- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

3 US Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

As the U.S. markets experience a tech-led rally with the S&P 500 and Nasdaq Composite posting gains, investors are keenly observing growth companies that combine robust potential with strong insider ownership. In this dynamic environment, identifying stocks where insiders hold significant stakes can be indicative of confidence in the company's future prospects, aligning well with current market enthusiasm for innovation-driven sectors.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 49% |

| Capital Bancorp (NasdaqGS:CBNK) | 31.1% | 30.1% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.6% | 34.7% |

| Ryan Specialty Holdings (NYSE:RYAN) | 16.8% | 36.4% |

Let's dive into some prime choices out of the screener.

Roku (NasdaqGS:ROKU)

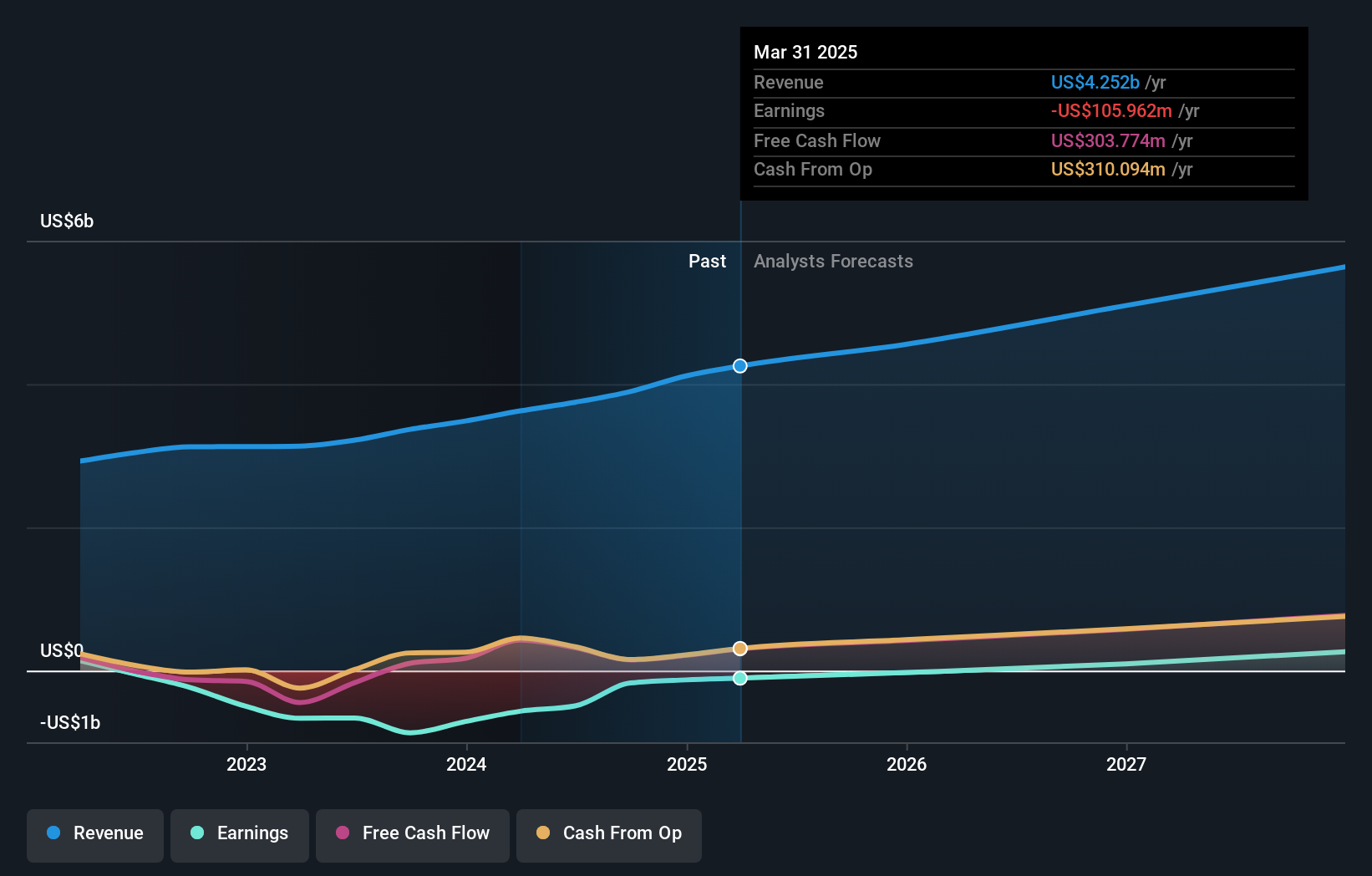

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Roku, Inc., along with its subsidiaries, operates a TV streaming platform both in the United States and internationally, with a market cap of approximately $11.24 billion.

Operations: The company's revenue is primarily generated through its Platform segment, which accounts for $3.32 billion, and its Devices segment, contributing $579.97 million.

Insider Ownership: 12.3%

Roku's growth prospects are underscored by its forecasted revenue increase of 10.8% per year, surpassing the US market average, and anticipated profitability within three years. Recent product launches, such as the QLED CHiQ Roku TVs and expanded streaming options in Canada, highlight Roku's innovation and market reach. Despite trading below estimated fair value, insider ownership remains a critical factor for investors considering growth potential amidst evolving product offerings and strategic partnerships like those with Instacart.

- Navigate through the intricacies of Roku with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Roku's shares may be trading at a discount.

Frontier Group Holdings (NasdaqGS:ULCC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Frontier Group Holdings, Inc. operates as a low-fare passenger airline serving leisure travelers in the United States and Latin America, with a market cap of $1.60 billion.

Operations: The company generates revenue of $3.66 billion from providing air transportation services for passengers.

Insider Ownership: 34%

Frontier Group Holdings is poised for growth, with earnings expected to rise significantly at 103.6% annually, outpacing the US market's average. Despite recent insider selling, the company remains attractive due to its addition to the S&P Transportation Select Industry Index and ongoing customer-focused transformation initiatives like The New Frontier. Revenue forecasts of 13.2% annually exceed market averages, while new premium offerings and loyalty enhancements could bolster future performance amidst a volatile share price environment.

- Click here and access our complete growth analysis report to understand the dynamics of Frontier Group Holdings.

- Insights from our recent valuation report point to the potential undervaluation of Frontier Group Holdings shares in the market.

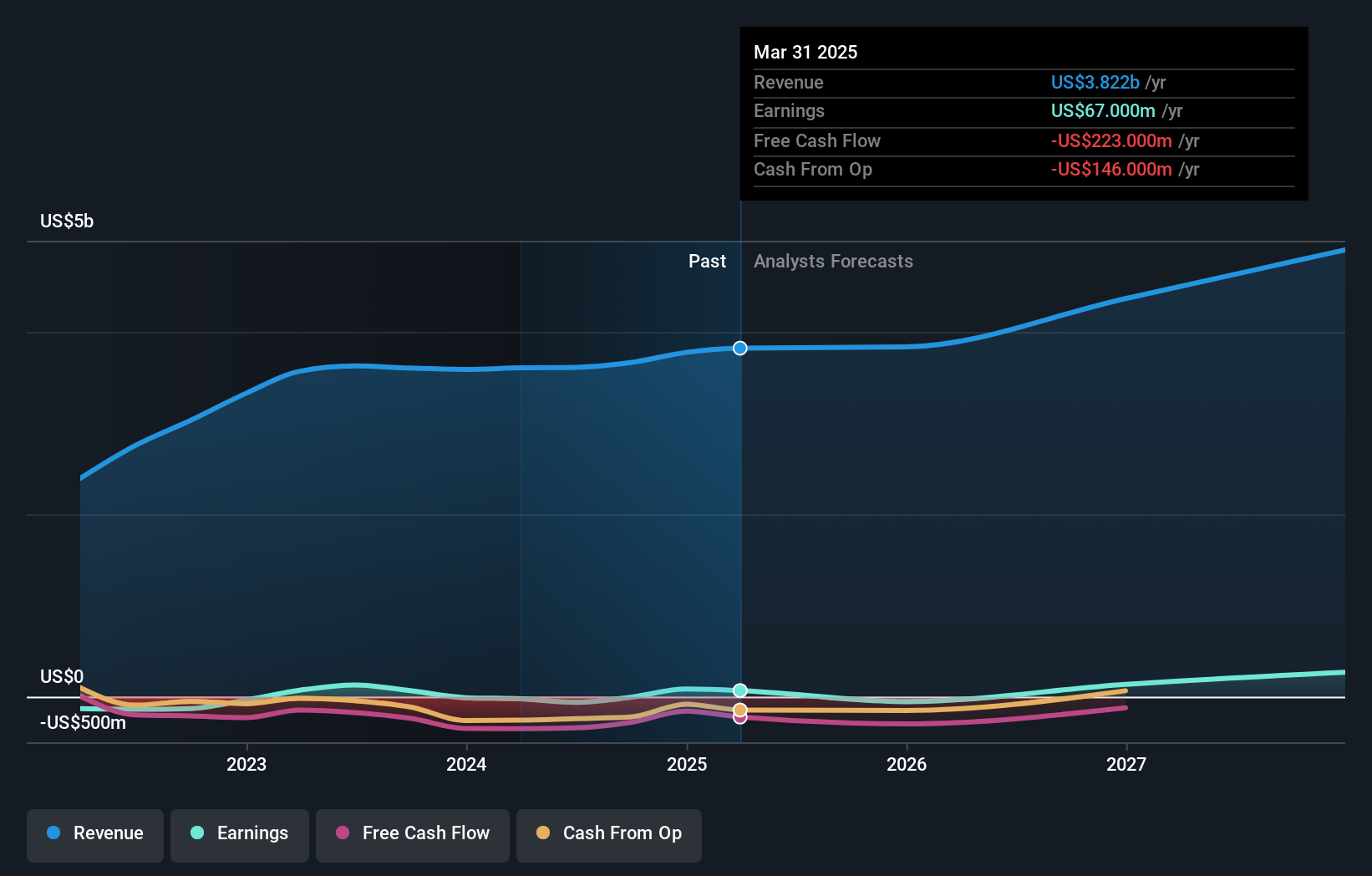

Sea (NYSE:SE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sea Limited operates in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, the rest of Asia, and internationally with a market cap of approximately $61.06 billion.

Operations: Sea Limited generates its revenue through three main segments: digital entertainment, e-commerce, and digital financial services, operating across Southeast Asia, Latin America, the rest of Asia, and globally.

Insider Ownership: 15.1%

Sea Limited demonstrates strong growth potential, with earnings projected to increase significantly at 37.7% annually, surpassing the US market average. Despite a recent dip in net profit margins and large one-off items affecting results, the company reported substantial revenue growth in Q3 2024 with US$4.33 billion compared to US$3.31 billion a year ago. Trading below estimated fair value and forecasted high return on equity further underscore its appeal amidst no significant insider trading activity recently.

- Delve into the full analysis future growth report here for a deeper understanding of Sea.

- Our valuation report here indicates Sea may be undervalued.

Turning Ideas Into Actions

- Dive into all 198 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United states and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives