- United States

- /

- Software

- /

- NasdaqGS:CIFR

US Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

As major U.S. stock indices like the Dow Jones Industrial Average and S&P 500 reach record highs, buoyed by robust bank earnings and favorable inflation data, investors are increasingly optimistic about the market's trajectory. In this environment, growth companies with high insider ownership can be particularly appealing as they demonstrate strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.4% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.2% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 41.3% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Here's a peek at a few of the choices from the screener.

Cipher Mining (NasdaqGS:CIFR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cipher Mining Inc., along with its subsidiaries, develops and operates industrial-scale bitcoin mining data centers in the United States, with a market cap of $1.26 billion.

Operations: The company generates revenue primarily from data processing, amounting to $158.67 million.

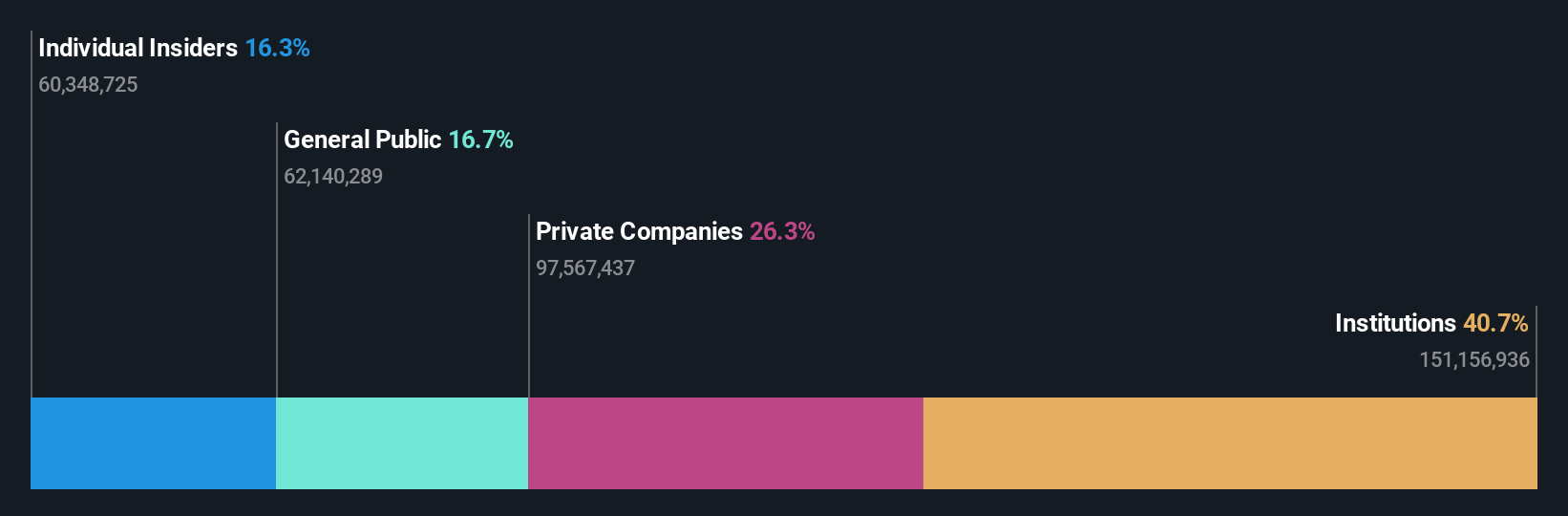

Insider Ownership: 17.6%

Earnings Growth Forecast: 73.2% p.a.

Cipher Mining demonstrates significant growth potential with forecasted revenue and earnings growth rates surpassing the US market averages. Despite recent shareholder dilution, the company has shown profitability this year, reporting a net income of US$24.61 million for the first half of 2024. Recent production results indicate robust operational capacity with 78,000 mining rigs deployed and a hash rate of 9.3 EH/s as of September 2024. However, volatility in share price and ongoing equity offerings may pose challenges to investors seeking stability.

- Click here and access our complete growth analysis report to understand the dynamics of Cipher Mining.

- Insights from our recent valuation report point to the potential overvaluation of Cipher Mining shares in the market.

Krystal Biotech (NasdaqGS:KRYS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company focused on discovering, developing, and commercializing genetic medicines for rare diseases in the United States, with a market cap of approximately $4.94 billion.

Operations: Krystal Biotech focuses on the discovery, development, and commercialization of genetic medicines targeting rare diseases in the U.S.

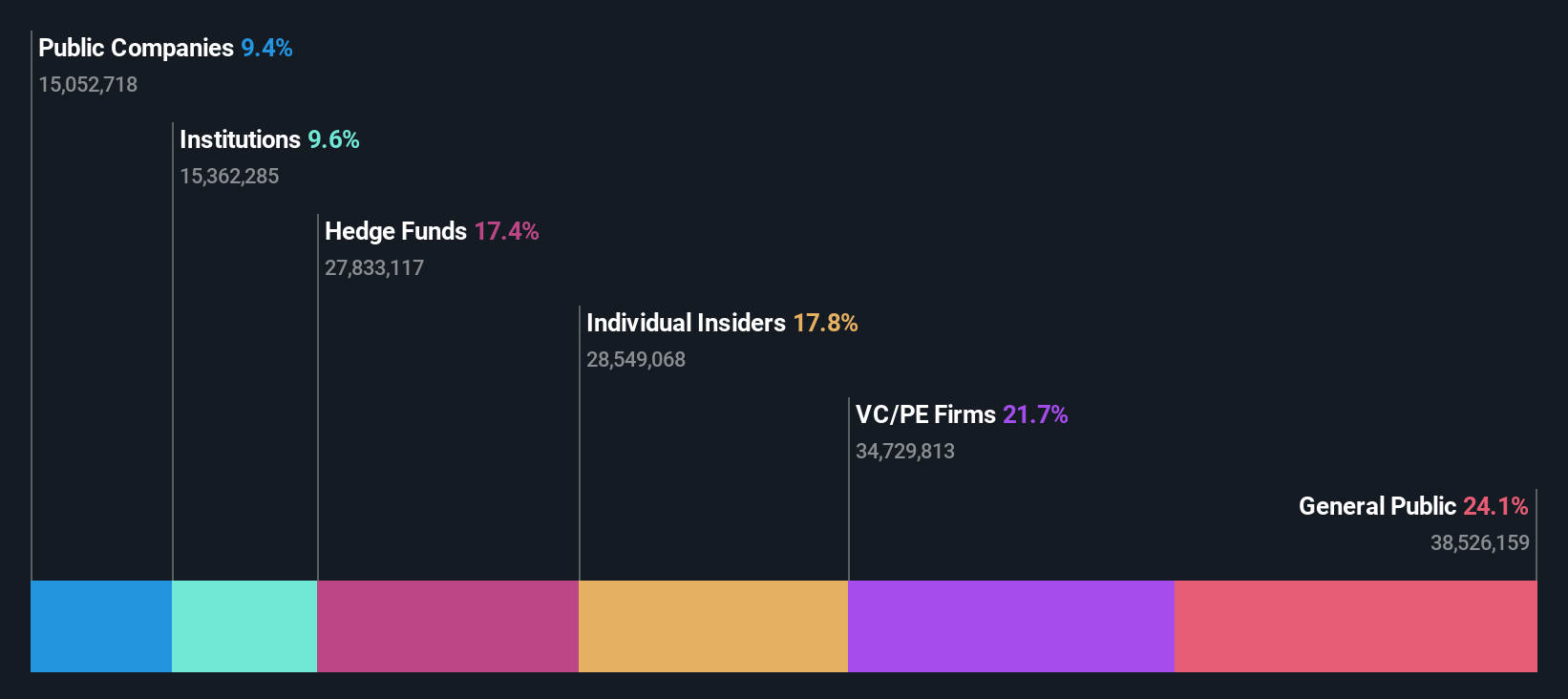

Insider Ownership: 10.2%

Earnings Growth Forecast: 34.2% p.a.

Krystal Biotech shows strong growth potential with earnings and revenue expected to grow significantly, outpacing US market averages. The company recently turned profitable, reporting a net income of US$16.5 million for the first half of 2024. Despite past shareholder dilution, it trades below estimated fair value by 60.3%. Recent presentations at major conferences highlight strategic developments in its pipeline, though insider trading activity remains low over the last three months.

- Click here to discover the nuances of Krystal Biotech with our detailed analytical future growth report.

- According our valuation report, there's an indication that Krystal Biotech's share price might be on the expensive side.

ZKH Group (NYSE:ZKH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ZKH Group Limited operates a trading and service platform for maintenance, repair, and operating (MRO) products, including spare parts and office supplies in China, with a market cap of approximately $583.07 million.

Operations: The company's revenue is primarily generated from its Business-To-Business Trading and Services of Industrial Products segment, which accounted for CN¥8.82 billion.

Insider Ownership: 17.7%

Earnings Growth Forecast: 116.0% p.a.

ZKH Group demonstrates growth potential with revenue forecasted to grow faster than the US market at 12.5% annually, though below 20%. Recent earnings show reduced net losses and increased revenue, indicating improvement. Trading at a good value, it's priced 14.3% below fair value estimates and analysts expect a price rise of 24.6%. Despite no recent insider trading activity, ZKH's inclusion in the S&P Global BMI Index underscores its market relevance.

- Take a closer look at ZKH Group's potential here in our earnings growth report.

- Our expertly prepared valuation report ZKH Group implies its share price may be lower than expected.

Summing It All Up

- Click here to access our complete index of 182 Fast Growing US Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CIFR

Cipher Mining

Engages in the development and operation of industrial scale bitcoin mining data centers in the United States.

High growth potential and good value.