- United States

- /

- Biotech

- /

- NasdaqGM:IMAB

Spotlight On 3 Promising Penny Stocks With Over $20M Market Cap

Reviewed by Simply Wall St

As the U.S. markets react to recent economic uncertainties, including weak job reports and tariff concerns, investors are reassessing their strategies amid fluctuating indices. In this context, penny stocks—often perceived as remnants of a bygone era—continue to capture attention for their potential value and growth opportunities. Despite their small size or relative newness, these stocks can offer intriguing prospects when backed by solid financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.66 | $600.36M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9224 | $155.13M | ✅ 4 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.68 | $20.89M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $90.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Cricut (CRCT) | $4.64 | $982.65M | ✅ 2 ⚠️ 1 View Analysis > |

| Riverview Bancorp (RVSB) | $4.82 | $101.11M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (BABB) | $0.89 | $6.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.27 | $95.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.78 | $159.36M | ✅ 3 ⚠️ 1 View Analysis > |

| TETRA Technologies (TTI) | $3.86 | $513.66M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 424 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Equillium (EQ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Equillium, Inc. is a clinical-stage biotechnology company focused on developing therapeutics for severe autoimmune and immuno-inflammatory disorders in the United States, with a market cap of $25.36 million.

Operations: Equillium, Inc. currently does not report any revenue segments.

