- United States

- /

- Biotech

- /

- NasdaqCM:ORGO

US Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

As the Nasdaq Composite reaches new heights and Bitcoin surges to unprecedented levels, the U.S. market is experiencing a mix of optimism and caution, with investors keenly watching upcoming Federal Reserve decisions. In this context, penny stocks—often representing smaller or emerging companies—remain a compelling area for those seeking growth opportunities. By focusing on firms with solid financial foundations and clear growth potential, investors might uncover significant value in these often-overlooked segments of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.42 | $2.03B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $128.29M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.874625 | $6.32M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.87 | $89.78M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.23 | $8.25M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.50 | $48.84M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.875 | $13.39M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8366 | $75.59M | ★★★★★☆ |

Click here to see the full list of 717 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Organogenesis Holdings (NasdaqCM:ORGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Organogenesis Holdings Inc. is a regenerative medicine company that develops, manufactures, and commercializes solutions for advanced wound care and surgical and sports medicine markets in the United States, with a market cap of $450.76 million.

Operations: The company's revenue is primarily generated from its regenerative medicine segment, amounting to $455.04 million.

Market Cap: $450.76M

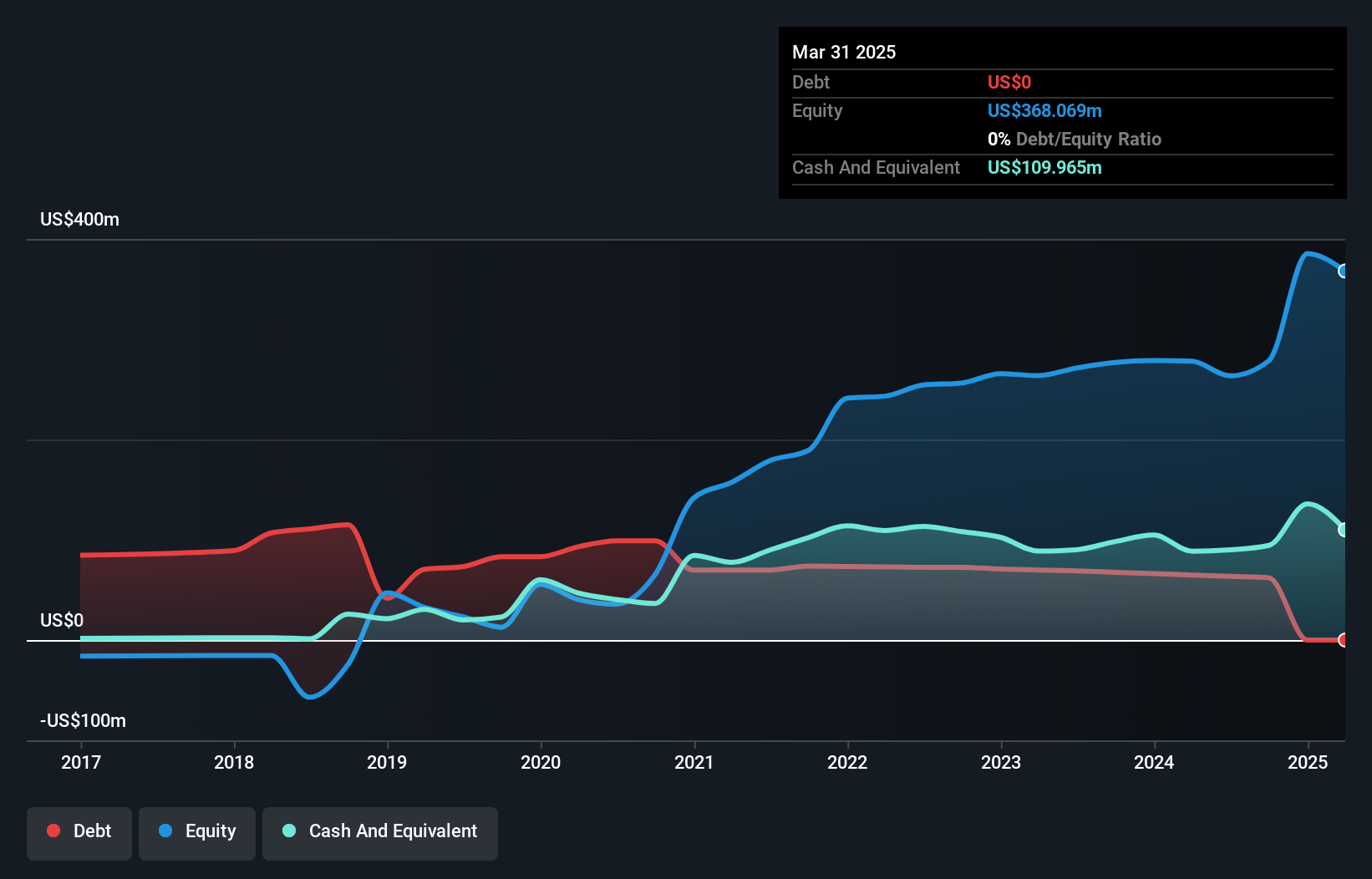

Organogenesis Holdings Inc., with a market cap of US$450.76 million, has shown financial resilience despite being unprofitable. It reported significant revenue from its regenerative medicine segment, reaching US$455.04 million. The company is executing strategic initiatives such as a share repurchase program and expansion of manufacturing capacity in Rhode Island, contingent on tax incentives. Financially, Organogenesis's debt level is well-managed with cash exceeding total debt and operating cash flow covering debt obligations effectively. Although the stock remains volatile, it trades at a good value compared to peers and analysts anticipate potential price appreciation.

- Dive into the specifics of Organogenesis Holdings here with our thorough balance sheet health report.

- Understand Organogenesis Holdings' earnings outlook by examining our growth report.

Big 5 Sporting Goods (NasdaqGS:BGFV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Big 5 Sporting Goods Corporation operates as a sporting goods retailer in the western United States with a market cap of $35.42 million.

Operations: The company generates revenue primarily from its sporting goods retail operations, totaling $810.20 million.

Market Cap: $35.42M

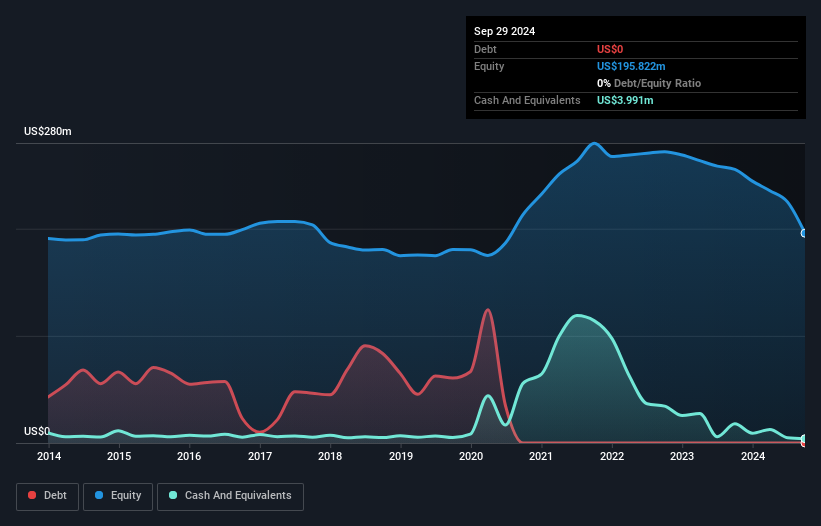

Big 5 Sporting Goods, with a market cap of US$35.42 million, is navigating financial challenges as it remains unprofitable with increasing losses over the past five years. Recent earnings reports reveal a net loss of US$29.9 million for Q3 2024, contrasting sharply with a net income from the previous year. Despite these setbacks, the company maintains no debt and has not diluted shareholders recently. Strategic efforts include store closures to optimize operations and plans for limited expansion in fiscal 2024. The board and management team are experienced, potentially providing stability amidst ongoing macroeconomic headwinds affecting sales forecasts.

- Navigate through the intricacies of Big 5 Sporting Goods with our comprehensive balance sheet health report here.

- Evaluate Big 5 Sporting Goods' historical performance by accessing our past performance report.

Nerdy (NYSE:NRDY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nerdy, Inc. operates a platform for live online learning and has a market cap of approximately $313.86 million.

Operations: The company's revenue is generated from its Educational Services segment, specifically through Education & Training Services, totaling $197.33 million.

Market Cap: $313.86M

Nerdy, Inc., with a market cap of US$313.86 million, is navigating the challenges typical of penny stocks, including high volatility and unprofitability. Despite generating US$197.33 million in revenue from its Educational Services segment, Nerdy remains unprofitable with losses increasing at 15.8% annually over five years. The company recently regained NYSE compliance for its share price after a period of non-compliance. It holds US$65 million in cash and no debt, offering financial flexibility to pursue growth initiatives. However, shareholder dilution has occurred over the past year as shares outstanding increased by 5.1%.

- Take a closer look at Nerdy's potential here in our financial health report.

- Learn about Nerdy's future growth trajectory here.

Summing It All Up

- Reveal the 717 hidden gems among our US Penny Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ORGO

Organogenesis Holdings

A regenerative medicine company, develops, manufactures, and commercializes products for the advanced wound care, and surgical and sports medicine markets in the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives