- United States

- /

- Airlines

- /

- NasdaqCM:BLDE

March 2025 Penny Stocks Worth Watching

Reviewed by Simply Wall St

As major U.S. stock indexes edge higher, investors are keenly awaiting the Federal Reserve's latest policy statement and economic forecasts, which could provide insights into future interest rate decisions. While traditional stocks capture much of the spotlight, penny stocks—typically representing smaller or newer companies—continue to offer intriguing opportunities for those willing to explore beyond the usual suspects. Despite being an older term, penny stocks remain a relevant investment area; this article highlights three such stocks with strong financial foundations that might present potential for growth in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.76 | $395.26M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $3.71 | $2.35B | ✅ 3 ⚠️ 3 View Analysis > |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.74 | $80.17M | ✅ 5 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ✅ 1 ⚠️ 5 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $3.36 | $450.14M | ✅ 5 ⚠️ 2 View Analysis > |

| Permianville Royalty Trust (NYSE:PVL) | $1.51 | $51.15M | ✅ 1 ⚠️ 4 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.49 | $75.83M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.8206 | $6.01M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $143.12M | ✅ 3 ⚠️ 1 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8675 | $76.46M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 763 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Blade Air Mobility (NasdaqCM:BLDE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blade Air Mobility, Inc. provides air transportation alternatives to congested ground routes in the United States and internationally, with a market cap of approximately $253.43 million.

Operations: The company's revenue is derived from two main segments: Medical, contributing $146.82 million, and Passenger, generating $101.88 million.

Market Cap: $253.43M

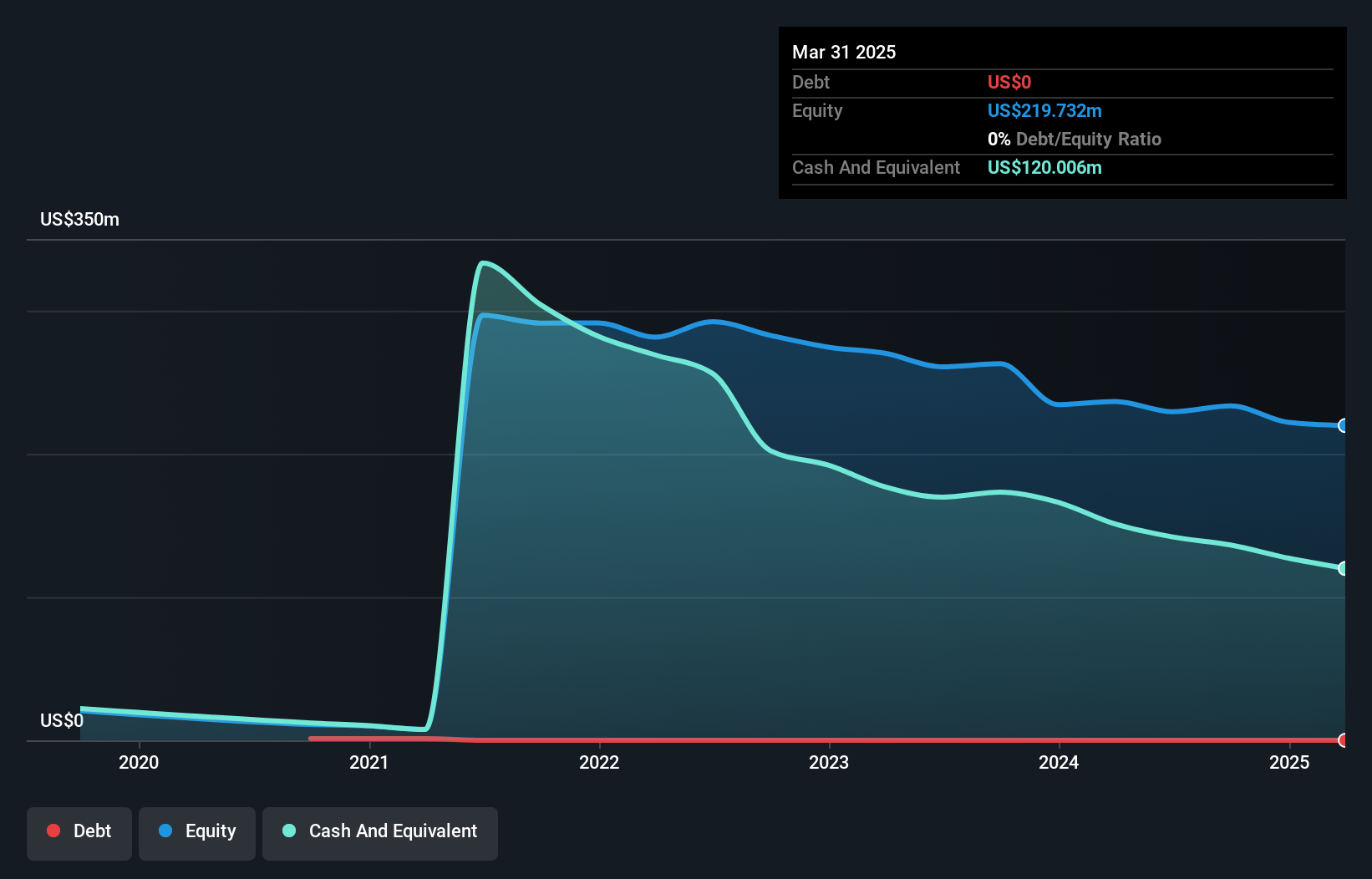

Blade Air Mobility, Inc. has shown a reduction in net loss from US$33.94 million to US$9.79 million year-over-year for Q4 2024, with annual sales reaching US$248.69 million. Despite being unprofitable, the company is debt-free and its short-term assets of US$160.7 million cover both short-term and long-term liabilities comfortably, indicating financial stability within its operations. The recent alliance with Skyports Infrastructure aims to enhance urban air mobility services in New York City through a pilot program that could support future Electric Vertical Aircraft operations, potentially expanding Blade's market presence and service offerings despite current profitability challenges.

- Click to explore a detailed breakdown of our findings in Blade Air Mobility's financial health report.

- Evaluate Blade Air Mobility's prospects by accessing our earnings growth report.

Cardlytics (NasdaqGM:CDLX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cardlytics, Inc. operates an advertising platform in the United States and the United Kingdom with a market cap of $123.96 million.

Operations: The company generates revenue through its Bridg Platform, which contributed $22.68 million, and its Cardlytics Platform, which brought in $255.62 million.

Market Cap: $123.96M

Cardlytics, Inc., with a market cap of US$123.96 million, faces challenges typical of penny stocks. The company reported a decrease in annual revenue to US$278.3 million and an increased net loss of US$189.3 million for 2024, highlighting ongoing profitability issues. Despite having sufficient cash runway for over three years if free cash flow reduces at historical rates, its high net debt to equity ratio of 211.4% is concerning. Management and board turnover suggests instability, while recent legal troubles and earnings volatility add risk factors that investors should consider when evaluating potential opportunities in this space.

- Click here to discover the nuances of Cardlytics with our detailed analytical financial health report.

- Gain insights into Cardlytics' future direction by reviewing our growth report.

Absci (NasdaqGS:ABSI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Absci Corporation is a U.S.-based company specializing in generative artificial intelligence for drug creation, with a market cap of approximately $368.69 million.

Operations: The company's revenue is derived from its biotechnology segment, totaling $4.21 million.

Market Cap: $368.69M

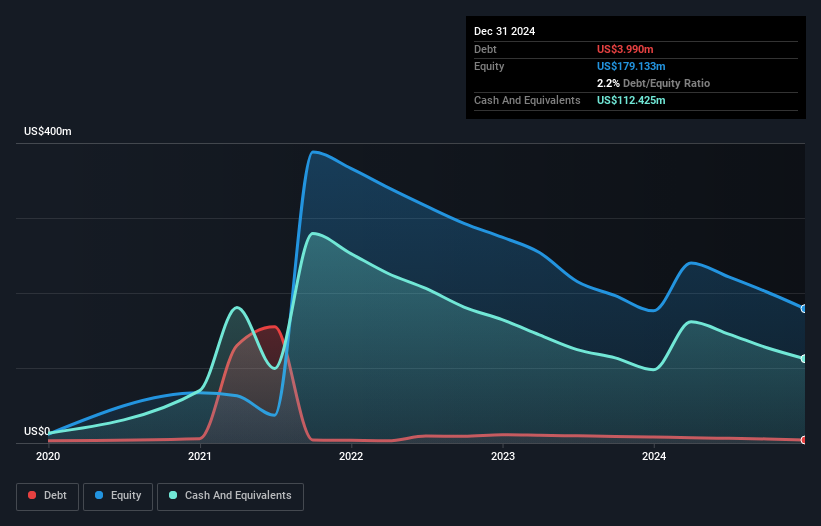

Absci Corporation, with a market cap of US$368.69 million, is navigating the challenges typical of penny stocks, such as limited revenue and ongoing unprofitability. The company reported a full-year revenue decrease to US$4.53 million and a net loss of US$103.11 million for 2024. Despite these hurdles, Absci maintains strong liquidity with short-term assets exceeding liabilities and has secured strategic partnerships with industry leaders like AMD and Owkin to bolster its AI-driven drug discovery efforts. Recent filings for shelf registration suggest potential capital raising activities to support future growth initiatives in its biotechnology segment.

- Dive into the specifics of Absci here with our thorough balance sheet health report.

- Examine Absci's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Explore the 763 names from our US Penny Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blade Air Mobility might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BLDE

Blade Air Mobility

Provides air transportation and logistics services for hospitals in the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives