- United States

- /

- Personal Products

- /

- NYSE:EL

Top US Growth Companies With High Insider Ownership In October 2024

Reviewed by Simply Wall St

As the Nasdaq Composite reaches new record highs, driven by anticipation of major tech earnings and a surge in Bitcoin nearing its all-time high, investors are keenly observing growth trends across various sectors. In this buoyant market environment, companies with high insider ownership often attract attention due to the confidence insiders demonstrate in their own businesses, suggesting potential alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.6% | 26% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.4% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 33.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.7% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 37.5% |

| Duolingo (NasdaqGS:DUOL) | 14.7% | 41.8% |

| Coastal Financial (NasdaqGS:CCB) | 18.3% | 45.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Here we highlight a subset of our preferred stocks from the screener.

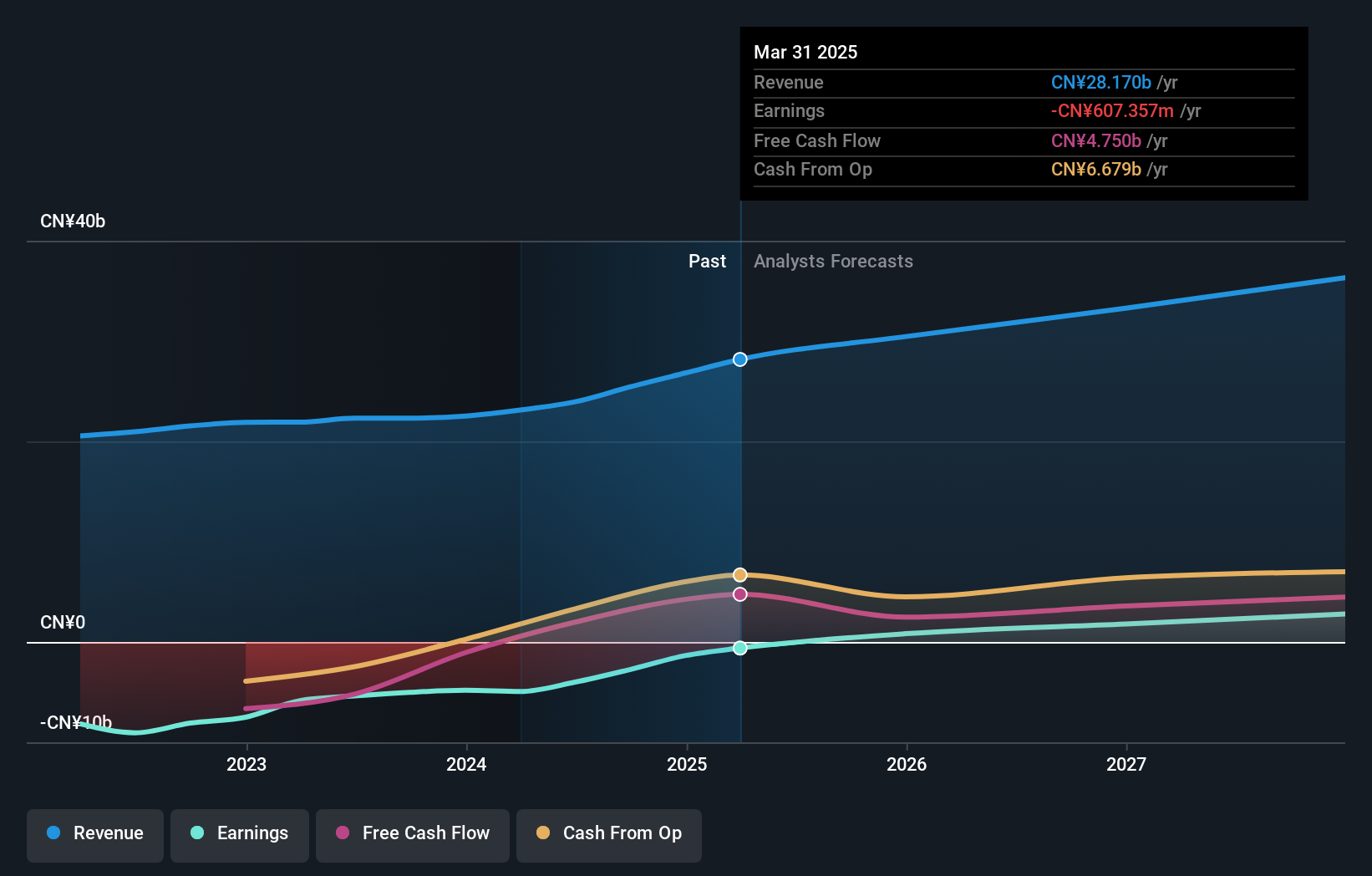

Bilibili (NasdaqGS:BILI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. offers online entertainment services targeting young generations in the People’s Republic of China, with a market cap of approximately $9.23 billion.

Operations: The company generates revenue of CN¥23.95 billion from its Internet Information Providers segment, catering to young audiences in China.

Insider Ownership: 20.7%

Bilibili, a growth-oriented company with significant insider ownership, has shown improved financial performance with a reduced net loss of CNY 608.7 million in Q2 2024 compared to the previous year. Its revenue grew to CNY 6.13 billion, indicating positive momentum despite high share price volatility. The company is trading below its estimated fair value and is expected to become profitable within three years, outpacing average market profit growth expectations. Recent filings include a US$2.75 billion shelf registration for ESOP-related offerings.

- Navigate through the intricacies of Bilibili with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Bilibili's share price might be too optimistic.

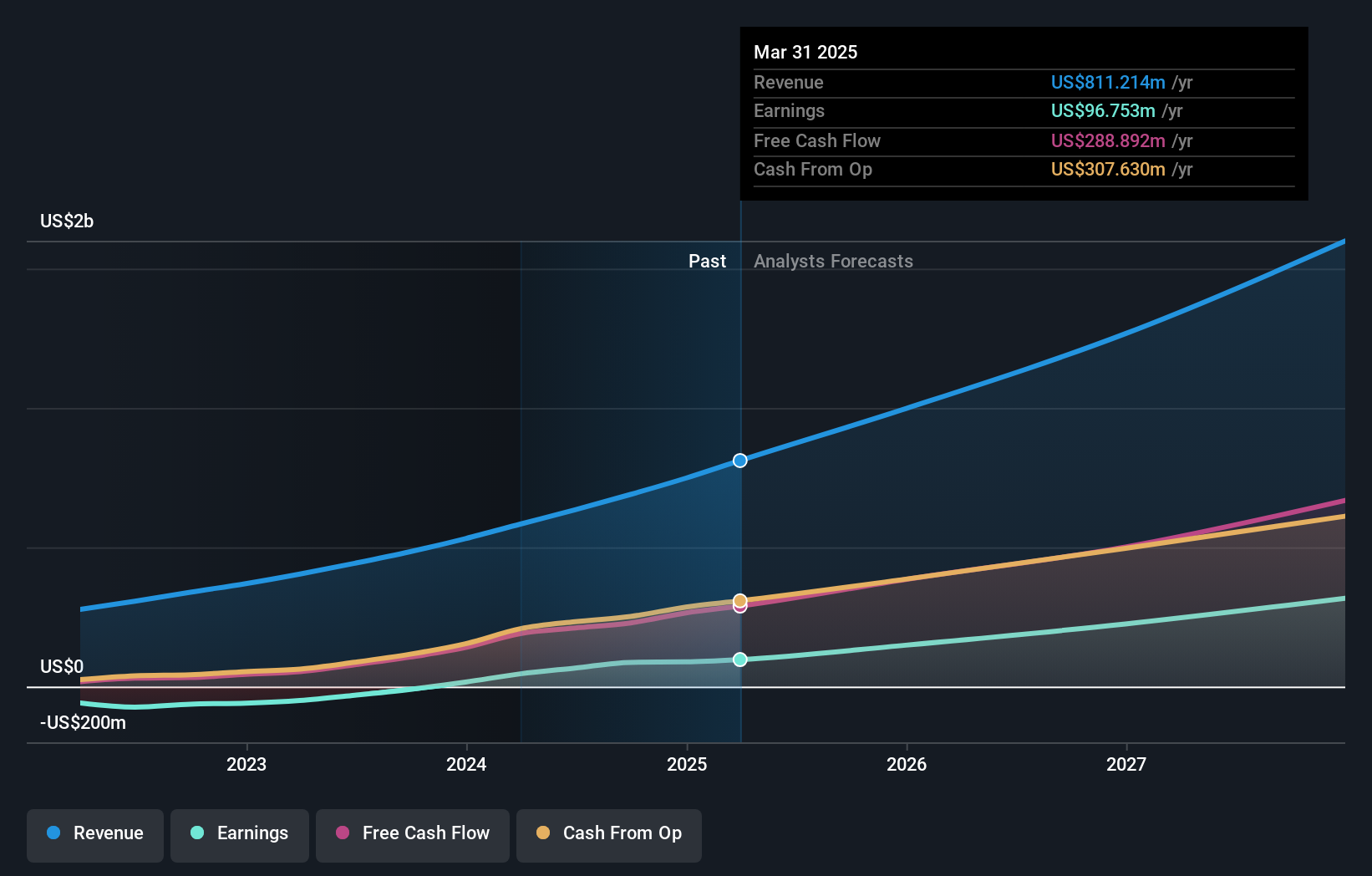

Duolingo (NasdaqGS:DUOL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Duolingo, Inc. operates as a mobile learning platform in the United States, the United Kingdom, and internationally with a market cap of approximately $12.64 billion.

Operations: The company's revenue primarily comes from its educational software segment, which generated $634.49 million.

Insider Ownership: 14.7%

Duolingo, with substantial insider ownership, has demonstrated strong financial growth. In Q2 2024, it reported US$178.33 million in sales and a net income of US$24.35 million, becoming profitable this year. The company's revenue is forecast to grow at 22.3% annually, outpacing the market average of 8.9%. Despite trading below its estimated fair value and recent insider selling, Duolingo's earnings are expected to grow significantly over the next three years.

- Unlock comprehensive insights into our analysis of Duolingo stock in this growth report.

- Our valuation report here indicates Duolingo may be overvalued.

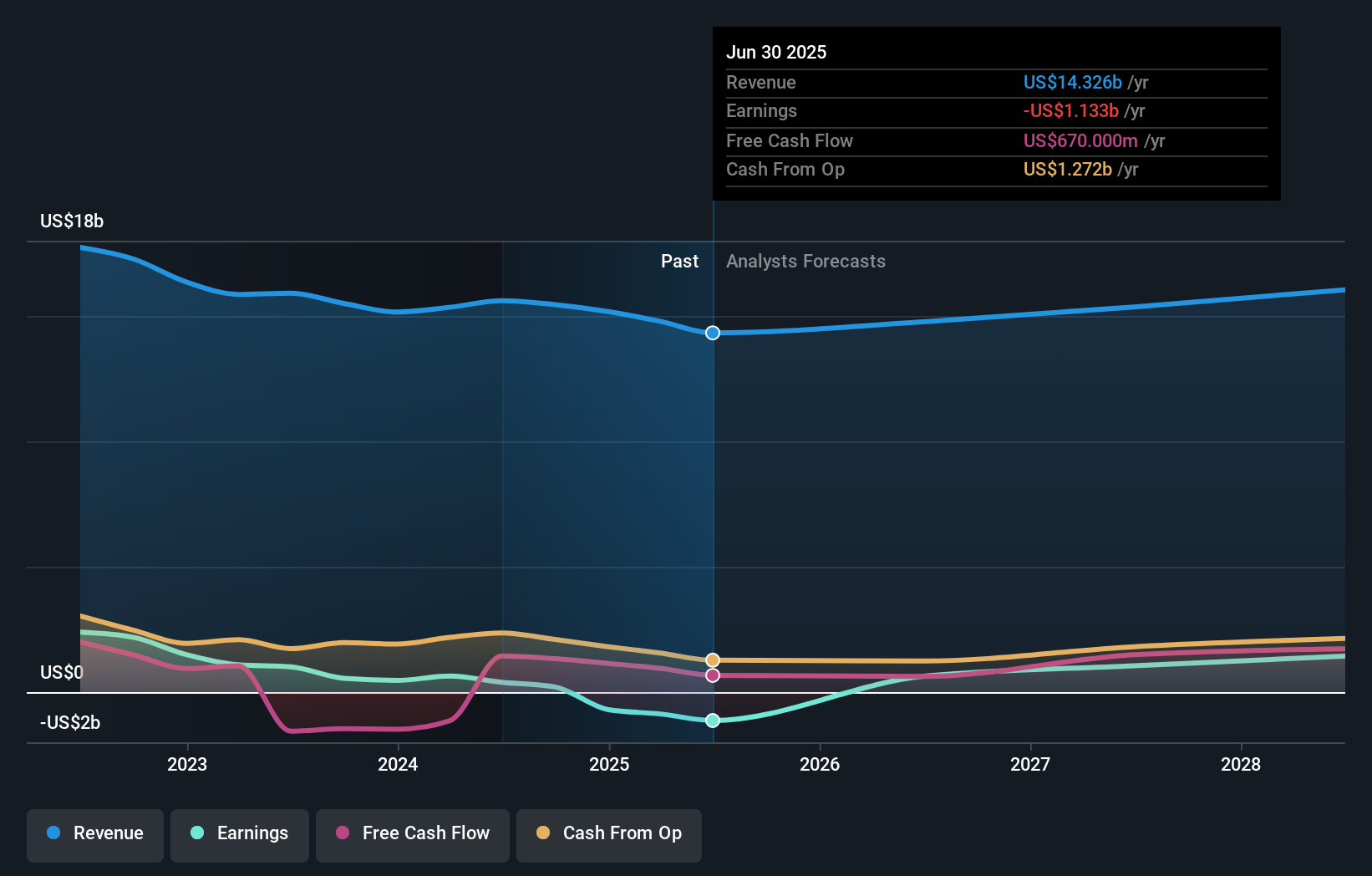

Estée Lauder Companies (NYSE:EL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Estée Lauder Companies Inc. is a global manufacturer and marketer of skincare, makeup, fragrance, and hair care products with a market cap of approximately $31.83 billion.

Operations: The company's revenue is primarily derived from its skin care segment at $7.91 billion, followed by makeup at $4.47 billion, fragrance at $2.49 billion, and hair care products contributing $629 million.

Insider Ownership: 12.8%

Estée Lauder Companies, with significant insider ownership, is poised for substantial earnings growth at 27.7% annually, surpassing the US market average. Despite trading below its fair value and facing challenges like lower profit margins and high debt levels, the company is expanding its digital presence through a strategic partnership with Amazon's Premium Beauty store. Recent executive changes aim to enhance North American operations and digital transformation efforts amid a challenging financial year with declining net income.

- Get an in-depth perspective on Estée Lauder Companies' performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Estée Lauder Companies' shares may be trading at a premium.

Where To Now?

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 189 more companies for you to explore.Click here to unveil our expertly curated list of 192 Fast Growing US Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Estée Lauder Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EL

Estée Lauder Companies

Manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide.

Reasonable growth potential slight.