- United States

- /

- Software

- /

- NasdaqGS:AVPT

3 US Growth Stocks With High Insider Ownership To Watch

Reviewed by Simply Wall St

As the U.S. stock market approaches record highs, with the S&P 500 and Nasdaq Composite showing resilience amid fluctuating earnings reports, investors are keenly observing growth opportunities in companies where insiders hold significant stakes. In such a climate, stocks with high insider ownership can be particularly attractive as they often signal confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| BBB Foods (NYSE:TBBB) | 16.4% | 40.4% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 33.8% |

| MoneyLion (NYSE:ML) | 20.3% | 92.4% |

| Myomo (NYSEAM:MYO) | 12.7% | 56.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.9% | 66.2% |

Here we highlight a subset of our preferred stocks from the screener.

AvePoint (NasdaqGS:AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

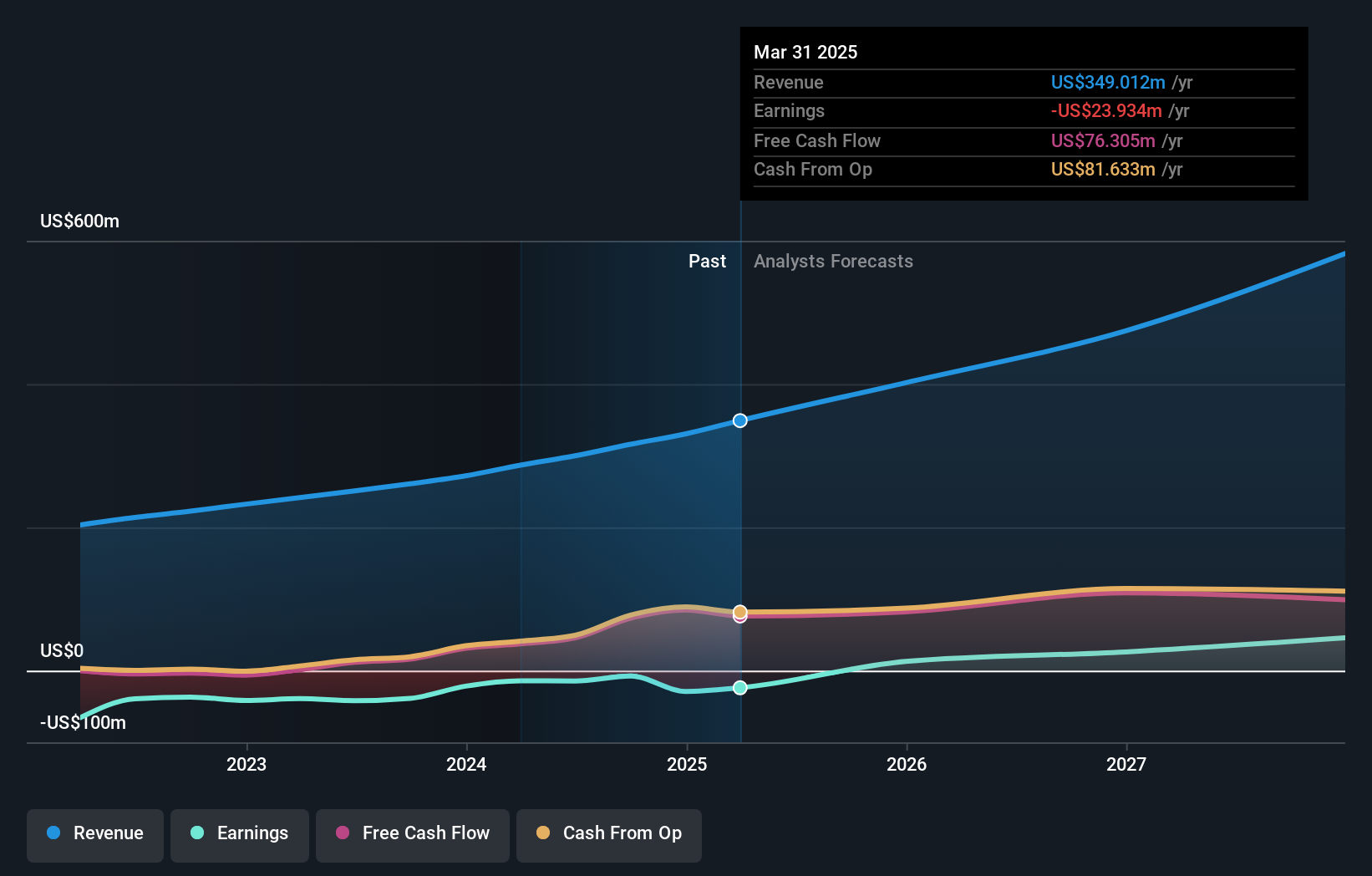

Overview: AvePoint, Inc. offers a cloud-native data management software platform across various regions including North America, Europe, the Middle East, Africa, and Asia Pacific, with a market cap of approximately $3.64 billion.

Operations: The company generates revenue of $315.92 million from its Software & Programming segment.

Insider Ownership: 37.1%

AvePoint, with a strong insider ownership profile, is positioned for growth as it forecasts revenue to increase at 18% annually, outpacing the US market. The company recently turned profitable and reported Q3 revenue of US$88.8 million, up from US$72.76 million year-on-year. AvePoint's innovative Microsoft 365 Copilot benchmarking capabilities enhance its AI offerings, supporting future growth potential despite lower-than-benchmark return on equity projections in three years.

- Unlock comprehensive insights into our analysis of AvePoint stock in this growth report.

- The valuation report we've compiled suggests that AvePoint's current price could be inflated.

Travelzoo (NasdaqGS:TZOO)

Simply Wall St Growth Rating: ★★★★☆☆

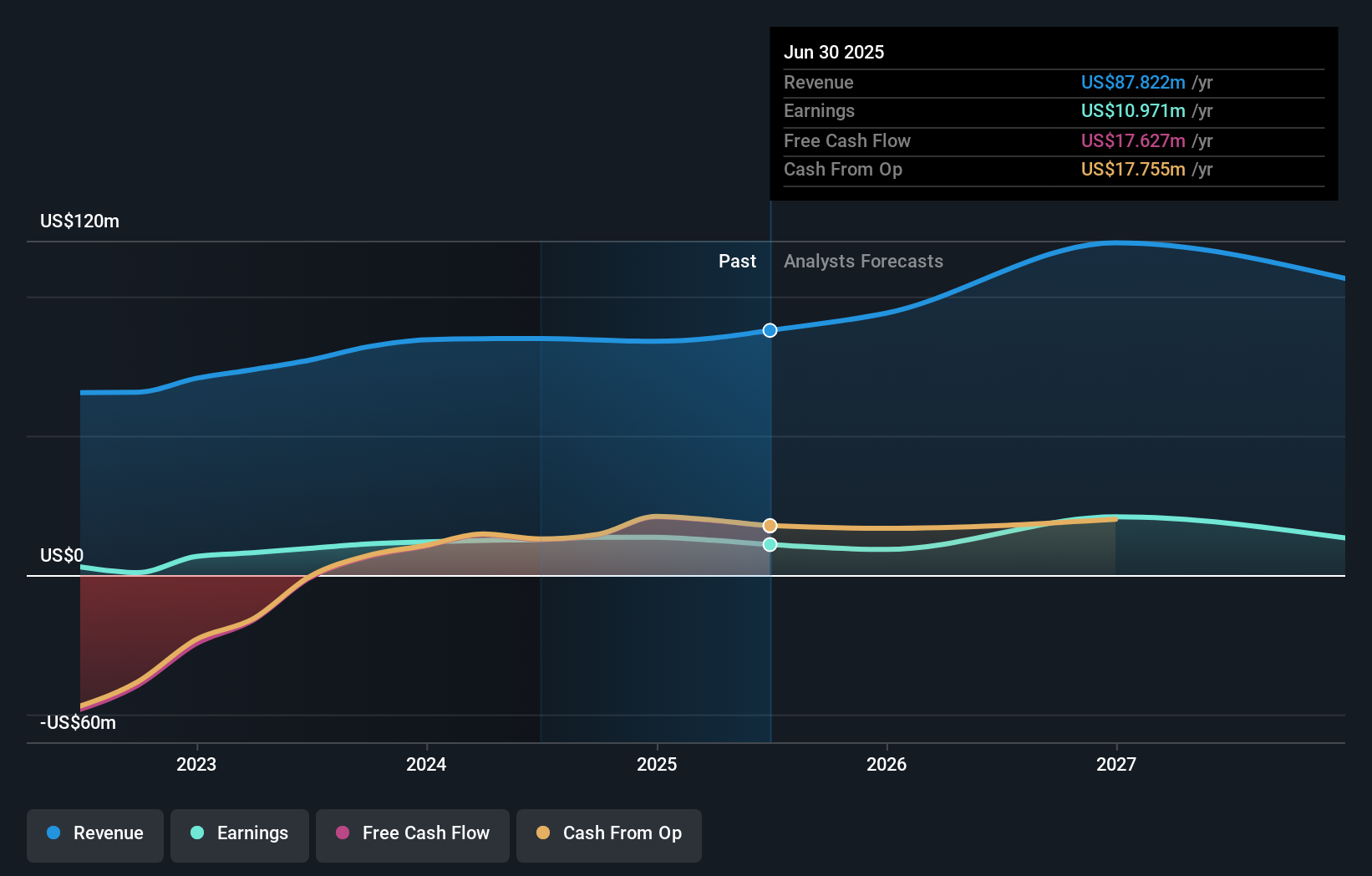

Overview: Travelzoo, with a market cap of $255.92 million, operates as an Internet media company offering travel, entertainment, and local experiences globally.

Operations: The company's revenue segments consist of Travelzoo North America at $54.97 million, Travelzoo Europe at $24.90 million, Jack's Flight Club at $4.27 million, and New Initiatives contributing $0.24 million.

Insider Ownership: 38%

Travelzoo, benefiting from substantial insider ownership, is poised for growth with its earnings forecast to increase by 26.7% annually, surpassing the US market's average. Despite trading at 75.2% below estimated fair value, recent months saw more insider buying than selling. Revenue is expected to grow at 18.8% per year, exceeding market expectations but below significant growth thresholds. Earnings grew by 21.8% last year; however, significant insider selling was noted recently.

- Navigate through the intricacies of Travelzoo with our comprehensive analyst estimates report here.

- Our valuation report here indicates Travelzoo may be undervalued.

Endava (NYSE:DAVA)

Simply Wall St Growth Rating: ★★★★☆☆

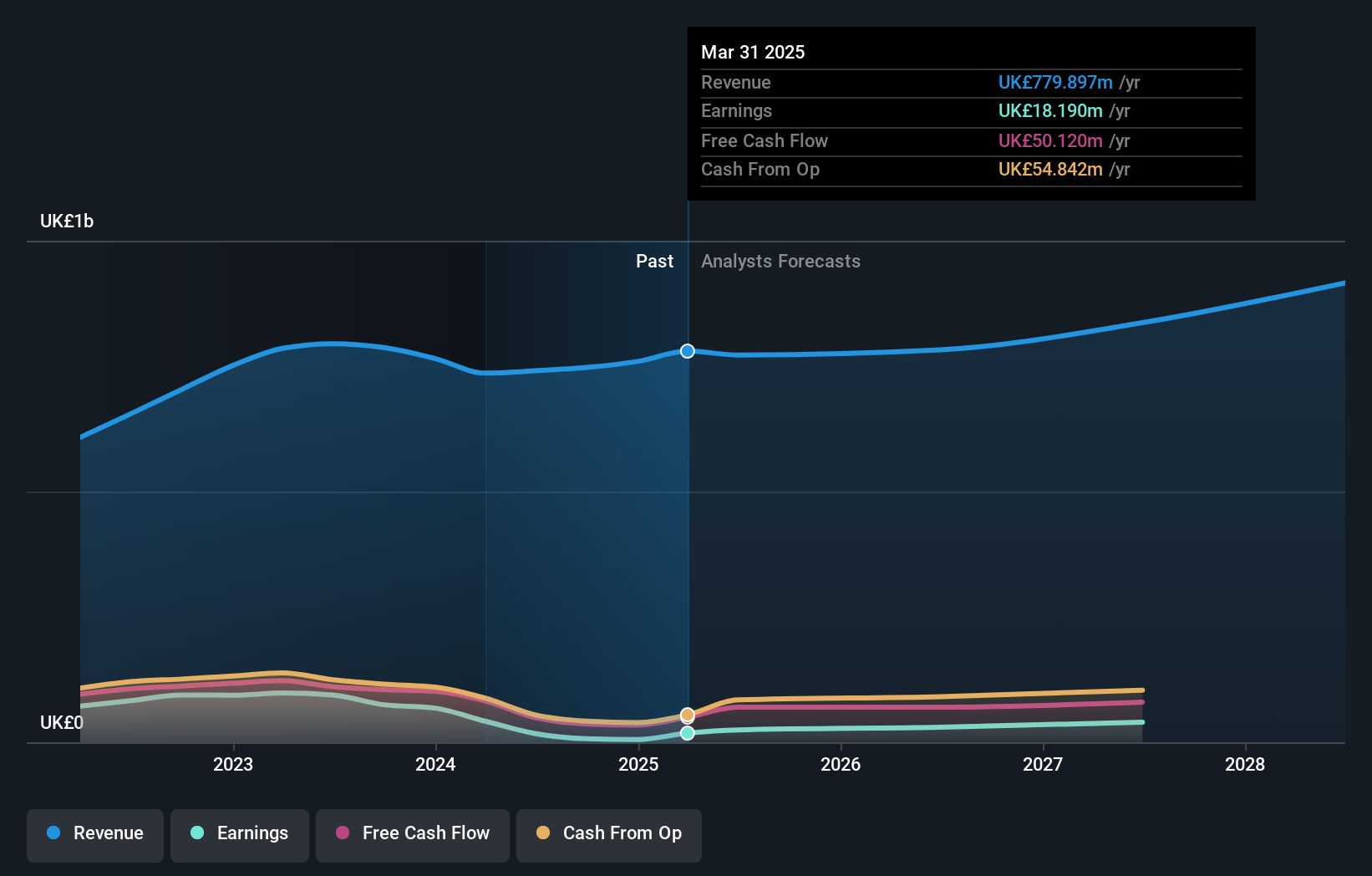

Overview: Endava plc, along with its subsidiaries, offers technology services across North America, Europe, the United Kingdom, and other international markets, with a market cap of approximately $1.94 billion.

Operations: Endava generates its revenue primarily from the Computer Services segment, which accounted for £747.39 million.

Insider Ownership: 26.6%

Endava, with high insider ownership, is expected to see earnings grow at 41% annually, significantly outpacing the US market average. Despite a substantial drop in net income from £12.37 million to £2.25 million year-over-year, revenue grew slightly and is forecasted to increase by 9.2% per year. The company's recent guidance indicates steady revenue growth but profit margins remain low compared to last year's figures, and no significant insider trading activity was noted recently.

- Click here and access our complete growth analysis report to understand the dynamics of Endava.

- According our valuation report, there's an indication that Endava's share price might be on the expensive side.

Summing It All Up

- Embark on your investment journey to our 202 Fast Growing US Companies With High Insider Ownership selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives