- United States

- /

- Software

- /

- NasdaqGS:BSY

High Growth Tech Stocks In The US With Promising Potential

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 1.7% drop, yet it remains up by 12% over the past year with earnings forecasted to grow by 14% annually. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for innovation and scalability in an evolving market landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 26.19% | 37.78% | ★★★★★★ |

| Alkami Technology | 21.98% | 85.17% | ★★★★★★ |

| Travere Therapeutics | 28.43% | 65.01% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| Bitdeer Technologies Group | 44.71% | 127.60% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.90% | 58.64% | ★★★★★★ |

| Blueprint Medicines | 22.38% | 55.75% | ★★★★★★ |

| Alvotech | 31.17% | 100.18% | ★★★★★★ |

| Lumentum Holdings | 21.24% | 119.37% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Ardelyx (NasdaqGM:ARDX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ardelyx, Inc. focuses on discovering, developing, and commercializing medicines for unmet medical needs both in the United States and internationally, with a market cap of $1.26 billion.

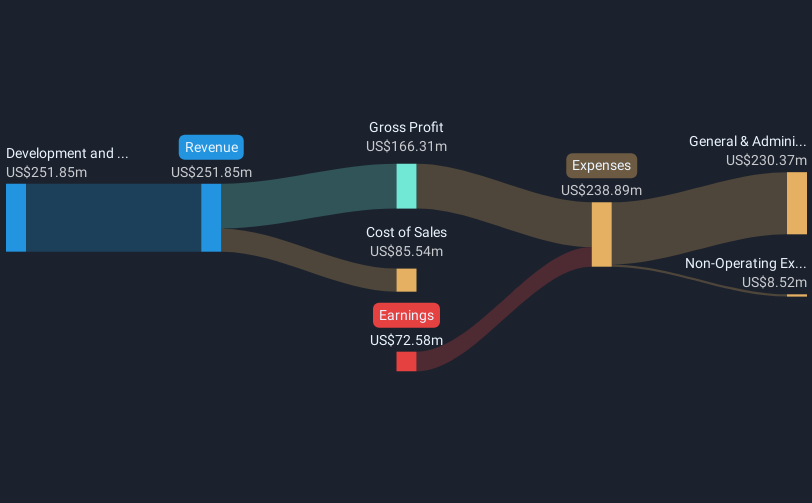

Operations: Ardelyx generates revenue primarily through the development and commercialization of biopharmaceutical products, totaling $333.62 million.

Ardelyx has recently shown promising developments, notably with the approval of its New Drug Application in China for tenapanor, which is expected to generate up to $100 million in milestone payments plus royalties. This approval reflects Ardelyx's strategic expansion into international markets, potentially boosting its revenue streams significantly. Furthermore, the company's recent earnings report indicates a robust recovery with a year-over-year revenue increase from $124.46 million to $333.62 million and a shift from a net loss to net income in Q4 2024. These financial improvements, coupled with an anticipated annual earnings growth rate of 54%, position Ardelyx for potential profitability and sustained growth in the biotech sector.

- Navigate through the intricacies of Ardelyx with our comprehensive health report here.

Explore historical data to track Ardelyx's performance over time in our Past section.

Bentley Systems (NasdaqGS:BSY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bentley Systems, Incorporated offers infrastructure engineering software solutions across various global regions and has a market cap of approximately $13.59 billion.

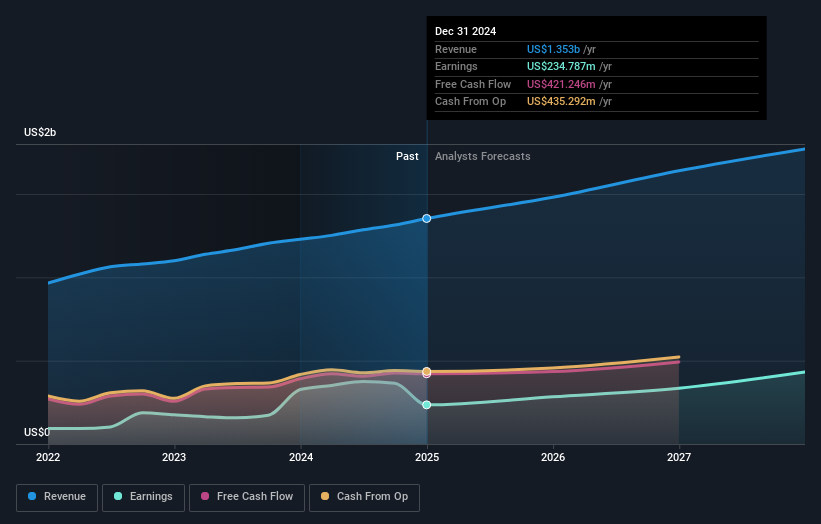

Operations: The company generates revenue primarily from computer software and related services, amounting to approximately $1.35 billion. Its operations span several global regions, focusing on infrastructure engineering solutions.

Bentley Systems, with a year-over-year revenue increase from $1.23 billion to $1.35 billion, underscores its resilience in the tech sector, despite a dip in net income from $326.79 million to $234.79 million for 2024. The company's strategic appointment of James Lee as COO and the consolidation of product development under CTO Julien Moutte highlight a strengthened focus on operational excellence and innovation, particularly in asset analytics and subsurface technologies through its Seequent division. Looking ahead, Bentley anticipates revenues between $1.46 billion and $1.49 billion for 2025, reflecting sustained growth amidst challenging market conditions.

- Dive into the specifics of Bentley Systems here with our thorough health report.

Review our historical performance report to gain insights into Bentley Systems''s past performance.

Day One Biopharmaceuticals (NasdaqGS:DAWN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Day One Biopharmaceuticals, Inc. is a commercial-stage company dedicated to developing advanced treatments for both childhood and adult diseases in the United States, with a market cap of $878.74 million.

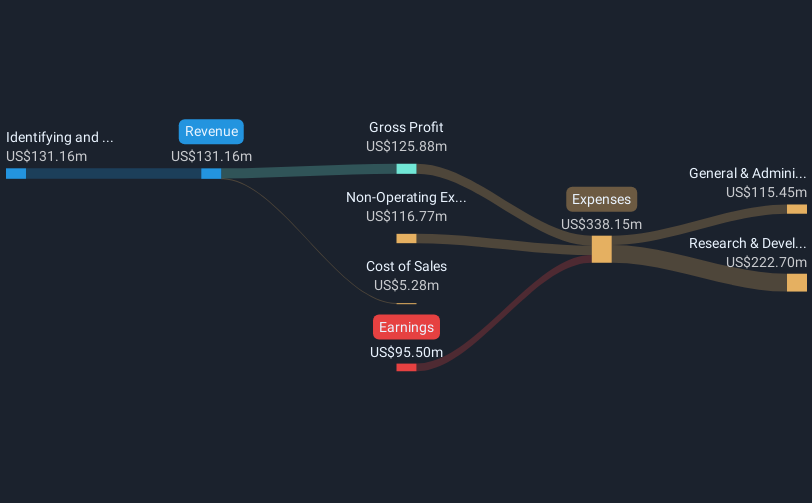

Operations: Day One Biopharmaceuticals focuses on identifying and advancing targeted therapies, generating $131.16 million in revenue from this segment.

Day One Biopharmaceuticals, amid a challenging landscape for biotech firms, reported a significant reduction in net loss to $95.5 million from $188.92 million year-over-year, reflecting improved operational efficiencies and strategic management of R&D expenses. The company's recent partnership with the Children's Brain Tumor Network underscores its commitment to leveraging extensive pediatric brain tumor data to accelerate targeted therapies—a move that enhances its innovative edge in developing treatments for life-threatening diseases. With revenue growth forecasted at 29.8% annually and earnings expected to surge by 58.59% per year, Day One is strategically positioned for future profitability and growth within the high-stakes biopharmaceutical sector.

Summing It All Up

- Click here to access our complete index of 236 US High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bentley Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSY

Bentley Systems

Provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Reasonable growth potential with questionable track record.