- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:CARG

If You Like EPS Growth Then Check Out CarGurus (NASDAQ:CARG) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like CarGurus (NASDAQ:CARG). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for CarGurus

CarGurus's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. As a tree reaches steadily for the sky, CarGurus's EPS has grown 19% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that CarGurus is growing revenues, and EBIT margins improved by 5.1 percentage points to 19%, over the last year. That's great to see, on both counts.

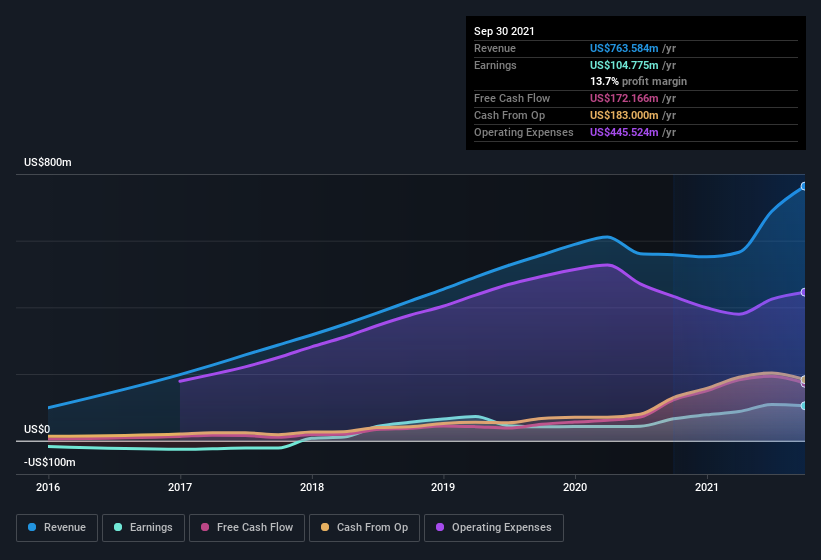

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for CarGurus.

Are CarGurus Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that CarGurus insiders have a significant amount of capital invested in the stock. Notably, they have an enormous stake in the company, worth US$617m. That equates to 15% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations between US$2.0b and US$6.4b, like CarGurus, the median CEO pay is around US$5.1m.

CarGurus offered total compensation worth US$3.4m to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does CarGurus Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about CarGurus's strong EPS growth. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. This may only be a fast rundown, but the takeaway for me is that CarGurus is worth keeping an eye on. You should always think about risks though. Case in point, we've spotted 2 warning signs for CarGurus you should be aware of.

Although CarGurus certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CARG

CarGurus

Operates an online automotive platform for buying and selling vehicles in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)