Quote of the Week: “Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world." - Franklin D. Roosevelt

While those with leverage are happy about the latest interest rate cuts, those looking for yield are less so. Lower interest rates mean lower yields on bonds and money market funds, which for some, is their retirement income.

So, assuming interest rates continue to fall, dividend-paying stocks like REITs will become more attractive.

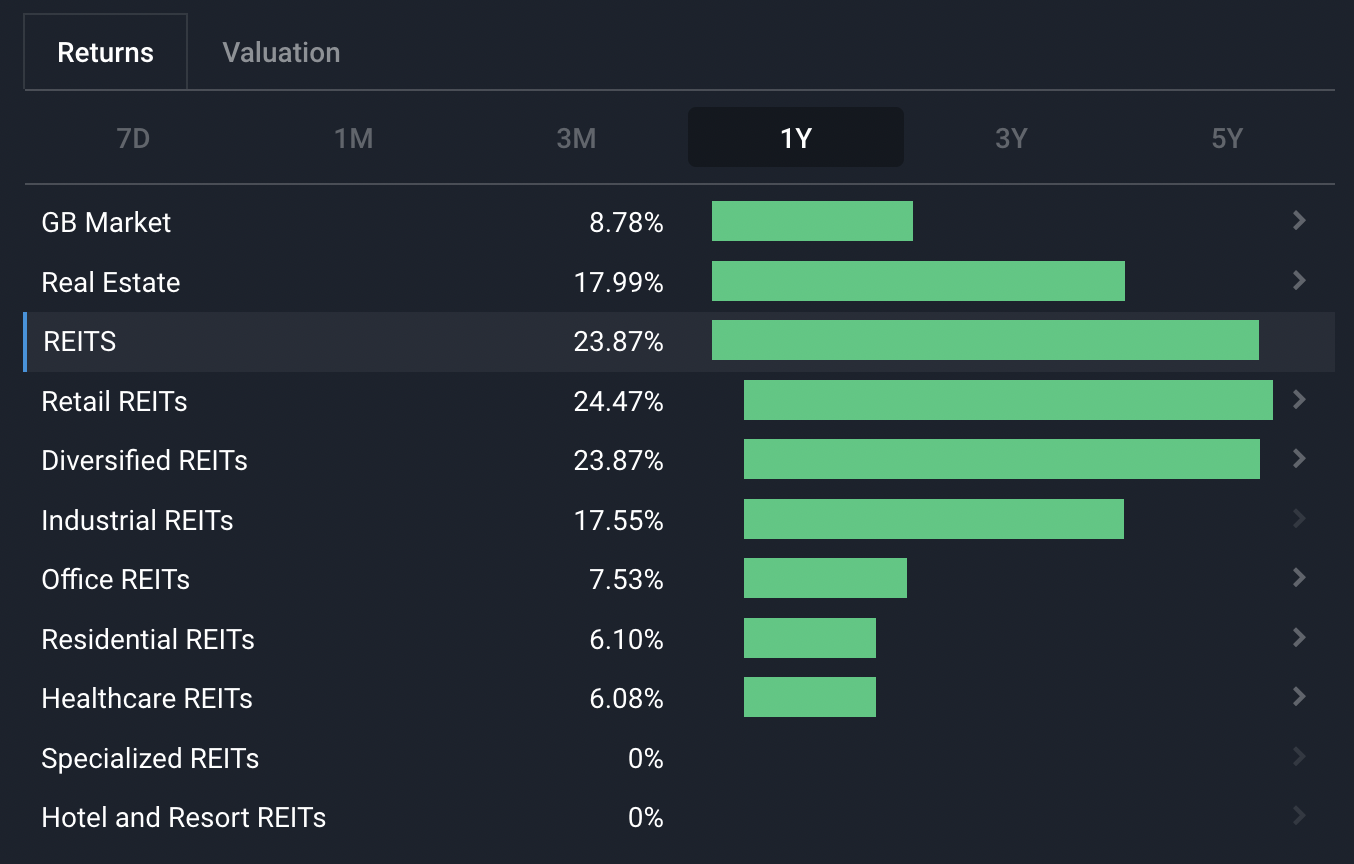

In quite a few markets, REITs have been amongst the top-performing sectors since June.

Real Estate Investment Trusts, aka REITs, are unique investment vehicles that share characteristics of listed equities, bonds and direct real estate investments. If you want to create an income-generating portfolio, REITs are one of the tools available to you, but there is more to investing in the asset class than looking for the ones with the highest yield.

So since interest rates seem to be trending lower, we wanted to do a primer on REITs, what they are, how they work and the different flavors they come in.

Then next week we’ll have a look at evaluating and valuing said REITs.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or our YouTube!

What Happened In Markets This Week?

Here’s a quick summary of what’s been going on:

-

🏦 Wall Street Banks Cashed in on Q3 Volatility and Record Highs ( Reuters )

- What’s our take?

- While great news for bank shareholders, t rading profits can be a double-edged sword.

- The investment banking divisions at Goldman Sachs, Morgan Stanley and other Wall Street banks reported their best quarters in years. In particular, it was trading revenue that stood out. Trading desks perform best during short periods of volatility - just like markets experienced in August. They also do well when stock prices are rising, and they had that in Q3 as well.

- The thing to remember about a bank’s trading P&L is that it isn’t predictable or recurring, and can dip into the red.

- Banks have become better at risk management than they were before 2009. That’s partly because the ones with poor risk management (e.g. Lehman Brothers, Bear Stearns and Credit Suisse) are no longer in business. These days, large losses are usually due to errors or a trader going ‘rogue’ - but they do still happen. Any sign of poor risk management at a bank should be a red flag for investors.

- Investment banking divisions are also reporting higher fee income, which they earn advising on deals or underwriting debt sales. This is a sign that corporations are more confident about the economy and ready to commit to plans that were previously on hold.

- What’s our take?

-

🧑💻 ASML Guidance Sparks Panic for Chip Stock Investors ( CNBC )

- What’s our take?

- ASML may not be the best barometer for the entire chip industry.

- Last week, ASML cut its guidance for 2025, citing a number of reasons. The company’s share price fell more than 20%, and the entire sector followed it lower.

- ASML sells equipment used to manufacture chips, and is therefore viewed as a leading indicator for the chip sector. The rationale for this is that its order book reflects what the chipmaker themselves expect demand to look like in the future. However, in this instance, several unique factors have led to ASML’s lowered guidance.

- The guidance cited ‘ very specific competitive issues in the foundry business ’, a slower recovery from the non AI-related parts of the market, and declining orders from China. China’s foundries have invested heavily in capacity over the last two years, so this is really the result of that cycle ending. Sales of advanced equipment to China have been restricted, but that’s old news.

- The recovery in PC demand has been slower than expected, and demand for gaming, embedded and auto chips has yet to start recovering. Uncertainty at Intel’s foundry business seems to have led to orders being put on hold, too.

- ASML’s guidance points to a slower recovery for some parts of the market heading into 2025, but doesn’t imply there won’t be a recovery later. Ultimately, the company has cut its 2025 revenue forecast from ‘as high as €40bn ’, to between €30 and €35bn. That’s still not bad compared to the €26bn it earned in the year to June.

- What’s our take?

-

🤖 Tesla's Much-hyped Robotaxi Event Fails To Impress ( Axios )

- What’s our take?

- Expectations were sky-high, and the lack of details or near-term revenue impact from these reveals left investors disappointed.

- Musk indicated that we’d have to wait until 2026 for the CyberCab, sometime before 2027 for the Cyberbus, and there is no date on when the Optimus robot would be available for consumers. However, Optimus is expected to begin limited production for Tesla facilities next year, and then be available to other companies the year after that.

- Investors wanted more details on the software network side of things and expected production to begin sooner. As a result, Tesla stock sold off 9% on Friday, but it has been mostly flat since then. Considering the stock is still up around 30% from when Musk teased the October event back in April, we’d say the company is moving in the right direction, and investors are a fickle bunch.

- What’s our take?

-

🚀 SpaceX’s Starship Test Completes With A Remarkable ‘Chopstick’ Booster Catch ( The Verge )

- What’s our take?

- Like catching a fly with chopsticks, catching a 20-story tall booster from where it launched a 40-story tall rocket just minutes before is insanely impressive.

- The amount of engineering effort and complexity required to pull off this kind of feat is incredible. This was the first step to making the Super Heavy Booster a reusable launch system for the Starship , like SpaceX’s Falcon 9 rockets. The Falcon 9s have so far flown and landed 335 times.

- While there is no SpaceX IPO expected in the foreseeable future, there are aerospace ETFs and other companies in the sector.

- What’s our take?

-

🛢️ As Crude Oil Tests $70, Citi Strategist Puts A $120 Bull Case On The Table ( WSJ )

- What’s our take?

- The odds of this scenario may be low, but the impact on the global economy could be severe.

- Analysts at Citi Research reiterated their base case of $74 in Q4 and $65 in Q1 2024, based on weak fundamentals. Their bear case also remains at $60, falling to $55 in Q1 if OPEC+ increases production.

- However, they have raised their bull case target to $120 in Q1. The catalyst for this case would be major disruptions to supply due to the conflict between Israel and Iran. Israel could target Iran’s oil infrastructure, and Iran could respond by attacking regional energy assets.

- Citi’s bull case may not be a high probability scenario, but it’s not a zero probability scenario either. They pointed out that the disruption to supply when Russia invaded Ukraine peaked at 1 million barrels a day, and the oil price spiked to $129. The balance between supply and demand in the oil market is tight, and small changes can have a big impact on the price. Sentiment is magnified in the futures market, which in turn affects investor and consumer sentiment.

- $120 oil could trigger a rebound in inflation, an economic slowdown, or both. Oil stocks can act as a hedge against these types of events, and particularly if they have good long-term fundamentals.

- What’s our take?

-

🏘️ US Mortgage Demand Falls As Mortgage Rates Spike ( CNBC )

- What’s our take?

- Despite the Fed funds rate seeing a slight haircut, things have been heating up in the mortgage market.

- Mortgage interest rates rose for the third consecutive week, hitting 6.52% for 30-year fixed-rate mortgages - the highest since August - which led to a noticeable slowdown in the housing market.

- Total mortgage application volume dropped by 17% last week, with refinance demand taking a significant hit, falling 26%. Despite this drop, refinance applications are still 111% higher than the same week last year due to previously higher rates.

- First-time homebuyers seem to be holding steady, as FHA purchase applications remained largely unchanged despite rising rates. Improved housing inventory conditions are likely helping, and although first homebuyers are sensitive to pricing, there are often greater motivations for taking the step towards homeownership which persist regardless of price.

- We'd say that rising interest rates are starting to cool off the mortgage market, but it's not just about the rates. Overall, economic uncertainties and the upcoming election appear to be what’s on consumers' minds and making them cautious about major purchases like homes. It seems many are taking a "wait and see" approach before jumping into the housing market.

- What’s our take?

-

💉 India’s Copycat Drugmakers Gear Up To Offer Cheaper Weight-loss Drugs ( FT )

- What’s our take?

- The expiry of Novo Nordisk’s UK patent for Saxenda tastes like an opportunity for some pharmaceutical companies.

- India's generic drugmakers are gearing up to offer cheaper weight-loss drugs, with Biocon leading the charge by launching a generic version of Saxenda in the UK by November, following the expiration of its patent protection.

- Saxenda is an older drug of the same GLP-1 class as the popular Ozempic.

- The introduction of generic Saxenda could serve as a test for future generic versions of semaglutide, the active ingredient in Novo Nordisk's popular Ozempic and Wegovy, whose patents will begin expiring in various regions from 2026.

- India's generic pharmaceutical industry is ready and raring to capitalize on the huge market for GLP-1 drugs, with companies like Cipla, Dr. Reddy’s, and Sun Pharmaceutical eager to tap into a market expected to exceed $140 billion by 2030.

- It seems that the arrival of Indian generics could significantly disrupt the weight-loss drug market, making these treatments more accessible worldwide due to lower prices. No doubt a welcome change for consumers who are still feverishly demanding GLP-1 class drugs. The demand in India also can’t be understated, as the WHO estimates that 77m people in India suffer from type-2 diabetes and recent government surveys show almost one in four are overweight or obese.

- What’s our take?

The Rundown On REITs

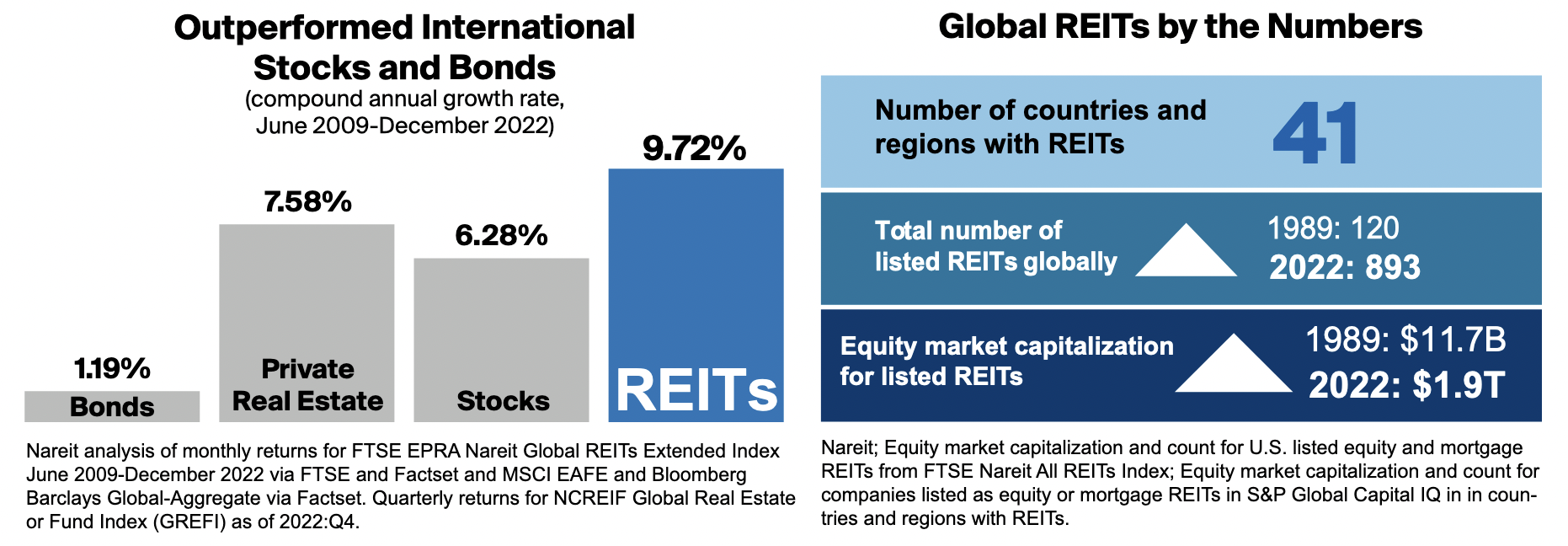

Real Estate Investment Trusts are a distinct legal structure that now exists in at least 41 countries. They were first introduced in the US in 1960 to give individual investors a way to invest in a diversified portfolio of income-producing real estate.

REITs benefit from significant tax advantages which help them raise capital and fund real estate development - so they also contribute to infrastructure development and economic growth.

REITs are unique in that they adhere to the following rules:

- Have at least 75% of assets invested in real estate.

- Derive at least 75% of income from rent or mortgage payments.

- Derive at least 95% of income from dividends, and property income.

- Distribute at least 90% of net income as dividends.

- Be jointly owned by 100 persons or more, with no more than 50% of shares owned by 5 or fewer entities.

- Structured as a corporation, trust, or association.

Entities that qualify as REITs typically pay no tax. Instead, the dividends they distribute to shareholders are taxed as ordinary income. You can check the legislation specific to each country here.

Types of REITs

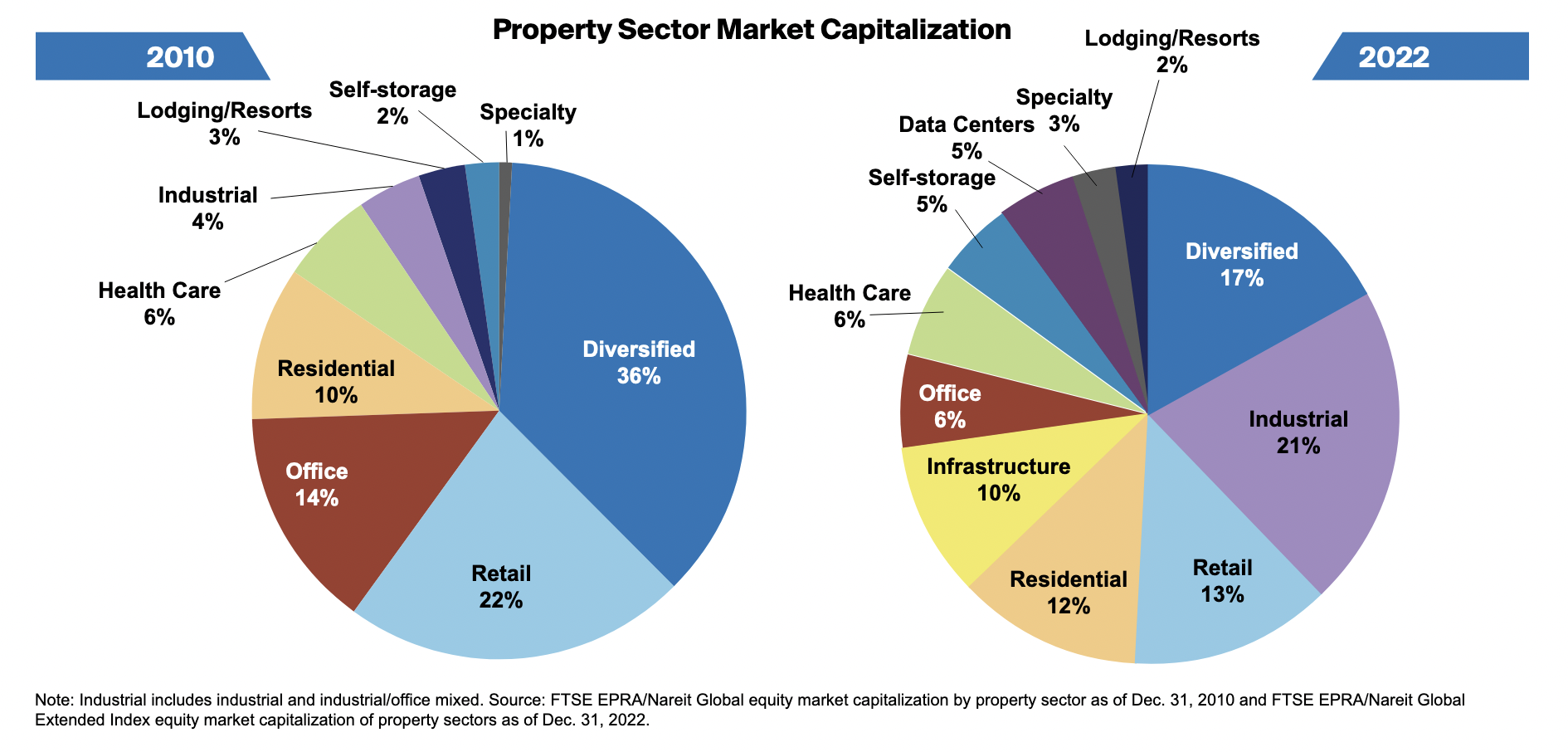

Most REITs specialize in specific types of real estate. Those that are listed are categorized as follows:

🏭 Industrial

The largest part of the REIT universe in many markets invests in industrial facilities - mostly warehouses and distribution centers. Industrial REITs benefit from long-term leases, and the growth of e-commerce acts as a tailwind.

Space is often limited around major transport hubs like ports and airports which means rent can appreciate over time. Prologis , the most valuable REIT in the world by market cap, specializes in modern distribution centers.

🏠 Residential

Residential REITs develop and acquire apartment buildings, single-family homes, and student housing. These REITs are very sensitive to changes in population and economic growth in the areas where they operate.

🛒 Retail

Retail REITs develop and operate shopping malls and other retail locations. This part of the market has been on the wrong side of the shift to e-commerce but still accounts for a big chunk of the sector.

🏢 Office

Commercial real estate, AKA office buildings, are often owned by Office REITs. This sector was always sensitive to economic activity in specific urban centers, but it’s been on the wrong side of the work-from-home trend since 2020.

Those who own prime, high-quality commercial real estate own a desirable asset, and the “ Flight to quality” trend is benefiting them.. For others, the silver lining could come from converting excess office space into residential units.

🏥 Healthcare REITs

Healthcare REITs own a wide range of properties in the healthcare industry. These include hospitals, clinics, consulting rooms, and senior living facilities.

This sector has benefited from increasing healthcare spending and reliable tenants. Changing trends in healthcare could affect some healthcare operators in the future.

🏨 Hotel and Resort REITs

Hotel and resort REITs own a wide variety of properties that acco m modate both tourists and business travelers. The performance of these REITs is very specific to the assets they own.

🧑💻 Specialized REITs

A growing list of REITs focus on specific industry verticals and the types of properties they own. Here are some examples:

- 🏢 Data Center REITs

- Companies like Equinix and Digital Realty Trust are having their moment as AI and cloud growth drive demand for data centers. These facilities are highly specialized and can command lucrative rent. Note: Quite a few data center REITs started out as other types of companies and later changed their structure - so they might not be listed as REITs.

- 📶 Telecommunication REITs

- These own the facilities that are used for communications, including cell towers.

- 📦 Self Storage

- These REITs are incredibly lucrative relative to the investment required and the operating costs.

- 🏗️ Other specialized REITs own timberland, casinos and entertainment, pipelines and infrastructure.

🏛️ Diversified REITs

As the name implies, diversified REITs own different types of real estate assets. Just how diversified they are varies widely. Over time, the industry has shifted toward more specialized companies that develop a competency in one area.

💰 Mortgage REITs

The types of REITs listed above are all equity REITs that own physical land and buildings. Mortgage REITs own mortgages (which they either buy or originate) and mortgage-backed securities.

These entities collect interest and principal payments from these mortgages. Mortgage REITs are actually part of the financial sector rather than the real estate sector - but the same principles apply.

Now, let’s compare REITs against investments in direct real estate, listed companies, and ETFs.

REITs vs Direct Real Estate Investments

REITs offer a few obvious advantages when compared to direct real estate investments:

- You can invest as little as $100 , which is way below the minimum downpayment on a physical property.

- You’ll have exposure to a diversified portfolio of properties from the start. Owning a diversified portfolio of property is beyond the reach of most people.

- You don’t have to deal with tenants, maintenance, or other admin issues .

There are two more fundamental differences to be aware of, and these can turn out to be pros or cons:

- REITs do use debt to increase their buying power. They typically have debt-to-equity ratios of 50 to 150%, though sometimes it’s even higher. When individual investors buy properties as an investment they often use a lot more debt. That can result in bigger gains - but obviously means more risk too.

- The returns from direct real estate investments often come from capital appreciation, while rental income is used to finance the investment. REITs are more sensitive to interest rates, and returns typically come from the yield rather than from flipping properties at a profit.

REITs vs Listed Companies and ETFs

There are also a few important differences between REITs and other listed companies.

With most companies, you hope to see profits being reinvested to grow the company, and you like to see the number of outstanding shares remaining flat, or decreasing.

However, REITs pay most of their profits out as dividends, rather than reinvesting them or buying back shares. This means they do issue new shares to fund new investments. So a rising share count isn’t necessarily a bad thing. However, if new shares are issued at a discount, current shareholders will be diluted. New funding rounds should also enhance the yield or NAV (by making new investments).

A REIT’s net income is calculated in the same way as any company, but it’s a less useful number due to the distortions from depreciation and other items. REITs are required to depreciate assets and subtract the deprecation from net income. However, real estate is one type of asset that often appreciates in value.

-

Funds From Operations (FFO) is the preferred metric to reflect the cash flow actually generated from a REITs assets. FFO can also be calculated to exclude amortization, interest income, and gains and losses from the sale of assets.

-

The full formula is:

- FFO = Net income

+ depreciation + amortization + losses on sale of assets

- gains on sale of assets - interest income

✨ In some ways, REITs are also similar to exchange-traded funds (ETFs). After all, they are both structured as trusts, and they both pool investor funds to invest in a portfolio of assets.

But there is one very important distinction:

- ETFs are open-ended which allows the share count to rise and fall according to supply and demand. This allows market makers to keep an ETF trading close to its NAV, ie. the value of the underlying securities.

- REITs are closed-ended , and the share price is determined by supply and demand. That means a REIT share price can trade at a premium or discount to NAV, which is the value of the properties. This can create opportunities if you believe the NAV is higher than the share price. For more on that, we will take a look at the NAVs of REITs next week.

💡 The Insight: Secular Trends Are Important Catalysts For Long-term Yields and Returns

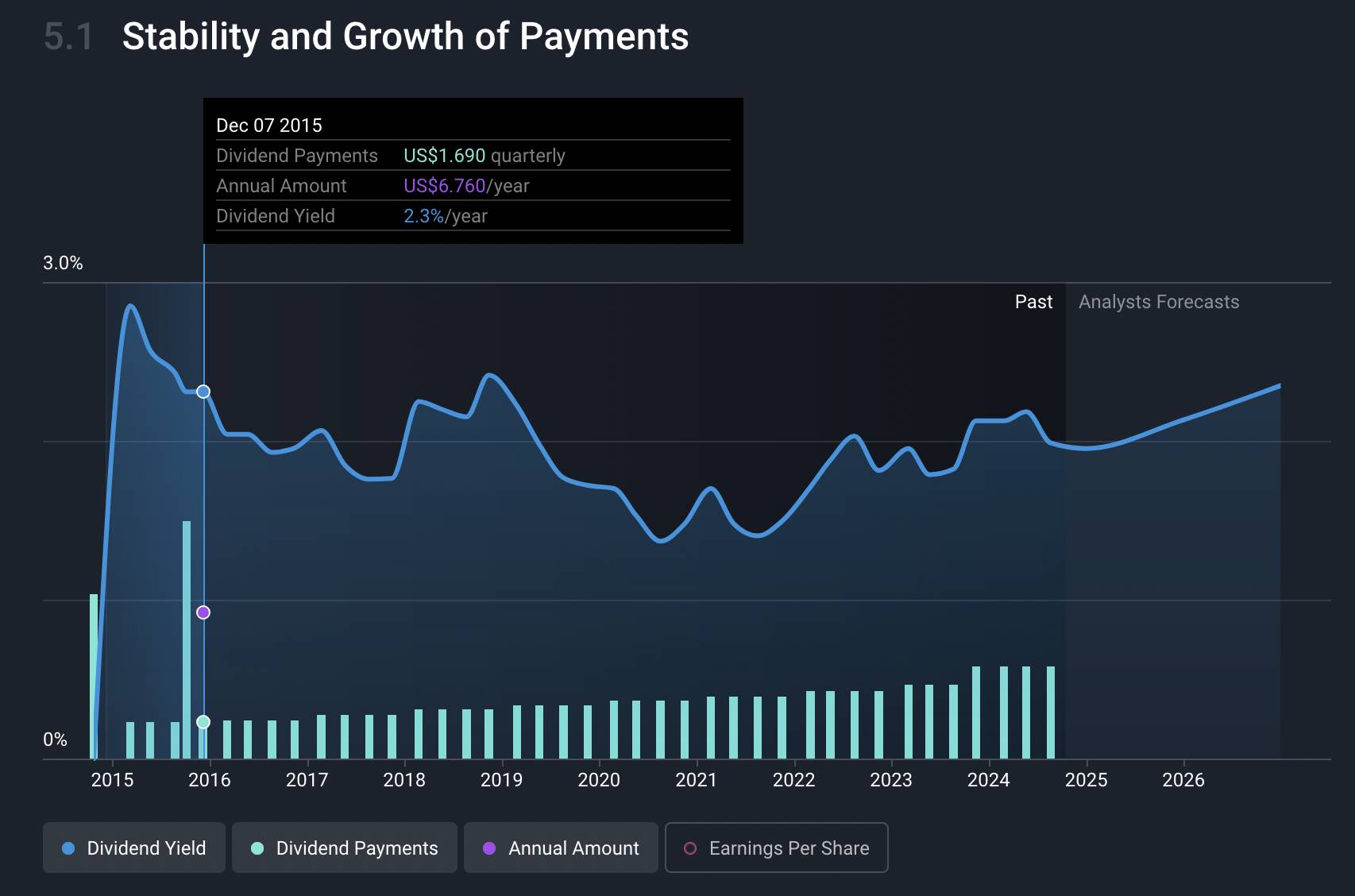

In the short to medium term, REIT performance is sensitive to interest rates and market sentiment. Over the long term, the yield on the underlying property portfolio is key.

✨ The big secular trends playing out around the world play a role in determining the rental income that real estate assets generate. Secular trends can act as positive and negative catalysts for different types of real estate assets.

Here are a few examples:

Positive impact:

- 🤖 AI and cloud computing are driving demand for data centers and communication infrastructure.

- 🧓 Aging populations result in growing demand for assisted living facilities and retirement estates.

Negative impacts:

- 💻 Remote work is reducing demand for office space. At the same time, hybrid work has created demand for different types of office buildings and shared office space.

- 🛍️ E-commerce reduces demand for most retail spaces but increases demand for some prime locations.

- ⚕️ Telehealth and non-invasive surgery is leading to fewer hospital stays, but more demand for out-patient healthcare centers.

Equinix is on the right side of demand for data centers, as illustrated by its quarterly dividend payments which have increased from $1.69 to $4.26 in the last 10 years:

Some demographic trends are location-specific, as some cities attract people while others are losing residents due to high rents and taxes.

In time, housing shortages could lead to big changes in urban areas, and as mentioned, excess office space could be converted to accommodation.

To get into the nitty gritty of valuing REITs, keep your eyes peeled for next week’s insights.

Key Events During the Next Week

There isn’t much economic data due this week, but it is a big week for corporate earnings.

Wednesday

- 🇨🇦 The Bank of Canada will announce its decision on interest rates. Economists expect the benchmark rate to fall from 4.285% to 4%.

Thursday

- 🇺🇸 US Initial jobless claims data will be published. Claims have spiked in the last two weekly reports, so investors will be watching this closely.

Friday

- 🇺🇸 US durable goods orders are expected to have increased to 0.2%, in September, compared to 0% in August.

- 🇺🇸 The University of Michigan Consumer Sentiment Index is forecast to fall to 68.9, from 70.1 in September.

It’s week one of ‘big tech’ earnings, and large caps in most other sectors will also be reporting Q3 results. The Nasdaq website has a more comprehensive list, but these are the biggest companies expected to report:

- Alphabet

- Amazon

- Tesla

- SAP

- HDFC Bank Limited

- GE Aerospace

- Texas Instruments

- Coca-Cola

- IBM

- S&P Global

- Caterpillar

- Honeywell

- HCA Healthcare

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.