- United States

- /

- Pharma

- /

- NasdaqGS:NMRA

3 US Penny Stocks With Market Caps Below $400M

Reviewed by Simply Wall St

As major U.S. stock indexes hover near record highs, investors are closely watching market movements and economic indicators for signs of future trends. For those interested in exploring smaller or newer companies, penny stocks—though an outdated term—remain a viable investment area with potential value. These stocks, often characterized by lower price points and the possibility of growth, can be particularly appealing when backed by strong financials and solid fundamentals. In this article, we explore three U.S. penny stocks that exhibit financial strength and may offer promising opportunities for long-term success.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.88 | $6.39M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $127.27M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.249 | $9.16M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.79 | $84.63M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.41 | $46.53M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.39 | $24.65M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $4.13 | $154.8M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8718 | $78.41M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.59 | $383.33M | ★★★★☆☆ |

Click here to see the full list of 705 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Adverum Biotechnologies (NasdaqCM:ADVM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Adverum Biotechnologies, Inc. is a clinical-stage company focused on developing gene therapy product candidates for ocular diseases, with a market cap of $92.78 million.

Operations: Adverum Biotechnologies generates revenue from the development and commercialization of gene therapeutics, totaling $1 million.

Market Cap: $92.78M

Adverum Biotechnologies, with a market cap of US$92.78 million, is pre-revenue and focuses on gene therapy for ocular diseases. Recent data from the LUNA Phase 2 and OPTIC trials show promising results in reducing treatment burdens for wet AMD patients, with significant reductions in anti-VEGF injections and strong patient preference for their Ixo-vec therapy. Despite being unprofitable and forecasted earnings decline, Adverum maintains a solid cash position with no debt, providing a runway of 1.9 years if cash flow trends continue. The company plans to initiate Phase 3 trials in 2025 to further evaluate Ixo-vec’s efficacy.

- Unlock comprehensive insights into our analysis of Adverum Biotechnologies stock in this financial health report.

- Gain insights into Adverum Biotechnologies' outlook and expected performance with our report on the company's earnings estimates.

Neumora Therapeutics (NasdaqGS:NMRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Neumora Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on developing treatments for brain diseases, neuropsychiatric disorders, and neurodegenerative diseases, with a market cap of approximately $281.12 million.

Operations: Neumora Therapeutics, Inc. currently does not report any revenue segments as it is a clinical-stage biopharmaceutical company focused on developing treatments for brain diseases and related disorders.

Market Cap: $281.12M

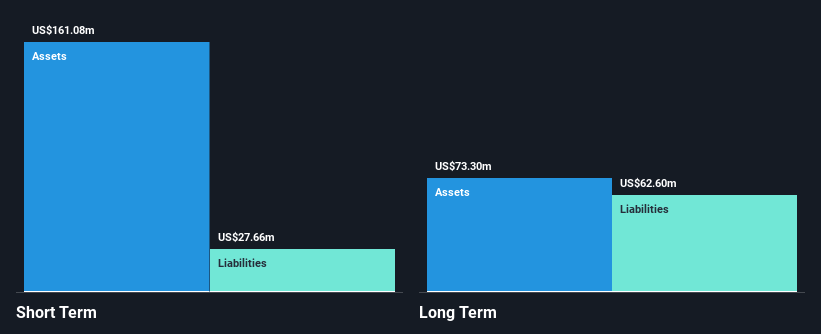

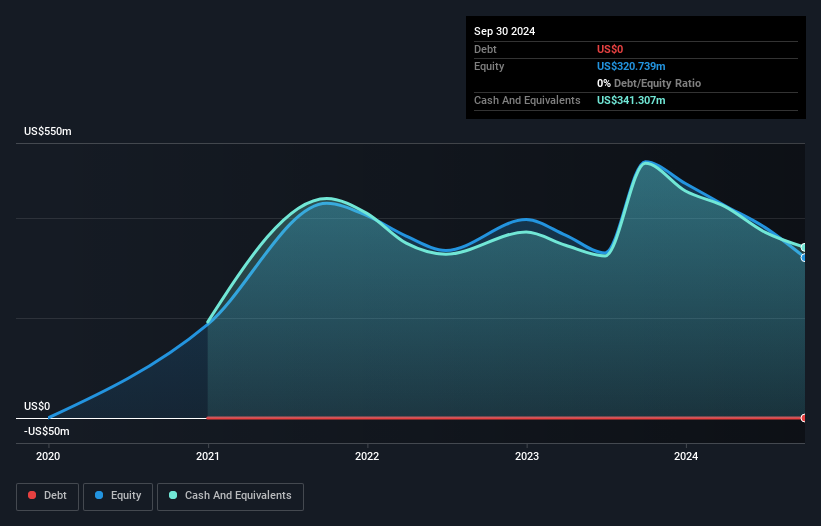

Neumora Therapeutics, with a market cap of US$281.12 million, is pre-revenue and focused on treatments for brain diseases. Despite being debt-free and having short-term assets exceeding liabilities, the company faces challenges with increased losses over five years and heightened stock volatility. Recent management changes include Paul L. Berns transitioning to CEO amid executive reshuffles. Legal issues arise from a class action lawsuit related to their IPO disclosures. The KOASTAL-1 Phase 3 study for navacaprant in major depressive disorder showed no significant improvement on primary endpoints but demonstrated safety without serious adverse events reported.

- Navigate through the intricacies of Neumora Therapeutics with our comprehensive balance sheet health report here.

- Examine Neumora Therapeutics' earnings growth report to understand how analysts expect it to perform.

Nerdy (NYSE:NRDY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nerdy, Inc. operates a platform for live online learning and has a market cap of approximately $351.74 million.

Operations: The company's revenue is primarily derived from its Educational Services segment, specifically in Education & Training Services, which generated $197.33 million.

Market Cap: $351.74M

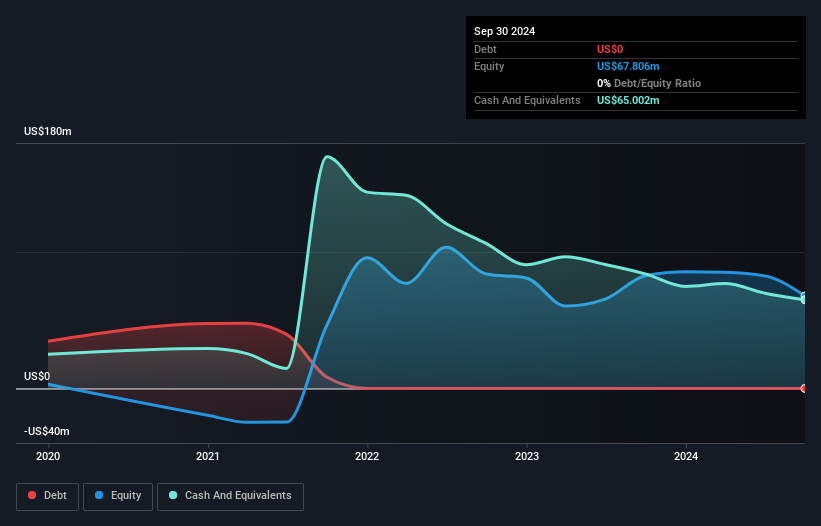

Nerdy, Inc., with a market cap of US$351.74 million, has faced challenges due to its unprofitability and increased losses over the past five years. Despite this, the company remains debt-free and has sufficient cash runway for more than three years based on current free cash flow. Nerdy recently regained compliance with NYSE listing standards after addressing share price concerns. A significant development is its partnership with Clover School District through Varsity Tutors for Schools, enhancing educational resource access for students nationwide. The management team and board are experienced but face volatility in stock performance amidst broader industry challenges.

- Click here to discover the nuances of Nerdy with our detailed analytical financial health report.

- Explore Nerdy's analyst forecasts in our growth report.

Summing It All Up

- Explore the 705 names from our US Penny Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Neumora Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Neumora Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NMRA

Neumora Therapeutics

A clinical-stage biopharmaceutical company, engages in developing therapeutic treatments for brain diseases, neuropsychiatric disorders, and neurodegenerative diseases in the United States.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives