As the United States stock market navigates a period of volatility, with major indexes managing to hold onto gains despite recent fluctuations, investors are exploring diverse opportunities. Penny stocks, though often viewed as a throwback term, continue to offer potential for growth by representing smaller or newer companies at lower price points. When these stocks are backed by strong financials and solid fundamentals, they can provide an intriguing opportunity for investors seeking hidden value in the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.25 | $1.87B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $104.78M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.86 | $6.25M | ★★★★★★ |

| Pangaea Logistics Solutions (NasdaqCM:PANL) | $4.89 | $229.35M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.25 | $9.2M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.90 | $87.96M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.54 | $44.07M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.45 | $25.72M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $96.23M | ★★★★★☆ |

Click here to see the full list of 731 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Atai Life Sciences (NasdaqGM:ATAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Atai Life Sciences N.V. is a clinical-stage biopharmaceutical company focused on developing and investing in therapeutics for mental health disorders such as depression, anxiety, and addiction, with a market cap of approximately $214.79 million.

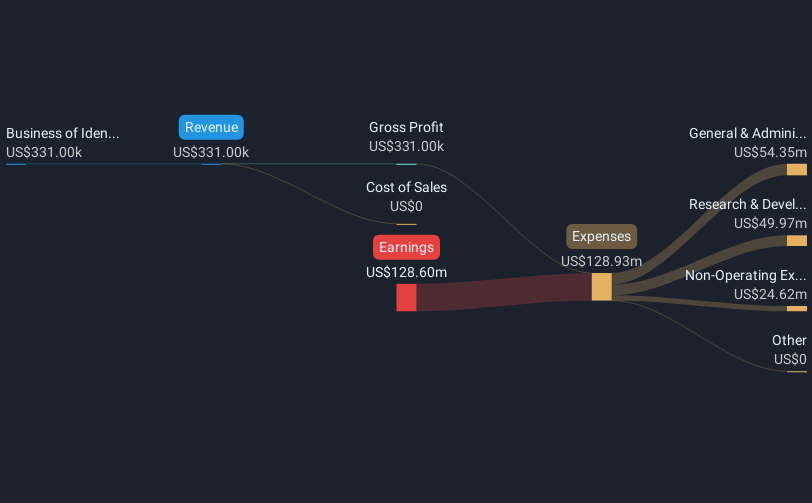

Operations: The company's revenue is primarily generated from its business of identifying and advancing mental health innovations, amounting to $0.33 million.

Market Cap: $214.79M

Atai Life Sciences, with a market cap of US$214.79 million, is a pre-revenue biopharmaceutical company focused on mental health therapeutics. Despite its innovative focus, Atai faces financial challenges; it reported significant net losses in recent quarters and was removed from the NASDAQ Biotechnology Index. The company has more cash than debt and sufficient short-term assets to cover liabilities but lacks profitability and experienced management, with an average tenure of 1.2 years. While revenue growth is forecasted at 82.34% annually, achieving profitability remains uncertain over the next three years amidst high share price volatility.

- Unlock comprehensive insights into our analysis of Atai Life Sciences stock in this financial health report.

- Assess Atai Life Sciences' future earnings estimates with our detailed growth reports.

Inuvo (NYSEAM:INUV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Inuvo, Inc. operates in the advertising technology and services sector mainly within the United States, with a market cap of $68.84 million.

Operations: The company generates revenue from its Software & Programming segment, totaling $78.45 million.

Market Cap: $68.84M

Inuvo, Inc., with a market cap of US$68.84 million, operates in the advertising technology sector and reported third-quarter sales of US$22.37 million, down from the previous year. Despite its unprofitability and negative return on equity (-66.96%), Inuvo is debt-free and has experienced management with an average tenure of 7.8 years. The company forecasts double-digit growth for Q4 2024 and plans to launch an enhanced AI-driven IntentKey product in early 2025, potentially boosting its competitive edge in marketing technology despite current financial challenges like insufficient cash runway for under a year based on free cash flow trends.

- Get an in-depth perspective on Inuvo's performance by reading our balance sheet health report here.

- Explore Inuvo's analyst forecasts in our growth report.

SmartRent (NYSE:SMRT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SmartRent, Inc. is an enterprise real estate technology company that offers management software and applications to rental property stakeholders in the U.S. and internationally, with a market cap of approximately $313.89 million.

Operations: The company's revenue is primarily generated from its electronic security devices segment, totaling $199.77 million.

Market Cap: $313.89M

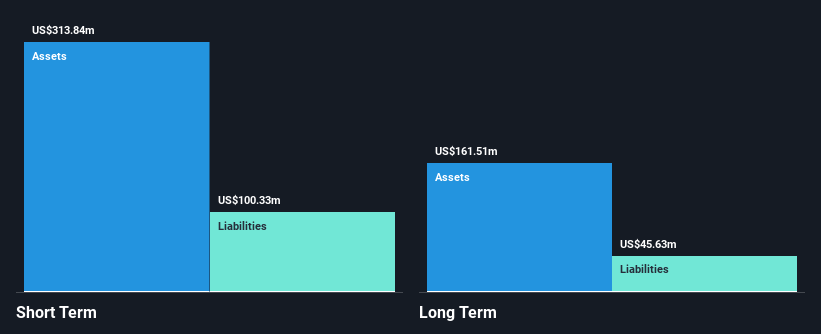

SmartRent, Inc., with a market cap of US$313.89 million, operates in the real estate technology sector and is currently unprofitable with a negative return on equity (-8.36%). Despite this, the company remains debt-free and has reduced its losses over the past five years by 2.9% annually. Recent developments include a $10 million investment program to enhance its Smart Operations Solutions for property management efficiency and security innovations like Alloy Deadbolt+. Although it was recently dropped from an industry index, SmartRent maintains sufficient cash runway exceeding three years based on current free cash flow trends.

- Take a closer look at SmartRent's potential here in our financial health report.

- Review our growth performance report to gain insights into SmartRent's future.

Summing It All Up

- Embark on your investment journey to our 731 US Penny Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SmartRent, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMRT

SmartRent

An enterprise real estate technology company, provides management software and applications to rental property owners and operators, property managers, homebuilders, developers, and residents in the United States and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives