- United States

- /

- Entertainment

- /

- NasdaqCM:LVO

LiveOne And 2 Other US Penny Stocks To Consider

Reviewed by Simply Wall St

As U.S. stocks continue to navigate a year-end slump, with the S&P 500 on track for its worst month since April, investors are reevaluating their strategies amid fluctuating market conditions. For those interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a relevant investment area that can offer surprising value. By focusing on those with robust financials and potential for growth, investors may uncover opportunities within this niche market segment.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8301 | $6.25M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.19 | $1.87B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $104.78M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.285 | $9.2M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.07 | $87.96M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.50 | $44.07M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.39 | $25.72M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.08 | $96.23M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.48 | $381.2M | ★★★★☆☆ |

Click here to see the full list of 736 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

LiveOne (NasdaqCM:LVO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LiveOne, Inc. is a digital media company focused on acquiring, distributing, and monetizing live music, Internet radio, podcasting/vodcasting, and music-related streaming and video content with a market cap of $113.84 million.

Operations: The company generates revenue from three main segments: Media ($7.63 million), Slacker ($72.73 million), and PodcastOne ($47.46 million).

Market Cap: $113.84M

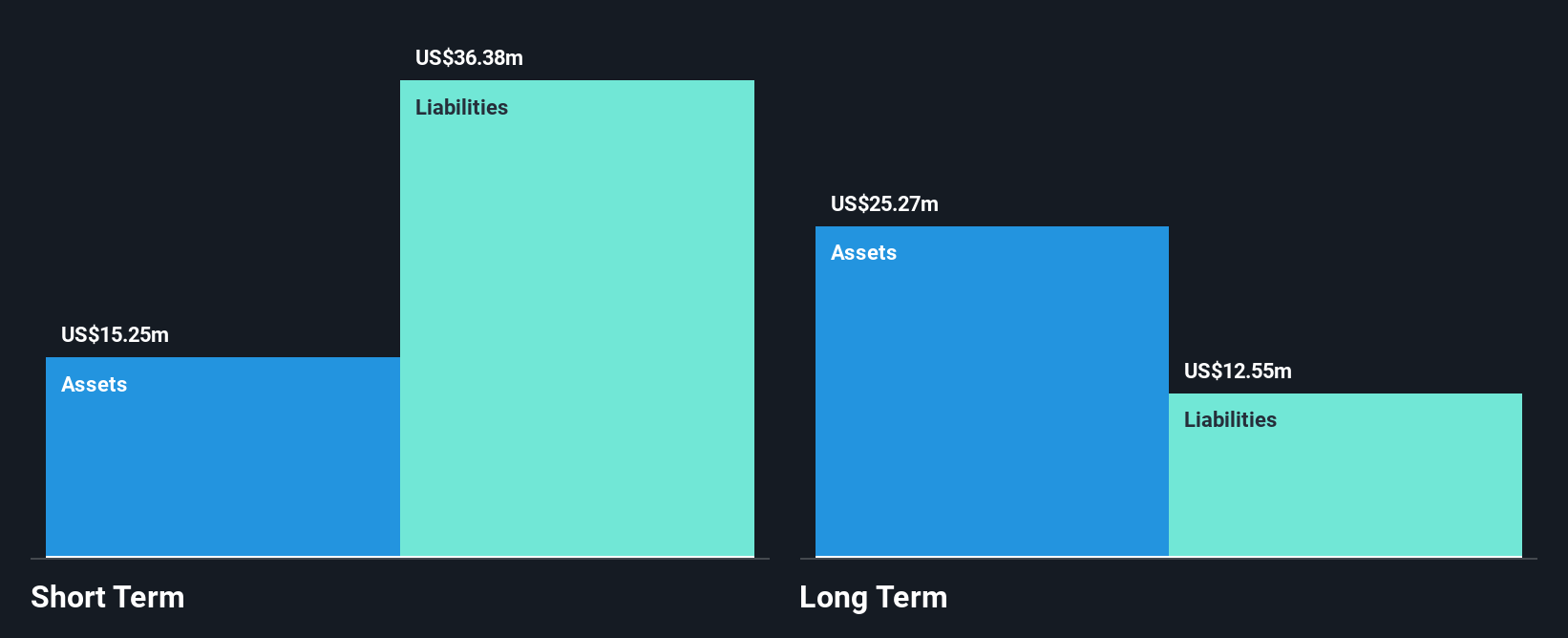

LiveOne, Inc. faces challenges typical of penny stocks, such as high volatility and recent Nasdaq compliance issues due to its share price falling below US$1.00. Despite being unprofitable, the company has reduced its losses over five years and maintains a positive cash flow with a sufficient runway for over three years. Revenue streams from Media, Slacker, and PodcastOne segments contribute to its US$113.84 million market cap but are overshadowed by short-term liabilities exceeding short-term assets by US$22.3 million. The management team is experienced; however, shareholders have faced dilution recently as the company explores strategic alternatives to enhance value.

- Unlock comprehensive insights into our analysis of LiveOne stock in this financial health report.

- Assess LiveOne's future earnings estimates with our detailed growth reports.

Valens Semiconductor (NYSE:VLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Valens Semiconductor Ltd. provides semiconductor products for the audio-video and automotive industries, with a market cap of approximately $264.66 million.

Operations: The company generates revenue from two main segments: Automotive, contributing $22.67 million, and Audio-Video, accounting for $40.47 million.

Market Cap: $264.66M

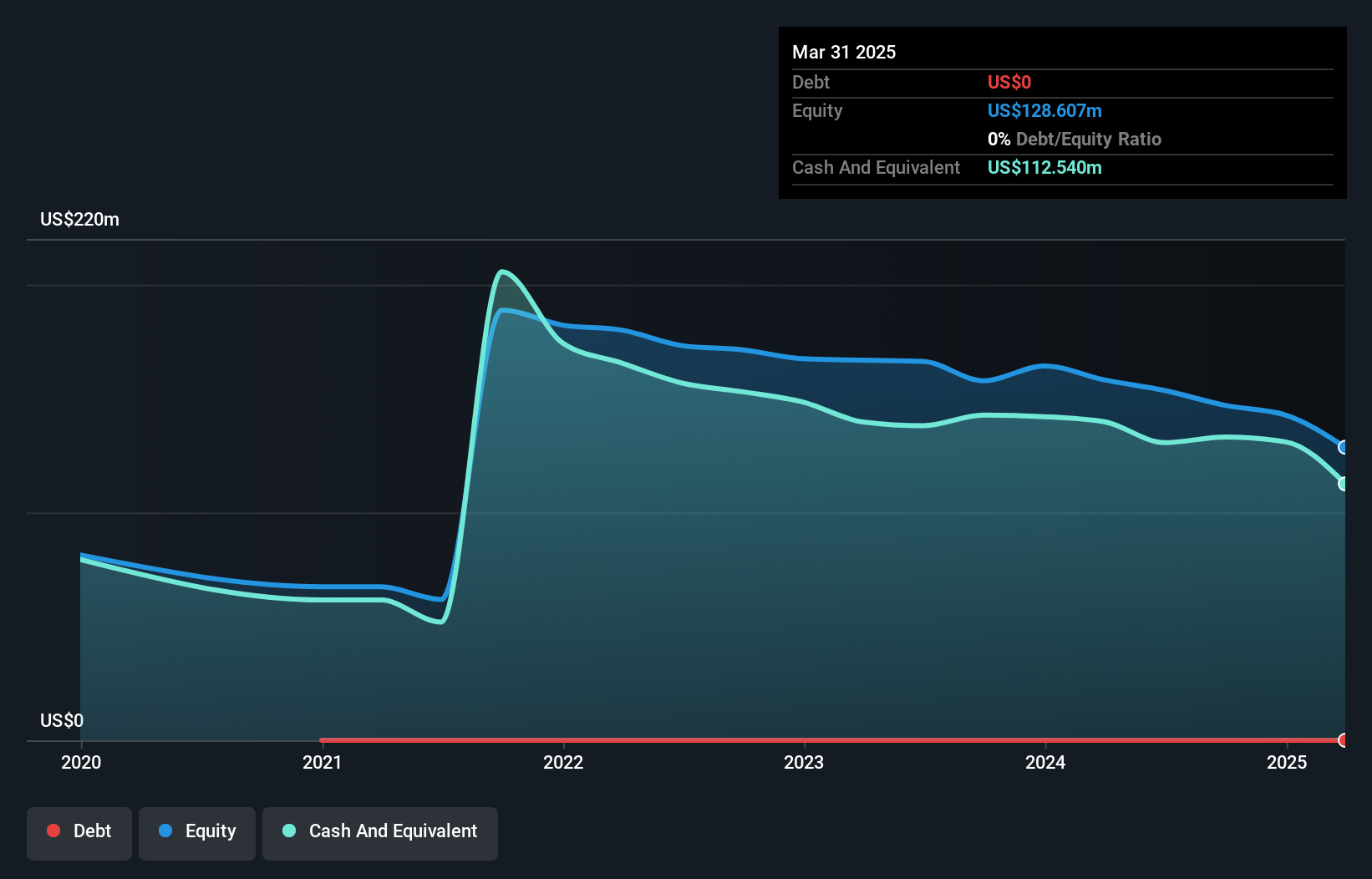

Valens Semiconductor, with a market cap of US$264.66 million, navigates the penny stock landscape with both opportunities and challenges. Despite being unprofitable, it has reduced losses by 12.3% annually over five years and forecasts revenue growth of 15.54% per year. The company boasts a robust cash runway exceeding three years and no debt burden, yet shareholders have experienced dilution recently. Valens is also undergoing strategic shifts in its business units to tap into high-growth markets like medical endoscopy and machine vision, supported by innovative chipsets such as the VA7000 for advanced endoscopes and VS6320 for USB3.2 extension capabilities.

- Jump into the full analysis health report here for a deeper understanding of Valens Semiconductor.

- Explore Valens Semiconductor's analyst forecasts in our growth report.

Verde Resources (OTCPK:VRDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Verde Resources, Inc., with a market cap of $258.99 million, primarily produces biochar from waste materials in the dairy, palm, and other natural resource industries in the United States and Malaysia through its subsidiaries.

Operations: Verde Resources generates its revenue primarily through the production of biochar from waste materials in the dairy, palm, and other natural resource sectors across the United States and Malaysia.

Market Cap: $259M

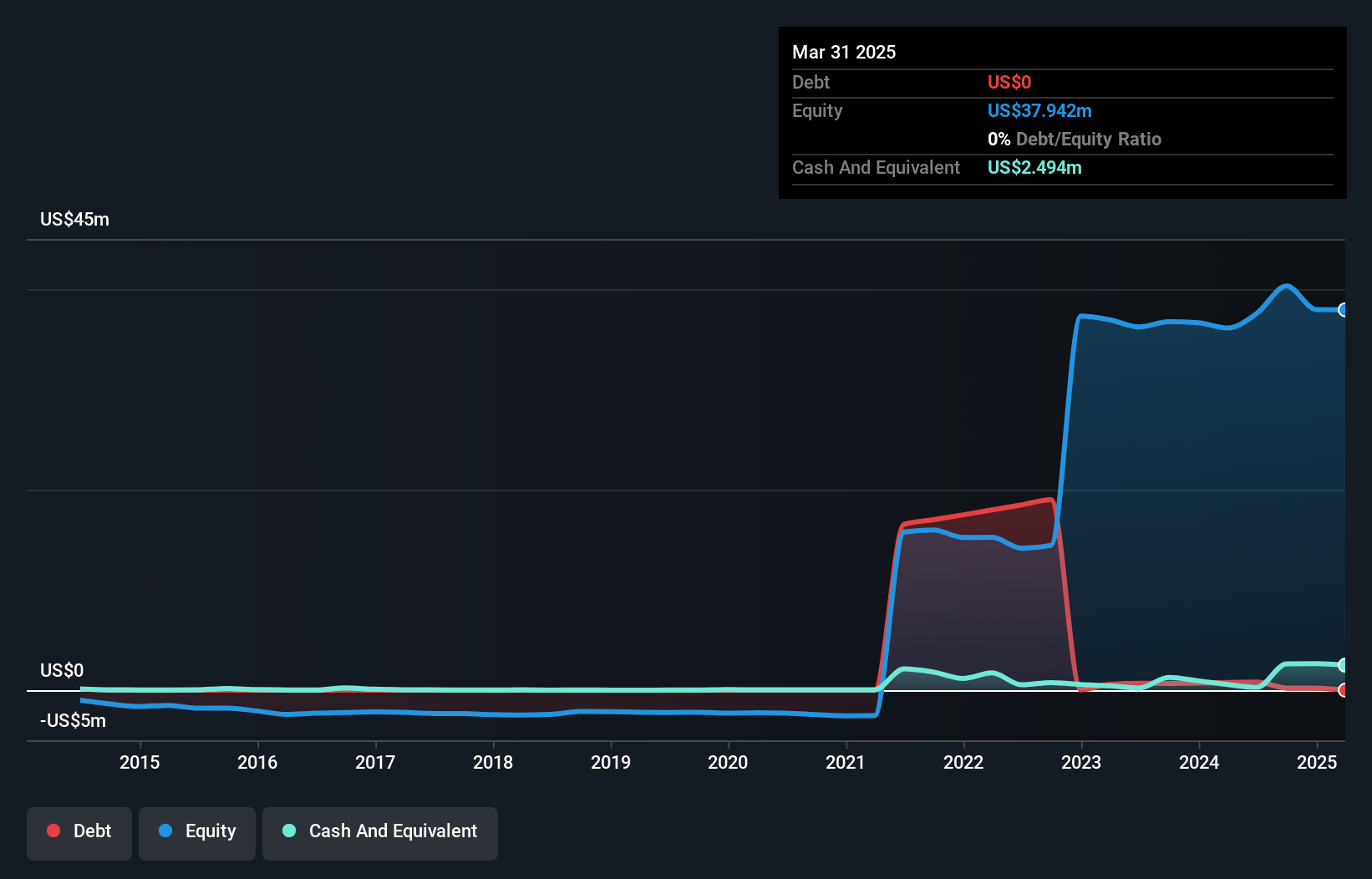

Verde Resources, Inc., with a market cap of US$258.99 million, operates within the penny stock domain, facing both potential and hurdles. The company is pre-revenue with earnings below US$1 million, though it reported a small sales increase recently. Despite having more cash than debt and short-term assets exceeding liabilities, Verde's financial stability is questioned by its auditor due to ongoing losses and limited cash runway under current free cash flow trends. Recent strategic initiatives include forming VerdePlus Inc., focusing on eco-friendly technologies in construction materials, but management changes might impact its future direction amidst high share price volatility.

- Dive into the specifics of Verde Resources here with our thorough balance sheet health report.

- Gain insights into Verde Resources' past trends and performance with our report on the company's historical track record.

Summing It All Up

- Reveal the 736 hidden gems among our US Penny Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LVO

LiveOne

A digital media company, engages in the acquisition, distribution, and monetization of live music, Internet radio, podcasting/vodcasting, and music-related streaming and video content.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives