- United States

- /

- Biotech

- /

- NasdaqGS:INCY

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

In the last week, the United States market has been flat, but over the past 12 months, it has risen by 8.4%, with earnings expected to grow by 14% per annum in the coming years. In this environment, identifying high-growth tech stocks can be crucial for investors seeking to capitalize on potential opportunities within a dynamic sector poised for expansion.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.44% | 29.79% | ★★★★★★ |

| TG Therapeutics | 26.03% | 37.60% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.40% | 64.74% | ★★★★★★ |

| Clene | 60.86% | 63.07% | ★★★★★★ |

| AVITA Medical | 27.91% | 55.77% | ★★★★★★ |

| TKO Group Holdings | 22.48% | 25.17% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.69% | 58.49% | ★★★★★★ |

| Lumentum Holdings | 21.61% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.36% | 59.79% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

AvePoint (NasdaqGS:AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

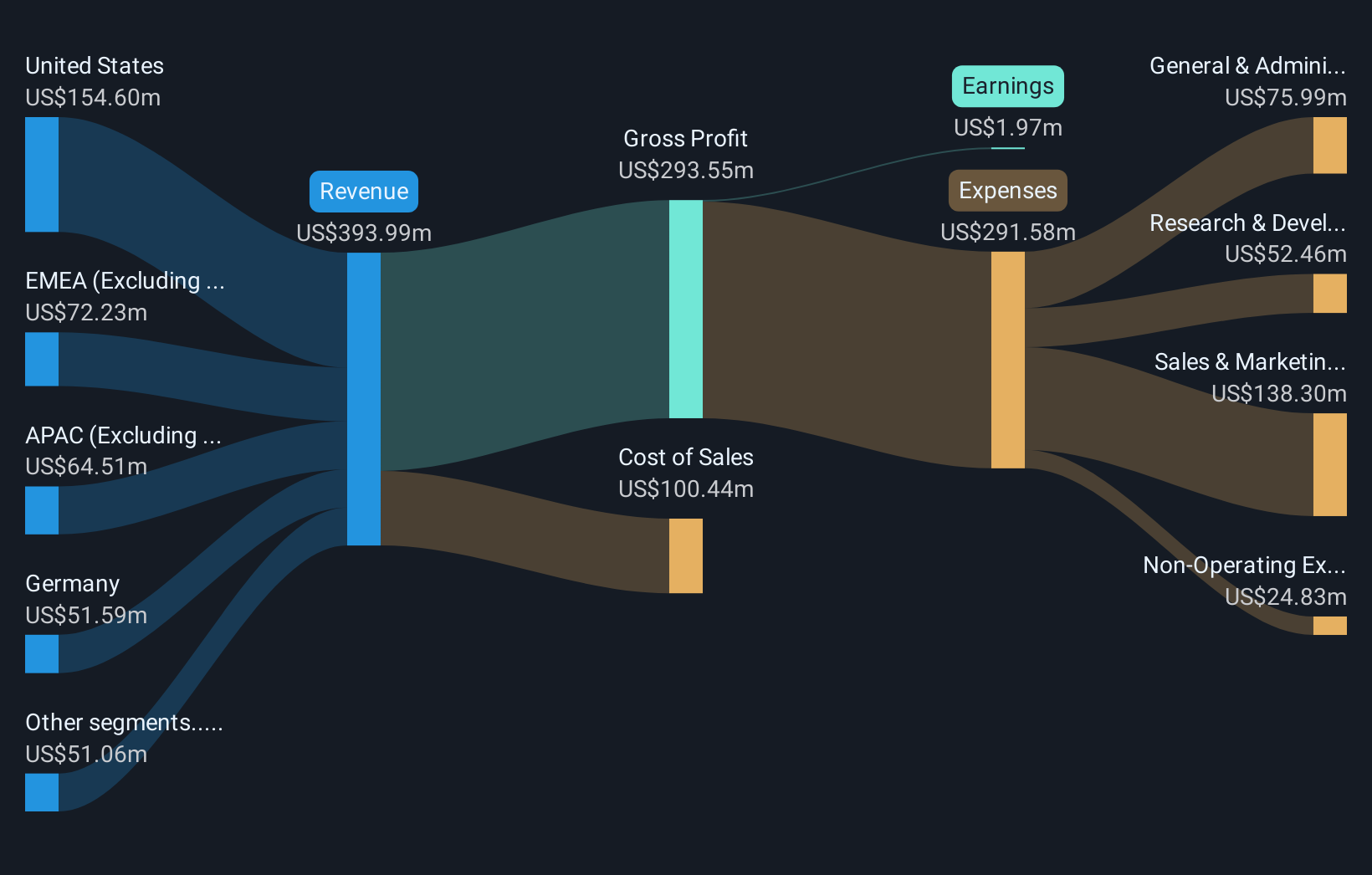

Overview: AvePoint, Inc. offers a cloud-native data management software platform across various regions including North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of $3.05 billion.

Operations: The company generates revenue primarily from its software and programming segment, amounting to $330.48 million.

AvePoint is actively pursuing growth through strategic acquisitions and investments, particularly focusing on enhancing its SaaS offerings and expanding global reach. This approach is underscored by their recent announcement of new data security solutions for Google Workspace, aiming to bolster their position in multi-cloud environments—a critical move as 89% of enterprises use multiple cloud services. Financially, AvePoint forecasts robust revenue growth with expectations set at $380 million to $388 million for 2025, marking an increase of up to 17% year-over-year. This projection aligns with their aggressive expansion strategy in the tech sector, where cloud adoption and data security are becoming increasingly paramount.

- Navigate through the intricacies of AvePoint with our comprehensive health report here.

Explore historical data to track AvePoint's performance over time in our Past section.

Incyte (NasdaqGS:INCY)

Simply Wall St Growth Rating: ★★★★☆☆

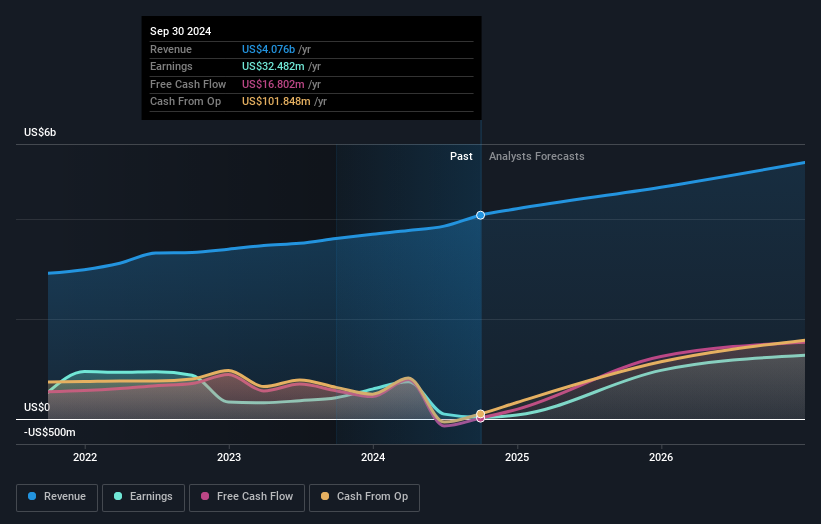

Overview: Incyte Corporation is a biopharmaceutical company focused on the discovery, development, and commercialization of therapeutics across the United States, Europe, Canada, and Japan with a market cap of $11.79 billion.

Operations: Incyte generates revenue primarily from its biotechnology segment, which amounts to $4.24 billion. The company's focus is on developing and commercializing therapeutics across major global markets including the United States, Europe, Canada, and Japan.

Incyte's recent strategic maneuvers, including its collaboration with Genesis Therapeutics, underscore a commitment to leveraging AI for drug discovery, potentially accelerating pipeline development with an upfront investment of $30 million. This aligns with their innovative approach as seen in the successful Phase 3 results of baricitinib for alopecia areata, emphasizing Incyte's focus on addressing unmet medical needs through advanced therapies. Financially, the company has demonstrated robust growth with a revenue increase to $4.24 billion in 2024 from $3.7 billion the previous year, reflecting a solid execution of its strategic initiatives despite some challenges in net income which saw a significant drop.

- Click here and access our complete health analysis report to understand the dynamics of Incyte.

Evaluate Incyte's historical performance by accessing our past performance report.

Scholar Rock Holding (NasdaqGS:SRRK)

Simply Wall St Growth Rating: ★★★★★☆

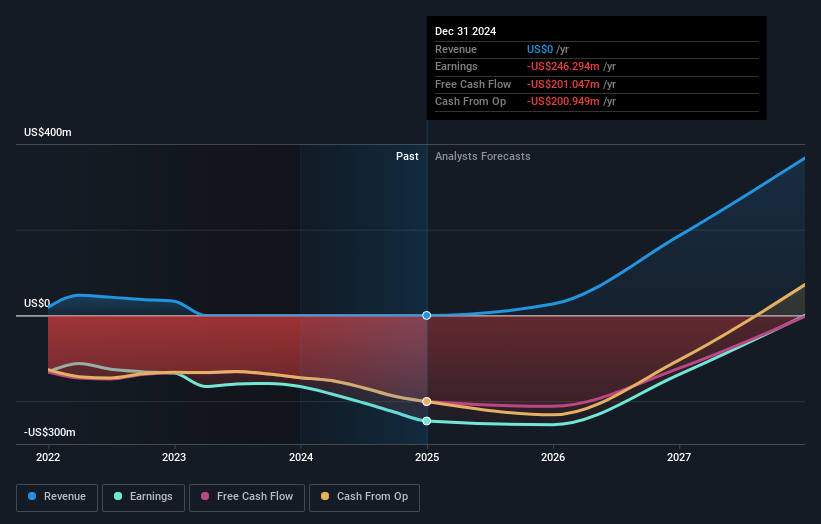

Overview: Scholar Rock Holding Corporation is a biopharmaceutical company dedicated to discovering, developing, and delivering medicines targeting serious diseases influenced by protein growth factor signaling, with a market cap of $2.85 billion.

Operations: Scholar Rock Holding specializes in developing therapies for diseases linked to protein growth factor signaling. The company operates within the biopharmaceutical sector, focusing on innovative drug discovery and development.

Scholar Rock's recent FDA acceptance of its Biologics License Application for apitegromab marks a significant milestone, positioning the company at the forefront of innovative treatments for spinal muscular atrophy. This development, coupled with a robust pipeline evidenced by positive Phase 3 SAPPHIRE trial results, underscores Scholar Rock's potential in a niche yet critical therapeutic area. Despite reporting a net loss increase to $246.29 million in 2024 from $165.79 million in the previous year, these regulatory advancements could pave the way for substantial future growth and market presence. The company’s strategic focus on muscle-targeted therapies is further highlighted by its extensive R&D efforts, which remain pivotal amidst financial volatility and competitive pressures within biotech sector dynamics.

- Get an in-depth perspective on Scholar Rock Holding's performance by reading our health report here.

Assess Scholar Rock Holding's past performance with our detailed historical performance reports.

Where To Now?

- Reveal the 236 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Incyte, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INCY

Incyte

A biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics in the United States, Europe, Canada, and Japan.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives