- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

The Alphabet Inc. (NASDAQ:GOOGL) Full-Year Results Are Out And Analysts Have Published New Forecasts

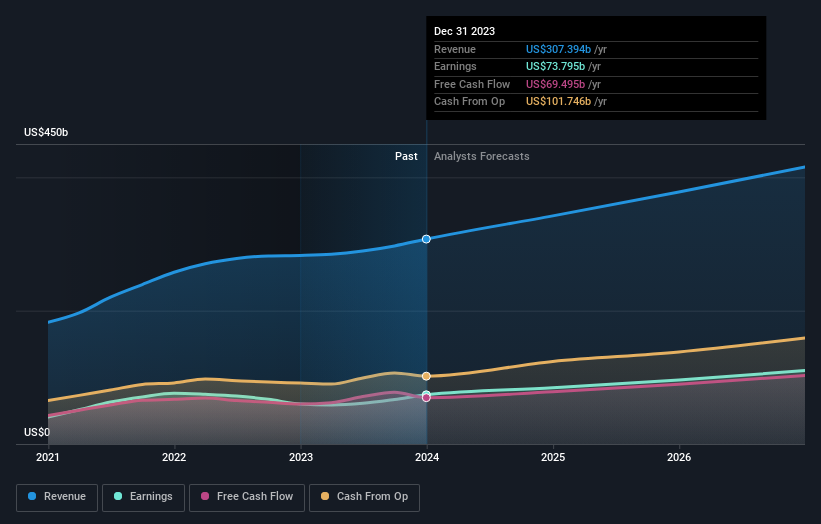

Shareholders might have noticed that Alphabet Inc. (NASDAQ:GOOGL) filed its full-year result this time last week. The early response was not positive, with shares down 7.2% to US$141 in the past week. It was a credible result overall, with revenues of US$307b and statutory earnings per share of US$5.80 both in line with analyst estimates, showing that Alphabet is executing in line with expectations. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

Check out our latest analysis for Alphabet

Taking into account the latest results, the consensus forecast from Alphabet's 47 analysts is for revenues of US$342.2b in 2024. This reflects a solid 11% improvement in revenue compared to the last 12 months. Statutory earnings per share are predicted to ascend 14% to US$6.76. Yet prior to the latest earnings, the analysts had been anticipated revenues of US$340.3b and earnings per share (EPS) of US$6.68 in 2024. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

There were no changes to revenue or earnings estimates or the price target of US$163, suggesting that the company has met expectations in its recent result. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Alphabet at US$180 per share, while the most bearish prices it at US$140. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's pretty clear that there is an expectation that Alphabet's revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 11% growth on an annualised basis. This is compared to a historical growth rate of 17% over the past five years. Compare this to the 149 other companies in this industry with analyst coverage, which are forecast to grow their revenue at 9.7% per year. Factoring in the forecast slowdown in growth, it looks like Alphabet is forecast to grow at about the same rate as the wider industry.

The Bottom Line

The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. They also reconfirmed their revenue estimates, with the company predicted to grow at about the same rate as the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Alphabet. Long-term earnings power is much more important than next year's profits. We have forecasts for Alphabet going out to 2026, and you can see them free on our platform here.

You can also see our analysis of Alphabet's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)