- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

Despite Roku's (NASDAQ:ROKU) Steep Correction, Institutions are Divided About its Prospects

After years of good performance, Roku, Inc. ( NASDAQ: ROKU ) is on the path to a negative year. Despite the efforts, the stock failed to establish a new high in the second half of the year, failing to break past the US$480 level once again.

Since then, the company has been hit with growing criticism, weakening sentiment, and rating cuts.

See our latest analysis for Roku .

Despite criticism, Roku is not backing away from the growth plans, as they are looking to develop over 50 original shows in the next 2 years. The company seeks to create shows in an ad-friendly format that would help monetize their viewership and target the 18-49y old age demographic.

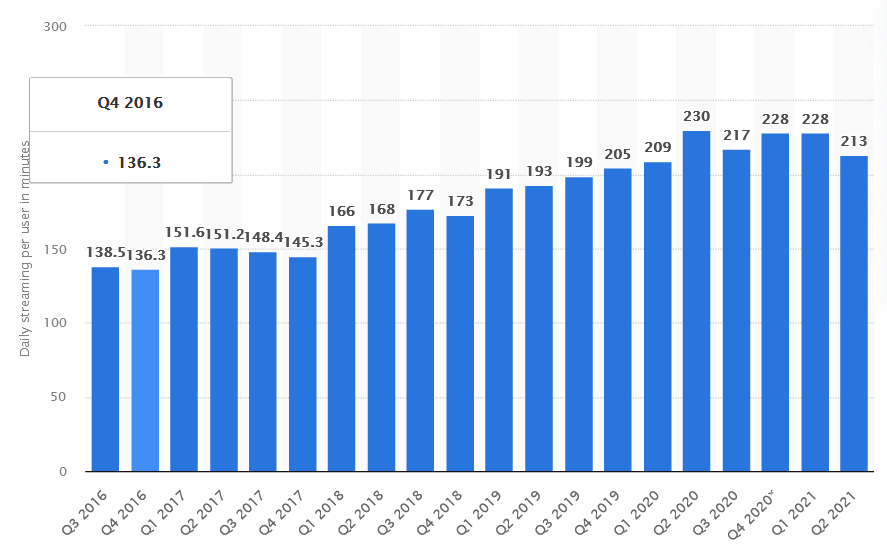

Hopefully, this move would help increase the viewership, as it has peaked in the last few quarters, as the chart shows.

Although Roku is looking for quality content, they won't be looking to produce high-budget shows like their rivals, as they are looking for a sweet spot between revenue and returns.

Some institutions like Guggenheim like the news, as their analyst Michael Morris took a contrarian move, with a Buy rating and a US$370 price target. Meanwhile, others like MoffettNathanson downgraded the stock to Sell, quoting the negative trends in the industry, as well as the fact that Roku has the richest valuation among the competition.

Analyzing Roku's Performance

Although Roku has shed US$5.5b from its market cap this week, let's take a look at its longer-term fundamental trends and see if they've driven returns.

While Roku made a small profit in the last year, we think that the market is probably more focused on top-line growth at the moment.Generally, we believe this kind of company is comparable to loss-making stocks since the actual profit is low.It would be hard to believe in a more profitable future without growing revenues.

Over the last three years, Roku has grown its revenue by 44% annually.That's well above most pre-profit companies.And it's not just the revenue that is taking off. The share price is up 80% per year at that time.It's always tempting to take profits after a share price gain like that, but high-growth companies like Roku can sometimes sustain strong growth for many years.It might be time to put it on your watchlist if you're not already familiar with the stock.

The company's revenue and earnings (over time) are depicted in the image below ( click to see the exact numbers ).

Roku is a well-known stock with plenty of analyst coverage, suggesting some visibility into future growth. If you think of buying or selling Roku stock, you should check out this free report showing analyst consensus estimates for future profits .

Rich Valuation and Growth Concerns

The last three months have been tough on Roku shareholders, who have seen the share price decline a rather worrying 35%. But that doesn't displace its brilliant performance over three years. In fact, the share price has taken off in that time, up 486%. After such a substantial rise, it is not rare to see deep pullbacks, especially for young, high-growth companies that are very volatile.

While Roku shareholders are down 11% for the year, the broader market is up 30%.Of course, the long term matters more than the short term, and even great stocks will sometimes have a poor year. Sometimes when a good quality long-term winner has a weak period, it turns out to be an opportunity. Yet, in Roku's example, 3 things worry us: rich valuation, stagnating viewership, and concerns about the overall market growth.

To truly gain insight, we need to consider other information, too. We've identified 2 warning signs with Roku , and understanding them should be part of your investment process.

We will like Roku better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

If you're looking to trade Roku, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United states and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives