- United States

- /

- Medical Equipment

- /

- NasdaqGS:DXCM

October 2024 US Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market faces turbulence with major indexes tumbling due to rising oil prices and Treasury yields, investors are keenly observing potential opportunities amidst the volatility. In such an environment, identifying stocks that may be trading below their estimated value can provide a strategic edge, as they offer the prospect of growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MidWestOne Financial Group (NasdaqGS:MOFG) | $27.03 | $53.83 | 49.8% |

| Molina Healthcare (NYSE:MOH) | $325.26 | $641.75 | 49.3% |

| Associated Banc-Corp (NYSE:ASB) | $21.21 | $41.76 | 49.2% |

| Cadence Bank (NYSE:CADE) | $31.07 | $61.50 | 49.5% |

| Heartland Financial USA (NasdaqGS:HTLF) | $56.17 | $110.14 | 49% |

| California Resources (NYSE:CRC) | $54.18 | $104.21 | 48% |

| Tenable Holdings (NasdaqGS:TENB) | $40.44 | $78.80 | 48.7% |

| EVERTEC (NYSE:EVTC) | $33.55 | $66.42 | 49.5% |

| Dingdong (Cayman) (NYSE:DDL) | $3.64 | $7.18 | 49.3% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | $266.77 | $518.82 | 48.6% |

Underneath we present a selection of stocks filtered out by our screen.

DexCom (NasdaqGS:DXCM)

Overview: DexCom, Inc. is a medical device company specializing in the design, development, and commercialization of continuous glucose monitoring systems globally, with a market capitalization of approximately $27.29 billion.

Operations: The company's revenue is primarily derived from its continuous glucose monitoring systems, with the Patient Monitoring Equipment segment generating $3.93 billion.

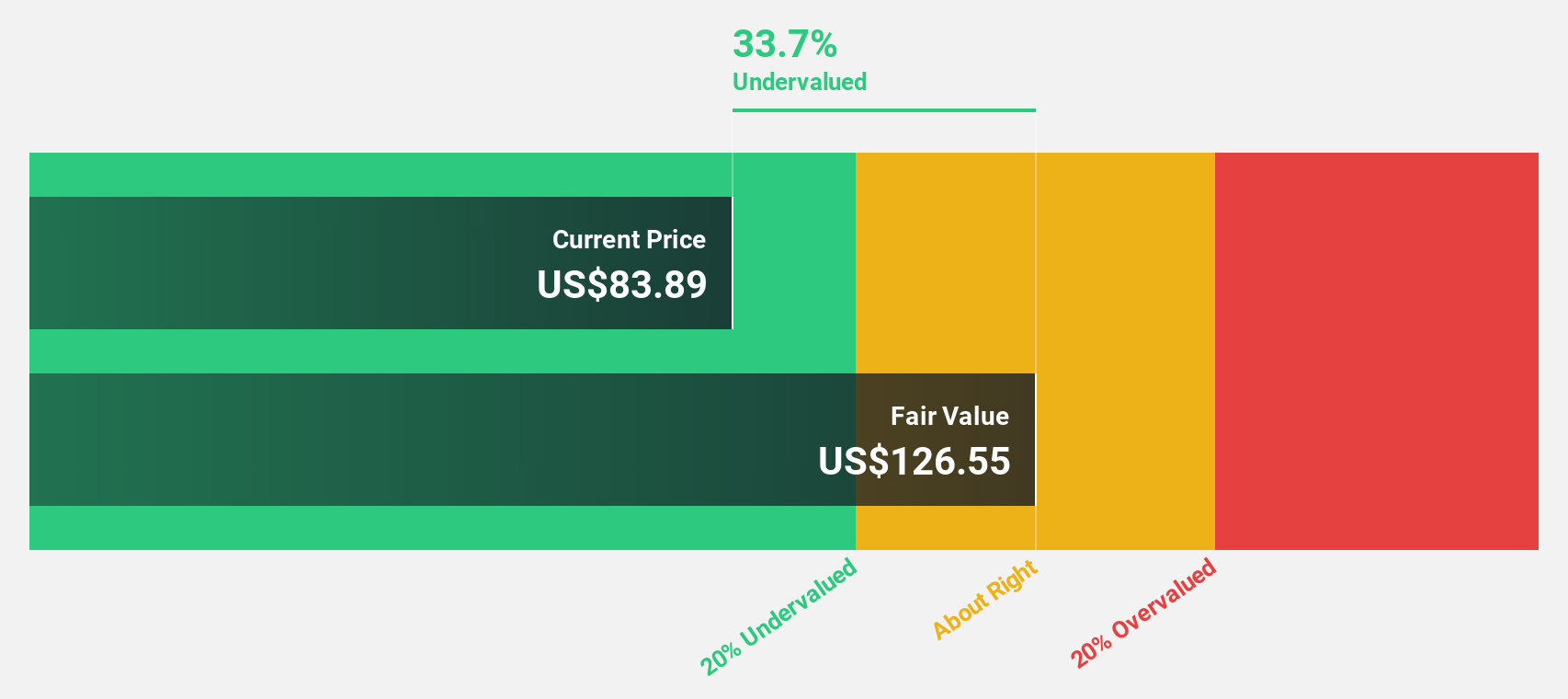

Estimated Discount To Fair Value: 44.6%

DexCom is trading at US$68.62, significantly below its estimated fair value of US$123.93, suggesting it could be undervalued based on discounted cash flow analysis. The company's earnings are projected to grow 16.54% annually, outpacing the broader U.S. market's expected growth rate of 15.3%. However, recent shareholder dilution and high share price volatility may pose risks despite robust revenue forecasts and strategic product expansions in diabetes management technology enhancing its market position.

- Our earnings growth report unveils the potential for significant increases in DexCom's future results.

- Take a closer look at DexCom's balance sheet health here in our report.

Coherent (NYSE:COHR)

Overview: Coherent Corp. is involved in developing, manufacturing, and marketing engineered materials, optoelectronic components and devices, as well as optical and laser systems for industrial, communications, electronics, and instrumentation markets globally with a market cap of $14.72 billion.

Operations: The company's revenue segments include Lasers at $1.40 billion, Materials at $1.47 billion, and Networking at $2.34 billion.

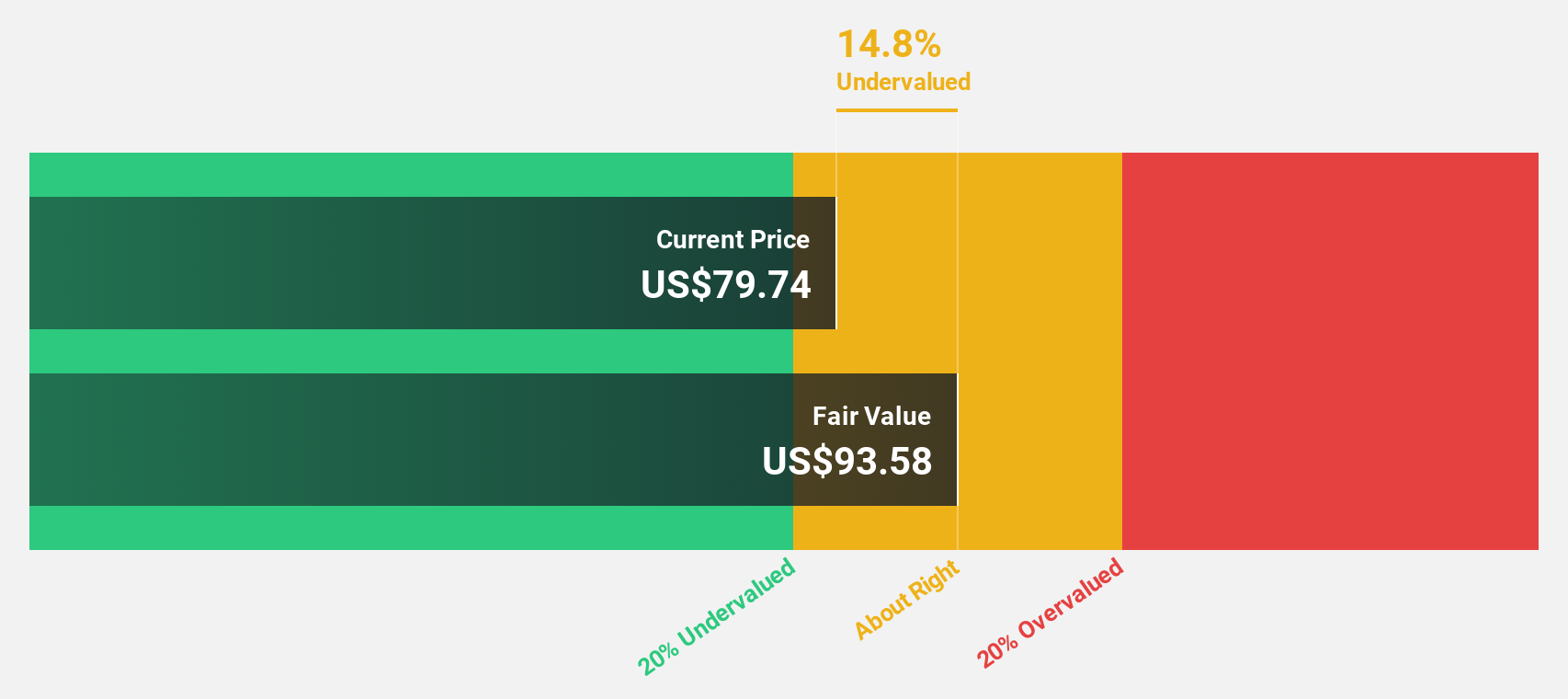

Estimated Discount To Fair Value: 20.8%

Coherent, priced at US$95.18, is trading below its estimated fair value of US$120.14, indicating it might be undervalued based on cash flows. Despite a net loss of US$48.4 million in Q4 2024, Coherent's earnings are expected to grow significantly by 85.28% annually as it transitions to profitability within three years. Recent product innovations like the 200 mm SiC epi-wafers and high-efficiency lasers could enhance future cash flow potential amid rising demand for semiconductor solutions.

- The growth report we've compiled suggests that Coherent's future prospects could be on the up.

- Get an in-depth perspective on Coherent's balance sheet by reading our health report here.

Sea (NYSE:SE)

Overview: Sea Limited operates in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, the rest of Asia, and internationally with a market cap of $55.13 billion.

Operations: Sea Limited's revenue is derived from its operations in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, and other international markets.

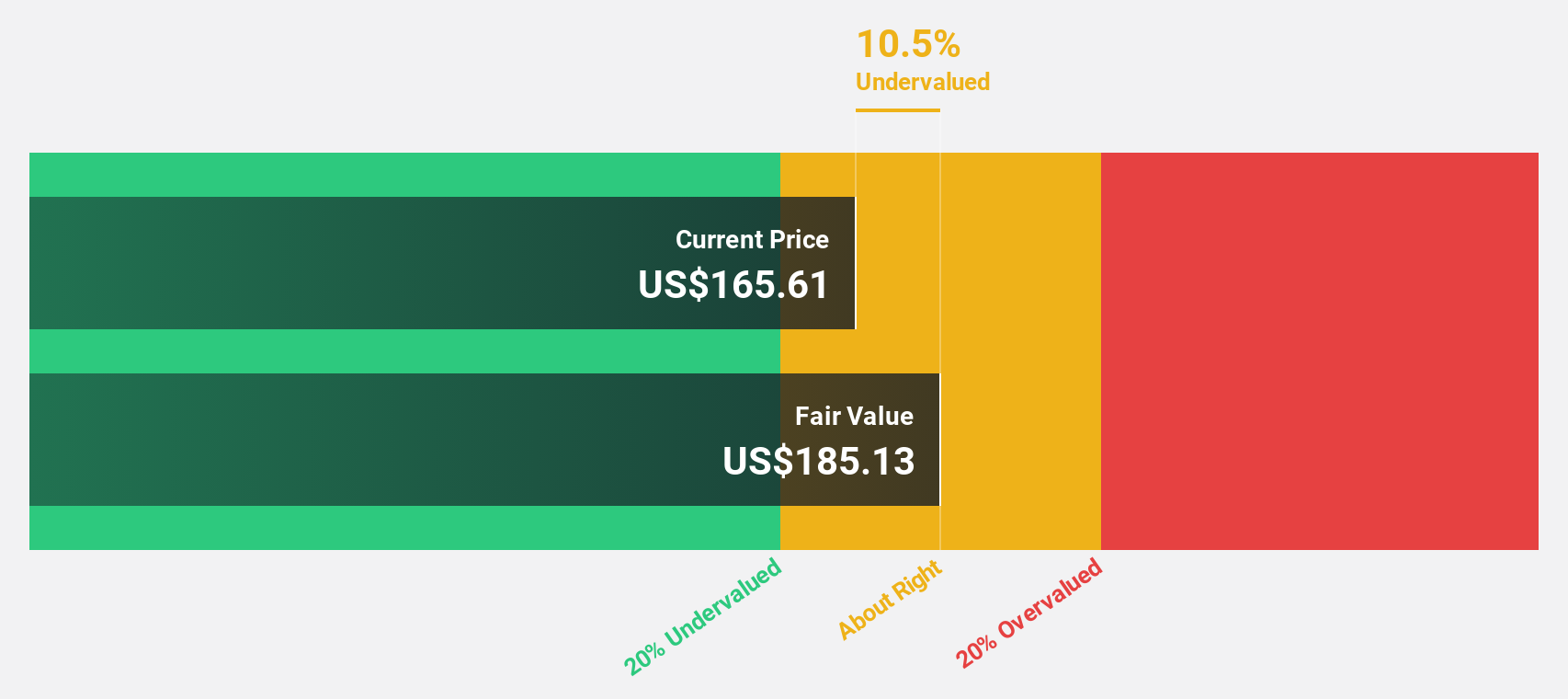

Estimated Discount To Fair Value: 37.6%

Sea, currently priced at US$95.15, trades below its estimated fair value of US$152.44, reflecting potential undervaluation based on cash flows. Despite a decline in net income to US$79.91 million for Q2 2024 from the previous year, Sea's revenue is forecasted to grow faster than the U.S. market at 12.5% annually. The company is expected to achieve profitability within three years with earnings growth projected at 49.41% per year, highlighting robust future cash flow prospects amidst recent board changes enhancing governance structure.

- Our growth report here indicates Sea may be poised for an improving outlook.

- Click here to discover the nuances of Sea with our detailed financial health report.

Summing It All Up

- Delve into our full catalog of 189 Undervalued US Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DXCM

DexCom

A medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally.

Flawless balance sheet with reasonable growth potential.