- United States

- /

- Life Sciences

- /

- NasdaqGS:LFCR

Further weakness as Lifecore Biomedical (NASDAQ:LFCR) drops 11% this week, taking three-year losses to 38%

While it may not be enough for some shareholders, we think it is good to see the Lifecore Biomedical, Inc. (NASDAQ:LFCR) share price up 24% in a single quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 38% in the last three years, falling well short of the market return.

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Lifecore Biomedical

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Lifecore Biomedical became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

We note that, in three years, revenue has actually grown at a 4.0% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Lifecore Biomedical more closely, as sometimes stocks fall unfairly. This could present an opportunity.

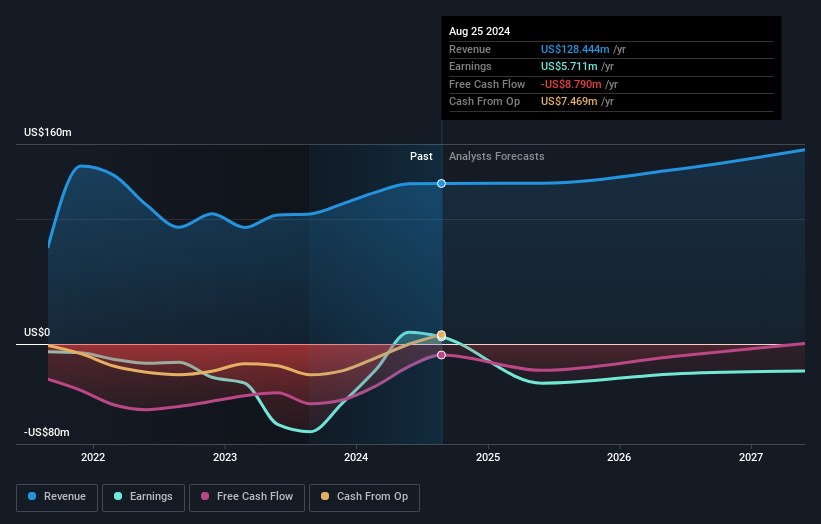

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Lifecore Biomedical has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Lifecore Biomedical

A Different Perspective

Lifecore Biomedical provided a TSR of 5.4% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 6% endured over half a decade. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for Lifecore Biomedical you should be aware of, and 2 of them are a bit concerning.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LFCR

Lifecore Biomedical

Operates as an integrated contract development and manufacturing organization in the United States.

Good value low.

Similar Companies

Market Insights

Community Narratives