- United States

- /

- Insurance

- /

- NasdaqGS:PLMR

3 Stocks Estimated To Be Up To 48.4% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. market navigates through a complex landscape marked by fluctuating indices and ongoing concerns about an AI bubble, investors are keenly observing opportunities that may arise amidst the volatility. In such an environment, identifying stocks trading below their intrinsic value can be a strategic move, offering potential for growth as market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zeta Global Holdings (ZETA) | $16.70 | $31.76 | 47.4% |

| WesBanco (WSBC) | $30.06 | $57.77 | 48% |

| TransMedics Group (TMDX) | $122.21 | $231.88 | 47.3% |

| TowneBank (TOWN) | $32.58 | $64.47 | 49.5% |

| So-Young International (SY) | $3.52 | $6.82 | 48.4% |

| SolarEdge Technologies (SEDG) | $31.82 | $63.37 | 49.8% |

| Northwest Bancshares (NWBI) | $11.77 | $22.75 | 48.3% |

| Niagen Bioscience (NAGE) | $6.95 | $13.43 | 48.3% |

| Duolingo (DUOL) | $262.04 | $506.20 | 48.2% |

| CF Bankshares (CFBK) | $23.36 | $45.20 | 48.3% |

Underneath we present a selection of stocks filtered out by our screen.

So-Young International (SY)

Overview: So-Young International Inc. operates an online platform for consumption healthcare services in the People's Republic of China and has a market cap of approximately $344.64 million.

Operations: Revenue segments for So-Young International include online platform services for consumption healthcare in China, with total revenues reported in millions of CN¥.

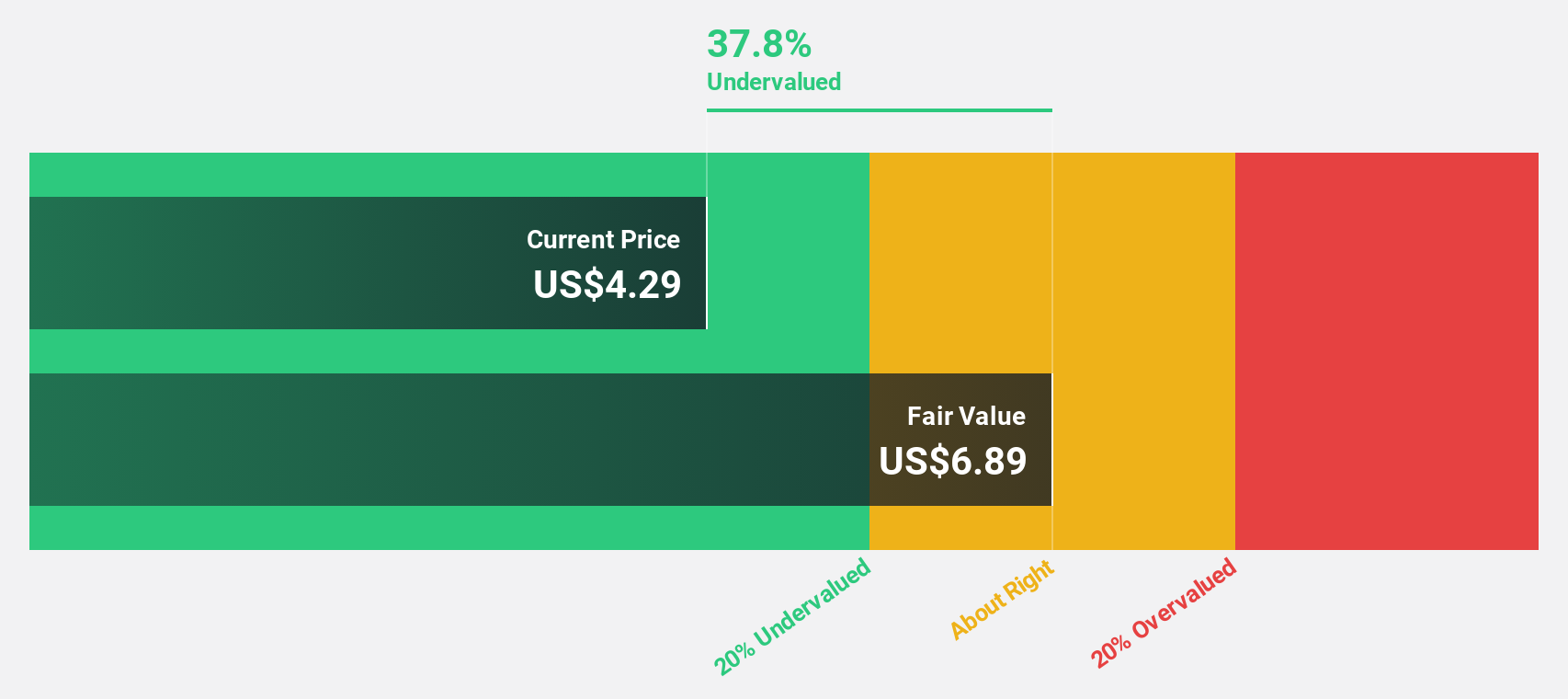

Estimated Discount To Fair Value: 48.4%

So-Young International is trading at US$3.52, significantly below its estimated fair value of US$6.82, suggesting it is undervalued based on discounted cash flows. Despite recent volatility and a reported net loss for the second quarter, the company's revenue growth forecast of 31.8% annually outpaces both market expectations and its return to profitability within three years aligns with above-average market growth projections. Recent inclusion in the S&P Global BMI Index may enhance visibility among investors.

- According our earnings growth report, there's an indication that So-Young International might be ready to expand.

- Unlock comprehensive insights into our analysis of So-Young International stock in this financial health report.

Palomar Holdings (PLMR)

Overview: Palomar Holdings, Inc. is a specialty insurance company offering property and casualty insurance to individuals and businesses in the United States, with a market cap of $3.05 billion.

Operations: The company's revenue primarily comes from its property and casualty insurance business, generating $682.21 million.

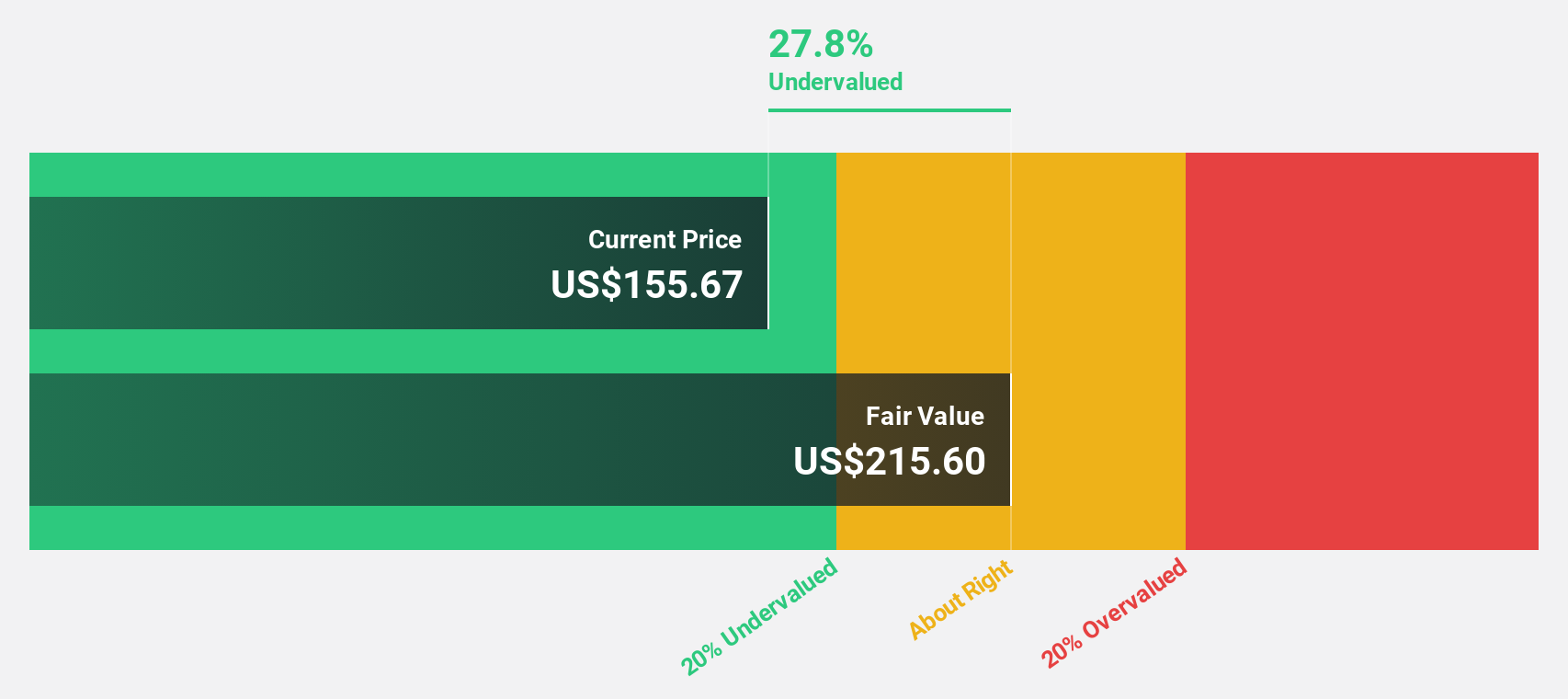

Estimated Discount To Fair Value: 45.8%

Palomar Holdings is trading at US$115.53, substantially below its estimated fair value of US$213.13, highlighting its undervaluation based on discounted cash flows. The company's revenue is projected to grow at 21.7% annually, surpassing the broader US market's growth rate of 10.5%. However, significant insider selling in the past quarter raises concerns despite analysts' consensus on a potential price increase of 36.1%. Earnings are expected to grow faster than the market average at 18% annually.

- In light of our recent growth report, it seems possible that Palomar Holdings' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Palomar Holdings' balance sheet health report.

HCI Group (HCI)

Overview: HCI Group, Inc. operates in the United States through its subsidiaries in property and casualty insurance, insurance management, reinsurance, real estate, and information technology sectors with a market capitalization of $2.62 billion.

Operations: The company's revenue segments include $726.94 million from insurance operations, $49.26 million from reciprocal exchange operations, and $11.12 million from real estate.

Estimated Discount To Fair Value: 43%

HCI Group is trading at US$206.15, significantly below its estimated fair value of US$361.57, indicating substantial undervaluation based on discounted cash flows. The company's earnings are projected to grow at 25.5% annually, outpacing the US market's average growth rate of 16%. Recent financial performance shows increased revenue and net income year-over-year, although shareholder dilution occurred in the past year. A regular quarterly dividend was recently affirmed by the board.

- Our comprehensive growth report raises the possibility that HCI Group is poised for substantial financial growth.

- Get an in-depth perspective on HCI Group's balance sheet by reading our health report here.

Next Steps

- Delve into our full catalog of 171 Undervalued US Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLMR

Palomar Holdings

A specialty insurance company, provides property and casualty insurance to individuals and businesses in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives