- United States

- /

- Construction

- /

- NasdaqCM:BBCP

Undervalued Small Caps With Insider Buying Across Regions

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.6% drop, yet it remains up by 9.1% over the past year with earnings projected to grow by 14% annually. In this context, identifying small-cap stocks that are perceived as undervalued and exhibit insider buying can be an intriguing strategy for investors looking to capitalize on potential growth opportunities amidst fluctuating market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 0.8x | 38.07% | ★★★★★★ |

| Thryv Holdings | NA | 0.7x | 28.13% | ★★★★☆☆ |

| Shore Bancshares | 9.7x | 2.4x | -68.29% | ★★★☆☆☆ |

| Columbus McKinnon | 50.2x | 0.5x | 35.30% | ★★★☆☆☆ |

| MVB Financial | 12.8x | 1.7x | 39.77% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -57.81% | ★★★☆☆☆ |

| BlueLinx Holdings | 13.8x | 0.2x | -72.96% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.4x | -2766.72% | ★★★☆☆☆ |

| Montrose Environmental Group | NA | 0.9x | 9.37% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -369.05% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Concrete Pumping Holdings (NasdaqCM:BBCP)

Simply Wall St Value Rating: ★★★☆☆☆

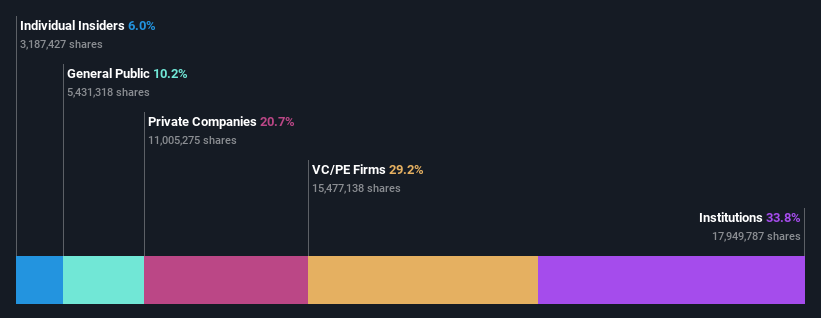

Overview: Concrete Pumping Holdings operates as a provider of concrete pumping and waste management services, primarily in the U.S. and U.K., with a market capitalization of approximately $0.44 billion.

Operations: The company generates revenue primarily from U.S. Concrete Pumping and U.S. Concrete Waste Management Services, with additional contributions from its U.K. Operations. The cost of goods sold (COGS) significantly impacts the company's gross profit, which has shown fluctuations over time, reaching 40.32% in the most recent period ending January 31, 2025. Operating expenses include notable general and administrative costs that influence net income margins, which have varied across different periods but stood at 3.74% as of January 31, 2025.

PE: 24.6x

Concrete Pumping Holdings, a smaller company in the U.S. market, recently reported a decline in first-quarter sales to US$86.45 million from US$97.71 million the previous year, though net losses improved slightly to US$2.64 million from US$3.83 million. Insider confidence is evident as Bruce Young purchased 49,507 shares worth approximately US$256,941 between November 2024 and January 2025. The company anticipates revenues of up to $420 million for fiscal year 2025 and has extended its share buyback plan through December 2026 after repurchasing over three million shares since June 2022 for $20.01 million. Despite relying on external borrowing for funding, earnings are projected to grow by over 30% annually, suggesting potential growth opportunities amid financial challenges.

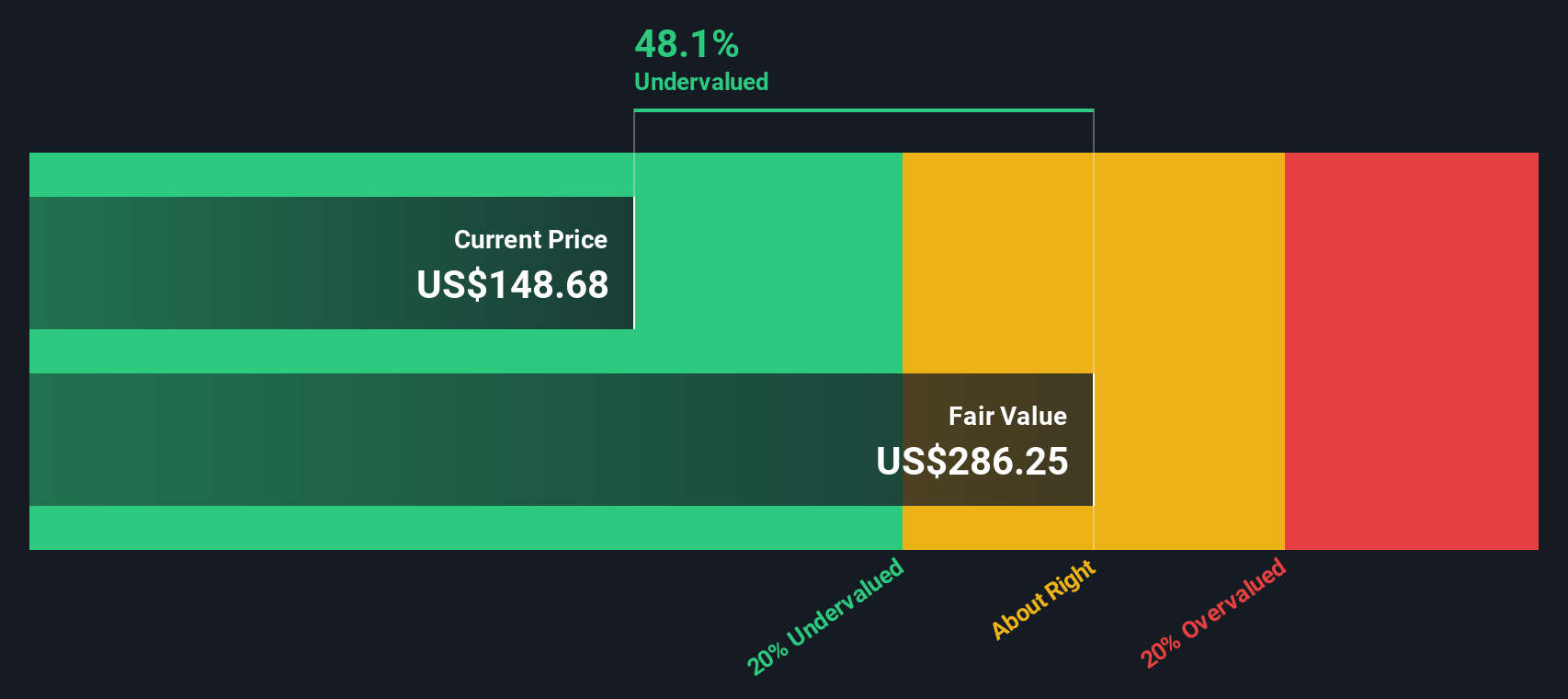

Cable One (NYSE:CABO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cable One is a broadband communications provider offering cable television services, with a market capitalization of approximately $4.92 billion.

Operations: Cable One's revenue model primarily revolves around its cable TV services, generating significant income. The company has experienced fluctuations in net income margin, which was -1.30% as of March 31, 2025. Operating expenses play a substantial role in the cost structure, with general and administrative expenses being a notable component. Gross profit margin stood at 73.64% during the same period, highlighting efficient management of direct costs relative to revenue generation.

PE: -42.1x

Cable One's recent initiatives, like the launch of FlexConnect and Lift Internet, highlight its focus on flexible and affordable internet solutions. However, financial challenges are evident with Q1 2025 revenue at US$380.6 million, down from US$404.31 million a year prior, and net income dropping significantly to US$2.61 million from US$37.35 million. Despite these hurdles, insider confidence is notable as Wallace Weitz purchased 4,000 shares for approximately US$982K in February 2025. The company's reliance on external borrowing poses risks but also underscores potential growth opportunities as earnings are projected to grow by nearly 20% annually.

- Click here to discover the nuances of Cable One with our detailed analytical valuation report.

Evaluate Cable One's historical performance by accessing our past performance report.

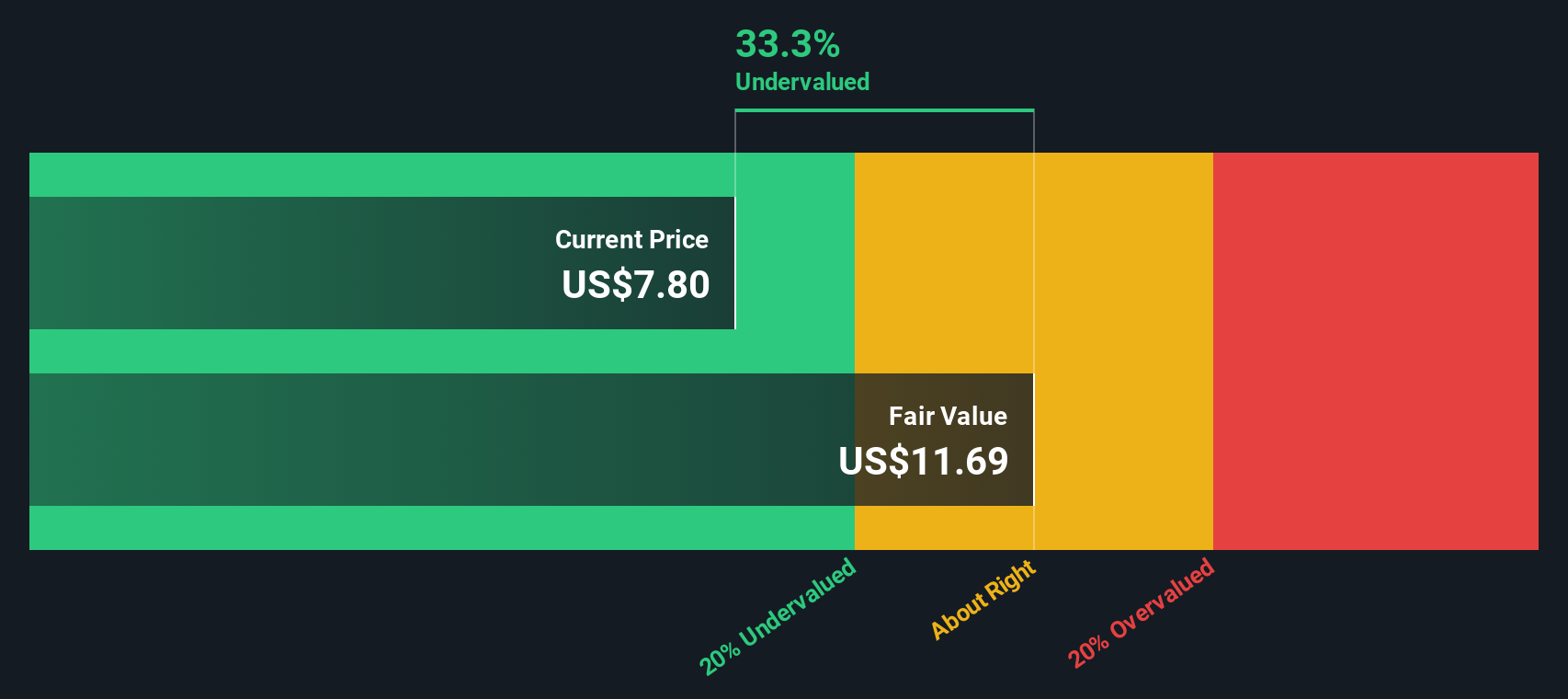

Methode Electronics (NYSE:MEI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Methode Electronics is a company that designs and manufactures custom-engineered solutions for the automotive, industrial, and interface markets, with a market capitalization of approximately $1.49 billion.

Operations: The company generates revenue primarily from its Automotive and Industrial segments, with the Automotive segment contributing $554 million and the Industrial segment $501.5 million. Over recent periods, gross profit margin has shown a declining trend, reaching 16.90% in early 2025.

PE: -2.9x

Methode Electronics, a small company in the U.S., has caught attention due to insider confidence, with President Jonathan DeGaynor purchasing 32,733 shares worth US$211K. Despite recent volatile share prices and a net loss of US$14.4 million in Q3 2025 compared to US$11.6 million the previous year, earnings are forecasted to grow significantly at 131% annually. The company faces higher risk funding from external borrowing but remains optimistic about future sales growth and profitability for fiscal 2026.

- Get an in-depth perspective on Methode Electronics' performance by reading our valuation report here.

Examine Methode Electronics' past performance report to understand how it has performed in the past.

Next Steps

- Take a closer look at our Undervalued US Small Caps With Insider Buying list of 110 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BBCP

Concrete Pumping Holdings

Provides concrete pumping and waste management services in the United States and the United Kingdom.

Moderate growth potential with questionable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026