- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TBLA

3 US Penny Stocks With Market Caps Under $10B

Reviewed by Simply Wall St

As the U.S. stock market grapples with recent tariff news impacting major indices, investors are exploring diverse opportunities beyond large-cap stocks. Penny stocks, despite their somewhat outdated name, continue to attract attention for their potential to offer surprising value and growth. Typically representing smaller or newer companies, these stocks can provide affordability paired with growth potential when supported by strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8975 | $6.46M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $121.65M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2651 | $10.4M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.91 | $89.18M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.45 | $48.18M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.94 | $52.92M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.24 | $22.53M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9305 | $85.11M | ★★★★★☆ |

| Information Services Group (NasdaqGM:III) | $3.11 | $150.16M | ★★★★☆☆ |

Click here to see the full list of 714 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Taboola.com (NasdaqGS:TBLA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taboola.com Ltd. operates an artificial intelligence-based algorithmic engine platform across various countries, including Israel, the United States, the United Kingdom, and Germany, with a market cap of approximately $1.28 billion.

Operations: The company generates revenue primarily from its advertising segment, totaling approximately $1.69 billion.

Market Cap: $1.28B

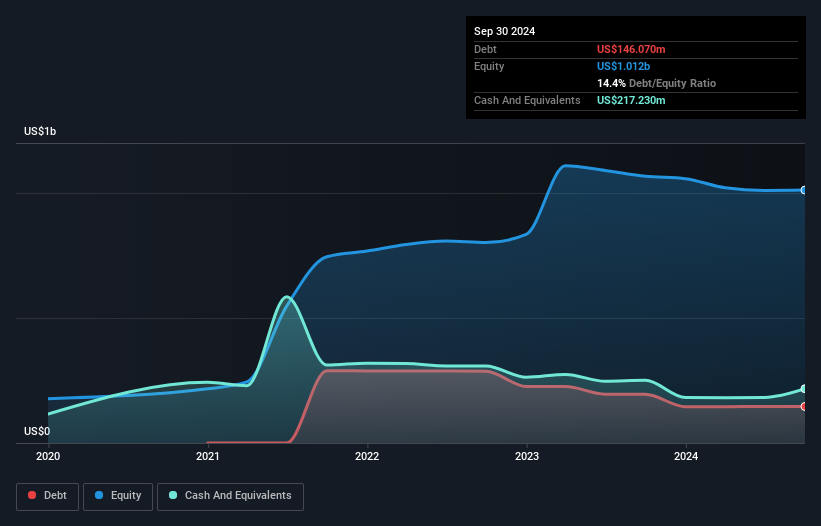

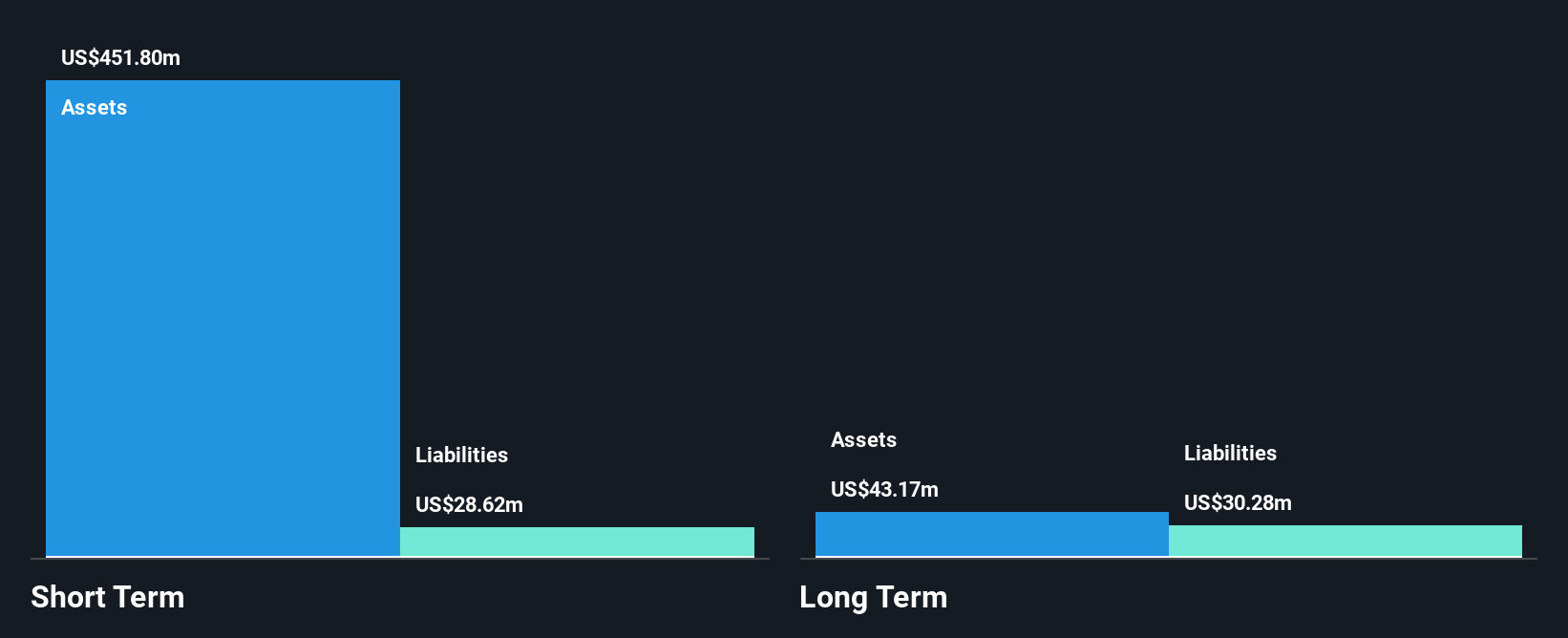

Taboola.com Ltd., with a market cap of US$1.28 billion, is navigating the penny stock landscape with strategic partnerships and a seasoned management team. Despite being unprofitable, it reported US$433.01 million in Q3 2024 sales, an improvement from the previous year. Recent renewals with Reach PLC and Future suggest strong client retention, enhancing revenue potential across major markets like the UK and U.S. Taboola's short-term assets exceed its liabilities, providing financial stability alongside a positive cash runway exceeding three years due to growing free cash flow. Analysts forecast significant earnings growth at nearly 48% annually.

- Dive into the specifics of Taboola.com here with our thorough balance sheet health report.

- Gain insights into Taboola.com's outlook and expected performance with our report on the company's earnings estimates.

Nextdoor Holdings (NYSE:KIND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nextdoor Holdings, Inc. operates a neighborhood network connecting neighbors, businesses, and public services both in the United States and internationally, with a market cap of approximately $1 billion.

Operations: The company generates revenue of $237.61 million from its Internet Information Providers segment.

Market Cap: $1B

Nextdoor Holdings, Inc., with a market cap of US$1 billion, is navigating the penny stock landscape despite being unprofitable and experiencing increased losses over the past five years. The company reported third-quarter revenue of US$65.61 million, up from US$56.09 million a year ago, while reducing net loss to US$14.9 million from US$38.12 million in the previous year. With no debt and short-term assets exceeding liabilities, Nextdoor maintains financial stability and a cash runway exceeding three years. Recent leadership changes aim to enhance revenue growth through its expanding Ads Platform and strategic design transformation initiative called NEXT.

- Get an in-depth perspective on Nextdoor Holdings' performance by reading our balance sheet health report here.

- Understand Nextdoor Holdings' earnings outlook by examining our growth report.

NIO (NYSE:NIO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NIO Inc. is a company that designs, develops, manufactures, and sells smart electric vehicles in China with a market cap of approximately $9.08 billion.

Operations: The company generates revenue primarily from its Auto Manufacturers segment, totaling CN¥63.13 billion.

Market Cap: $9.08B

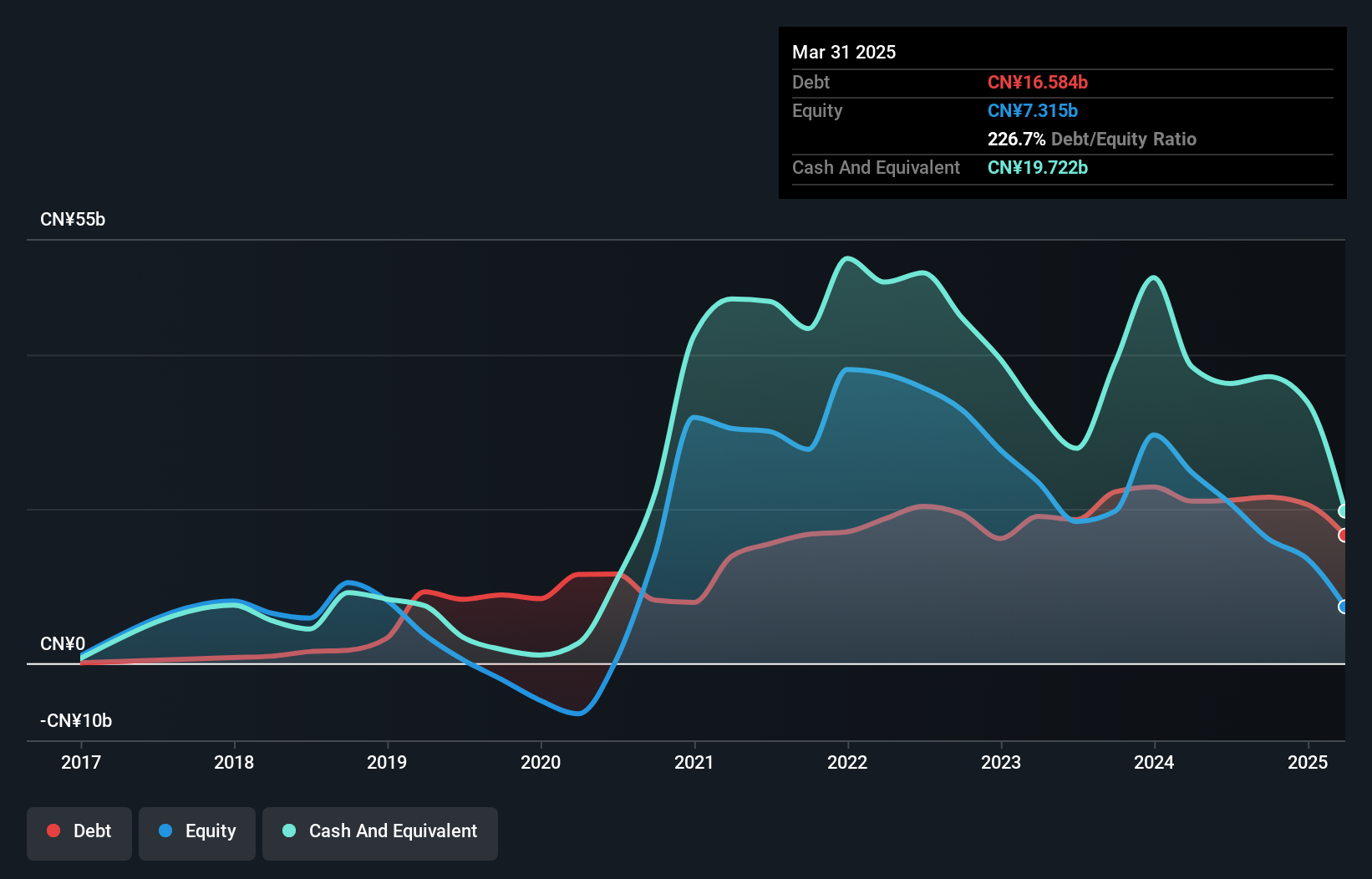

NIO Inc., with a market cap of approximately $9.08 billion, continues to navigate challenges as an unprofitable entity, despite its seasoned management team. The company has more cash than debt and short-term assets exceeding liabilities, indicating financial resilience. Recent delivery results show growth with 13,863 vehicles delivered in January 2025 and cumulative deliveries reaching 685,427. However, NIO's losses have increased over the past five years at a rate of 22.3% annually. While revenue is forecasted to grow by about 23.58% per year, profitability remains elusive for the next three years according to current forecasts.

- Click to explore a detailed breakdown of our findings in NIO's financial health report.

- Assess NIO's future earnings estimates with our detailed growth reports.

Make It Happen

- Access the full spectrum of 714 US Penny Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taboola.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TBLA

Taboola.com

Operates an artificial intelligence-based algorithmic engine platform in Israel, the United States, the United Kingdom, Germany, and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives