- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Discover 3 US Stocks Estimated To Be Trading At Discounts Of Up To 41.5%

Reviewed by Simply Wall St

As of February 2025, the U.S. stock market has shown resilience, with the S&P 500 closing just shy of a record high and major indexes posting weekly gains despite mixed economic signals such as declining retail sales and fluctuating treasury yields. In this environment, identifying undervalued stocks can be particularly appealing to investors seeking opportunities at discounted prices; these stocks may offer potential for growth when their true value is realized in the market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $18.65 | $36.99 | 49.6% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | $30.80 | $58.90 | 47.7% |

| Old National Bancorp (NasdaqGS:ONB) | $23.89 | $45.71 | 47.7% |

| Sandy Spring Bancorp (NasdaqGS:SASR) | $33.65 | $64.49 | 47.8% |

| Incyte (NasdaqGS:INCY) | $70.42 | $134.89 | 47.8% |

| Array Technologies (NasdaqGM:ARRY) | $6.79 | $13.53 | 49.8% |

| Constellium (NYSE:CSTM) | $9.34 | $18.31 | 49% |

| First Advantage (NasdaqGS:FA) | $19.93 | $38.12 | 47.7% |

| Fluence Energy (NasdaqGS:FLNC) | $6.43 | $12.61 | 49% |

| Kyndryl Holdings (NYSE:KD) | $41.79 | $82.10 | 49.1% |

Here's a peek at a few of the choices from the screener.

BioLife Solutions (NasdaqCM:BLFS)

Overview: BioLife Solutions, Inc. develops, manufactures, and markets bioproduction tools and services for the cell and gene therapy industry globally, with a market cap of approximately $1.29 billion.

Operations: The company's revenue segment includes biopreservation tools, generating $146.96 million.

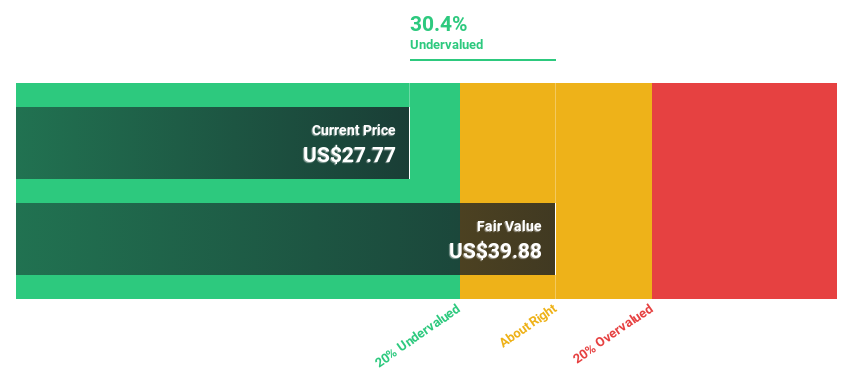

Estimated Discount To Fair Value: 30.4%

BioLife Solutions is trading at US$27.77, significantly below its estimated fair value of US$39.92, indicating it may be undervalued based on cash flows. Despite being currently unprofitable, the company is expected to achieve profitability in three years with earnings projected to grow substantially each year. Recent board appointment of Tony J. Hunt could enhance strategic direction and innovation in bioprocessing, potentially supporting its forecasted revenue growth exceeding the broader U.S. market rate.

- Our earnings growth report unveils the potential for significant increases in BioLife Solutions' future results.

- Click to explore a detailed breakdown of our findings in BioLife Solutions' balance sheet health report.

Enphase Energy (NasdaqGM:ENPH)

Overview: Enphase Energy, Inc. designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry globally with a market cap of approximately $8.47 billion.

Operations: The company's revenue primarily comes from the design, manufacture, and sale of solutions for the solar photovoltaic industry, amounting to $1.33 billion.

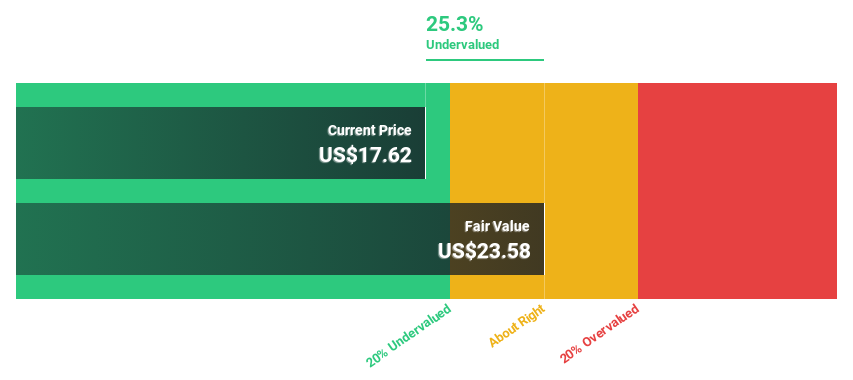

Estimated Discount To Fair Value: 12.5%

Enphase Energy, trading at US$63.94, is undervalued relative to its estimated fair value of US$73.06. Despite a decline in net income from US$438.94 million to US$102.66 million year-over-year, the company remains focused on expanding its market presence and product offerings, such as the IQ Battery 5P in California and Southeast Asia markets. With projected earnings growth outpacing the U.S. market average, Enphase's strategic expansions may bolster future cash flows despite current challenges.

- In light of our recent growth report, it seems possible that Enphase Energy's financial performance will exceed current levels.

- Dive into the specifics of Enphase Energy here with our thorough financial health report.

SolarEdge Technologies (NasdaqGS:SEDG)

Overview: SolarEdge Technologies, Inc. designs, develops, manufactures, and sells DC optimized inverter systems for solar photovoltaic installations globally and has a market cap of approximately $948.06 million.

Operations: The company's revenue segments include $961.61 million from Solar and $74.19 million from Energy Storage.

Estimated Discount To Fair Value: 41.5%

SolarEdge Technologies, trading at US$16.36, is significantly undervalued compared to its fair value estimate of US$27.96. The company anticipates substantial annual profit growth over the next three years, despite a volatile share price recently. Its partnership with Summit Ridge Energy for domestically-manufactured inverters and Power Optimizers enhances its U.S. market presence, while discontinuing non-core energy storage operations aims to streamline focus and reduce costs by approximately US$7.5 million quarterly by late 2025.

- Insights from our recent growth report point to a promising forecast for SolarEdge Technologies' business outlook.

- Take a closer look at SolarEdge Technologies' balance sheet health here in our report.

Taking Advantage

- Click here to access our complete index of 160 Undervalued US Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives