The United States market has recently experienced a 2.8% increase over the past week and a substantial 24% climb over the last year, with earnings expected to grow by 15% per annum in the coming years. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability to leverage these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 24.07% | 42.97% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 238 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Alnylam Pharmaceuticals (NasdaqGS:ALNY)

Simply Wall St Growth Rating: ★★★★★★

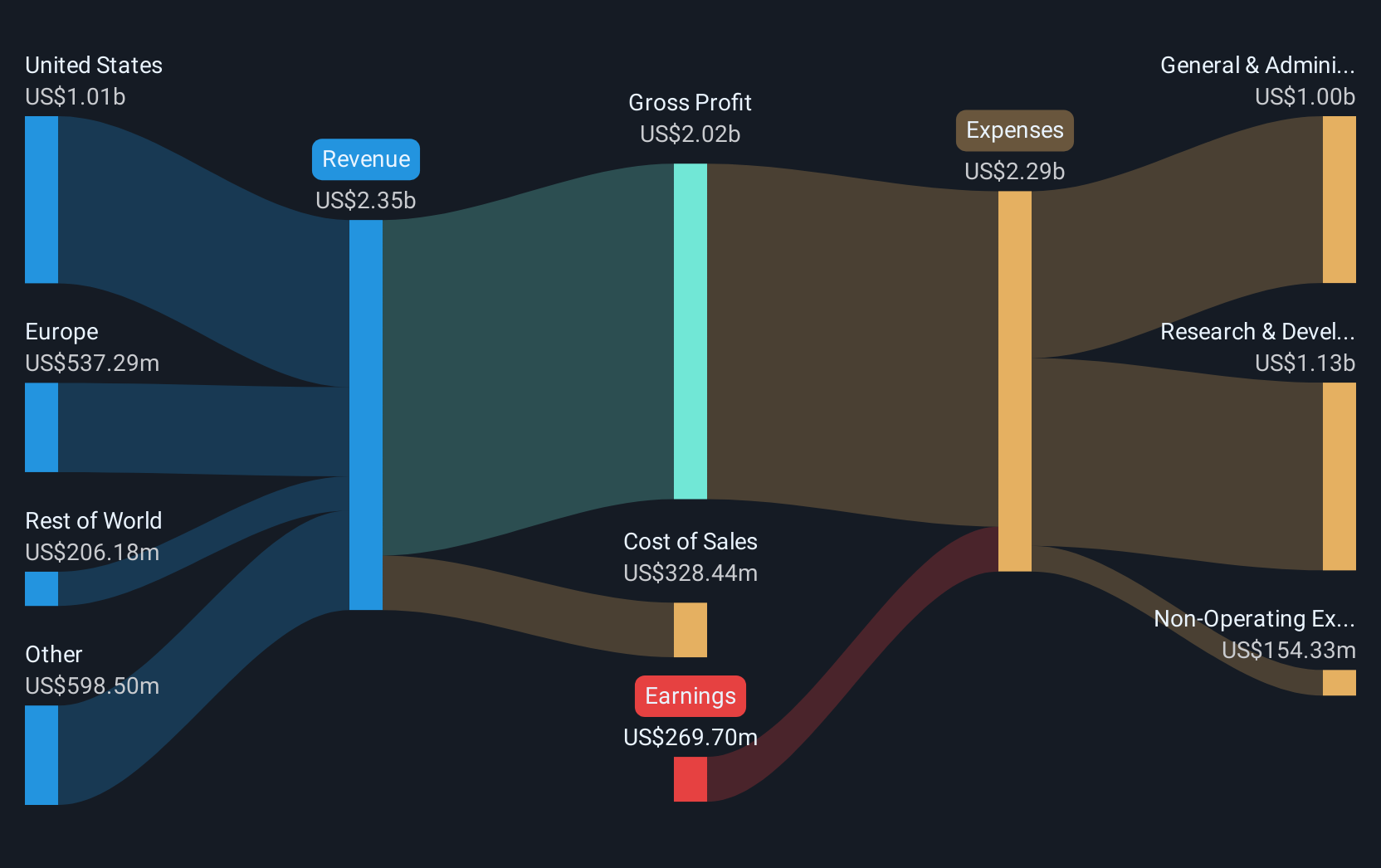

Overview: Alnylam Pharmaceuticals, Inc. is a biopharmaceutical company dedicated to the discovery, development, and commercialization of innovative therapeutics utilizing ribonucleic acid interference technology, with a market capitalization of $31.37 billion.

Operations: Alnylam Pharmaceuticals focuses on the discovery, development, and commercialization of RNAi-based therapeutics, generating $2.09 billion in revenue from these activities. The company's operations are centered around leveraging ribonucleic acid interference technology to create novel treatments.

Alnylam Pharmaceuticals is navigating a transformative phase with its aggressive investment in R&D, which is evident from its recent FDA application for vutrisiran, aimed at treating ATTR amyloidosis with cardiomyopathy. This move could potentially broaden its market, underscoring the company's commitment to addressing complex medical needs through innovation. Despite currently being unprofitable, Alnylam has shown promising signs of growth with a forecasted revenue increase of 22.3% annually and an anticipated profitability within three years. The firm's dedication to advancing healthcare through novel RNAi therapeutics positions it as a significant player in the biotech industry’s future landscape.

Sarepta Therapeutics (NasdaqGS:SRPT)

Simply Wall St Growth Rating: ★★★★★★

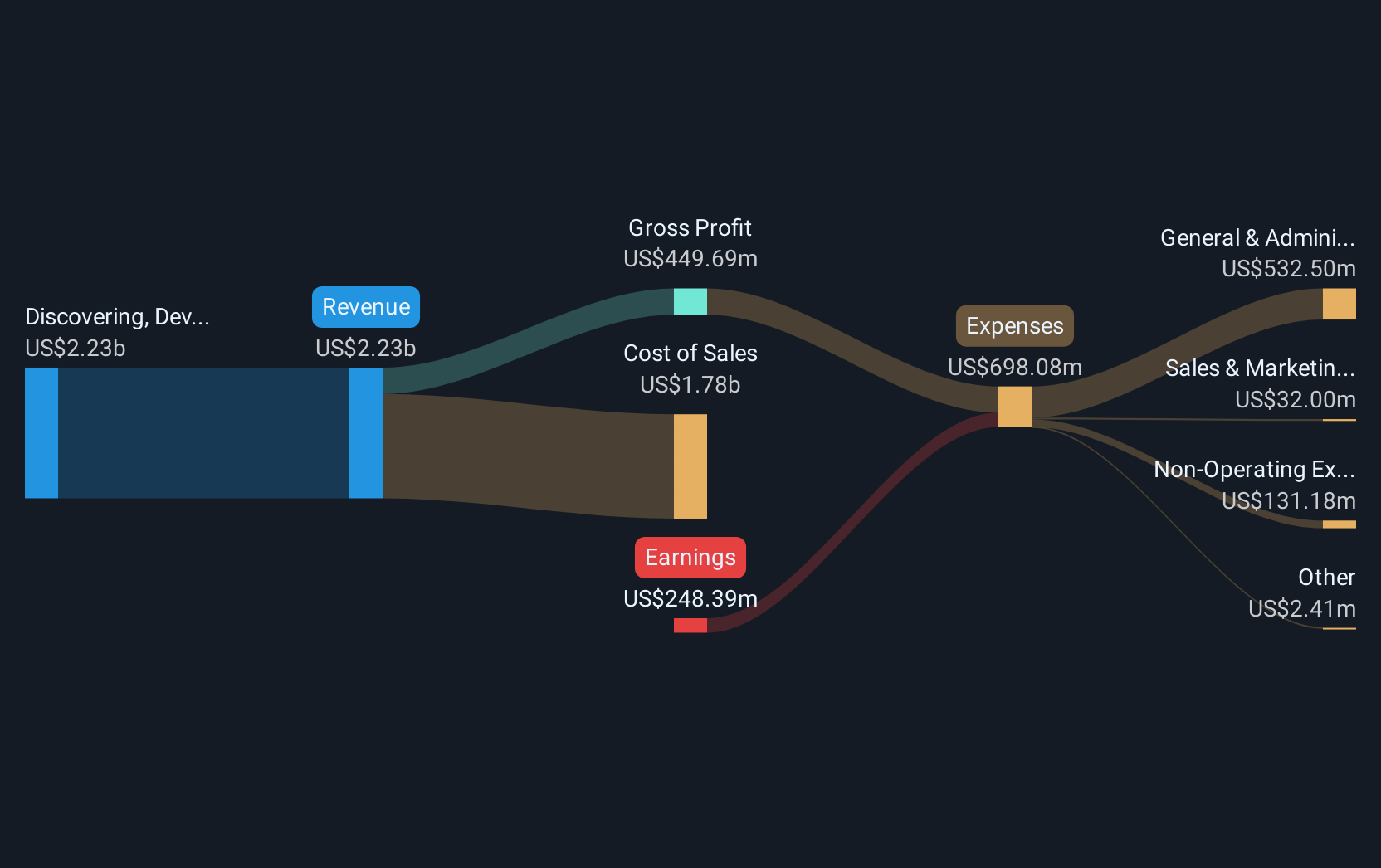

Overview: Sarepta Therapeutics, Inc. is a commercial-stage biopharmaceutical company specializing in RNA-targeted therapeutics and gene therapies for rare diseases, with a market cap of approximately $11.64 billion.

Operations: Sarepta Therapeutics focuses on discovering, developing, manufacturing, and delivering RNA-targeted therapeutics and gene therapies for rare diseases. The company generated approximately $1.64 billion in revenue from these activities.

Sarepta Therapeutics has transitioned into profitability this year, a significant turnaround highlighted by its third-quarter revenue surge to $467.17 million from $331.82 million year-over-year, reflecting a robust annual growth rate of 24.1%. This leap is underpinned by promising developments in gene therapy, notably with the EMERGENE trial for LGMD2E/R4, which could potentially enhance its market presence upon successful completion and FDA approval expected in 2025. The company's strategic collaborations, like the recent one with Arrowhead Pharmaceuticals, further bolster its innovation trajectory and market positioning within biotech's high-stakes arena.

Coherent (NYSE:COHR)

Simply Wall St Growth Rating: ★★★★☆☆

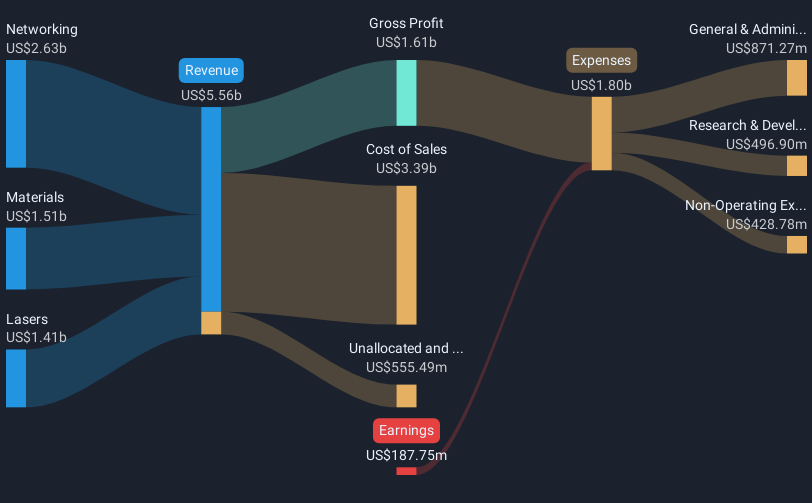

Overview: Coherent Corp. is a company that develops, manufactures, and markets engineered materials and optoelectronic components for various global industries, with a market capitalization of approximately $15.43 billion.

Operations: Coherent Corp. generates revenue through three primary segments: Lasers ($1.41 billion), Materials ($1.51 billion), and Networking ($2.63 billion). The company's operations cater to industrial, communications, electronics, and instrumentation markets globally.

Coherent is navigating a transformative phase with significant strides in both product innovation and strategic expansions. Recently, the company announced the Chameleon Discovery LX, enhancing its offerings in nonlinear microscopy—a field critical for advancing medical and scientific research. This launch aligns with Coherent's commitment to maintaining a competitive edge through continuous R&D, evidenced by their substantial investment in this area. Additionally, Coherent has embraced strategic growth opportunities such as the $33 million investment under the CHIPS and Science Act to expand its manufacturing capabilities in Texas, which is anticipated to bolster its position within tech supply chains significantly. These moves not only demonstrate Coherent’s proactive approach in high-tech markets but also underscore its potential for growth amidst evolving industry demands.

- Get an in-depth perspective on Coherent's performance by reading our health report here.

Gain insights into Coherent's past trends and performance with our Past report.

Summing It All Up

- Click this link to deep-dive into the 238 companies within our US High Growth Tech and AI Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and optical and laser systems and subsystems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives