- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Is Meta Still a Smart Pick After a 15% Slide and Major AI Announcements?

Reviewed by Bailey Pemberton

- Wondering if Meta Platforms is truly worth its current price? You are not alone, as plenty of investors are keen to know whether there's real value or just hype behind the stock.

- The stock has taken a breather lately, sliding 15.1% in the past week and down 10.3% over the last month. However, it is still up an impressive 6.4% year-to-date and 14.1% over the past year.

- Recent headlines have revolved around Meta’s latest advancements in artificial intelligence and its push into new hardware territory. These developments are fueling debates about long-term growth. The buzz about regulatory developments and shifting advertising trends has also kept Meta’s name front and center for market watchers.

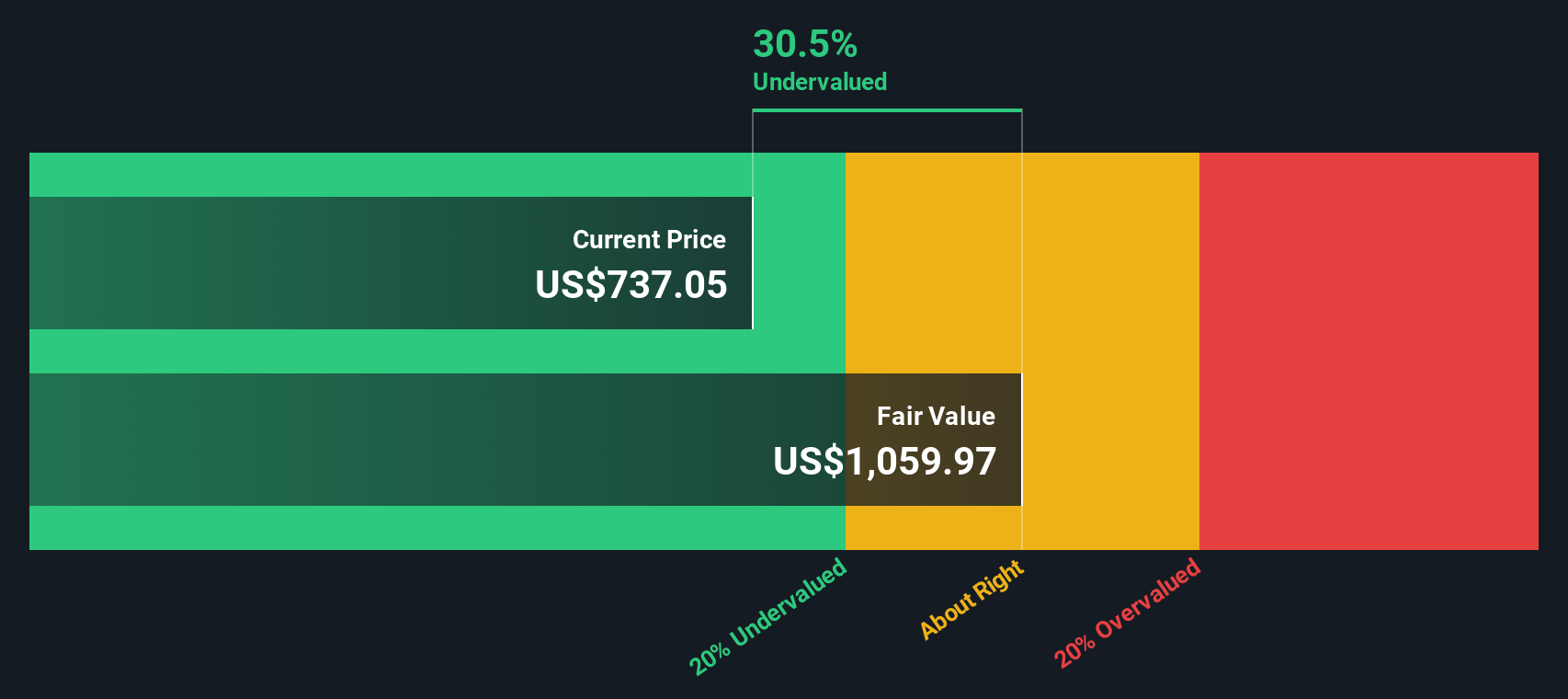

- With a valuation score of 5 out of 6, Meta stands out among its peers for being undervalued in most of our checks. We will break down what this means using traditional and advanced valuation techniques, and explore an even more insightful approach later in this article.

Find out why Meta Platforms's 14.1% return over the last year is lagging behind its peers.

Approach 1: Meta Platforms Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today. This approach helps investors evaluate what Meta Platforms is truly worth based on its capacity to generate cash in years ahead.

For Meta Platforms, the current Free Cash Flow stands at $58.8 Billion. Analysts forecast significant growth, with projections reaching $99.9 Billion by 2029. While analyst estimates cover only the next five years, further forecasts, extending through 2035, are extrapolated to map out long-term trends. These projections underpin a comprehensive calculation of Meta’s intrinsic worth.

Applying the 2 Stage Free Cash Flow to Equity model, the analysis suggests a fair value of $1,210.28 per share. Notably, this places the stock at about 47.3% below its estimated intrinsic value, reflecting a substantial discount at current market levels.

This result signals that, based on future cash flow expectations, Meta Platforms appears meaningfully undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Meta Platforms is undervalued by 47.3%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Meta Platforms Price vs Earnings

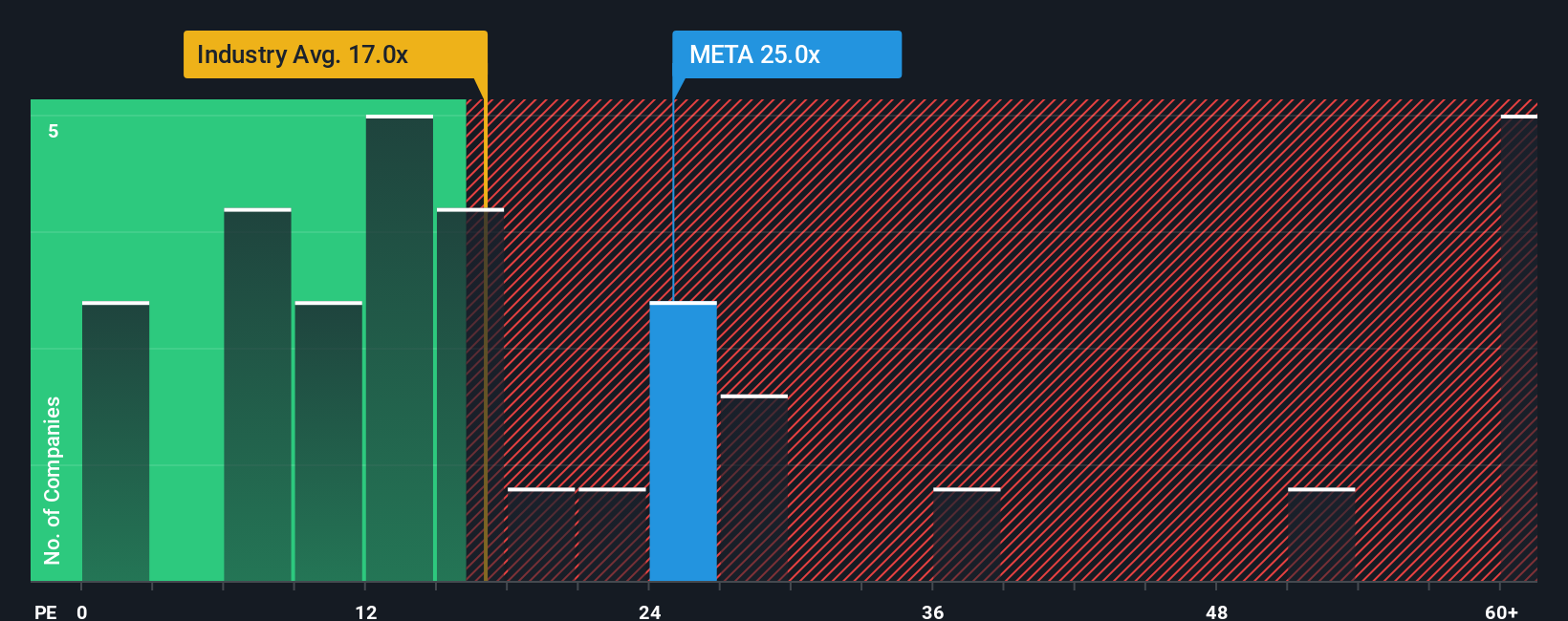

The Price-to-Earnings (PE) ratio is a widely used metric to value profitable companies like Meta Platforms because it links a stock’s price to its actual ability to generate earnings. For investors, it serves as a quick gauge for whether you are paying a reasonable amount relative to what the company earns.

The "right" PE ratio is influenced by several factors. Companies with higher expected growth or lower risk generally warrant higher PE multiples, reflecting investors’ willingness to pay up for future performance and stability. Conversely, riskier firms or those with sluggish prospects often trade at lower multiples.

Meta Platforms currently trades on a PE ratio of 27.5x. To put this into context, the average for its industry, Interactive Media and Services, sits at just 16.9x. Peer companies average 36.1x. This means Meta shares are priced at a premium to the industry but appear cheaper than the peer group.

Simply Wall St’s "Fair Ratio" is a proprietary benchmark that incorporates not only peer and industry comparisons but also nuances like Meta’s expected earnings growth, profit margin, size, and business risks. Unlike blunt industry averages, the Fair Ratio aims to capture a company’s specific prospects and circumstances for a more tailored valuation check.

For Meta Platforms, the Fair Ratio stands at 40.2x, noticeably above the current 27.5x. This suggests Meta shares are trading well below the level justified by their growth and quality profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Meta Platforms Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives.

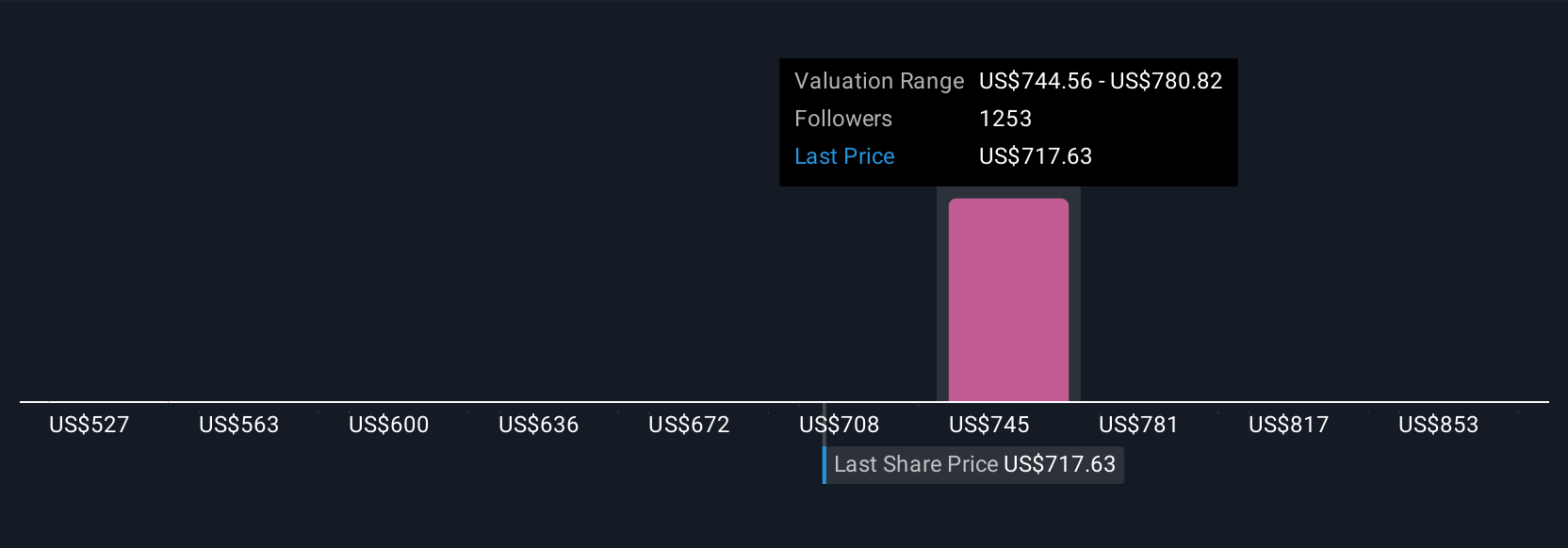

A Narrative is your personal investment story, where you combine your view of a company’s future, such as assumptions for growth, profit margins, or risks, with a financial forecast and a resulting fair value estimate.

Instead of relying on one fixed valuation, Narratives help you connect Meta Platforms’ big picture (like AI innovation or ad revenue trends) directly to the numbers, empowering you to make smarter, more adaptive investment decisions.

On Simply Wall St’s Community page, millions of investors already use Narratives to map out their outlook, compare fair value calculations to the current share price, and decide if and when to buy or sell.

Narratives automatically update with new news, earnings, or data, keeping your analysis current.

For example, some Meta Platform Narratives see fair value as high as $1,086 per share based on rapid AI-driven growth, while others are more cautious, with targets around $658 due to concerns over heavy spending and tighter margins.

Whichever viewpoint you hold, Narratives let you easily visualize and act on the story behind your investment.

For Meta Platforms, however, we'll make it really easy for you with previews of two leading Meta Platforms Narratives:

- 🐂 Meta Platforms Bull Case

Fair Value: $848.43

Currently Undervalued by: 24.8%

Forecast Revenue Growth: 15.8%

- AI-driven ad personalization and expanded monetization support strong user growth, increasing ad performance and diversifying revenue streams across Meta’s platforms.

- Investment in AI infrastructure and ecosystem advantages reinforce Meta’s durable revenue growth, competitive moat, and monetization as digital commerce and advertising shift online.

- Key risks include high spending on AI and metaverse initiatives, regulatory headwinds, and uncertainty surrounding the long-term sustainability of margins and revenue.

- 🐻 Meta Platforms Bear Case

Fair Value: $538.09

Currently Overvalued by: 18.5%

Forecast Revenue Growth: 10.5%

- Innovation in AI, new products, and continued dominance in social media are expected to drive revenue and earnings, with diversification across apps and Reality Labs.

- Heavy investment in AI and AR/VR is set to continue, but execution risks, significant AR/VR losses, and the challenge of monetizing new platforms remain concerns.

- Risks include ongoing regulatory scrutiny, Meta’s high dependence on advertising revenue, and whether the company can translate investment in the metaverse into sustainable profit growth.

Do you think there's more to the story for Meta Platforms? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026