- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BILI

Bilibili (NasdaqGS:BILI) Soars 21% After Announcing Improved Financial Performance

Reviewed by Simply Wall St

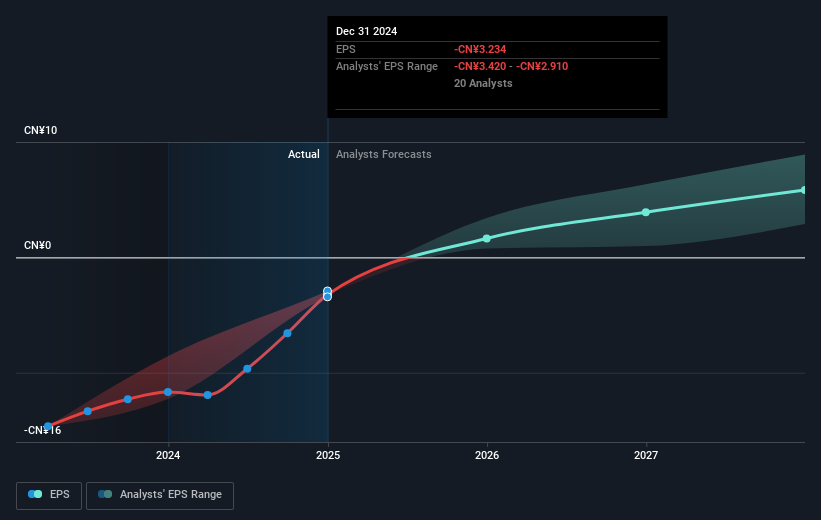

Bilibili (NasdaqGS:BILI) experienced a 21% rise in share price over the past month, coinciding with the announcement of its improved financial performance for the year ending December 2024. The company posted significant revenue growth and reduced net losses, bolstering investor sentiment. Bilibili completed a share buyback program, which may have supported its stock price by reducing the number of shares available in the market. Additionally, its optimistic outlook for continued revenue growth in 2025 likely reinforced investor confidence. These developments occurred amidst a backdrop of a broader market decline, with major indices like the Nasdaq falling 4% in February. However, a positive reaction to easing inflation data towards the month's end provided a more favorable environment for tech stocks, including Bilibili. The combination of company-specific positive news and macroeconomic factors may have fueled the notable increase in Bilibili's share price.

Click here to discover the nuances of Bilibili with our detailed analytical report.

Bilibili's shares delivered a total return of 102.39% over the last year, surpassing both the US market and the Interactive Media and Services industry, which returned 15.3% and 26.1%, respectively. A pivotal factor in this substantial performance was Bilibili's impressive financial results for 2024, with total revenue reaching CNY 26.83 billion, marking significant growth from the previous year. Improvements in net loss, narrowing to CNY 1.35 billion from larger losses, also contributed positively. The completion of a share repurchase program announced on November 14, 2024, potentially provided further support to its share price.

Moreover, projections for profitability within the next three years, despite its current unprofitability, likely galvanized investor interest. Additionally, Bilibili's forecasted revenue growth, while slower than 20% per year, is set to outpace the broader US market's growth rate of 8.5% annually, enhancing its attractiveness to growth-oriented investors.

- Analyze Bilibili's fair value against its market price in our detailed valuation report—access it here.

- Understand the uncertainties surrounding Bilibili's market positioning with our detailed risk analysis report.

- Got skin in the game with Bilibili? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives