- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Novavax (NasdaqGS:NVAX) Reports Q1 2025 Financial Turnaround

Reviewed by Simply Wall St

Novavax (NasdaqGS:NVAX) recently reported a significant financial turnaround for Q1 2025, demonstrating substantial revenue growth and net income improvements. The amending of its collaboration agreement with Takeda offers increased flexibility in vaccine development, while the new board appointment of Charles Newton enhances the company's strategic leadership in healthcare. Over the last week, Novavax's shares rose by 13%, slightly exceeding the broader market's 5% increase, indicating investor optimism around these developments. These factors likely reinforced the stock's upward movement, in line with positive market trends.

Novavax has 5 possible red flags (and 2 which are a bit unpleasant) we think you should know about.

The recent organizational changes and amendments in Novavax's collaboration with Takeda could potentially bolster the company's future revenue streams and operational flexibility. The increase in share price by 13% following these announcements is indicative of rising investor confidence. However, over the longer term, the company's total return, considering both share price movement and dividends, saw a 48.27% decline over the past year. This period highlights significant volatility and challenges faced by Novavax, underscoring the need for continued strategic adjustments.

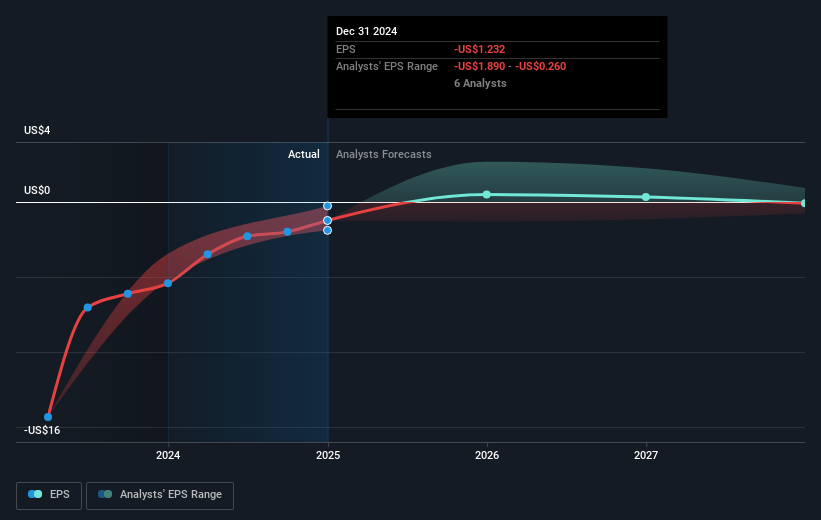

Compared to the broader market, which rose 11.9%, and the U.S. Biotechs industry, which experienced a 14.2% decline over the past year, Novavax's shares have underperformed significantly. Analyst forecasts indicate revenue is expected to decline 31% annually over the next three years, with earnings projected to decrease 44.3% annually. The recent announcements might help mitigate some of these declines by potentially expanding market opportunities and enhancing profitability through partnerships, but the ongoing dependency on partner execution remains a major risk.

The price target set by analysts is US$15.17, notably higher than the current share price of US$6.42. This implies substantial growth potential if Novavax can meet future expectations. The company's continued adaptation through partnerships and cost optimization efforts are critical elements that could influence its revenue and earnings growth perspectives, moving closer to the analysts' valuation expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Moderate and fair value.

Similar Companies

Market Insights

Community Narratives