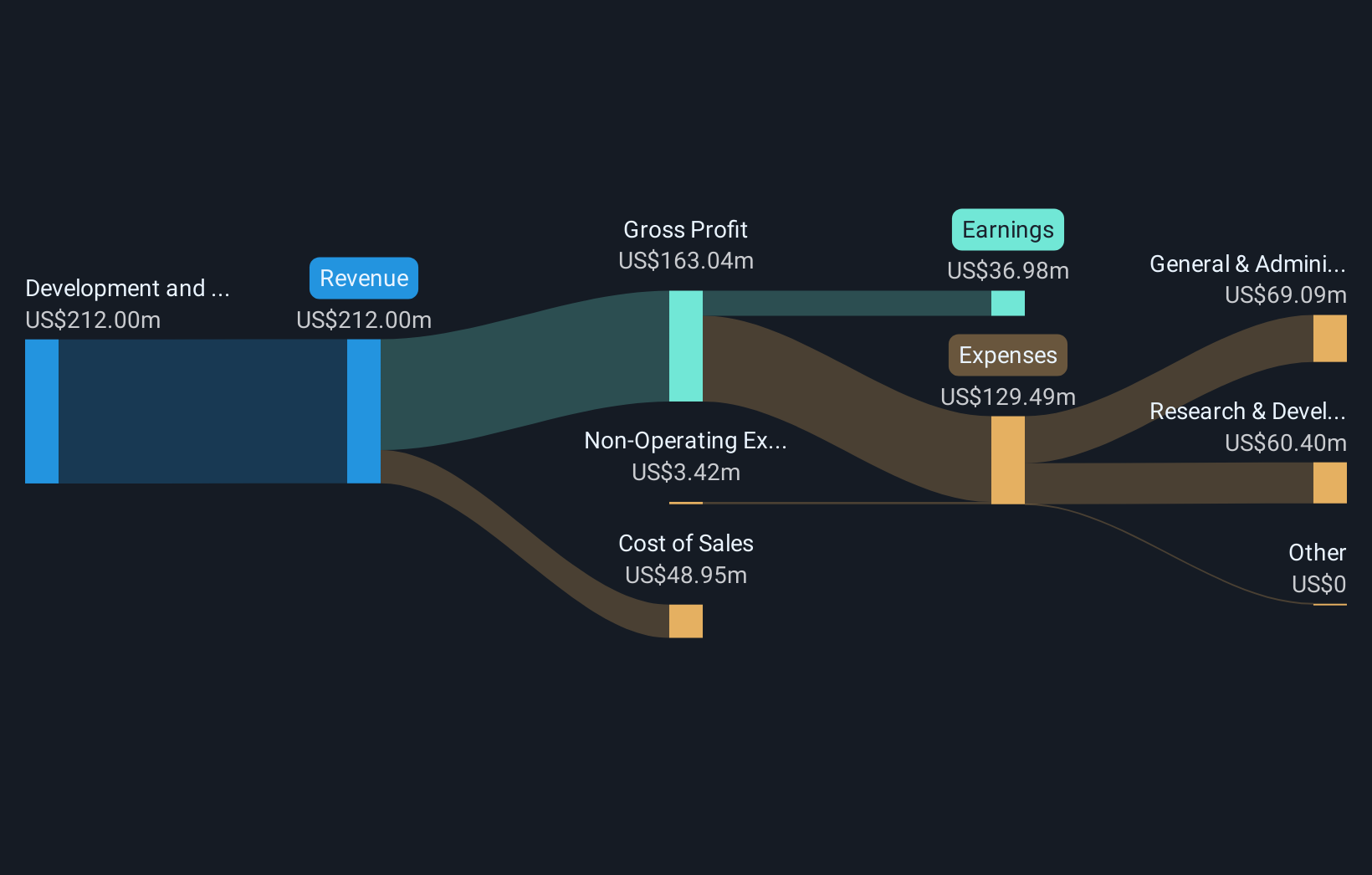

Operations: The company generates $243.57 million from the development and commercialization of innovative cancer care products.

Market Cap: $147.26M

Puma Biotechnology has shown significant earnings growth, with a 525.3% increase over the past year, surpassing its five-year average growth rate of 62.7% annually. The company reported third-quarter revenue of US$80.54 million, up from US$56.1 million the previous year, and net income rose to US$20.32 million from US$5.8 million, reflecting improved profit margins and high-quality earnings despite recent shareholder dilution by 3.2%. With reduced debt levels and strong cash flow coverage, Puma's financial health is stable as it advances clinical trials for alisertib in metastatic breast cancer treatment.

- Navigate through the intricacies of Puma Biotechnology with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Puma Biotechnology's future.

Five Point Holdings (NYSE:FPH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Five Point Holdings, LLC, through its subsidiary Five Point Operating Company, LP, focuses on owning and developing mixed-use and planned communities in Orange County, Los Angeles County, and San Francisco County with a market cap of approximately $269.90 million.

Operations: The company's revenue segments include $103.08 million from Valencia, $9.62 million from Commercial, and $568.62 million from Great Park, with adjustments for the removal of Great Park Venture and Gateway Commercial Venture amounting to -$475.95 million and -$9.16 million respectively, along with a contribution of $0.67 million from San Francisco.

Market Cap: $269.9M

Five Point Holdings, LLC has demonstrated stable financial metrics with a market cap of approximately US$269.90 million and significant revenue contributions from its Great Park segment, despite recent declines in quarterly revenue to US$17.01 million from US$65.92 million year-over-year. The company maintains a satisfactory net debt to equity ratio of 17.5% and high-quality earnings, although its current net profit margin has decreased to 26.1% from the previous year's 33.4%. Recent board changes include the addition of Sam Levinson following equity interest transactions involving Castlelake and Glick Family Investments, potentially influencing future strategic directions.

- Dive into the specifics of Five Point Holdings here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Five Point Holdings' track record.

Zhihu (NYSE:ZH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhihu Inc. operates an online content community in the People’s Republic of China and has a market cap of approximately $304.08 million.

Operations: Zhihu's revenue is primarily generated from advertising, amounting to CN¥4.06 billion.

Market Cap: $304.08M

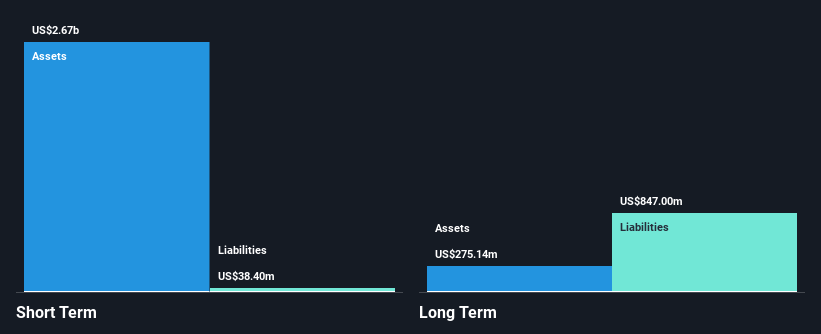

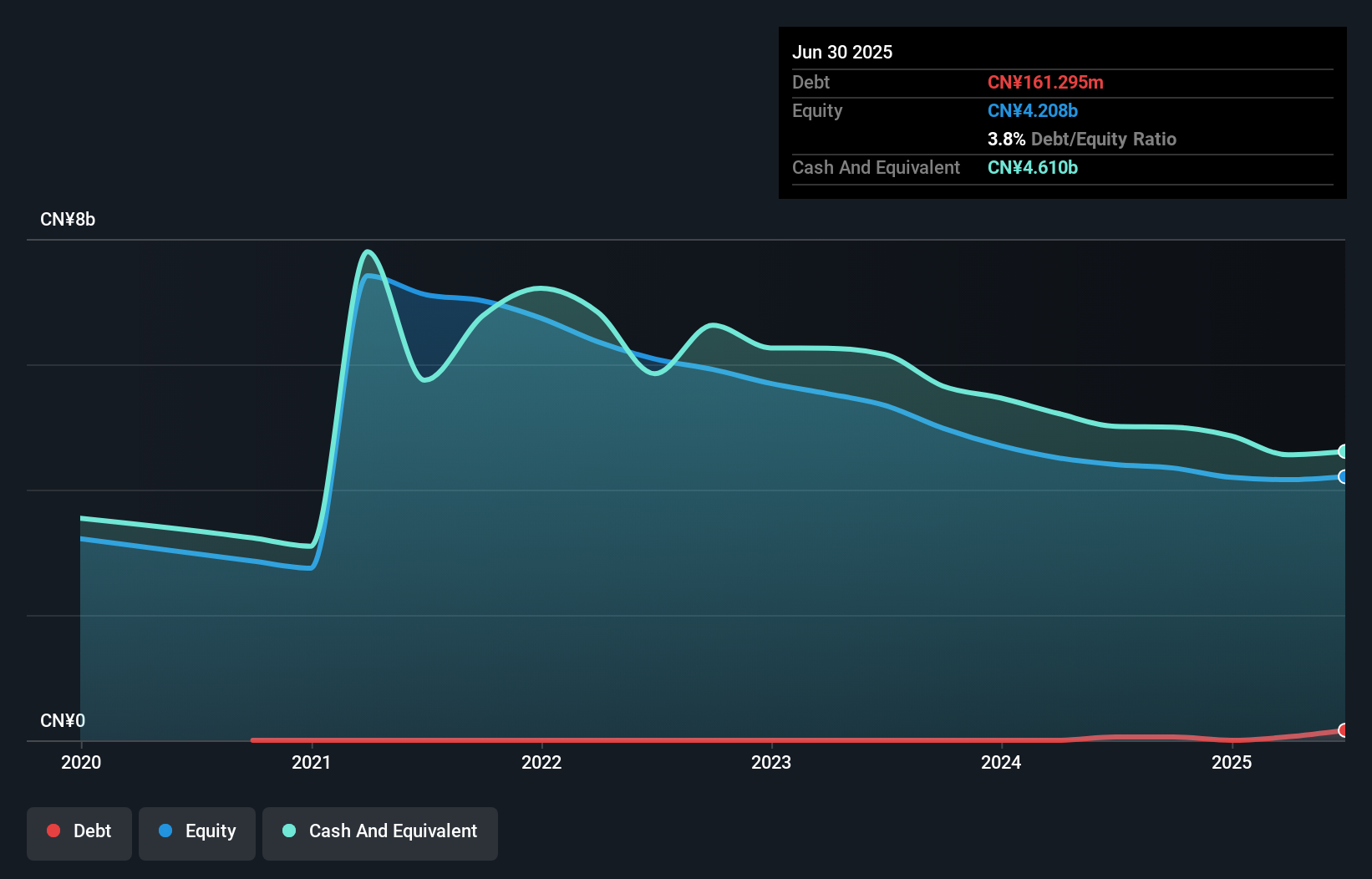

Zhihu Inc.'s recent financial results highlight a decrease in third-quarter revenue to CN¥845.02 million from CN¥1.02 billion year-over-year, while net losses significantly narrowed to CN¥10.49 million from CN¥278.67 million, indicating improved cost management despite ongoing unprofitability. The company maintains a strong liquidity position with short-term assets of CN¥5.8 billion surpassing both its short and long-term liabilities, and it completed a share buyback worth HKD 300.78 million recently, reflecting shareholder value initiatives. However, the management team is relatively new with an average tenure of 0.8 years, which might impact strategic consistency moving forward.

- Jump into the full analysis health report here for a deeper understanding of Zhihu.

- Assess Zhihu's future earnings estimates with our detailed growth reports.

Summing It All Up

- Click through to start exploring the rest of the 717 US Penny Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FPH

Five Point Holdings

Through its subsidiary, Five Point Operating Company, LP, owns and develops mixed-use and planned communities in Orange County, Los Angeles County, and San Francisco County.

Excellent balance sheet with acceptable track record.