Quote of the Week: “Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves." - Peter Lynch

Last week’s newsletter was part 1 of an introduction to the financial sector, and specifically banks and companies in the capital markets space.

This week we are having a look at the other financial industries, namely insurance, diversified financials, fintech and payments.

There has been a notable rise of non-bank lending over the last decade, so we also delved into two important implications of this.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or our YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🇨🇳 China Markets Warn Xi More Stimulus Is Needed to Fuel Rally ( Bloomberg )

- What’s our take?

- Investors loved hearing about the monetary easing measures, but the lack of fiscal stimulus was a buzzkill on the recent rally.

- China is in a deflationary spiral , and that is bad for an economy when you have a lot of debt, but less of an issue if you aren’t leveraged. This is why our global financial system, which is based on credit, is so afraid of deflation, where debts become harder to pay, and fine with a little inflation, where debts slowly get cheaper.

- The People’s Bank of China’s sweeping monetary policy measures that were announced on September 24th are in stark contrast to the fiscal side of things, where China’s economic planning agency, the NRDC, announced they’d bring forward a meager $28bn USD, or 200bn Yuan, that was slated for 2025. Analysts were expecting 2-3 trillion Yuan in fiscal stimulus measures, which is why the Chinese market pulled back on Tuesday.

- The Ministry of Finance is expected to hold a briefing soon where they possibly outline fiscal measures, so this might change.

- However, researchers have said that given the strong rally since the PBoC’s announcement in late September, NDRC policymakers probably don’t feel too much pressure to do anything just yet. But if the market continues to drop because there’s no fiscal news, then they may feel compelled to bring in fiscal stimulus measures too.

- What’s our take?

-

🛢️ Brent Crude Oil Falls Below $80 as China Holds Back on More Stimulus ( Bloomberg )

- What’s our take?

- The oil market is being driven higher by rising tensions in the Middle East and pulled down by decreased demand from weaker economic outlooks.

- The lack of stimulus measures mentioned in the previous story also resulted in commodity prices like oil and iron ore falling, given China is the world's biggest importer.

- Oil traders are watching the conflict between Israel and Iran closely, as well as OPEC’s plans to delay output production increases in October. This was supposed to be an unwinding of the previous production cuts, but with oil prices remaining suppressed, they’re not keen to increase production yet.

- The oil market seems like it could go either way. It could go higher if tensions escalate in the Middle East or if China brings in heavy fiscal stimulus measures. However, if conflict doesn’t escalate, China doesn’t bring in fiscal stimulus, and production output is increased or economic growth remains subdued, the price could stay where it is or reduce.

- The uncertainty means investors should position themselves accordingly.

- What’s our take?

-

🥤 PepsiCo Took It Too Far With Shrinkflation ( Yahoo )

- What’s our take?

- Consumers are getting tired of paying more for less, especially on impulse buys.

- “Shrinkflation”, where a company sells you less product but charges more, is a tactic that has worked very well for consumer packaged goods companies over the last 10 years, and especially more recently.

- But consumers have noticed and their habits are changing accordingly. PepsiCo’s reports indicate as much. Analysts say that Pepsi may have pushed it too far, and so there will be an adjustment period before you’d expect to see any sort of volume growth from these consumer packaged goods businesses.

- All in all, the signs from these businesses indicate that the consumer may not be as strong as we thought.

- What’s our take?

-

🙇 Samsung issues public apology after falling behind on AI ( FT )

- What’s our take?

- We’ve all heard of FOMO, but for Samsung it seems it’s less of a matter of fear and more of a matter of actually missing out on the AI boom.

- Samsung has issued an apology to shareholders acknowledging the company is in ‘crisis’, following a disappointing earnings release that came in below expectations.

- Despite reporting operating profits that have nearly tripled since last year, the market was disappointed by the fact that the latest figures came in below expectations, while also taking a 13% hit from last quarter.

- There’s growing concern that Samsung is falling behind rivals like SK Hynix and Micron in supplying the most advanced HBM chips, memory chips that are vital for AI hardware.

- SK Hynix entered into mass production of their most advanced HBM3E, getting a further leg up on Samsung whose own HBM3E have failed to pass Nvidia’s qualification tests for use in their hardware.

- With AI hardware companies like Nvidia going from strength to strength, missing the bus like this is a huge missed opportunity for Samsung.

- What’s our take?

-

🇮🇳 Danone Plans India Expansion To Close In On Rivals Unilever And Nestlé ( FT )

- What’s our take?

- If you can’t beat them, join them!

- French consumer goods company Danone has set its sights on expanding in India. This focus on India feels like a necessary move, given how quickly the company’s economy has been growing and the success competitors like Unilever and Nestlé have achieved there.

- The company’s CEO expressed a sense of urgency in the company’s pursuit of growth in the subcontinent, stating their presence is “nowhere near where it should be”.

- The company announced a €20 million investment over four years to expand their existing plant in Punjab, which seems quite modest for such ambitious expansion plans.

- Danone’s CEO echoed sentiments similar to discussions about AI, stating that companies that fail to scale in India 'will be less relevant as a global player' in the future.

- While this sentiment may ring true, it remains to be seen whether Danone’s current expansion plans will be enough to capitalise on India’s growing consumer market and catch up to competitors despite a late start in the market.

- What’s our take?

🏢 The Pros And Cons Of The Insurance Industry

Insurance might not be the most exciting industry around, but it can be incredibly profitable for long-term investors. In fact, insurance has been the cornerstone of Warren Buffett’s success with Berkshire Hathaway.

Berkshire receives insurance premiums from customers, it then invests that float into long term investments and only pays out small amounts in claims per year when cover is needed, because they’re conservative with who they insure. That float is essentially free capital, and the compounding is insane because they keep receiving more premiums every year while only paying out marginal amounts in claims.

Like banking, insurance is also very different from most companies, and investors need to use a different approach to assessing them.

There are lots of different types of insurance companies, with the most common being:

- ⚰️ Life insurers pay a lump sum to beneficiaries upon the death of a policyholder.

- 🤕 Health insurers cover for healthcare, personal injury and disability.

- 🏠 Property and casualty insurance covers loss or damage to property, as well as personal liability.

- 🚘 Auto insurance covers the cost to repair or replace vehicles involved in accidents.

- 🏚️ Reinsurance covers insurance companies in the event of catastrophic loss.

The business model for all these companies is very similar: they receive premiums from policyholders and pay out claims, and hopefully make a profit in the process.

In practice, the math varies a lot. Health insurers expect to make payments for most of their customers, while property insurers only expect claims from a small percentage of policyholders.

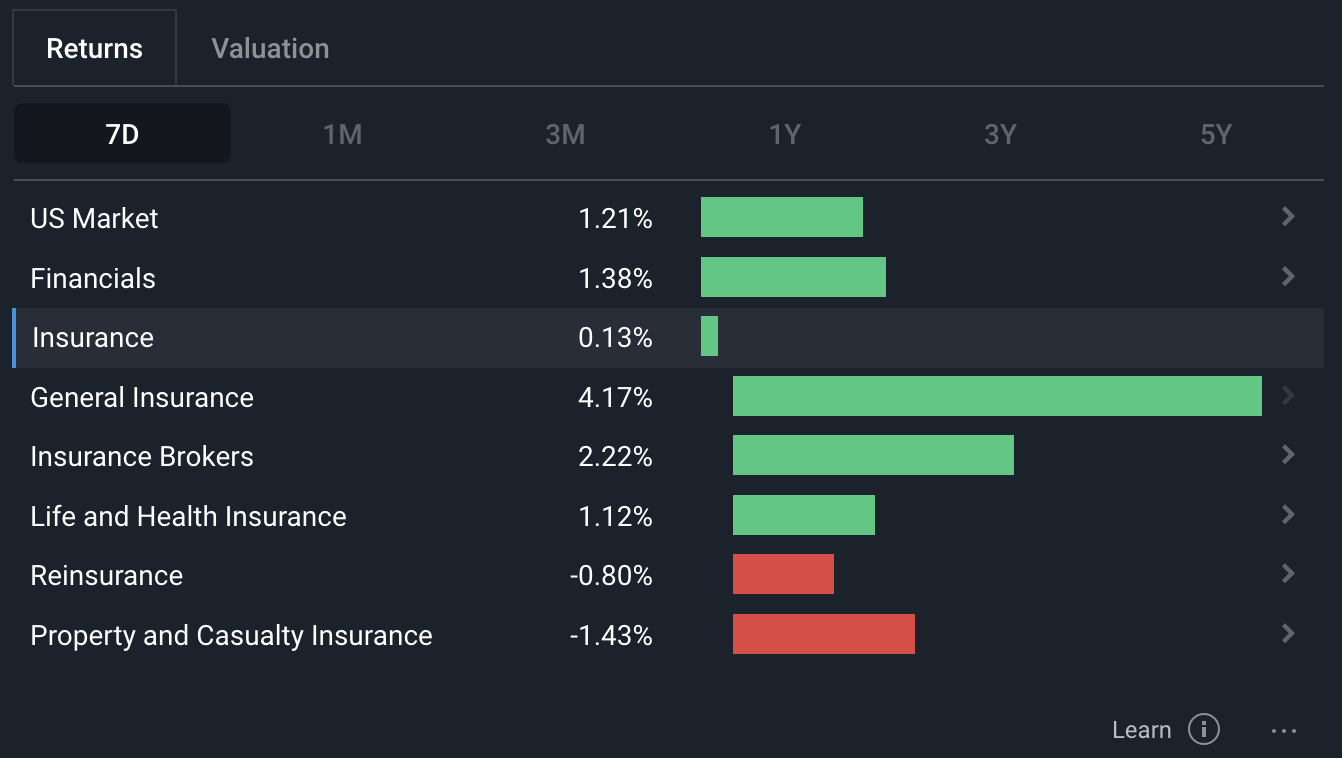

Last week, as Hurricane Milton barreled towards Florida, investors dumped shares in the companies with exposure, while the rest of the sector notched up gains.

There are actually two parts to an insurance business, and both contribute to returns for shareholders:

🗒️ The Art Of Underwriting - Taking Calculated Risks

For an insurance company, underwriting means selling policies, and paying out claims. The underwriting part of the business needs to price premiums at a level that will cover future claims with some profit leftover. At the same time, premiums need to be competitive compared to other insurers.

✨Insurance is one industry where higher revenue growth might not be such a good thing. Insurers can easily increase sales by making sure their premiums are lower than competitors - but that could leave them with more claims.

Investors need to understand a company’s underwriting track record, which is where the following three ratios come in:

- Loss ratio: Total Claims Paid / Total Premiums Earned

- Expense ratio: Operating Expense / Total Premiums Earned

- Combined ratio: Loss Ratio + Expense Ratio

The loss ratio tells you how good an insurer is at pricing risk and managing claims. The expense ratio reflects the efficiency of the business by dividing operating costs by premium income.

✨ To compare different insurance businesses, investors often use the combined ratio, which includes claims and expenses. These ratios need to be tracked over time, and should really improve (ie. fall) as the business grows.

💰 Investing that Sweet, Sweet Float

The other way insurers make money and increase shareholder value is by investing the premiums they have earned and have yet to pay out - known as the float.

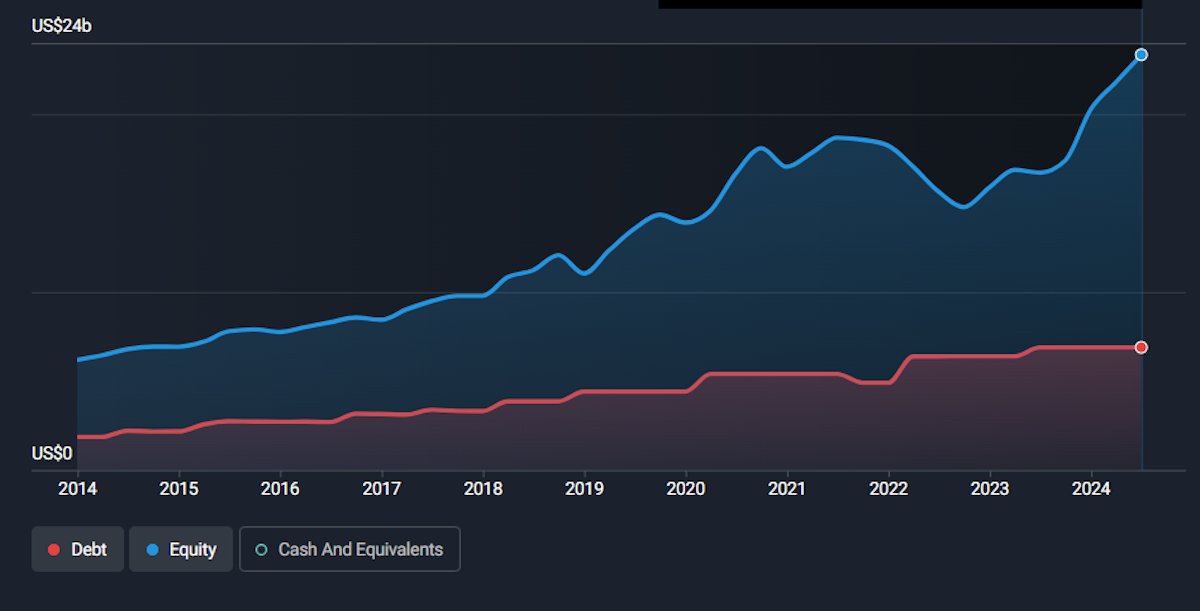

Most of the float is invested in fixed-income securities, with a smaller percentage going to stocks and other investments. Over time, profits generated from investments and underwriting pile up as retained earnings. Retained earnings act as a cushion and allow the company to take more risk underwriting and investing. Ideally, an insurance company should be increasing its book value over time from a combination of successful underwriting and investing activities.

Below, you can see how Progressive Corporation has managed to increase equity from $6 bln to $23 bln in 10 years.

❗️ Reminder: Book value = equity = assets minus liabilities

The price-to-book ratio is a key valuation metric for insurance companies. Those that have a solid track record tend to trade at a higher P/B ratio than smaller companies and those that aren’t increasing their book value.

Larger and diversified insurers also trade at a premium because their risk is spread across various markets. Smaller insurers come with more risk, but trade at lower valuations, and offer the potential for multiple expansion as they grow.

✨ BTW: The Simply Wall St Stock Screener lets you sort companies by book value, along with other key ratios.

If you’d like a premade screener, here’s one we made that looks for stocks in the diversified financials or insurance industry with a low P/B ratio and earnings growth forecasts above 5% per year.

🏢 Diversified Financials and Fintech

The Diversified Financials industry is really a catch-all for all the companies that don’t fit into other parts of the sector.

For the US market, it includes conglomerates like Berkshire Hathaway, private equity companies and financial technology companies that aren’t really diversified at all. In other markets, the category includes ‘ bancassurance groups ’ (yep, it’s a word) which own banks, insurers and other financial service firms.

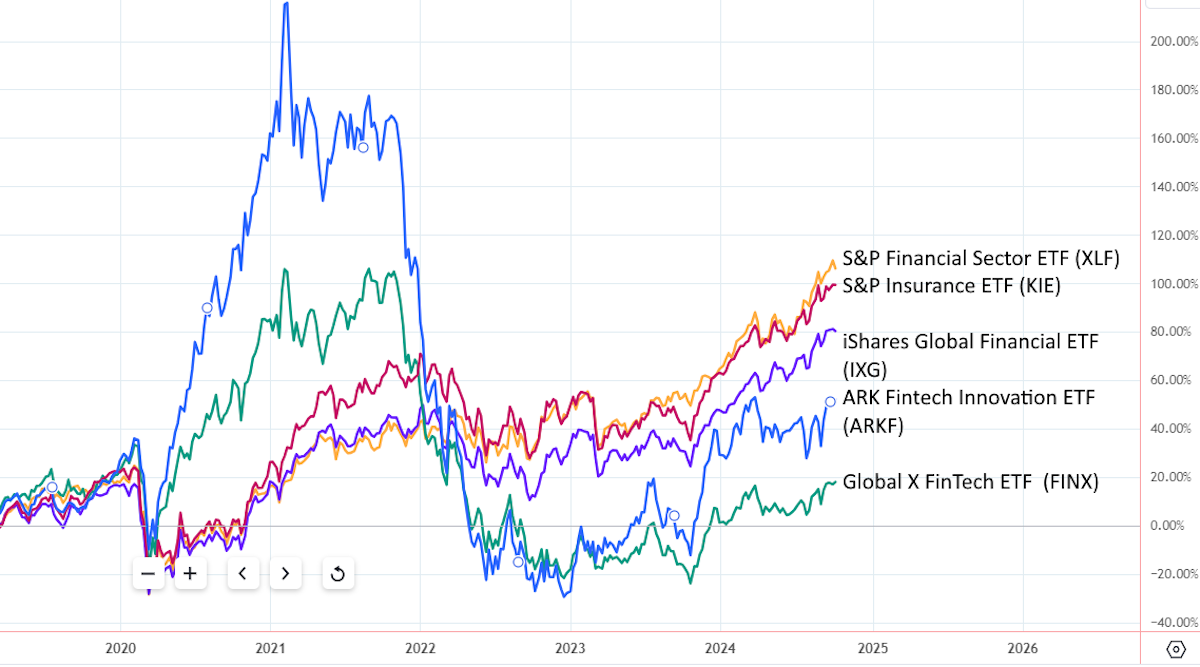

The most prominent of these companies are the payment networks Visa and Mastercard , which were the original ‘fintechs’. For the last decade or two, the world has been waiting for a wave of fintech companies to disrupt the financial industry. There are thousands of fintech companies around the world, but they really haven't managed to dislodge the major banks and insurance companies in a meaningful way. For a comparison, consider how much the media and retail industries have been changed by technology.

Small fintech companies were caught up in a speculative bubble in 2021, but have since come back to earth. As it stands now, boring banks and insurers have managed to outperform all the fintech ETFs (and most of the stocks in those ETFs) over five years. Here’s a chart for proof.

The exception in the fintech space has been the companies that provide technology to financial companies and those that process payments for e-commerce sites. These include the likes of Visa, Mastercard, Fiserv and Adyen - as well as PayPal which lost momentum.

The fintech companies that investors were more excited about like Affirm , SoFi and Upstart are struggling to find a sustainable business model that doesn’t involve a lot of free cash.

✨ The difference between these two groups of companies is that the first group are enabling existing businesses, while the second group are trying to compete against incumbent businesses.

💡 The Insight: Non-bank Lenders Have Become the Real Financial Sector Disruptors

The biggest growth trend in the financial sector in recent years has probably been ‘non-bank lending’. This term refers to companies that aren’t banks that make loans - mostly to companies, but to consumers as well.

There are too many reasons for this. The first is that capital requirements for banks were increased after the Global Financial Crisis. This means banks can’t use as much leverage as they could in the past, particularly for riskier loans.

The second catalyst has been the growth in private equity funds. These funds are happy to make money any way they can, and they have stepped in to fill the gap as banks cut back on lending. In practice, these lenders often leverage themselves, placing higher quality collateral with banks, borrowing at one rate, and lending at a higher rate.

By some estimations, private credit has risen fourfold in the US over the last 10 years, and it’s increasing just as fast elsewhere. Higher interest rates have also made private credit even more attractive, leading to more inflows for lenders.

Recently, Apollo Global , one of the largest private equity firms in the world outlined plans to increase assets under management from $700bn to $1.5tn by 2029 . Lending is one of Apollo’s key activities, and it's on course to become as big a lender as any bank on Wall Street.

There are two potential implications for the growth in non-bank lending.

- ⚠️ One is that there could be more systemic risk in the financial system than regulators realize. One of the reasons for capital requirements and stress testing is to help regulators manage financial system risk. When too much capital flows into a market, lending standards inevitably drop too.

- 🤝 Secondly, and a more positive implication, is that fintech companies might get an opportunity to take on the banks by partnering with these lenders , and offering a better customer experience AND capital.

Key Events During the Next Week

Tuesday

- 🇬🇧 UK employment data will be published. Economists expect to see a substantial increase in unemployment, from 4.1% to 4.6%

- 🇨🇦 Canada’s inflation rate will be released, and is expected to remain at 2%

Wednesday

- 🇬🇧 UK inflation data will be published. The headline inflation rate is forecast to remain steady at 2.2%.

Thursday

- 🇯🇵 Japan’s trade balance is forecast to swing to a ¥300 bln surplus, compared to last month’s ¥695 bln deficit

- 🇪🇺 The ECB will announce its interest rate decision. The benchmark rate is expected to fall from 3.65% to 3.4%.

- 🇺🇸 US initial jobless claims will be reported. Claims are forecast to rise slightly, from 258k to 269k.

Friday

- 🇯🇵 Japan’s inflation rate is expected to fall from 3% to 2.7%

- 🇨🇳 China’s GDP growth rate for the 3rd quarter is expected to be 5%, compared to 4.7%. Industrial production and retail sales are also forecast to rise slightly.

- 🇺🇸 US Building permits will be published. Economists expect to see building permits falling slightly, while housing starts are expected to rise marginally.

It’s the second week of the earnings season. The remaining big banks will be reporting third quarter results, along with the first tech and healthcare companies.

- UnitedHealth

- Johnson & Johnson

- Bank of America

- Goldman Sachs

- Citigroup

- Rio Tinto

- ASML Holding

- Abbott Laboratories

- Taiwan Semiconductor

- Netflix

- Morgan Stanley

- Intuitive Surgical

- Elevance Health

- Procter & Gamble

- American Express

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.