Market Cap: $25.36M

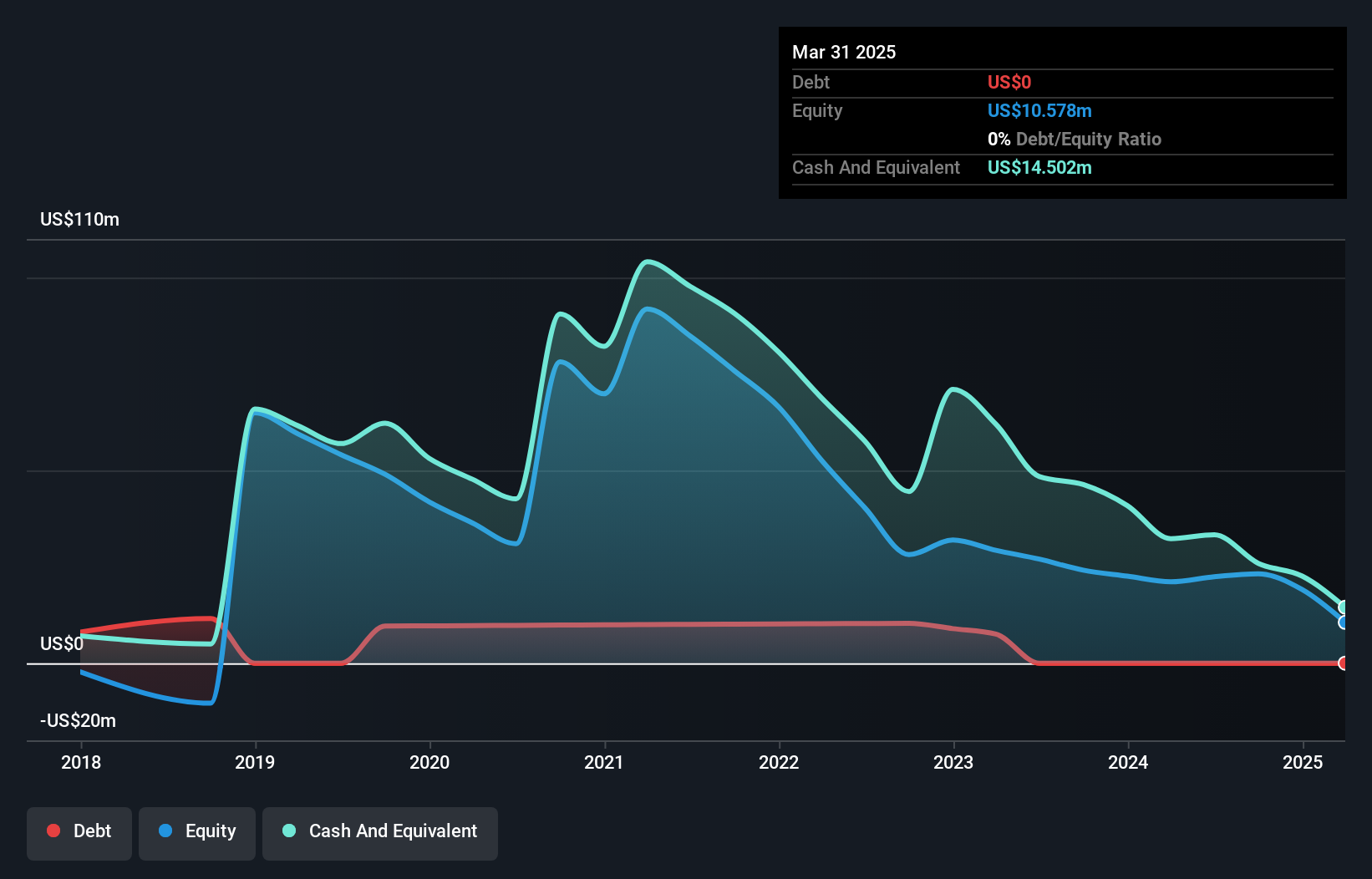

Equillium, Inc., a clinical-stage biotech firm with a market cap of US$25.36 million, is currently pre-revenue and facing financial challenges. The company has less than a year of cash runway and reported an increased net loss in the first quarter of 2025. Despite being debt-free and having assets that cover liabilities, Equillium's earnings are forecast to decline while its stock remains highly volatile. Recently, Nasdaq granted an extension to meet listing requirements after the stock price fell below US$1.00 per share for over 30 days; potential measures include a reverse stock split approved by shareholders.

- Take a closer look at Equillium's potential here in our financial health report.

- Evaluate Equillium's prospects by accessing our earnings growth report.

Ardelyx (ARDX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ardelyx, Inc. is a biopharmaceutical company focused on discovering, developing, and commercializing medicines for unmet medical needs in the United States and internationally, with a market cap of approximately $1.04 billion.

Operations: The company's revenue primarily comes from the development and commercialization of biopharmaceutical products, totaling $361.71 million.

Market Cap: $1.04B

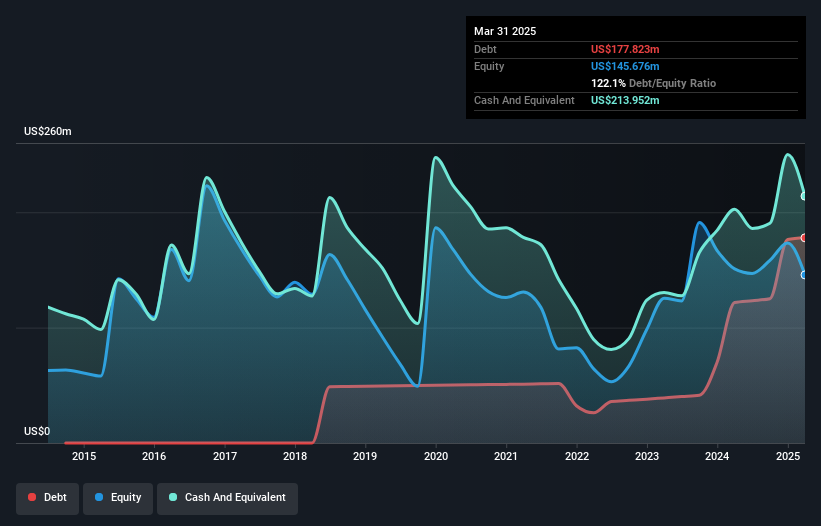

Ardelyx, Inc., with a market cap of US$1.04 billion, is navigating its unprofitable status while showing potential in the biopharmaceutical sector. The company's short-term assets significantly exceed both its short and long-term liabilities, indicating robust financial management. Despite a high debt-to-equity ratio increase over five years, Ardelyx maintains more cash than total debt and has secured additional financing options through recent amendments to its loan agreements. Earnings are forecasted to grow substantially annually, supported by innovative products like IBSRELA for IBS-C treatment. Leadership changes aim to bolster strategic growth and operational efficiency amidst stable stock volatility.

- Click here to discover the nuances of Ardelyx with our detailed analytical financial health report.

- Gain insights into Ardelyx's outlook and expected performance with our report on the company's earnings estimates.

I-Mab (IMAB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: I-Mab is a biotech company that develops immuno-oncology agents for cancer treatment in the United States, with a market cap of approximately $214 million.

Operations: There are no specific revenue segments reported for this biotech firm focused on developing immuno-oncology agents.

Market Cap: $213.95M

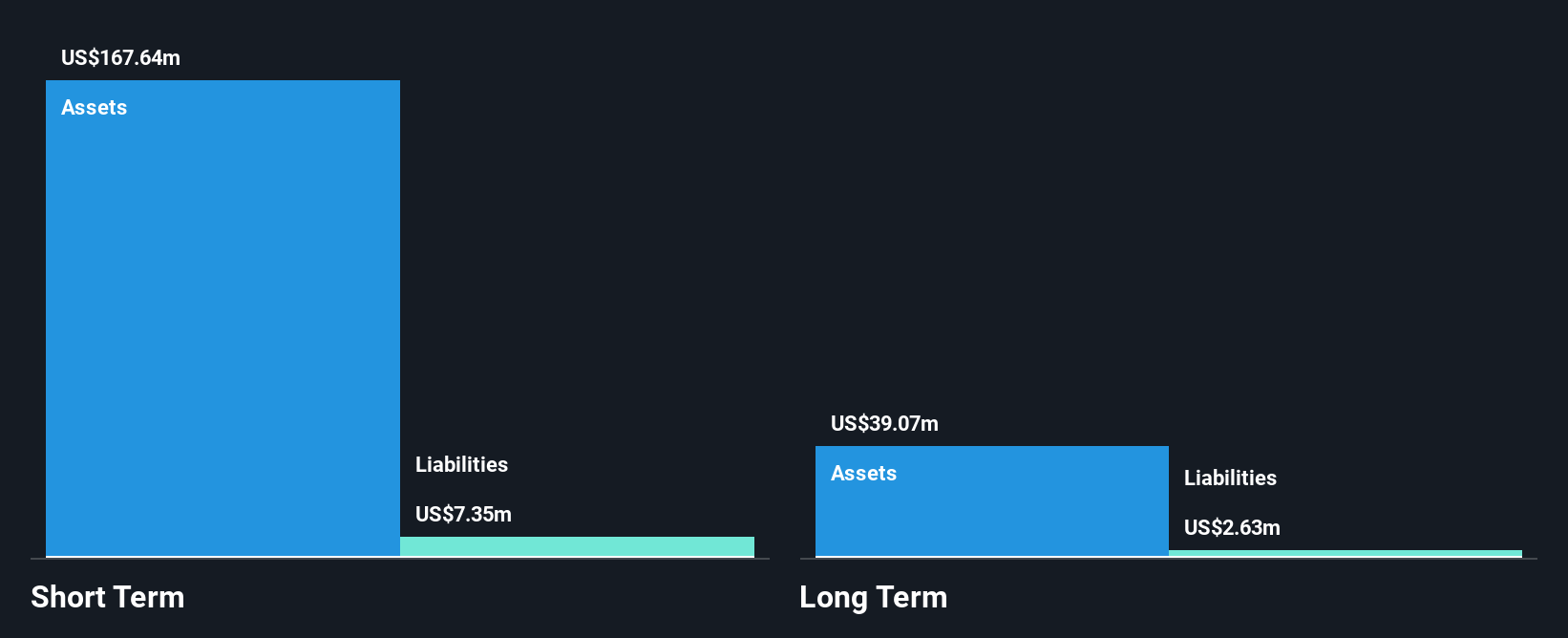

I-Mab, with a market cap of US$214 million, is navigating its pre-revenue status in the biotech sector. The company recently raised US$65 million through a follow-on equity offering, enhancing its financial position. I-Mab's short-term assets significantly exceed liabilities, and it remains debt-free. Recent clinical data for givastomig show promising results in combination therapies for gastric cancer, bolstering confidence in its potential efficacy. Despite being unprofitable and facing volatile share prices, I-Mab has reduced losses over the past five years and maintains a sufficient cash runway to support ongoing research and development efforts.

- Jump into the full analysis health report here for a deeper understanding of I-Mab.

- Review our growth performance report to gain insights into I-Mab's future.

Seize The Opportunity

- Embark on your investment journey to our 424 US Penny Stocks selection here.

- Want To Explore Some Alternatives? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IMAB

I-Mab

A biotech company, focuses on the development of immuno-oncology agents for the treatment of cancer in the United States.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives