- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BZ

3 US Growth Companies With High Insider Ownership Seeing 19% Revenue Growth

Reviewed by Simply Wall St

As the U.S. stock market rebounds from recent volatility, investors are shifting their focus to earnings reports and the Federal Reserve's policy meeting, with particular attention on how these factors might influence future growth trajectories. Amidst this backdrop, growth companies with high insider ownership and robust revenue growth stand out as potential opportunities for those seeking resilient investment options in a fluctuating market environment.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 48% |

| Smith Micro Software (NasdaqCM:SMSI) | 23% | 85.4% |

| CarGurus (NasdaqGS:CARG) | 16.7% | 42.4% |

| Similarweb (NYSE:SMWB) | 25.4% | 126.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Kanzhun (NasdaqGS:BZ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kanzhun Limited, with a market cap of $6.48 billion, operates in the People's Republic of China offering online recruitment services through its subsidiaries.

Operations: The company generates its revenue from the Internet Information Providers segment, amounting to CN¥7.11 billion.

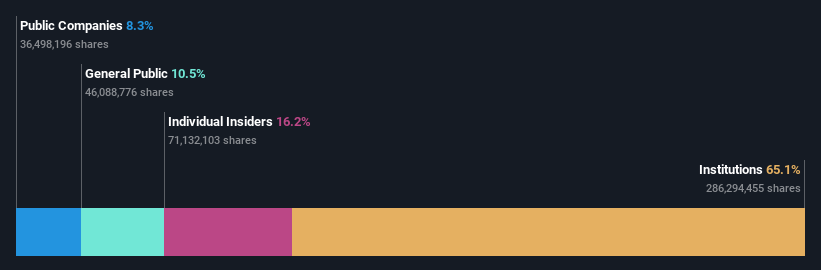

Insider Ownership: 16.4%

Revenue Growth Forecast: 11.5% p.a.

Kanzhun is trading at 44.8% below its estimated fair value and forecasts suggest significant earnings growth of 25% annually, outpacing the US market. However, revenue growth of 11.5% per year trails behind the company's earnings trajectory. Recent financial results show robust performance with a notable increase in net income and revenue for Q3 2024 compared to last year. Despite no recent insider transactions, substantial share buybacks were completed, enhancing shareholder value by $200 million (US$).

- Click here to discover the nuances of Kanzhun with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Kanzhun is priced lower than what may be justified by its financials.

Duolingo (NasdaqGS:DUOL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Duolingo, Inc. operates as a mobile learning platform in the United States, the United Kingdom, and internationally with a market cap of approximately $14.38 billion.

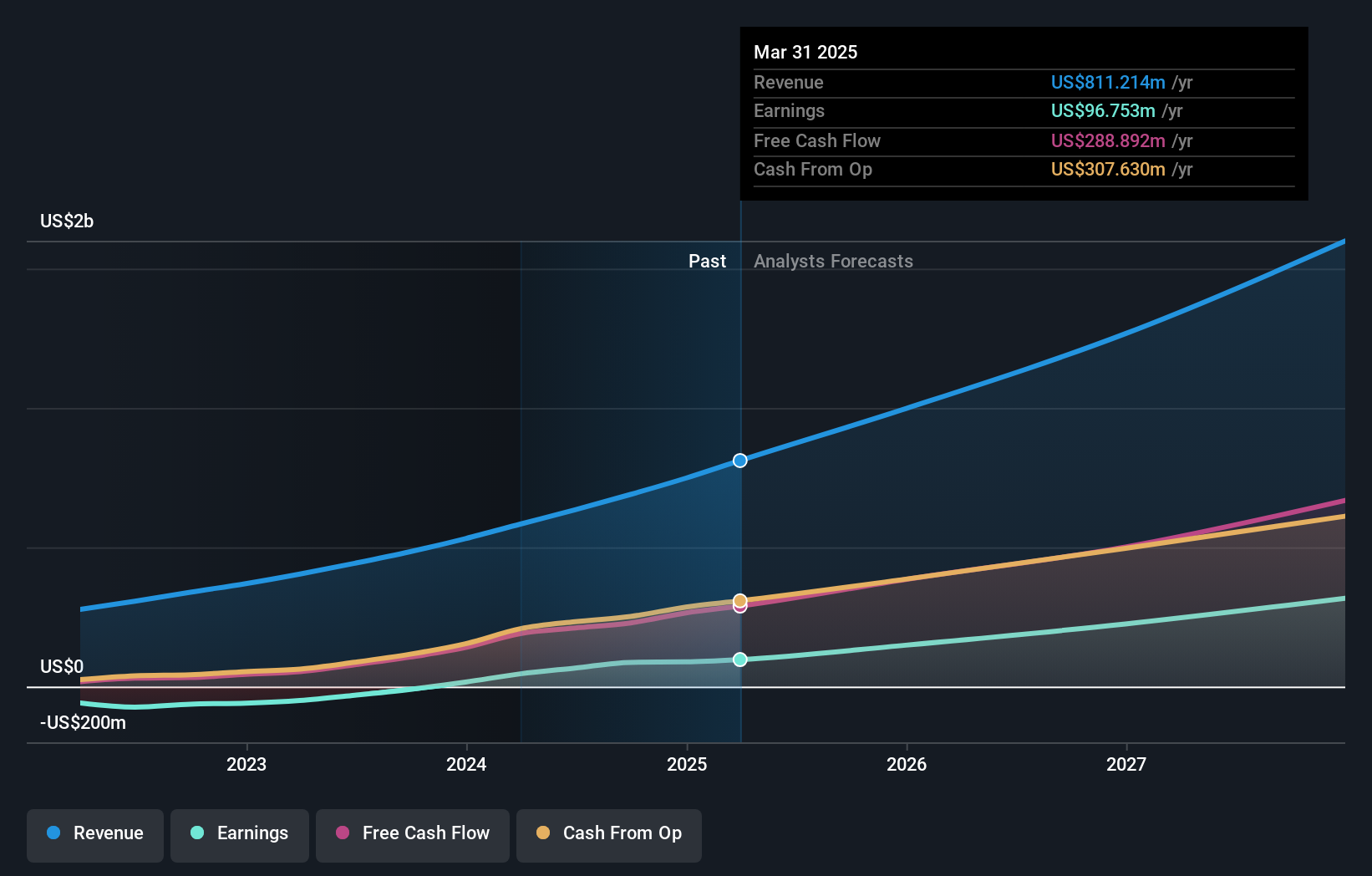

Operations: The company generates revenue primarily from its educational software segment, which amounted to $689.46 million.

Insider Ownership: 14.8%

Revenue Growth Forecast: 19.3% p.a.

Duolingo is trading at 34.9% below its estimated fair value, with earnings projected to grow significantly at 34.9% per year, surpassing the US market average. Despite slower revenue growth of 19.3%, it remains above the market rate of 8.9%. Recent developments include expanding their AI-driven Video Call feature to Android and adding new languages, enhancing user engagement and learning experiences. However, there has been significant insider selling recently despite no substantial buying activity in the past three months.

- Click here and access our complete growth analysis report to understand the dynamics of Duolingo.

- According our valuation report, there's an indication that Duolingo's share price might be on the expensive side.

Tuya (NYSE:TUYA)

Simply Wall St Growth Rating: ★★★★☆☆

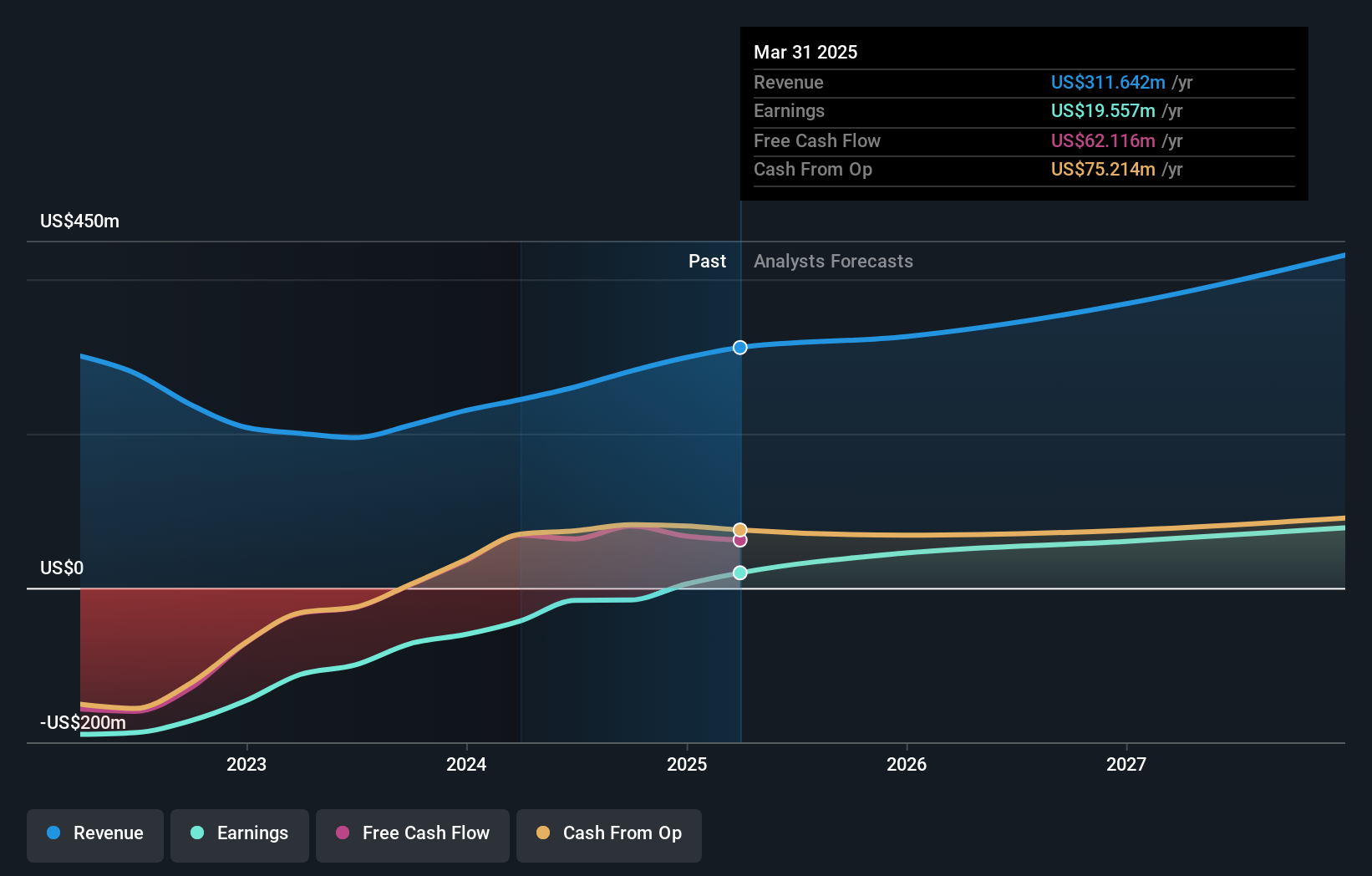

Overview: Tuya Inc. provides a specialized Internet of Things (IoT) cloud development platform both in China and internationally, with a market cap of approximately $1.37 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $280.97 million.

Insider Ownership: 30.5%

Revenue Growth Forecast: 15.8% p.a.

Tuya is trading significantly below its estimated fair value, with earnings forecasted to grow at a remarkable 125.2% annually as it aims for profitability within three years. Its revenue growth of 15.8% per year is expected to outpace the US market average. Recent product innovations, like the smart door lock supporting Apple's ecosystem and collaborations in smart lighting and temperature control, underscore Tuya's commitment to advancing smart home technology integration globally.

- Delve into the full analysis future growth report here for a deeper understanding of Tuya.

- Our expertly prepared valuation report Tuya implies its share price may be lower than expected.

Key Takeaways

- Dive into all 203 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kanzhun might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BZ

Kanzhun

Provides online recruitment services in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives