- United States

- /

- Banks

- /

- NasdaqGS:CBNK

3 US Growth Companies With High Insider Ownership Growing Revenues At 27%

Reviewed by Simply Wall St

As U.S. stock markets navigate a mixed landscape of tech earnings and key economic data, investors are closely watching how these factors influence broader market trends. In this environment, growth companies with high insider ownership often stand out due to their potential for robust revenue expansion and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| Smith Micro Software (NasdaqCM:SMSI) | 23.9% | 85.4% |

| Neonode (NasdaqCM:NEON) | 22.6% | 110.9% |

| CarGurus (NasdaqGS:CARG) | 16.6% | 42.3% |

We'll examine a selection from our screener results.

Capital Bancorp (NasdaqGS:CBNK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capital Bancorp, Inc. is the bank holding company for Capital Bank, N.A., with a market cap of $510.31 million.

Operations: The company's revenue segments include Opensky with $70.58 million, Corporate at $0.15 million, Commercial Bank generating $85.87 million, and Capital Bank Home Loans (CBHL) contributing $6.89 million.

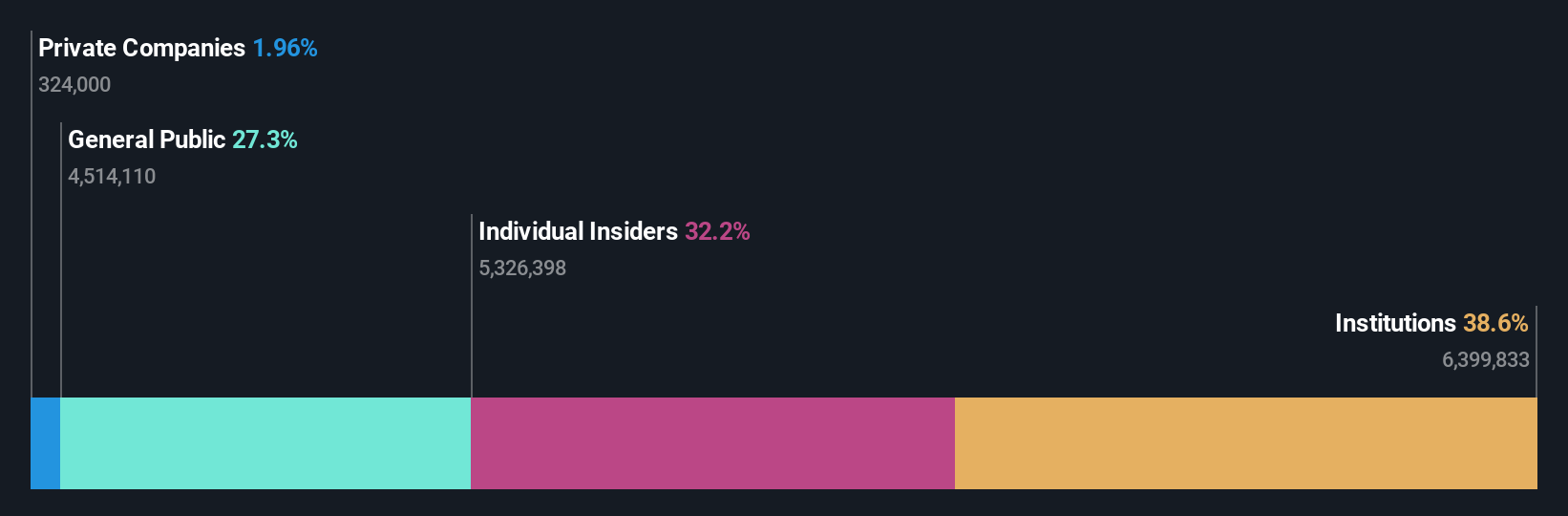

Insider Ownership: 31.1%

Revenue Growth Forecast: 20.8% p.a.

Capital Bancorp demonstrates strong growth potential with expected annual earnings and revenue growth significantly outpacing the US market. Despite a recent decline in net income, insider buying has been substantial, indicating confidence in future prospects. The company trades well below its estimated fair value, presenting a potential opportunity for investors. However, past shareholder dilution and low forecasted return on equity are considerations. Recent dividend affirmations and stable charge-offs further support its solid financial standing.

- Dive into the specifics of Capital Bancorp here with our thorough growth forecast report.

- Our expertly prepared valuation report Capital Bancorp implies its share price may be lower than expected.

Hesai Group (NasdaqGS:HSAI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hesai Group develops, manufactures, and sells three-dimensional LiDAR solutions across Mainland China, Europe, North America, and internationally with a market cap of approximately $1.95 billion.

Operations: Hesai Group generates revenue through the development, production, and distribution of three-dimensional LiDAR solutions across various regions including Mainland China, Europe, and North America.

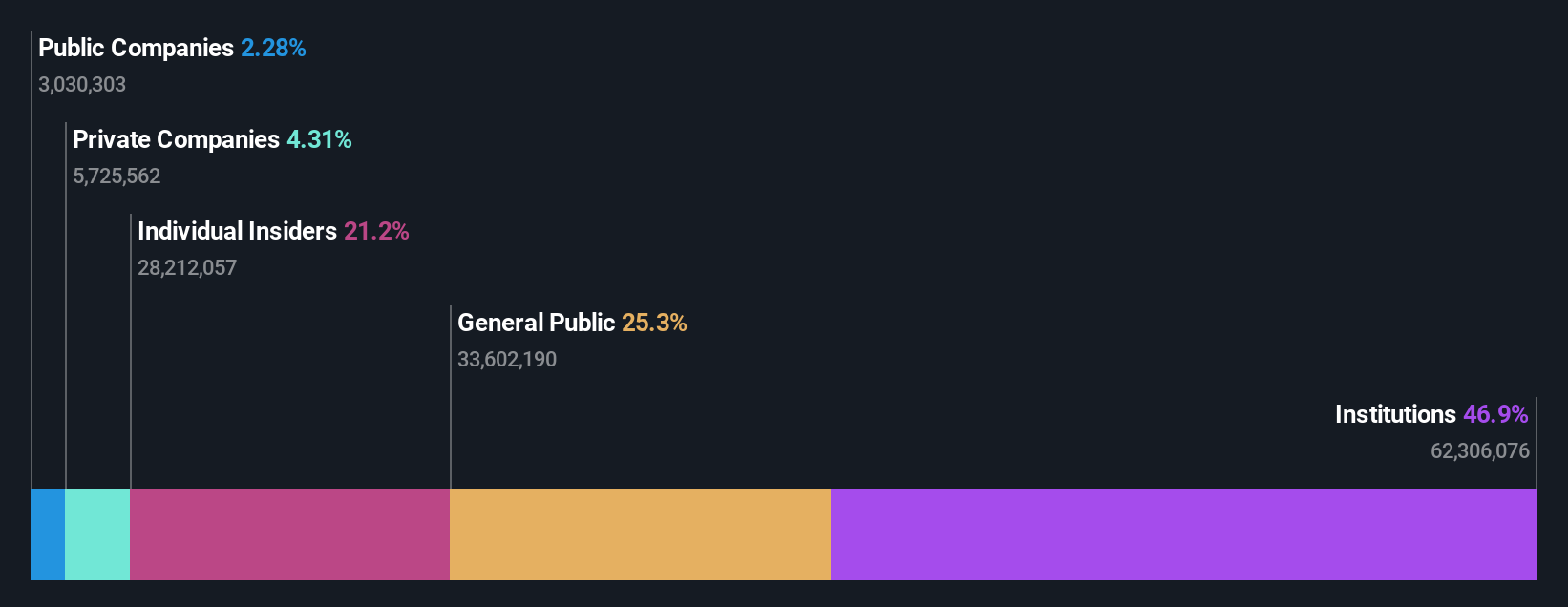

Insider Ownership: 24.4%

Revenue Growth Forecast: 27.6% p.a.

Hesai Group is experiencing rapid growth, with revenue forecasted to increase by 27.6% annually, outpacing the US market. The company is expected to become profitable within three years, marking above-average market growth. Recent strategic alliances and product innovations in lidar technology bolster its position in autonomous driving and robotics sectors. Despite high share price volatility, Hesai trades below estimated fair value and has secured significant design wins with major automotive OEMs like Chery and Changan.

- Delve into the full analysis future growth report here for a deeper understanding of Hesai Group.

- Insights from our recent valuation report point to the potential overvaluation of Hesai Group shares in the market.

Taboola.com (NasdaqGS:TBLA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taboola.com Ltd. operates an artificial intelligence-based algorithmic engine platform across various countries, including Israel, the United States, and the United Kingdom, with a market cap of approximately $1.23 billion.

Operations: The company's revenue is primarily generated from its advertising segment, which amounts to $1.69 billion.

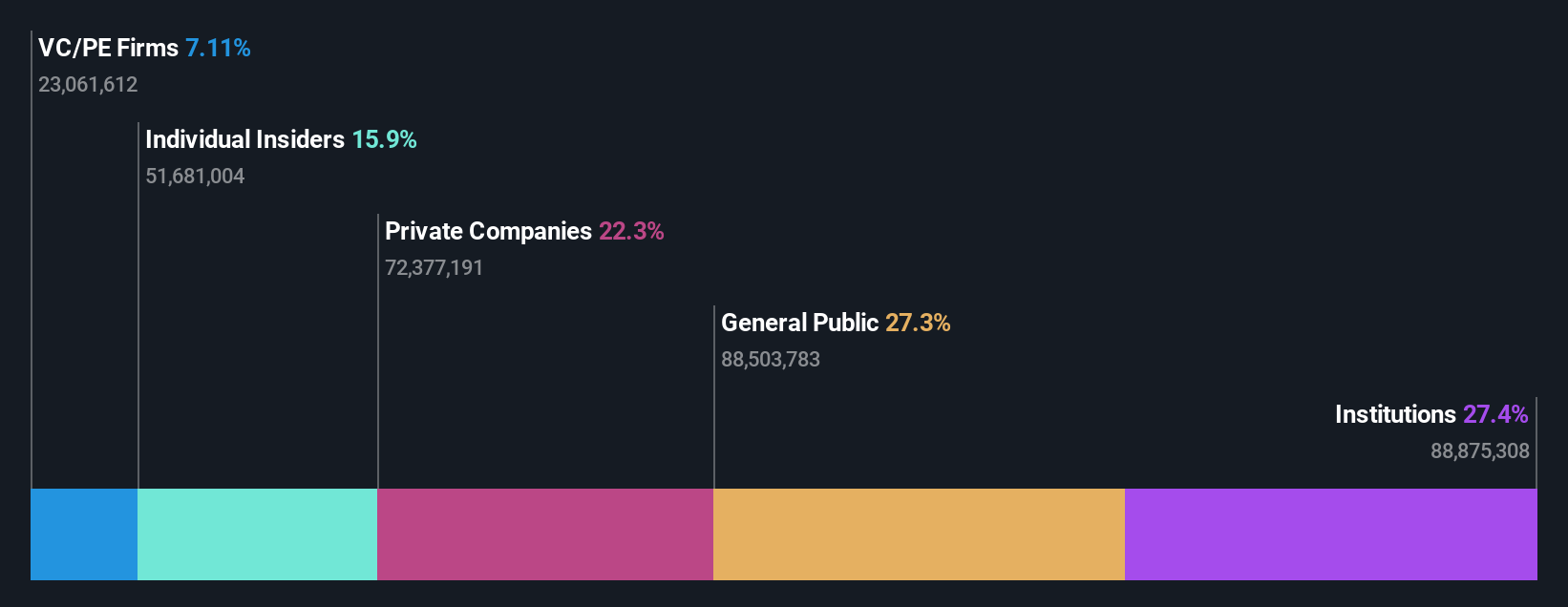

Insider Ownership: 14.2%

Revenue Growth Forecast: 12.5% p.a.

Taboola.com is poised for growth with a forecasted 12.5% annual revenue increase, surpassing the US market average. The company is expected to achieve profitability within three years, indicating strong future prospects. Insider confidence is evident as more shares have been bought than sold recently. Strategic partnerships, including renewed agreements with Reach PLC and Future, enhance Taboola's audience engagement capabilities across major media platforms in the UK and US, supporting its expansion strategy.

- Click here and access our complete growth analysis report to understand the dynamics of Taboola.com.

- Insights from our recent valuation report point to the potential undervaluation of Taboola.com shares in the market.

Taking Advantage

- Explore the 204 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CBNK

Capital Bancorp

Operates as the bank holding company for Capital Bank, N.A.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives