- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Novavax (NasdaqGS:NVAX) Shares Rise 11% Following Q4 2024 Earnings Improvement

Reviewed by Simply Wall St

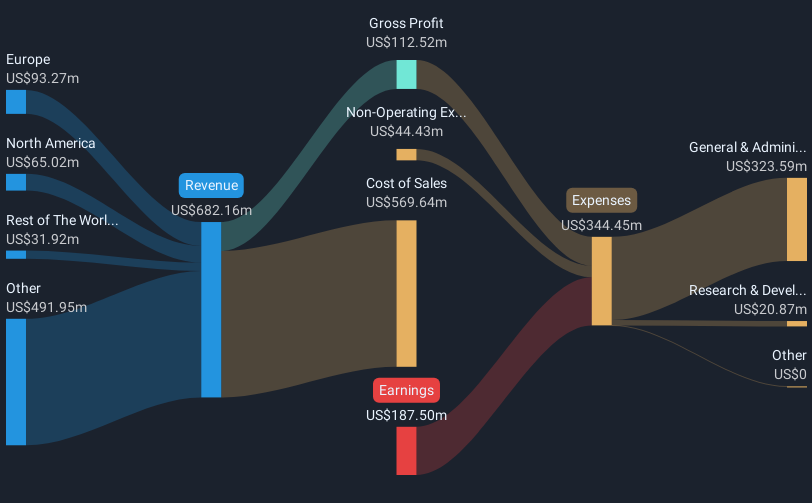

Novavax (NasdaqGS:NVAX) recently announced its earnings for Q4 2024, showing a significant improvement in net loss and loss per share, which may have positively influenced its stock price movement. The company experienced an 11% share price increase over the past week, a notable performance given the general market downturn. This stock price rise occurred despite broader market challenges, as the Dow Jones, S&P 500, and Nasdaq suffered notable declines, with the S&P 500 on track for its worst week in two years. While many stocks, particularly in the technology sector, faced significant headwinds due to concerns around tariffs and economic uncertainty, Novavax's focus on vaccine deliveries and its significant improvement in financial results likely played a role in buoying investor confidence. The general market sentiment remained cautious, with the yield on the 10-year Treasury notes experiencing a decline, reflecting persistent economic unease.

Navigate through the intricacies of Novavax with our comprehensive report here.

Over the last year, Novavax achieved a total shareholder return of 40.29%, surpassing the broader US Market's 11.1% gain and the US Biotechs industry decline of 5.9%. This exceptional performance can be partly attributed to several significant developments. In December 2024, Novavax received EU approval for its updated Nuvaxovid™ COVID-19 vaccine, targeting individuals aged 12 and older, concurrently opening U.S. pharmacy channels. Furthermore, the company initiated a promising COVID-19-Influenza combination vaccine trial, marking a significant stride in its research initiatives.

Novavax's decision to sell its Czech Republic manufacturing facility to Novo Nordisk for US$200 million in December 2024 was another impactful business maneuver, aimed at achieving annual cost reductions of approximately US$80 million. Additionally, a co-exclusive licensing agreement with Sanofi in May 2024 for its vaccine, with substantial upfront payments and milestone potentials, likely bolstered investor interest and contributed positively to the company's annual returns.

- Discover whether Novavax is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Explore the potential challenges for Novavax in our thorough risk analysis report.

- Hold shares in Novavax? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives