- United States

- /

- Software

- /

- NYSE:RSKD

Promising Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates through a period of earnings reports and fluctuating commodity prices, investors continue to explore various avenues for potential growth. Penny stocks, often associated with smaller or newer companies, remain a relevant area of interest due to their potential for significant returns at lower price points. In this article, we examine three penny stocks that exhibit strong financial foundations and promising prospects in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.84 | $420.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.81 | $654.61M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.51 | $267.06M | ✅ 4 ⚠️ 2 View Analysis > |

| WM Technology (MAPS) | $1.04 | $182.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.38 | $1.45B | ✅ 3 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $4.95 | $56.35M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.9501 | $24.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.9501 | $7.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.46 | $77.94M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 363 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

DocGo (DCGO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DocGo Inc. operates in the United States and the United Kingdom, offering mobile health and medical transportation services, with a market cap of $117.37 million.

Operations: The company generates its revenue from two main segments: Mobile Health Services, which contributed $238.43 million, and Transportation Services, which brought in $197.54 million.

Market Cap: $117.37M

DocGo Inc., with a market cap of US$117.37 million, operates in mobile health and medical transportation services. Despite being unprofitable, the company has not diluted shareholders significantly over the past year and maintains more cash than its total debt, with short-term assets exceeding liabilities. Recent initiatives include launching care gap closure services in New Mexico and securing contracts for community vaccination services in San Diego, aiming to enhance healthcare access for underserved populations. However, revenue has decreased compared to last year, leading to a net loss of US$20.56 million for the first half of 2025.

- Click here and access our complete financial health analysis report to understand the dynamics of DocGo.

- Learn about DocGo's future growth trajectory here.

Metagenomi (MGX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metagenomi, Inc. is a genetic medicines company that develops therapeutics using a metagenomics-derived genome editing toolbox in the United States, with a market cap of $125.74 million.

Operations: The company generates revenue from developing next-generation gene-editing technologies and therapies, amounting to $33.77 million.

Market Cap: $125.74M

Metagenomi, Inc., with a market cap of US$125.74 million, is navigating the biotech landscape by leveraging its metagenomics-derived genome editing toolbox. Despite being unprofitable and experiencing increased losses over five years, it maintains a debt-free status and has sufficient cash runway for over two years. Recent strategic moves include entering a non-exclusive license agreement with Acuitas Therapeutics to enhance its lipid nanoparticle technology capabilities while regaining full control of intellectual property from Affini-T Therapeutics after terminating their agreement. However, earnings are forecasted to decline by 16.7% annually over the next three years, reflecting ongoing challenges in achieving profitability.

- Click here to discover the nuances of Metagenomi with our detailed analytical financial health report.

- Understand Metagenomi's earnings outlook by examining our growth report.

Riskified (RSKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Riskified Ltd. develops and provides an e-commerce risk intelligence platform for online merchants across various regions globally, with a market cap of approximately $735.57 million.

Operations: The company's revenue is primarily generated from its Security Software & Services segment, amounting to $335.83 million.

Market Cap: $735.57M

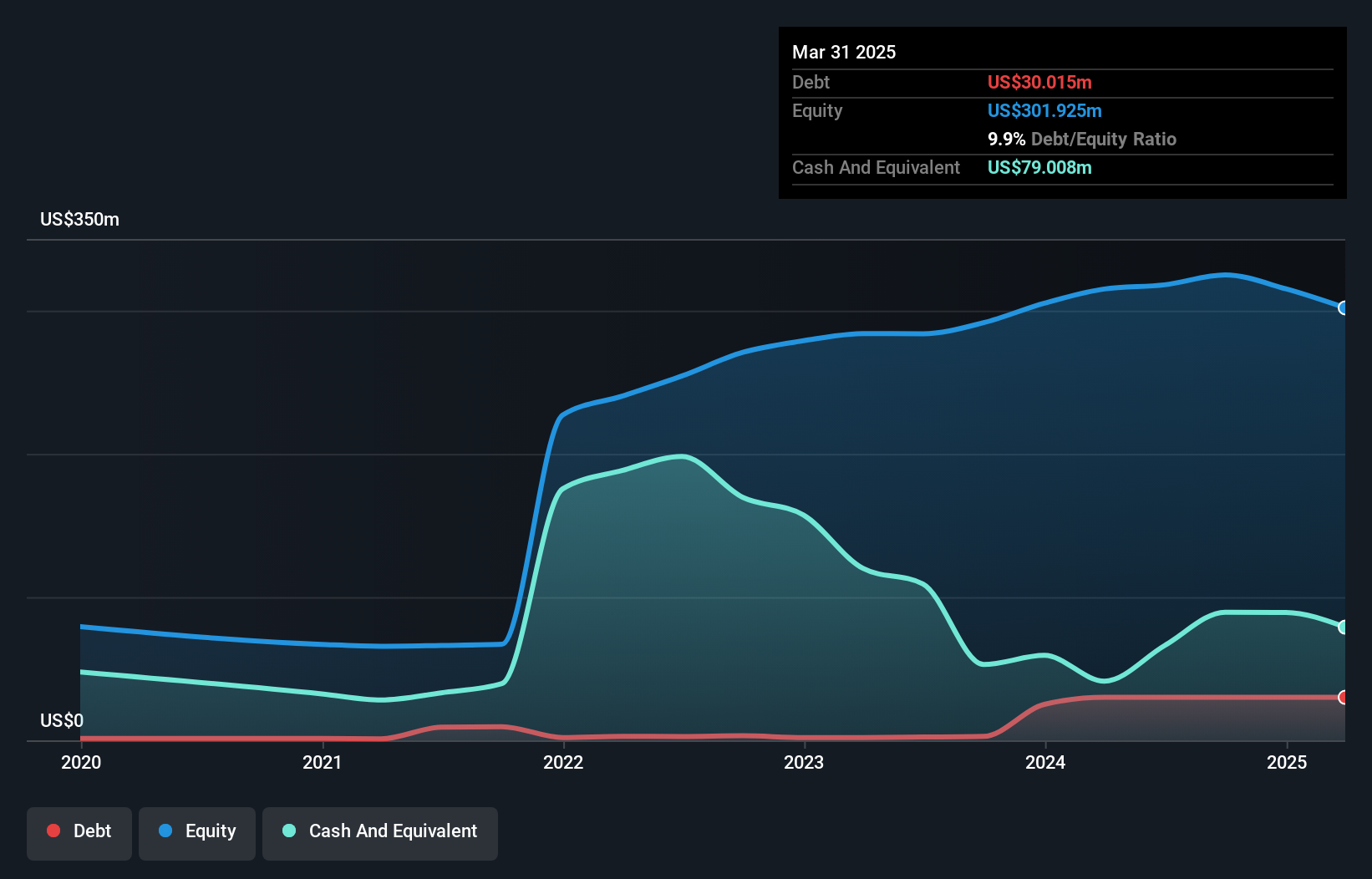

Riskified Ltd., with a market cap of approximately US$735.57 million, operates in the e-commerce risk intelligence space, generating revenue primarily from its Security Software & Services segment. Despite being unprofitable with a net loss of US$11.63 million for Q2 2025, Riskified is debt-free and has a cash runway exceeding three years due to positive free cash flow growth. The company recently raised its revenue guidance for 2025 and completed significant share repurchases worth US$65 million. A new partnership with HUMAN Security aims to enhance AI-driven fraud prevention capabilities amid rising threats from AI shopping agents.

- Navigate through the intricacies of Riskified with our comprehensive balance sheet health report here.

- Gain insights into Riskified's future direction by reviewing our growth report.

Where To Now?

- Access the full spectrum of 363 US Penny Stocks by clicking on this link.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSKD

Riskified

Develops and offers an e-commerce risk intelligent platform that allows online merchants to create trusted relationships with consumers in the United States, Europe, the Middle East, Africa, the Asia-Pacific, and the Americas.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives