- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BILI

Bilibili (NasdaqGS:BILI): Assessing Valuation After First Profitable Quarter and 20% Revenue Surge

Reviewed by Simply Wall St

Bilibili (NasdaqGS:BILI) just pulled off a turnaround that has quickly turned heads. The company reported its first-ever profitable quarter, with a net income swing fueled by 20% revenue growth. Gains came mainly from surging game and ad businesses, as Bilibili leaned into AI-driven monetization and new content launches. If you have been eyeing the stock amid recent volatility, this shift to profitability could mark an inflection point that raises questions about what is next for the platform and its shareholders.

This latest earnings update moves the spotlight from speculation to delivery. After a rocky stretch, Bilibili’s momentum has picked up. Shares are up 68% over the past year and have climbed 23% in the past three months. In parallel, management has not just improved the bottom line, but continues returning capital through a sizable share buyback. International expansion, fresh monetization initiatives, and deeper use of AI suggest that the company is shaking off past sluggishness. However, with long-term returns still flat, investors may be wondering whether this is a new chapter or just a temporary rebound.

So after these sharp gains, is Bilibili now a bargain with more upside, or has the market already priced in its projected growth?

Most Popular Narrative: 9.7% Undervalued

According to the community narrative, analysts currently see Bilibili trading well below what they consider its fair value. Their valuation is driven not just by recent profitability, but also by strong expectations for future monetization and growth.

“The expansion and improved engagement of Bilibili's user base, particularly among China's Gen Z Plus, along with their rising consumption demand, could significantly boost future revenue. The application of evolving AI technology, leveraging Bilibili's extensive high-quality content and interaction data, is expected to unlock new monetization opportunities and enhance net margins and profitability.”

Curious what makes this bullish fair value tick? It is not just hype around future earnings or next-gen tech, but a set of aggressive projections for profit growth and margin expansion. Want to know which high-impact numbers underpin this analyst view, or what has to go right to make it real? Dive deeper to see the key assumptions powering Bilibili’s potential upside and discover the full story behind its current valuation call.

Result: Fair Value of $26.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, it is important to note that Bilibili’s progress relies heavily on gaming and advertising, which could face regulatory hurdles or market fluctuations.

Find out about the key risks to this Bilibili narrative.Another View: SWS DCF Model Backs Up the Undervaluation

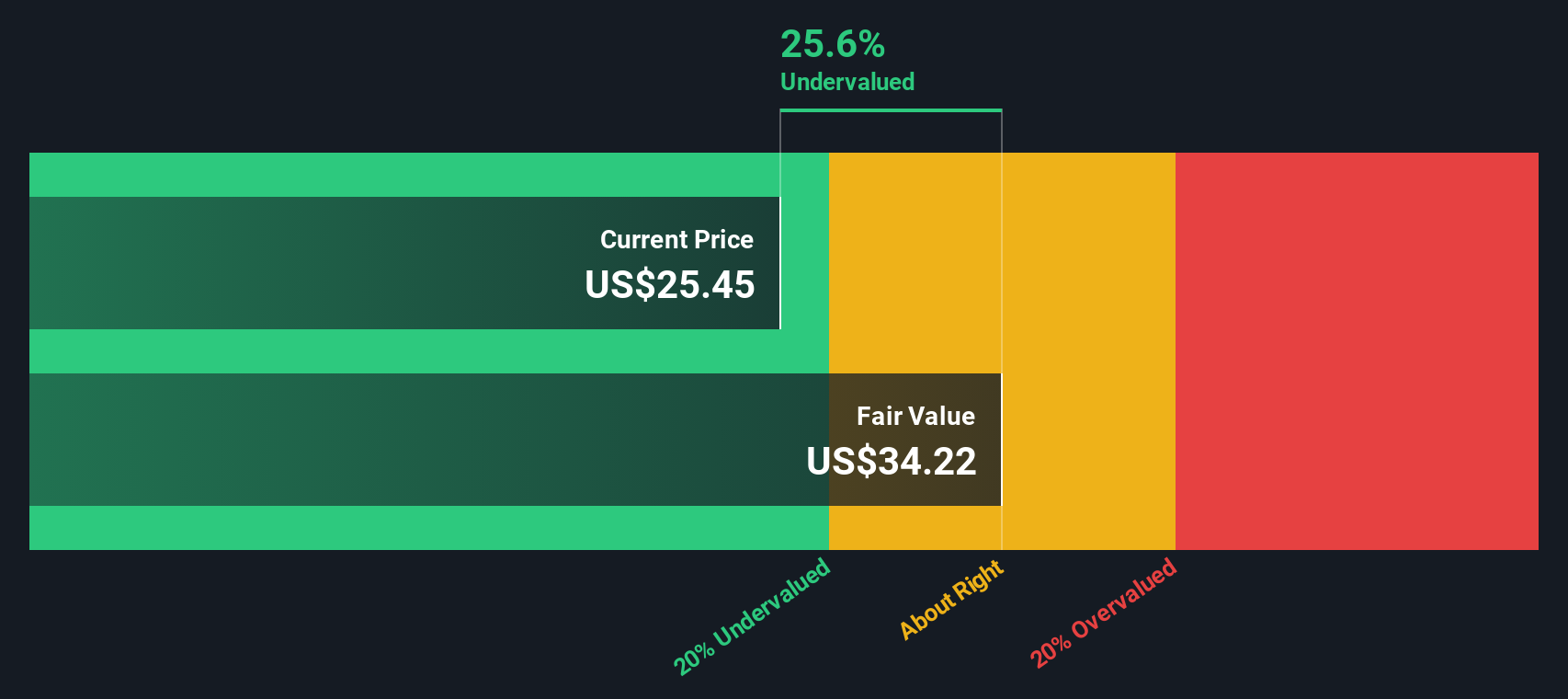

While some investors focus on how Bilibili compares to industry price-to-sales ratios, our DCF model supports the idea that the shares are still undervalued. This raises the question: does this approach provide a more reliable anchor, or does it overlook market shifts?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bilibili Narrative

If you want to challenge the mainstream view or dig into the numbers yourself, it is easy to craft your personal take in just a few minutes, so why not do it your way?

A great starting point for your Bilibili research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for Your Next Smart Investment?

Why stop with Bilibili? Take charge of your investing journey by checking out powerful stock ideas that could shape your financial future. These opportunities are too good to ignore. Act now and find your next winning edge.

- Power up your passive income with companies offering dividend stocks with yields > 3% for yields above 3%, helping you grow wealth while you sleep.

- Step ahead in artificial intelligence by targeting hand-picked AI penny stocks making big moves in the AI revolution.

- Accelerate your portfolio growth with undervalued stocks based on cash flows, connecting you to overlooked businesses trading below their true value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives