- United States

- /

- Life Sciences

- /

- NasdaqCM:CDXC

January 2025 US Undervalued Small Caps With Insider Action To Consider

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 2.4%, contributing to a remarkable 25% climb over the past year, with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying small-cap stocks that are currently undervalued and exhibit insider activity can present intriguing opportunities for investors seeking potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| OptimizeRx | NA | 1.1x | 44.15% | ★★★★★☆ |

| Quanex Building Products | 33.3x | 0.9x | 38.67% | ★★★★☆☆ |

| First United | 13.0x | 3.0x | 47.13% | ★★★★☆☆ |

| Franklin Financial Services | 10.4x | 2.0x | 33.90% | ★★★★☆☆ |

| McEwen Mining | 4.3x | 2.2x | 44.35% | ★★★★☆☆ |

| Innovex International | 9.2x | 2.1x | 47.28% | ★★★★☆☆ |

| ChromaDex | 305.2x | 4.9x | 29.74% | ★★★☆☆☆ |

| ProPetro Holding | NA | 0.8x | 11.49% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -75.07% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -64.39% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

ChromaDex (NasdaqCM:CDXC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: ChromaDex is a bioscience company focused on developing and commercializing dietary supplements and ingredients, with a market cap of $0.19 billion.

Operations: ChromaDex's revenue is primarily derived from consumer products, followed by ingredients and analytical reference standards and services. The company's gross profit margin has shown an upward trend, reaching 61.45% in the latest period. Operating expenses are a significant cost component, with general and administrative expenses being the largest contributor.

PE: 305.2x

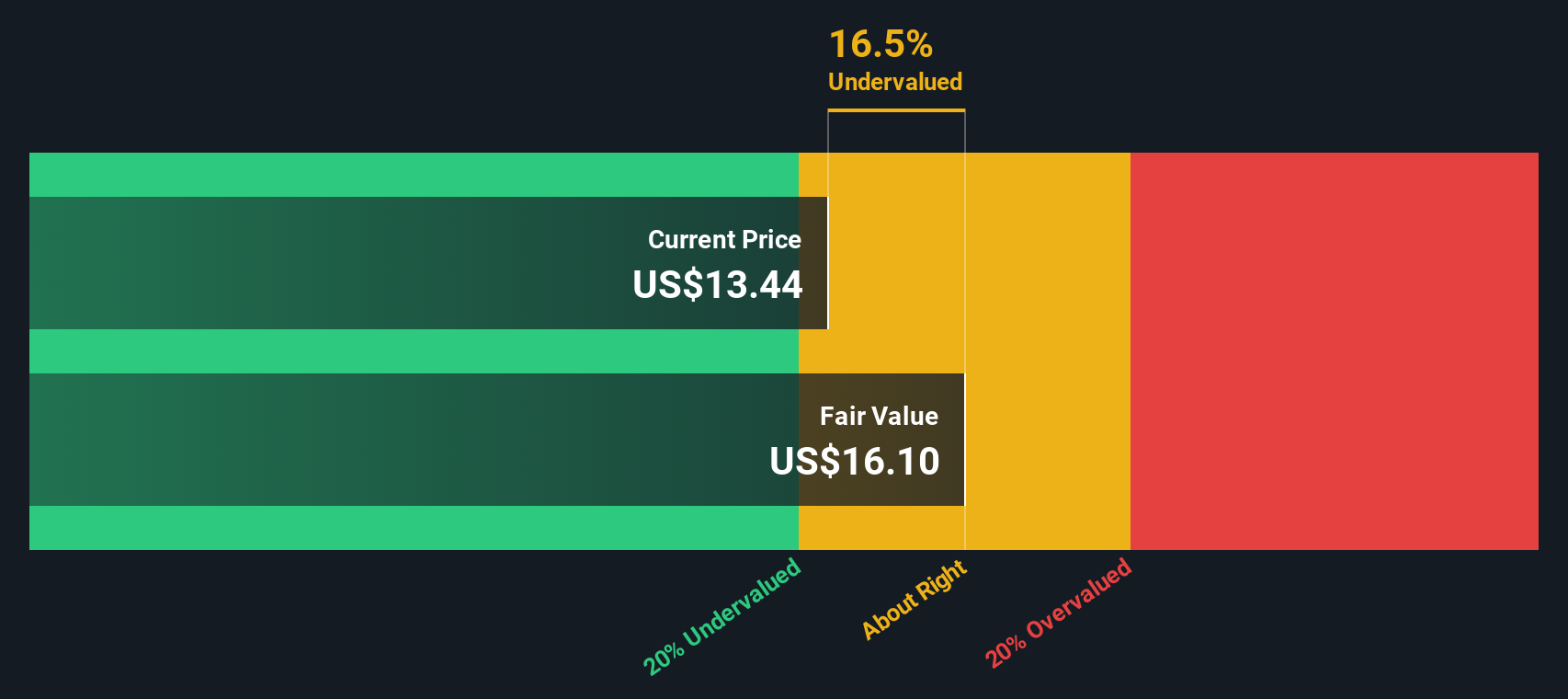

ChromaDex, a smaller player in the U.S. market, is gaining attention for its innovative health products like Niagen IV, now available nationwide. Despite a volatile share price recently, their financials show promise with Q3 2024 sales hitting US$25.58 million, up from US$19.5 million the previous year. Insider confidence is evident as individuals within the company have been purchasing shares over recent months, signaling potential growth optimism amidst projected revenue increases and expanding product lines.

- Unlock comprehensive insights into our analysis of ChromaDex stock in this valuation report.

Gain insights into ChromaDex's historical performance by reviewing our past performance report.

SNDL (NasdaqCM:SNDL)

Simply Wall St Value Rating: ★★★☆☆☆

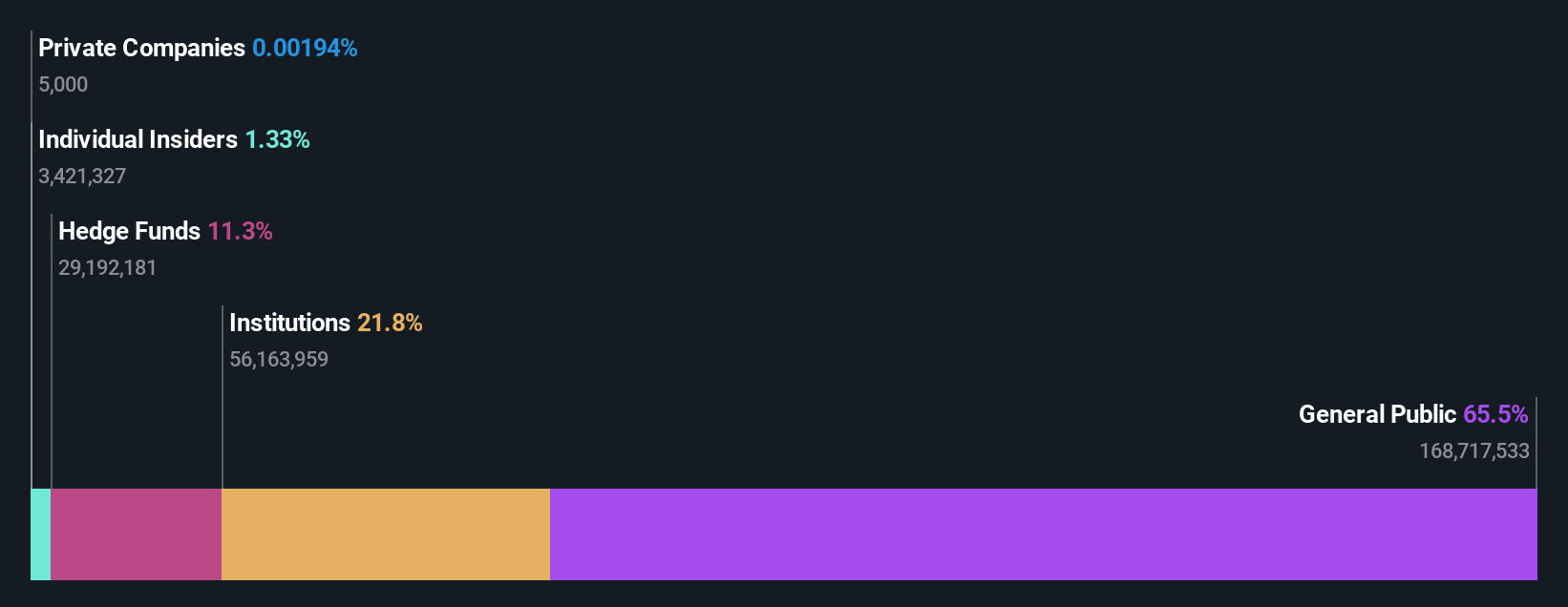

Overview: SNDL is a company engaged in liquor retail, cannabis retail, and cannabis operations with a market capitalization of CA$1.09 billion.

Operations: The company generates revenue primarily through liquor retail, cannabis retail, and cannabis operations. The gross profit margin has shown an upward trend, reaching 25.12% as of the latest reporting period.

PE: -6.0x

SNDL, a small company in the cannabis industry, is navigating its financial challenges with strategic initiatives. Despite being unprofitable and reliant on external funding, they are actively pursuing growth through collaborations like their recent agreement with HYTN Innovations to develop GMP-compliant vape cartridges. Insider confidence is evident as leadership changes bring experienced individuals onboard, enhancing digital transformation and operational efficiency. A share repurchase program aims to return value to shareholders while exploring acquisitions signals potential for future expansion.

- Delve into the full analysis valuation report here for a deeper understanding of SNDL.

Examine SNDL's past performance report to understand how it has performed in the past.

Potbelly (NasdaqGS:PBPB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Potbelly operates a chain of sandwich shops and has a market capitalization of $0.1 billion.

Operations: The company generates revenue primarily through its sandwich shops, with a recent gross profit margin of 35.50%. Cost of goods sold (COGS) and operating expenses are significant components of its cost structure, impacting net income.

PE: 8.5x

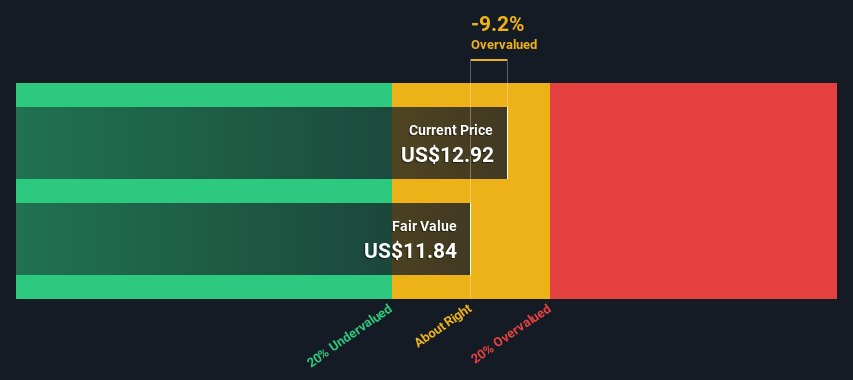

Potbelly, a smaller company in the U.S., is navigating its growth path with strategic franchise expansions and insider confidence reflected in recent share purchases. The company reported a rise in net income to US$3.74 million for Q3 2024, despite a drop in revenue to US$115.12 million compared to the previous year. However, future earnings are projected to decline significantly over the next three years. Recent auditor changes and modest share repurchases indicate an ongoing restructuring effort aimed at long-term stability and growth potential through its Franchise Growth Acceleration Initiative, targeting 2,000 shops nationwide.

- Get an in-depth perspective on Potbelly's performance by reading our valuation report here.

Explore historical data to track Potbelly's performance over time in our Past section.

Where To Now?

- Reveal the 45 hidden gems among our Undervalued US Small Caps With Insider Buying screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CDXC

ChromaDex

Operates as a bioscience company focusing on developing healthy aging products.

Flawless balance sheet with reasonable growth potential.