- United States

- /

- Software

- /

- NYSE:SMWB

US High Growth Tech Stocks To Watch In Your Portfolio

Reviewed by Simply Wall St

As the U.S. market navigates through fluctuating economic indicators and trade discussions, with key indices like the S&P 500 and Nasdaq Composite experiencing recent highs, investors are keenly observing high-growth tech stocks that could potentially offer robust returns amidst this dynamic environment. In such a climate, identifying stocks with strong fundamentals and innovative potential can be crucial for those looking to enhance their portfolios in the fast-evolving technology sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.99% | 39.09% | ★★★★★★ |

| Circle Internet Group | 32.27% | 61.44% | ★★★★★★ |

| Mereo BioPharma Group | 50.84% | 58.22% | ★★★★★★ |

| Ardelyx | 21.02% | 61.29% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.04% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.72% | 59.95% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 23.02% | 103.97% | ★★★★★★ |

Click here to see the full list of 225 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Tripadvisor (TRIP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tripadvisor, Inc. is an online travel company that offers travel guidance products and services globally, with a market capitalization of approximately $1.54 billion.

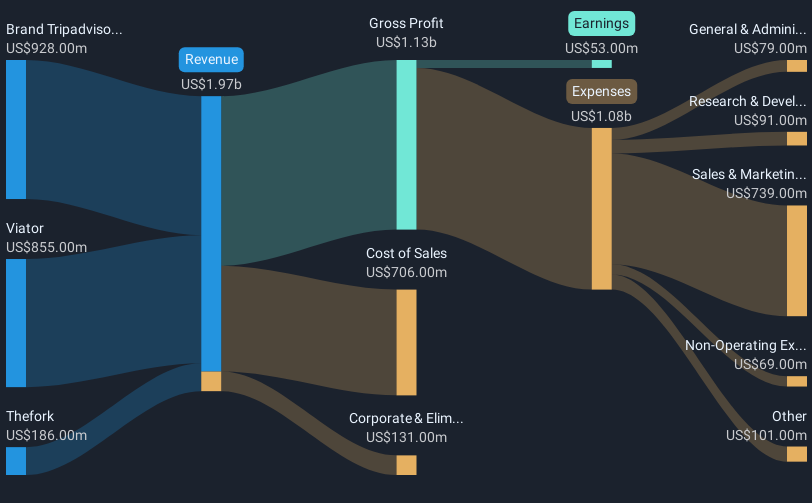

Operations: Tripadvisor generates revenue primarily through its Brand Tripadvisor segment ($928 million), Viator ($855 million), and Thefork ($186 million).

Tripadvisor has shown a robust earnings growth of 120.8% over the past year, significantly outpacing its industry's average of 16.4%. Despite recent volatility, including being dropped from several Russell indexes and then added to others, the company's strategic positioning in interactive media and services continues to evolve. Notably, its R&D investment aligns with an aggressive pursuit of innovation, crucial for maintaining competitive edge in a rapidly changing digital landscape. With an expected annual profit growth rate of 21.2%, Tripadvisor is poised to leverage its technological advancements and market adaptability for sustained growth.

- Unlock comprehensive insights into our analysis of Tripadvisor stock in this health report.

Examine Tripadvisor's past performance report to understand how it has performed in the past.

Olo (OLO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Olo Inc. provides an open SaaS platform tailored for restaurant operations across the United States, with a market capitalization of approximately $1.49 billion.

Operations: The company generates revenue primarily through its Internet Software & Services segment, amounting to $299.11 million. Operating within the restaurant industry, it leverages a SaaS platform to enhance operational efficiency for its clients across the United States.

Olo's recent inclusion in multiple Russell 2000 indexes underscores its growing relevance in the tech sector, particularly after turning profitable this year with a substantial earnings jump to $1.81 million from a previous loss. This shift is mirrored by a robust annual revenue growth forecast at 16%, outpacing the US market average of 8.7%. The firm's strategic re-engagement with Red Lobster, expanding into first-party catering and enhancing digital capabilities through AI-driven platforms like Sentiment, reflects its adaptive approach in a competitive landscape. These moves not only boost operational efficiency but also align with broader industry trends towards specialized tech partnerships over internal development, setting Olo up for sustained advancement in restaurant technology solutions.

- Delve into the full analysis health report here for a deeper understanding of Olo.

Assess Olo's past performance with our detailed historical performance reports.

Similarweb (SMWB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. offers digital data and analytics services that support crucial business decision-making across various regions, including the United States, Europe, Asia Pacific, the United Kingdom, Israel, and other international markets; its market cap is approximately $654.94 million.

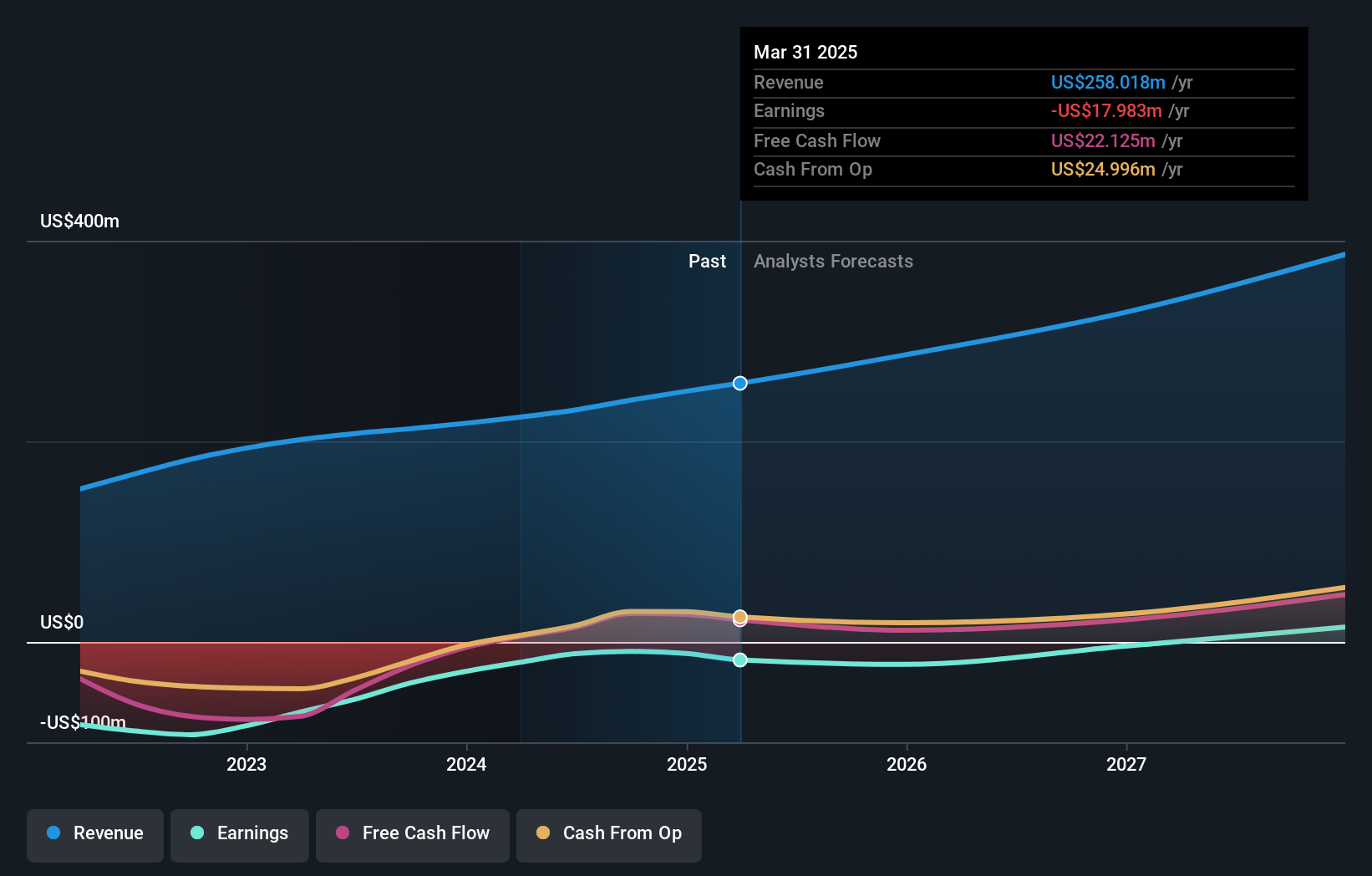

Operations: Similarweb Ltd. generates revenue primarily from its online financial information provider segment, totaling $258.02 million. The company operates across multiple regions, delivering digital data and analytics to facilitate critical business decisions.

Similarweb, despite a net loss of $9.26 million in Q1 2025, up from $2.73 million the previous year, demonstrates a robust commitment to innovation with its new AI-driven tools aimed at transforming digital market analytics. The company's recent product launches, including AI Agents that analyze real-time SEO trends and automate sales processes, leverage data from over 100 million websites and 4 million apps. This strategic focus on specialized AI solutions not only addresses specific customer needs but also positions Similarweb to capitalize on the growing demand for advanced digital intelligence tools. With revenues rising to $67.09 million this quarter and projected sales between $68.6 million and $69.0 million next quarter, Similarweb is navigating its growth trajectory by enhancing user engagement through technology that outpaces traditional methods.

- Dive into the specifics of Similarweb here with our thorough health report.

Gain insights into Similarweb's past trends and performance with our Past report.

Where To Now?

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 222 more companies for you to explore.Click here to unveil our expertly curated list of 225 US High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMWB

Similarweb

Provides digital data and analytics for power critical business decisions in the United States, Europe, the Asia Pacific, the United Kingdom, Israel, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion