- United States

- /

- Software

- /

- NYSE:CMCM

Top US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the U.S. equities market takes a breather from its recent rally, major indices like the S&P 500 have reached new highs, reflecting investor optimism amid strong corporate earnings and pro-business policies. Despite their historical connotations, penny stocks remain an intriguing investment area due to their potential for growth when backed by robust financials. This article will explore three noteworthy penny stocks that demonstrate financial strength and offer potential opportunities for investors seeking hidden value in smaller companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $111.94M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.93 | $6.36M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.80 | $11.61M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.94 | $2.18B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2899 | $10.66M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.90 | $88.72M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.38 | $54.13M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.26 | $22.7M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.92 | $83.39M | ★★★★★☆ |

Click here to see the full list of 706 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

4D Molecular Therapeutics (NasdaqGS:FDMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 4D Molecular Therapeutics, Inc. is a clinical-stage biotherapeutics company that develops genetic medicines using its therapeutic vector evolution platform in the Netherlands and the United States, with a market cap of $213.11 million.

Operations: The company generates revenue from its biotechnology segment, amounting to $0.017 million.

Market Cap: $213.11M

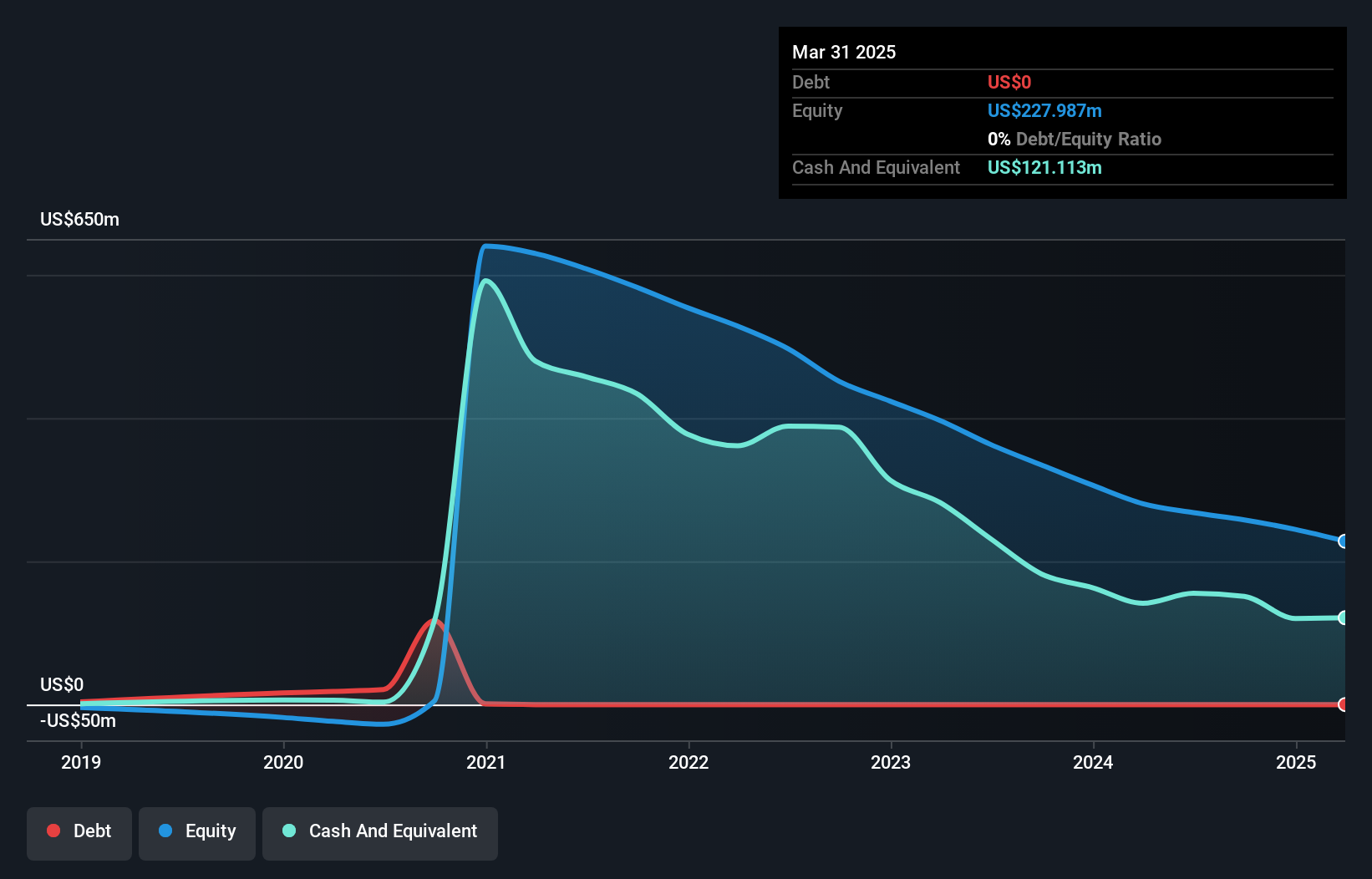

4D Molecular Therapeutics, with a market cap of US$213.11 million, is a pre-revenue biotech firm focused on genetic medicines. Despite its unprofitability and forecasted earnings decline, the company has no debt and a robust cash runway exceeding three years. Recent strategic updates highlight its pipeline focus on ophthalmology with the 4D-150 program for wet AMD and DME, which aims to reduce treatment burdens significantly. While it faces challenges like being dropped from the S&P Biotechnology Select Industry Index, ongoing clinical trials and partnerships suggest potential future advancements in both ophthalmology and pulmonology sectors.

- Take a closer look at 4D Molecular Therapeutics' potential here in our financial health report.

- Learn about 4D Molecular Therapeutics' future growth trajectory here.

Hyliion Holdings (NYSEAM:HYLN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hyliion Holdings Corp. develops sustainable electricity-producing technology aimed at clean and efficient energy solutions, with a market cap of $420.44 million.

Operations: Hyliion Holdings Corp. has not reported specific revenue segments.

Market Cap: $420.44M

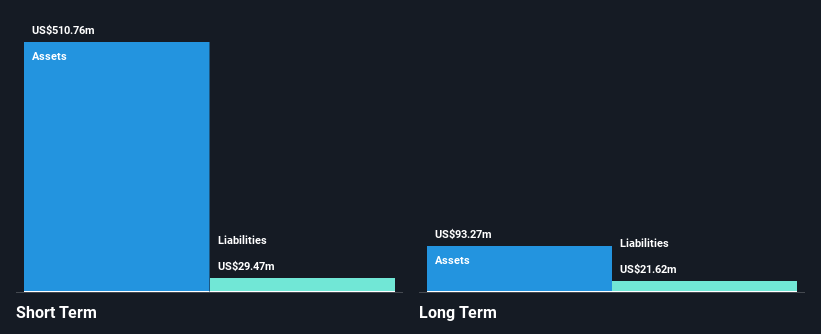

Hyliion Holdings Corp., with a market cap of US$420.44 million, is pre-revenue and focuses on sustainable energy solutions. Despite being unprofitable, the company has no debt and short-term assets exceeding liabilities. Recent developments include a collaboration with ElectriGen LLC to deploy its KARNO generators in the oil and gas sector, funded by a US$6 million U.S. Department of Energy grant aimed at reducing methane emissions. This initiative could create a revenue stream by utilizing excess gas while promoting environmental sustainability, though Hyliion's cash runway remains limited if historical cash flow trends persist.

- Dive into the specifics of Hyliion Holdings here with our thorough balance sheet health report.

- Examine Hyliion Holdings' earnings growth report to understand how analysts expect it to perform.

Cheetah Mobile (NYSE:CMCM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cheetah Mobile Inc., with a market cap of $132.98 million, provides internet services and artificial intelligence solutions in China, Hong Kong, Japan, and internationally.

Operations: The company's revenue is derived from two segments: Internet Business, which generated CN¥464.75 million, and AI and Others, contributing CN¥272.36 million.

Market Cap: $132.98M

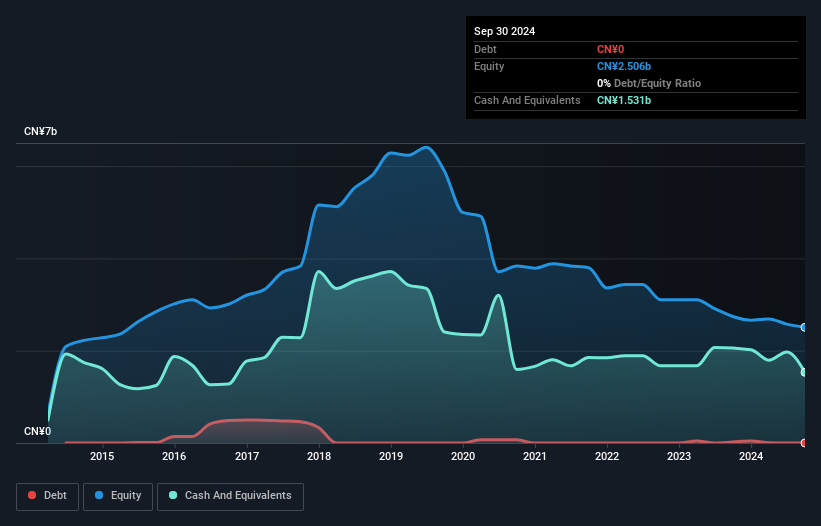

Cheetah Mobile Inc., with a market cap of $132.98 million, operates in the internet services and AI sectors, generating revenue from its Internet Business (CN¥464.75 million) and AI segments (CN¥272.36 million). Despite being debt-free, the company faces challenges with unprofitability and a negative return on equity (-21.54%). Recent earnings reports reveal increased quarterly revenue to CN¥192.08 million but also higher net losses of CN¥46.9 million compared to last year’s figures, reflecting ongoing financial struggles despite some revenue growth. The seasoned management team contrasts with an inexperienced board, indicating potential strategic shifts ahead.

- Click to explore a detailed breakdown of our findings in Cheetah Mobile's financial health report.

- Learn about Cheetah Mobile's historical performance here.

Turning Ideas Into Actions

- Embark on your investment journey to our 706 US Penny Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMCM

Cheetah Mobile

Cheetah Mobile Inc. along with its subsidiaries, engages in the provision of internet services, artificial intelligence (AI), and other services in the People’s Republic of China, Hong Kong, Japan, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives