- United States

- /

- Interactive Media and Services

- /

- NYSE:PINS

Exploring Three High Growth Tech Stocks In The United States

Reviewed by Simply Wall St

In the last week, the United States market has been flat, but over the past 12 months, it has risen by an impressive 31%, with earnings forecasted to grow by 15% annually. In this context of robust growth potential, identifying high-growth tech stocks that align with these optimistic market conditions can be crucial for investors seeking opportunities in the dynamic tech sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Ardelyx | 25.24% | 69.64% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.49% | ★★★★★★ |

| Clene | 78.50% | 60.16% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 248 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bilibili (NasdaqGS:BILI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. offers online entertainment services targeting young audiences in China, with a market cap of $7.84 billion.

Operations: The company generates revenue primarily from internet information providers, amounting to CN¥25.45 billion. Its business model focuses on delivering online entertainment services to a youthful demographic in China.

Bilibili, amidst a challenging landscape for tech firms, has demonstrated resilience and strategic foresight. With revenue growth projected at 10.8% annually, surpassing the U.S. market average of 8.9%, the company is poised for significant expansion. This growth trajectory is complemented by an aggressive R&D investment strategy, evident from its substantial allocation towards innovation—aiming to enhance its competitive edge in the Interactive Media and Services sector. Moreover, Bilibili's recent earnings report highlighted a reduction in net loss to CNY 79.52 million from CNY 1,351.44 million year-over-year for Q3 2024, signaling improving operational efficiency despite ongoing profitability challenges. The firm also announced a buyback plan of up to $200 million worth of its ADSs, underlining confidence in its future prospects and commitment to shareholder value amidst volatility in share prices.

- Click to explore a detailed breakdown of our findings in Bilibili's health report.

Gain insights into Bilibili's past trends and performance with our Past report.

Natera (NasdaqGS:NTRA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Natera, Inc. is a diagnostics company that focuses on developing and commercializing molecular testing services globally, with a market capitalization of approximately $22.24 billion.

Operations: The company generates revenue primarily from its molecular testing services, amounting to approximately $1.53 billion.

Natera, amidst recent legal challenges, continues to innovate in genetic testing, evidenced by a 12.3% annual revenue growth and an ambitious R&D focus which is crucial for maintaining its competitive edge in the biotech industry. The company's commitment to development is reflected in its substantial R&D expenses, supporting projects like the Prospera Lung test which recently gained CMS coverage. Despite facing significant legal penalties totaling $292.5 million for false advertising claims against competitor Guardant Health's Reveal™ product, Natera's advancements suggest resilience. The firm also anticipates robust future earnings growth at a rate of 69.4% annually, underpinning its strategic focus on transformative healthcare solutions.

- Take a closer look at Natera's potential here in our health report.

Examine Natera's past performance report to understand how it has performed in the past.

Pinterest (NYSE:PINS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pinterest, Inc. operates as a visual search and discovery platform both in the United States and internationally, with a market cap of approximately $20.49 billion.

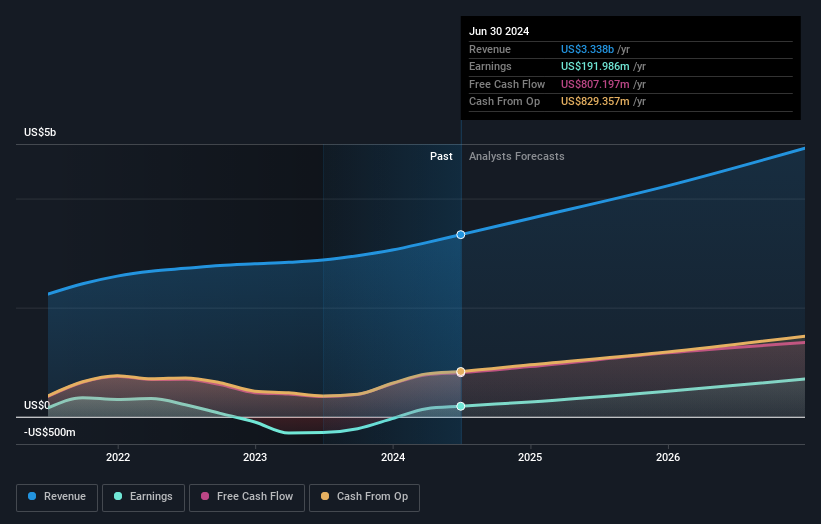

Operations: The company generates revenue primarily through its Internet Information Providers segment, amounting to $3.47 billion.

Pinterest has demonstrated a robust financial and operational trajectory, particularly in its recent earnings growth and strategic buybacks. The company reported a significant increase in quarterly sales to $898.37 million from $763.2 million year-over-year, alongside a rise in net income to $30.56 million from $6.73 million, reflecting a sharp improvement in profitability. This financial health is supported by an aggressive share repurchase strategy, with $500.05 million spent to buy back 15.89 million shares, enhancing shareholder value. Moreover, Pinterest's commitment to innovation is evident from its R&D investments which are pivotal for sustaining long-term growth within the competitive tech landscape; these efforts are expected to propel earnings by 34.3% annually, outpacing the US market projection of 15.4%. This combination of fiscal prudence and forward-looking investments positions Pinterest favorably amid evolving digital media dynamics.

- Unlock comprehensive insights into our analysis of Pinterest stock in this health report.

Review our historical performance report to gain insights into Pinterest's's past performance.

Seize The Opportunity

- Access the full spectrum of 248 US High Growth Tech and AI Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PINS

Operates as a visual search and discovery platform in the United States, Canada, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives