- United States

- /

- Healthtech

- /

- NasdaqGS:CERT

High Growth Tech Stocks To Watch In September 2024

Reviewed by Simply Wall St

In the last week, the market has stayed flat, but it is up 32% over the past year with earnings expected to grow by 15% per annum over the next few years. In this environment, identifying high growth tech stocks that can capitalize on these favorable conditions becomes crucial for investors looking to maximize their returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.46% | 66.34% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.37% | ★★★★★★ |

| Clene | 71.89% | 60.05% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 255 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Certara (NasdaqGS:CERT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Certara, Inc. provides software products and technology-enabled services for biosimulation in drug discovery, preclinical and clinical research, regulatory submissions, and market access globally, with a market cap of $1.89 billion.

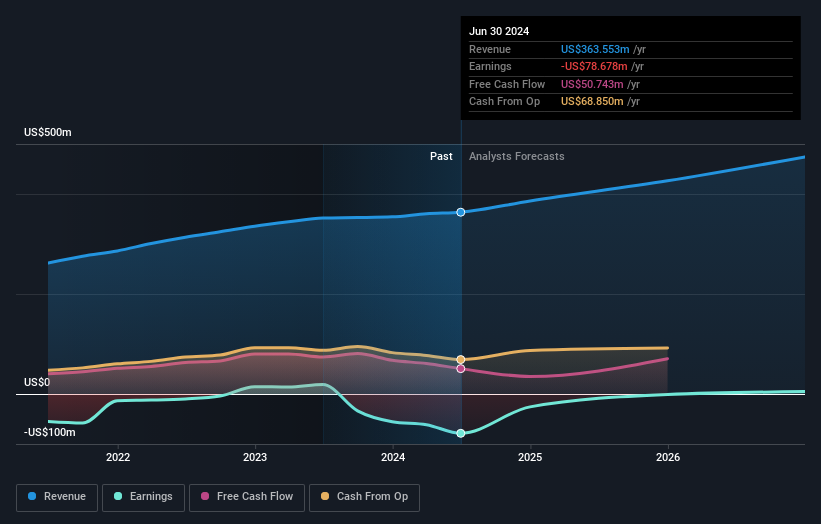

Operations: Certara, Inc. generates revenue primarily from its healthcare software segment, which reported $363.55 million in revenue. The company operates internationally, offering solutions for biosimulation in various stages of drug development and regulatory processes.

Certara, despite its current unprofitability, is poised for significant growth with earnings expected to surge by 107.21% annually. This forecast surpasses the broader US market's average and highlights a robust recovery trajectory into profitability within three years. The company's commitment to innovation is evident in its R&D spending trends, which are integral to developing cutting-edge pharmacokinetic/pharmacodynamic modeling software like Phoenix™ version 8.5. Recently launched, this platform is pivotal for over 75 of the top 100 pharmaceutical firms globally and several regulatory bodies, underscoring Certara’s critical role in drug approval processes. With revenue growth projected at 9.8% per year—outpacing the US market rate of 8.7%—and a strategic focus on enhancing software capabilities and user experience, Certara is reinforcing its footprint in the tech-driven pharmaceutical services sector.

- Click to explore a detailed breakdown of our findings in Certara's health report.

Gain insights into Certara's past trends and performance with our Past report.

Cognex (NasdaqGS:CGNX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cognex Corporation develops and sells machine vision products to automate manufacturing and distribution processes globally, with a market cap of $6.91 billion.

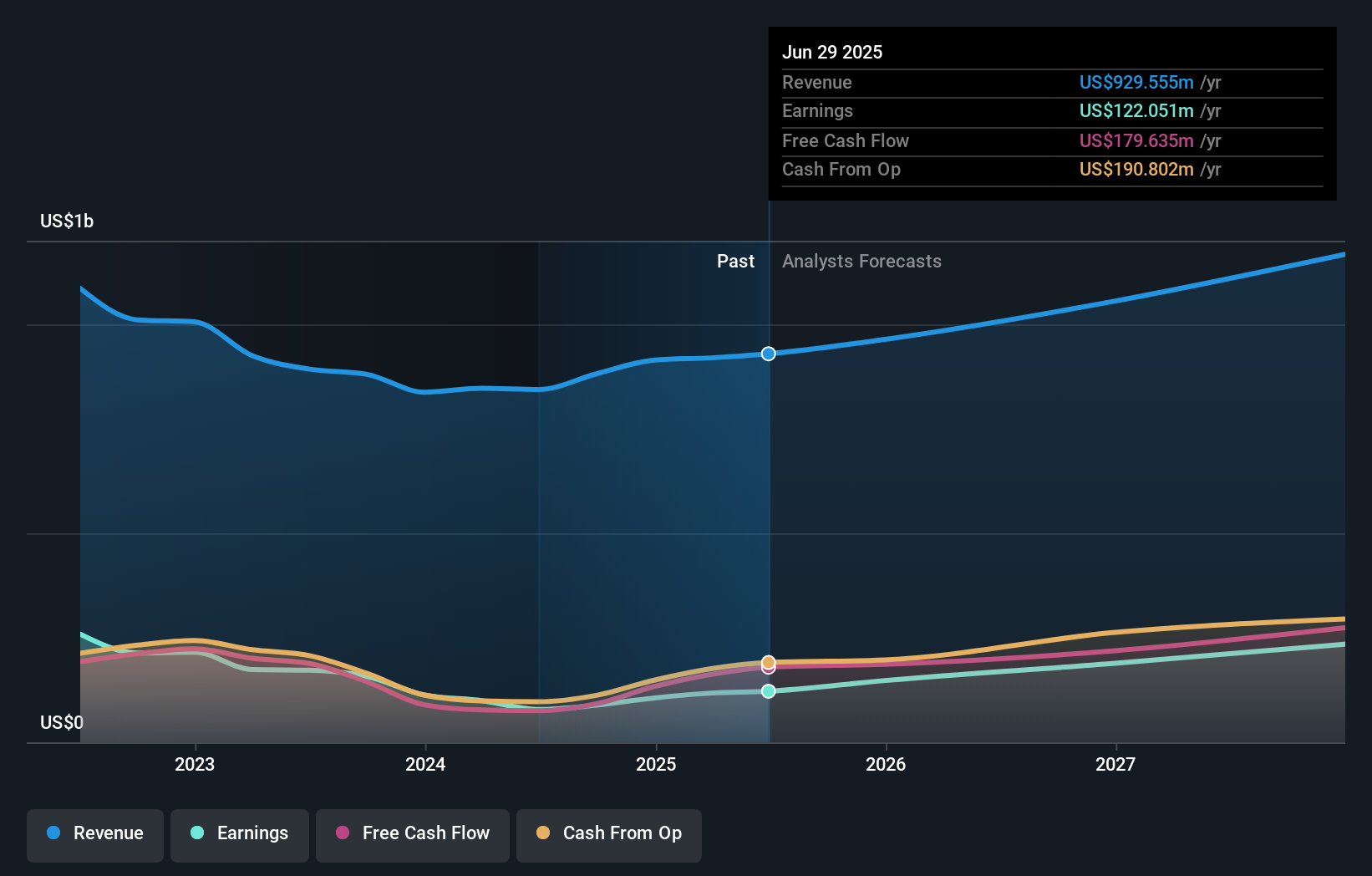

Operations: The company generates revenue primarily from its machine vision technology, which amounted to $844 million. It focuses on capturing and analyzing visual information to automate tasks in manufacturing and distribution.

Cognex is harnessing AI to revolutionize industrial automation with its latest In-Sight SnAPP™ vision sensor, which simplifies complex counting tasks across various industries. This innovation is part of why Cognex's R&D expenses have been strategically high, maintaining a competitive edge in machine vision technology. Despite a recent dip in net income to $36.21 million from last year's $57.47 million, the company's revenue growth remains robust at 12.2% annually, outpacing the US market average of 8.7%. Moreover, with earnings projected to grow by an impressive 31.1% per year and recent share repurchases totaling $187.01 million, Cognex is actively investing in its future while returning value to shareholders.

- Delve into the full analysis health report here for a deeper understanding of Cognex.

Examine Cognex's past performance report to understand how it has performed in the past.

Natera (NasdaqGS:NTRA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Natera, Inc. is a diagnostics company that develops and commercializes molecular testing services worldwide, with a market cap of approximately $15.55 billion.

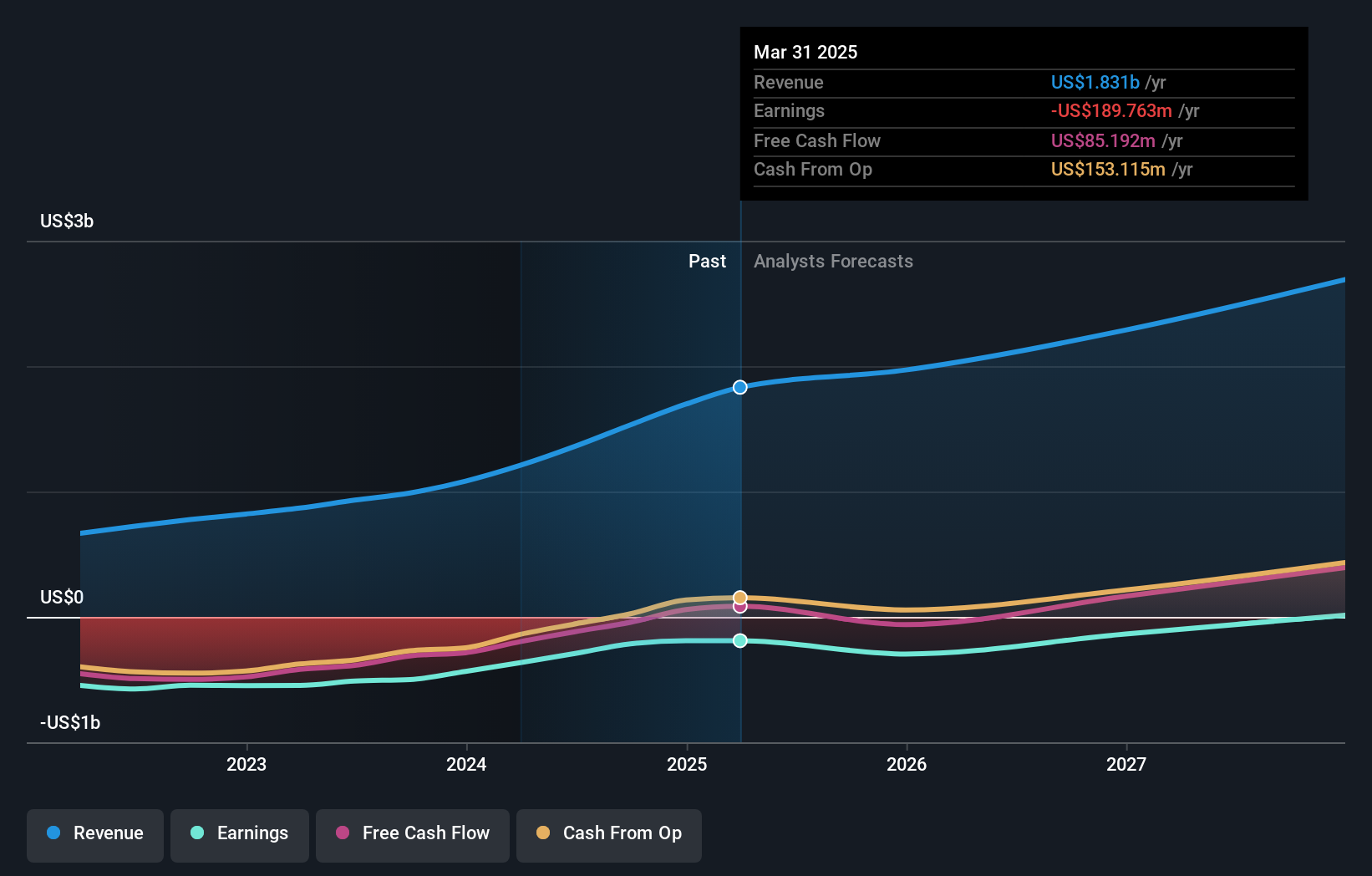

Operations: Natera, Inc. generates revenue primarily through the development and commercialization of molecular testing services, amounting to $1.36 billion. The company operates in the diagnostics sector with a focus on innovative testing solutions.

Natera stands out with its pioneering work in the biotech sector, particularly through its Signatera technology for detecting molecular residual disease in colorectal cancer. Recent findings presented at ESMO show that Signatera can predict survival outcomes significantly, a breakthrough likely to enhance patient management and treatment strategies. Financially, Natera's revenue surged by 13.1% year-over-year to $413.35 million in Q2 2024, reflecting robust market demand despite a net loss reduction from $110.8 million to $37.46 million over the same period last year. The company's R&D expenses remain a critical investment, fueling innovations like Signatera which are essential for long-term growth in the competitive biotech landscape.

- Get an in-depth perspective on Natera's performance by reading our health report here.

Review our historical performance report to gain insights into Natera's's past performance.

Summing It All Up

- Click through to start exploring the rest of the 252 US High Growth Tech and AI Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CERT

Certara

Provides software products and technology-enabled services to customers for biosimulation in drug discovery, preclinical and clinical research, regulatory submissions, and market access in the United States and internationally.

Excellent balance sheet with reasonable growth potential.