- United States

- /

- Medical Equipment

- /

- NasdaqGS:OSUR

OraSure Technologies Leads The Charge With 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market faces a challenging period with major indices like the Dow and S&P 500 on track for their worst week in two years, investors are increasingly seeking opportunities that may offer resilience amid economic uncertainty. Penny stocks, despite their somewhat outdated moniker, continue to represent an intriguing investment area for those interested in smaller or emerging companies with potential upside. By focusing on firms with strong financials and growth potential, investors can uncover promising opportunities among these lesser-known equities.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.80 | $6.25M | ★★★★★★ |

| Safe Bulkers (NYSE:SB) | $3.80 | $390.66M | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $118.07M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.38 | $72.19M | ★★★★★★ |

| Tuya (NYSE:TUYA) | $3.44 | $2.09B | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8791 | $79.15M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.21 | $21.82M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $3.73 | $141.3M | ★★★★★☆ |

| TETRA Technologies (NYSE:TTI) | $3.28 | $448.82M | ★★★★☆☆ |

Click here to see the full list of 750 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

OraSure Technologies (NasdaqGS:OSUR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OraSure Technologies, Inc. offers point-of-care and home diagnostic tests, specimen collection devices, and microbiome laboratory services globally, with a market cap of $242.43 million.

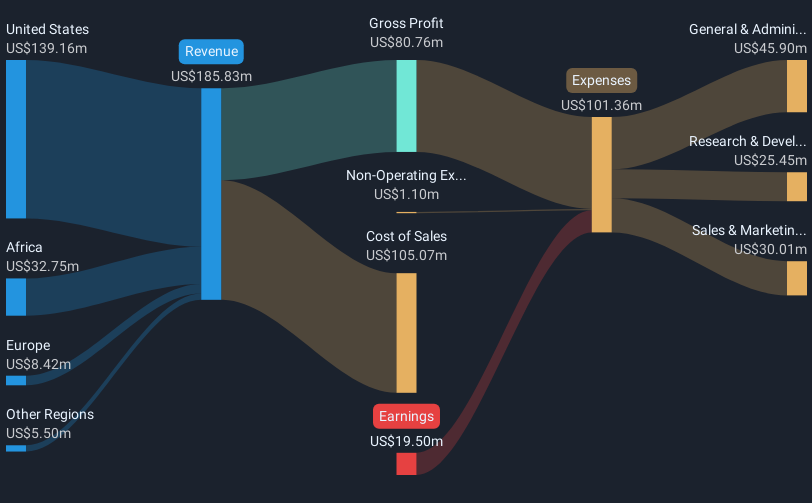

Operations: The company's revenue is derived from its Diagnostics and Molecular Solutions segment, which generated $185.83 million.

Market Cap: $242.43M

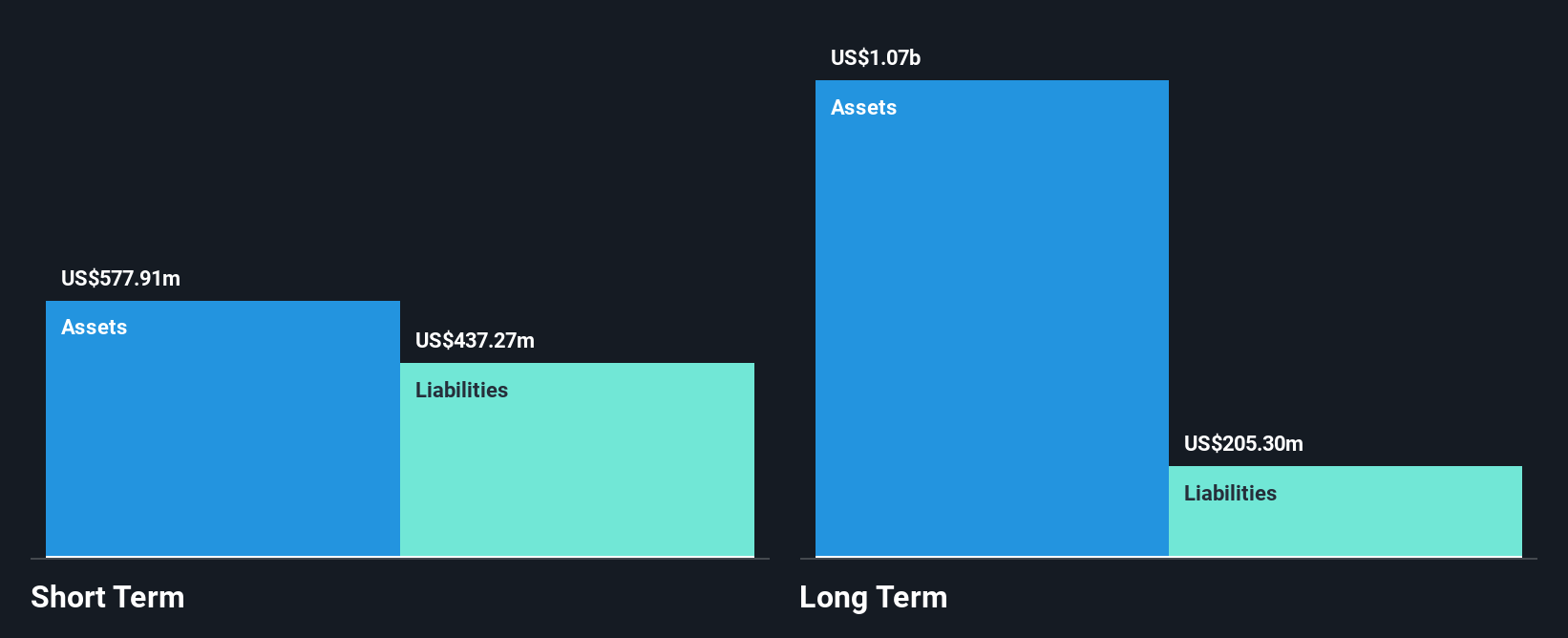

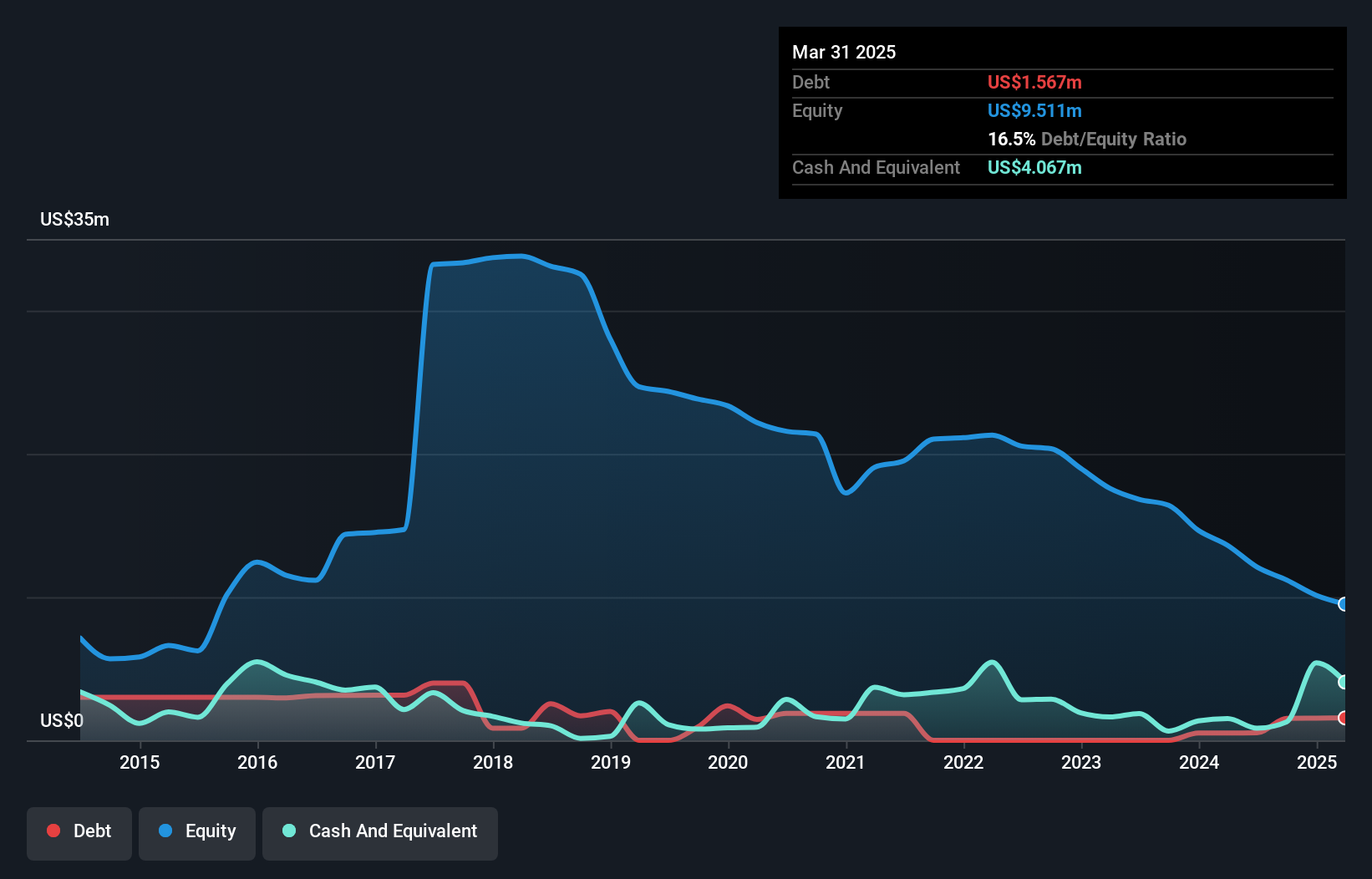

OraSure Technologies, Inc., with a market cap of US$242.43 million, has faced challenges recently, reporting a net loss of US$19.5 million for 2024 compared to a profit the previous year. Despite being unprofitable, it has reduced losses over five years and maintains no debt, offering some financial stability. The company is seeking acquisitions to expand innovation and recently received FDA approval for expanded use of its OraQuick HIV Self-Test. Legal issues have emerged with NOWDiagnostics alleging breach of contract and other violations against OraSure. Analysts expect stock price growth despite current setbacks in earnings performance.

- Click here to discover the nuances of OraSure Technologies with our detailed analytical financial health report.

- Explore OraSure Technologies' analyst forecasts in our growth report.

Taboola.com (NasdaqGS:TBLA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taboola.com Ltd. operates an artificial intelligence-based algorithmic engine platform across various countries including Israel, the United States, the United Kingdom, and Germany, with a market capitalization of approximately $1.02 billion.

Operations: The company's revenue is primarily derived from its advertising segment, which generated $1.77 billion.

Market Cap: $1.02B

Taboola.com Ltd., with a market cap of US$1.02 billion, has been unprofitable but shows financial resilience with short-term assets exceeding liabilities and a positive cash runway for over three years. Recent earnings guidance projects 2025 revenues between US$1.838 billion and US$1.888 billion, reflecting growth from 2024's US$1.77 billion revenue despite past losses increasing at 14.9% annually over five years. The company recently enhanced its equity buyback plan by an additional US$200 million and secured strategic partnerships, such as a new deal with LINE Plus to expand its global reach in advertising recommendations, signaling potential future growth avenues.

- Get an in-depth perspective on Taboola.com's performance by reading our balance sheet health report here.

- Evaluate Taboola.com's prospects by accessing our earnings growth report.

Tecogen (OTCPK:TGEN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tecogen Inc. designs, manufactures, markets, and maintains ultra-clean cogeneration products for various sectors primarily in the United States, with a market cap of $57.68 million.

Operations: The company's revenue is primarily derived from Services at $15.95 million, followed by Products at $4.77 million, and Energy Production contributing $2.09 million.

Market Cap: $57.68M

Tecogen Inc., with a market cap of US$57.68 million, derives its revenue primarily from services (US$15.95 million), supported by product sales (US$4.77 million) and energy production (US$2.09 million). Despite being unprofitable with a negative return on equity of -47.55%, it maintains financial stability as short-term assets exceed both short-term and long-term liabilities, offering a sufficient cash runway for over three years if free cash flow continues to grow historically at 27.1% annually. Management and the board are experienced, though increased volatility in share price suggests potential risk for investors seeking stability in penny stocks.

- Unlock comprehensive insights into our analysis of Tecogen stock in this financial health report.

- Evaluate Tecogen's historical performance by accessing our past performance report.

Seize The Opportunity

- Unlock our comprehensive list of 750 US Penny Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade OraSure Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OSUR

OraSure Technologies

Develops, manufactures, markets, sells, and distributes diagnostic products, specimen collection devices, and other diagnostic products in the United States, Europe, Africa, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives