- United States

- /

- Machinery

- /

- NYSEAM:HYLN

Agora And 2 Other US Penny Stocks To Watch Closely

Reviewed by Simply Wall St

As the U.S. stock market looks to extend its Santa Claus rally, investors are keeping an eye on both large-cap and smaller stocks, with the latter often presenting unique opportunities for growth. Penny stocks, a term that may seem outdated but remains relevant, represent smaller or less-established companies that can sometimes offer significant value. By focusing on those with solid financials and clear potential for growth, investors might uncover promising opportunities in this niche segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.21 | $1.85B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $103.25M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.8849 | $6.43M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2399 | $8.83M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.84 | $86.14M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.33 | $43.89M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.855 | $49.54M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.27 | $22.53M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8502 | $76.47M | ★★★★★☆ |

Click here to see the full list of 739 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Agora (NasdaqGS:API)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Agora, Inc. operates in the real-time engagement technology sector across China, the United States, and internationally, with a market cap of approximately $401.12 million.

Operations: The company's revenue is primarily derived from its Internet Telephone segment, which generated $134.84 million.

Market Cap: $401.12M

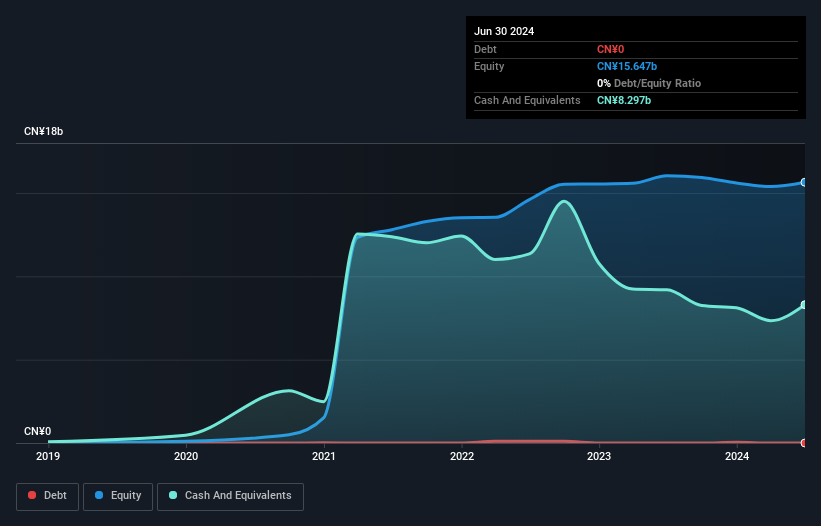

Agora, Inc., with a market cap of US$401.12 million, is navigating the challenges typical of penny stocks. Despite being unprofitable and experiencing a net loss increase to US$24.18 million in Q3 2024, Agora has reduced its losses over five years by 15.7% annually and maintains a strong cash position exceeding its debt levels. The company completed a significant share buyback program and forecasts revenue growth for Q4 2024 between US$34 million and US$36 million, signaling potential improvements in net income loss. Recent product innovations include their Conversational AI SDK integrated with OpenAI's Realtime API, enhancing real-time engagement capabilities globally.

- Take a closer look at Agora's potential here in our financial health report.

- Learn about Agora's future growth trajectory here.

Hyliion Holdings (NYSEAM:HYLN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hyliion Holdings Corp. develops sustainable electricity-producing technology aimed at providing clean and efficient energy solutions, with a market cap of approximately $479.51 million.

Operations: Currently, there are no reported revenue segments for Hyliion Holdings Corp.

Market Cap: $479.51M

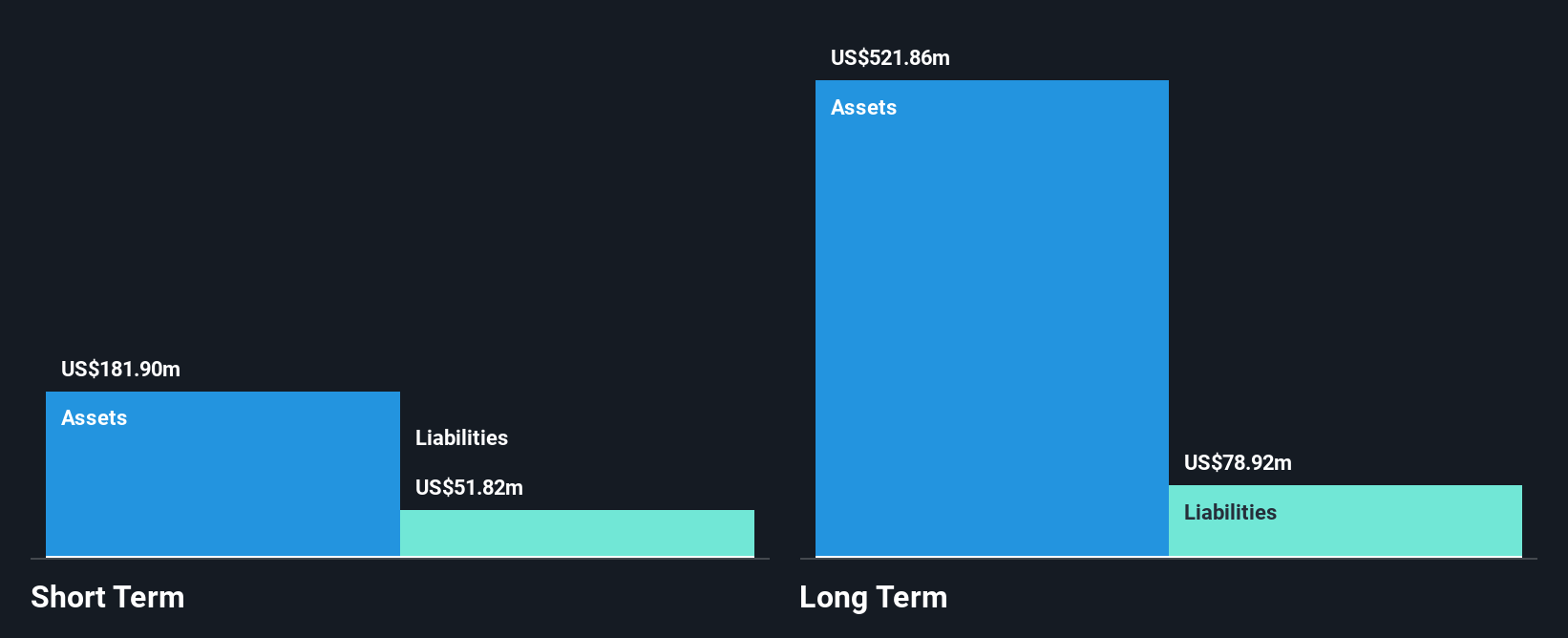

Hyliion Holdings, with a market cap of US$479.51 million, is a pre-revenue company focusing on sustainable energy solutions. Despite its unprofitability and volatile share price, Hyliion benefits from being debt-free and having short-term assets that cover both short and long-term liabilities. The recent US$6 million grant from the U.S. Department of Energy supports the deployment of its KARNO generators, showcasing their capability to operate on multiple fuel types with near-zero emissions—a promising step in reducing methane emissions in collaboration with oil and gas partners. However, significant insider selling raises some concerns about potential future volatility.

- Click to explore a detailed breakdown of our findings in Hyliion Holdings' financial health report.

- Gain insights into Hyliion Holdings' outlook and expected performance with our report on the company's earnings estimates.

RLX Technology (NYSE:RLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RLX Technology Inc., along with its subsidiaries, manufactures and sells e-vapor products in China and internationally, with a market cap of approximately $2.54 billion.

Operations: The company generates revenue from its Personal Products segment, totaling CN¥2.16 billion.

Market Cap: $2.54B

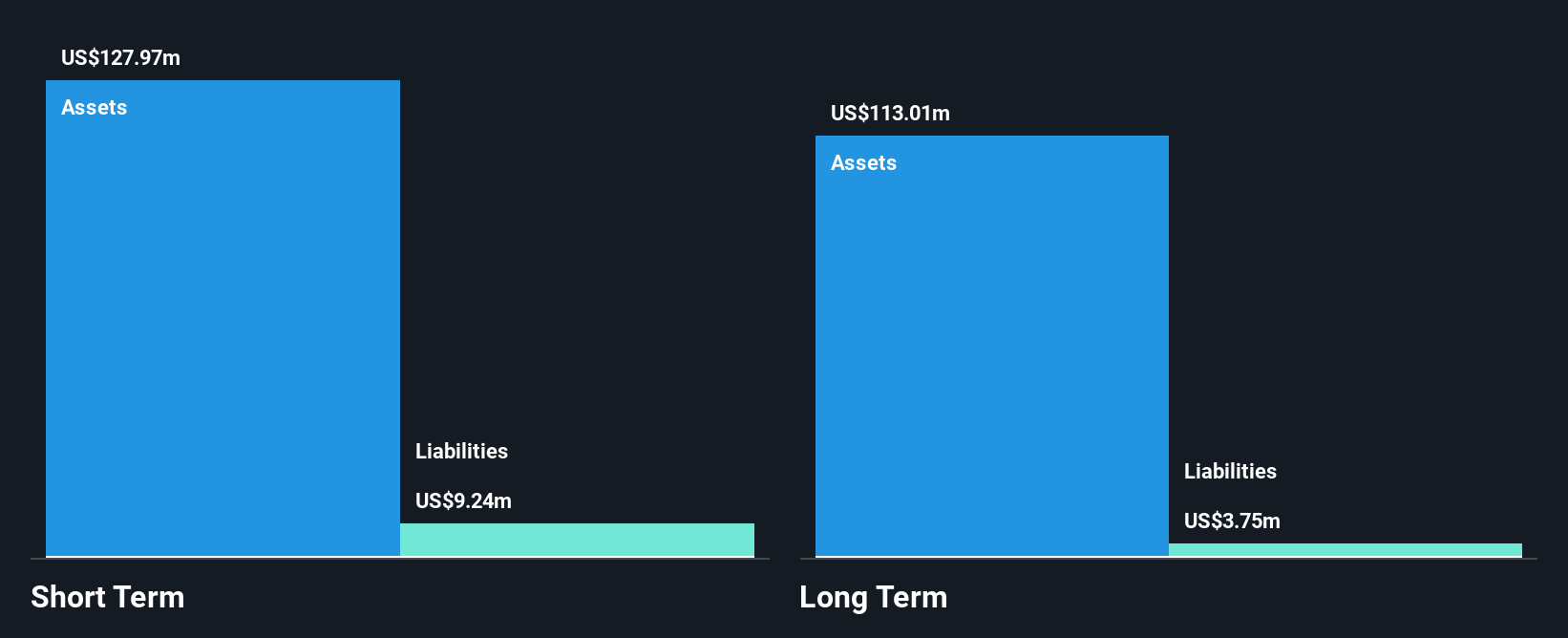

RLX Technology, with a market cap of approximately US$2.54 billion, has shown significant earnings growth, outpacing the tobacco industry's average. The company's net profit margins have improved from 8.5% to 29.8%, and it maintains a strong balance sheet with short-term assets exceeding both its short and long-term liabilities. RLX is debt-free, reducing financial risk and eliminating interest payment concerns. Recent earnings reports indicate substantial revenue increases year-over-year, although net income slightly declined in the latest quarter compared to last year. A modest dividend was recently approved, reflecting stable cash flow management despite low return on equity at 4.2%.

- Get an in-depth perspective on RLX Technology's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into RLX Technology's future.

Next Steps

- Click here to access our complete index of 739 US Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyliion Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:HYLN

Hyliion Holdings

Provides sustainable electricity-producing technology that offers solutions for clean, flexible, and efficient electricity production.

Excellent balance sheet moderate.