- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

3 US Stocks Estimated To Be Undervalued By Up To 42%

Reviewed by Simply Wall St

As the U.S. stock market begins to rebound from a sluggish start in 2025, with major indices like the S&P 500 and Nasdaq snapping multi-day losing streaks, investors are keenly observing opportunities that may arise from recent volatility. In this context, identifying undervalued stocks becomes crucial as they can offer potential value by trading below their intrinsic worth amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $27.27 | $53.03 | 48.6% |

| Dime Community Bancshares (NasdaqGS:DCOM) | $30.89 | $61.61 | 49.9% |

| German American Bancorp (NasdaqGS:GABC) | $39.06 | $77.34 | 49.5% |

| Camden National (NasdaqGS:CAC) | $42.08 | $83.90 | 49.8% |

| Ally Financial (NYSE:ALLY) | $35.85 | $71.62 | 49.9% |

| Kanzhun (NasdaqGS:BZ) | $13.95 | $27.36 | 49% |

| Constellium (NYSE:CSTM) | $10.52 | $20.92 | 49.7% |

| Mr. Cooper Group (NasdaqCM:COOP) | $95.39 | $187.71 | 49.2% |

| Progress Software (NasdaqGS:PRGS) | $65.26 | $128.87 | 49.4% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.59 | $30.75 | 49.3% |

Underneath we present a selection of stocks filtered out by our screen.

Micron Technology (NasdaqGS:MU)

Overview: Micron Technology, Inc. is a company that designs, develops, manufactures, and sells memory and storage products globally with a market cap of approximately $100.13 billion.

Operations: Micron's revenue segments include the Compute and Networking Business Unit (CNBU) at $12.17 billion, Mobile Business Unit (MBU) at $6.59 billion, Storage Business Unit (SBU) at $5.67 billion, and Embedded Business Unit (EBU) at $4.63 billion.

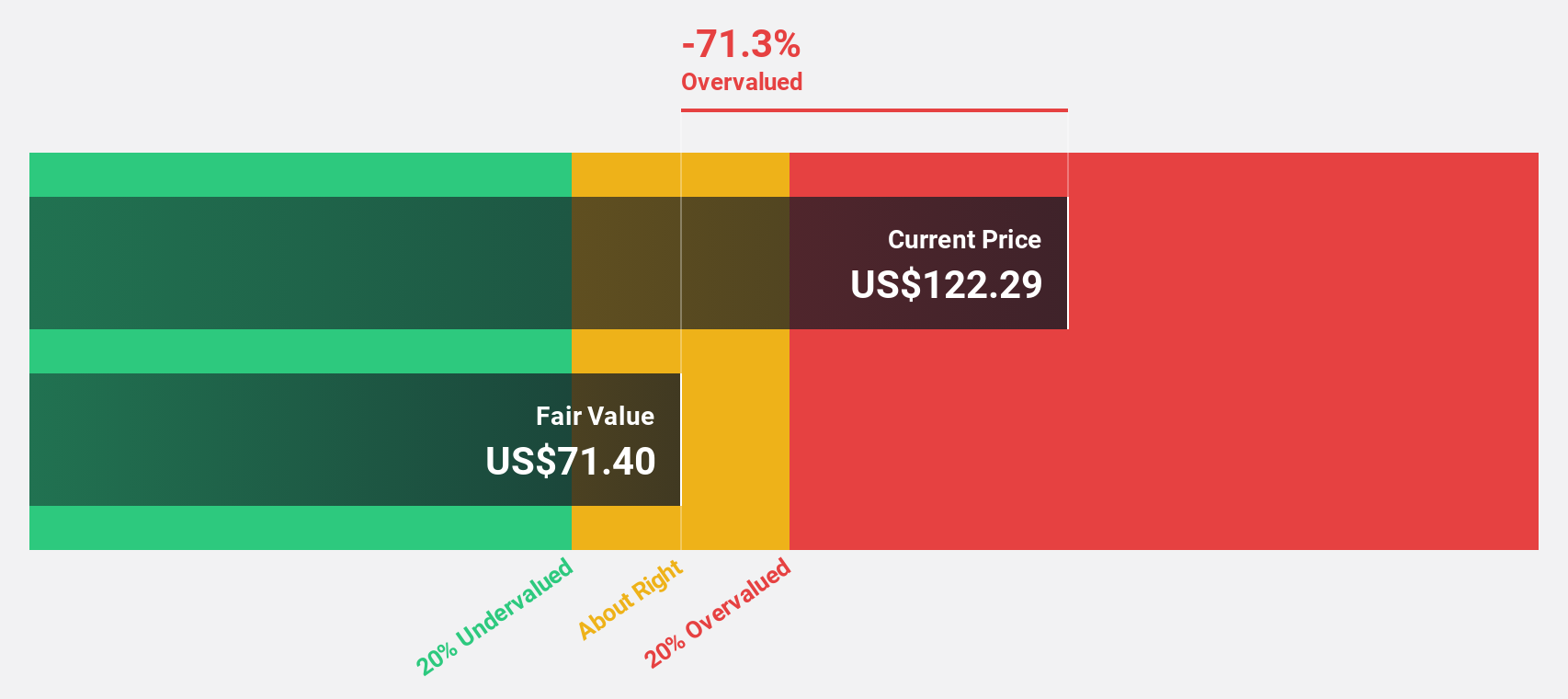

Estimated Discount To Fair Value: 17.2%

Micron Technology, trading at US$89.87, is considered undervalued based on discounted cash flow analysis with an estimated fair value of US$108.59. Recent earnings showed a strong recovery with sales reaching US$8.71 billion and net income of US$1.87 billion for the first quarter of fiscal 2025, compared to losses in the previous year. The company expects continued earnings growth, supported by innovative product launches like the Micron 6550 ION NVMe SSD for data centers.

- Insights from our recent growth report point to a promising forecast for Micron Technology's business outlook.

- Get an in-depth perspective on Micron Technology's balance sheet by reading our health report here.

Vertex Pharmaceuticals (NasdaqGS:VRTX)

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for treating cystic fibrosis, with a market cap of approximately $104.84 billion.

Operations: Vertex Pharmaceuticals generates its revenue primarily from its pharmaceuticals segment, which accounted for $10.63 billion.

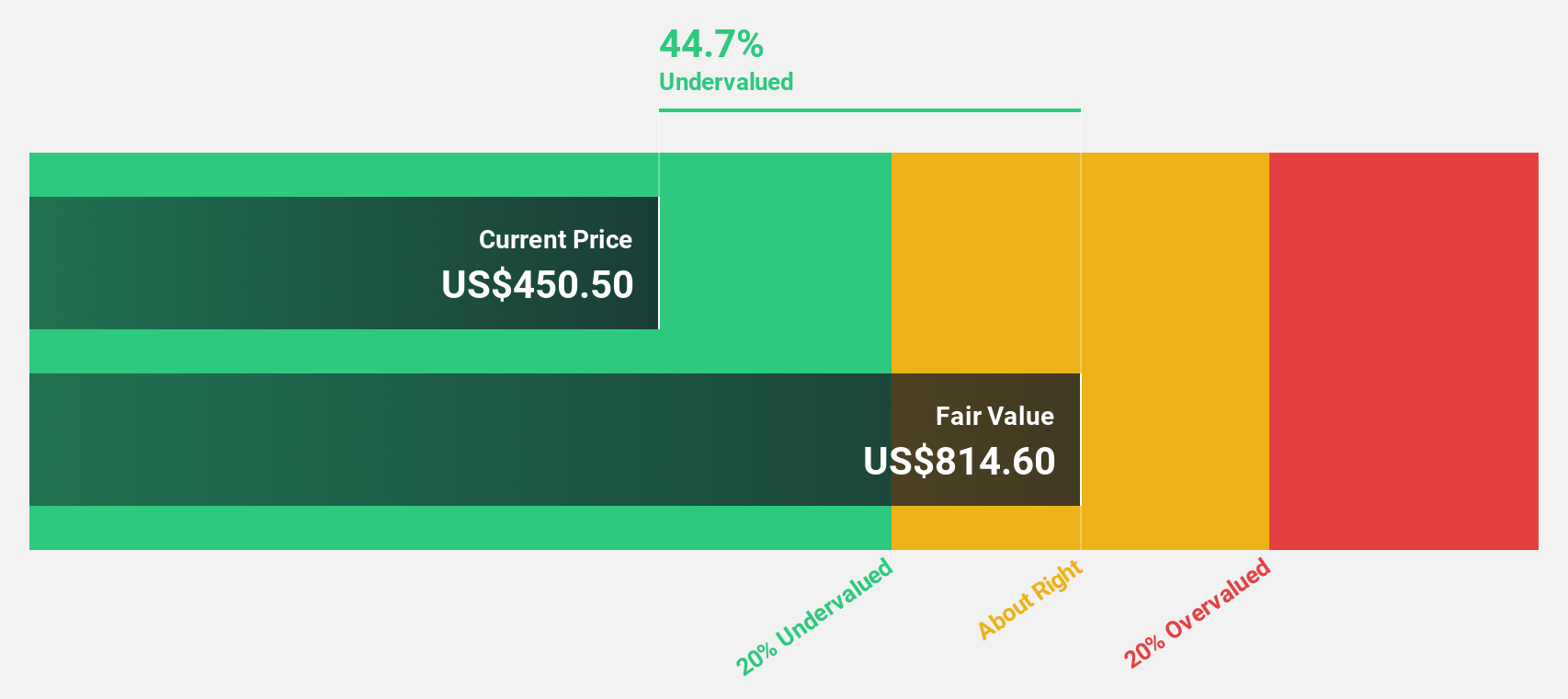

Estimated Discount To Fair Value: 42%

Vertex Pharmaceuticals, trading at US$407.11, is significantly undervalued with a fair value estimate of US$702.3 based on discounted cash flow analysis. The company is advancing its product pipeline with recent FDA approval for expanded use of TRIKAFTA® and promising Phase 2 results for suzetrigine in pain management. Despite slower revenue growth forecasts compared to the market, Vertex's earnings are expected to grow substantially at 36.77% annually, supporting its undervaluation thesis.

- Our expertly prepared growth report on Vertex Pharmaceuticals implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Vertex Pharmaceuticals with our comprehensive financial health report here.

Reddit (NYSE:RDDT)

Overview: Reddit, Inc. operates a website that organizes digital communities and has a market cap of $31.21 billion.

Operations: The company's revenue is primarily derived from its Internet Information Providers segment, which generated $1.12 billion.

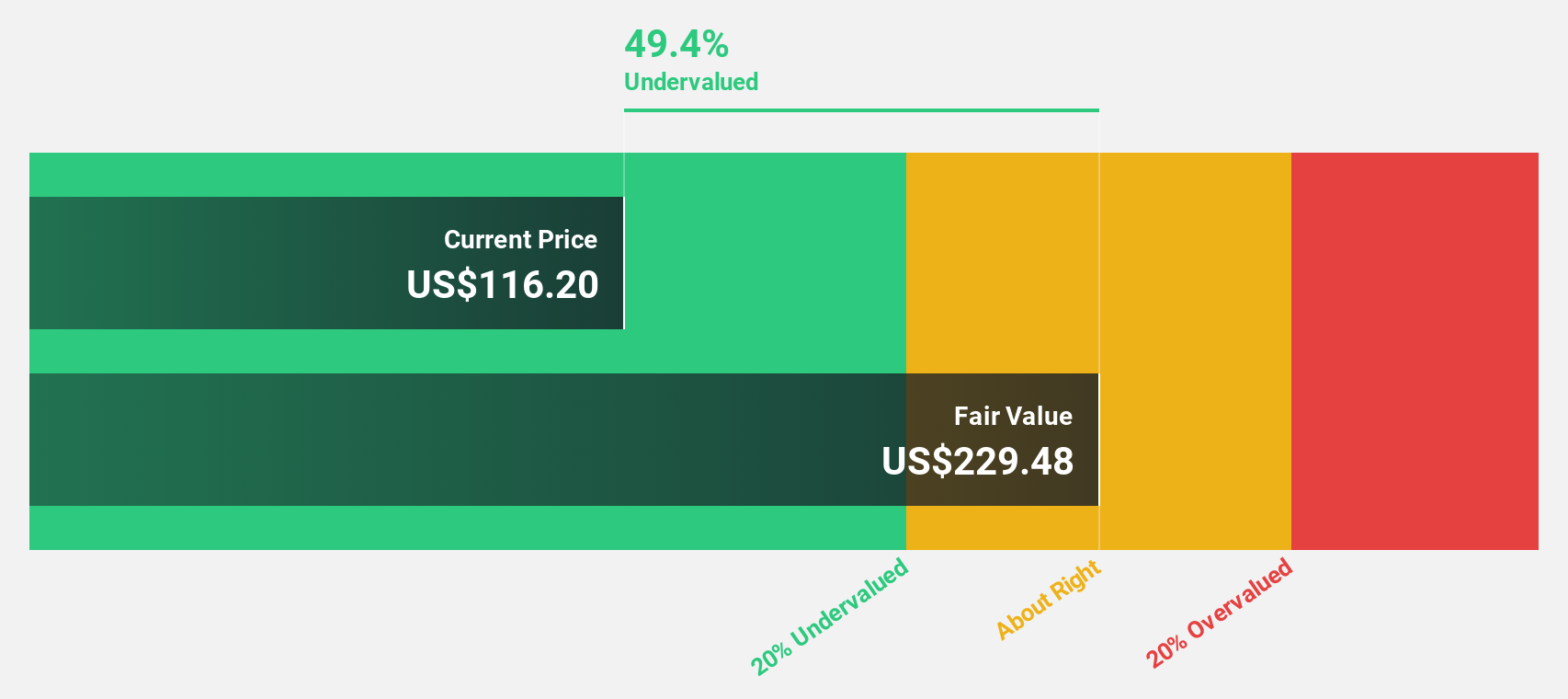

Estimated Discount To Fair Value: 28.5%

Reddit, Inc., priced at US$177.74, is significantly undervalued with a fair value estimate of US$248.63 based on discounted cash flow analysis. The company's revenue is projected to grow at 22% annually, surpassing the broader U.S. market growth rate of 9%. Despite recent volatility and significant insider selling, Reddit's earnings are expected to increase by 56.87% per year as it transitions to profitability within three years, reinforcing its undervaluation thesis.

- Our comprehensive growth report raises the possibility that Reddit is poised for substantial financial growth.

- Dive into the specifics of Reddit here with our thorough financial health report.

Taking Advantage

- Navigate through the entire inventory of 177 Undervalued US Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives