- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

3 US Stocks That May Be Up To 33.6% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As the S&P 500 flirts with record highs and major indexes post weekly gains, investors are keenly observing the market for opportunities amidst mixed economic signals such as declining retail sales and fluctuating treasury yields. In this environment, identifying stocks that may be undervalued relative to their intrinsic value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $18.65 | $36.99 | 49.6% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | $30.80 | $58.90 | 47.7% |

| Old National Bancorp (NasdaqGS:ONB) | $23.89 | $45.71 | 47.7% |

| Sandy Spring Bancorp (NasdaqGS:SASR) | $33.65 | $64.49 | 47.8% |

| Incyte (NasdaqGS:INCY) | $70.42 | $134.89 | 47.8% |

| Array Technologies (NasdaqGM:ARRY) | $6.79 | $13.53 | 49.8% |

| Constellium (NYSE:CSTM) | $9.34 | $18.30 | 49% |

| First Advantage (NasdaqGS:FA) | $19.93 | $38.12 | 47.7% |

| Fluence Energy (NasdaqGS:FLNC) | $6.43 | $12.61 | 49% |

| Kyndryl Holdings (NYSE:KD) | $41.79 | $82.10 | 49.1% |

Let's uncover some gems from our specialized screener.

Bilibili (NasdaqGS:BILI)

Overview: Bilibili Inc. offers online entertainment services targeting young generations in China and has a market cap of approximately $9.14 billion.

Operations: The company's revenue from Internet Information Providers amounts to CN¥25.45 billion.

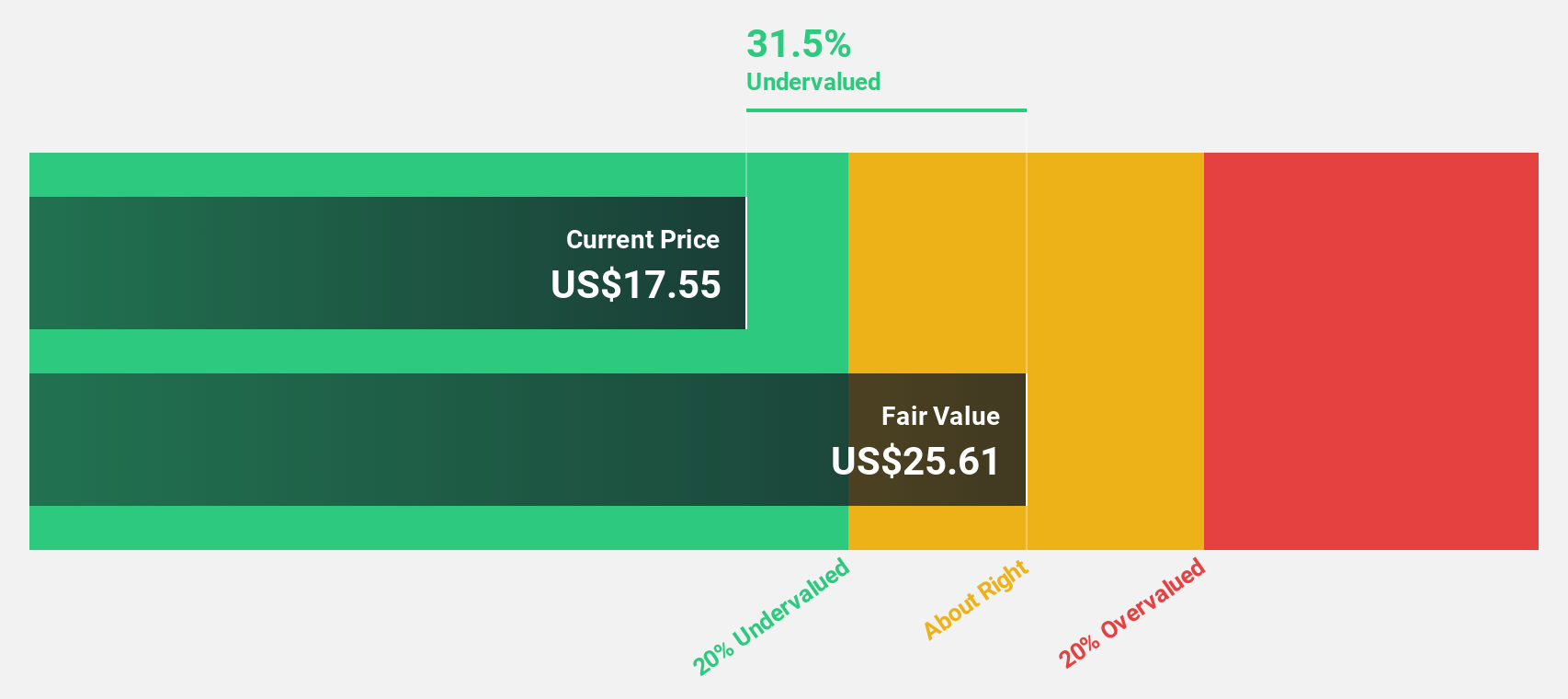

Estimated Discount To Fair Value: 23.8%

Bilibili, trading at US$21.99, is undervalued based on discounted cash flow analysis with a fair value estimate of US$28.84. Despite significant insider selling recently, the stock is priced 23.8% below its estimated fair value and is expected to become profitable within three years, outpacing average market growth rates. However, revenue growth forecasts of 10.2% annually are slower than desired but still exceed the broader US market's 8.9%.

- Our growth report here indicates Bilibili may be poised for an improving outlook.

- Click here to discover the nuances of Bilibili with our detailed financial health report.

Levi Strauss (NYSE:LEVI)

Overview: Levi Strauss & Co. designs, markets, and sells apparel and related accessories for men, women, and children both in the United States and internationally, with a market cap of approximately $7.23 billion.

Operations: The company's revenue segments include $1.08 billion from Asia, $1.62 billion from Europe, and $3.20 billion from the Americas.

Estimated Discount To Fair Value: 11.6%

Levi Strauss, priced at US$18.27, is trading 11.6% below its fair value estimate of US$20.67, suggesting it may be undervalued based on cash flows. Despite slower revenue growth forecasts of 2.8% annually compared to the broader US market, Levi's earnings are projected to grow significantly at 33.5% per year over the next three years, outpacing market averages. Recent strategic leadership changes aim to enhance operational efficiency and drive long-term profitability improvements.

- Upon reviewing our latest growth report, Levi Strauss' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Levi Strauss stock in this financial health report.

Pure Storage (NYSE:PSTG)

Overview: Pure Storage, Inc. provides data storage and management technologies, products, and services globally with a market cap of approximately $22.12 billion.

Operations: The company generates revenue primarily from its computer storage devices segment, which accounts for approximately $3.08 billion.

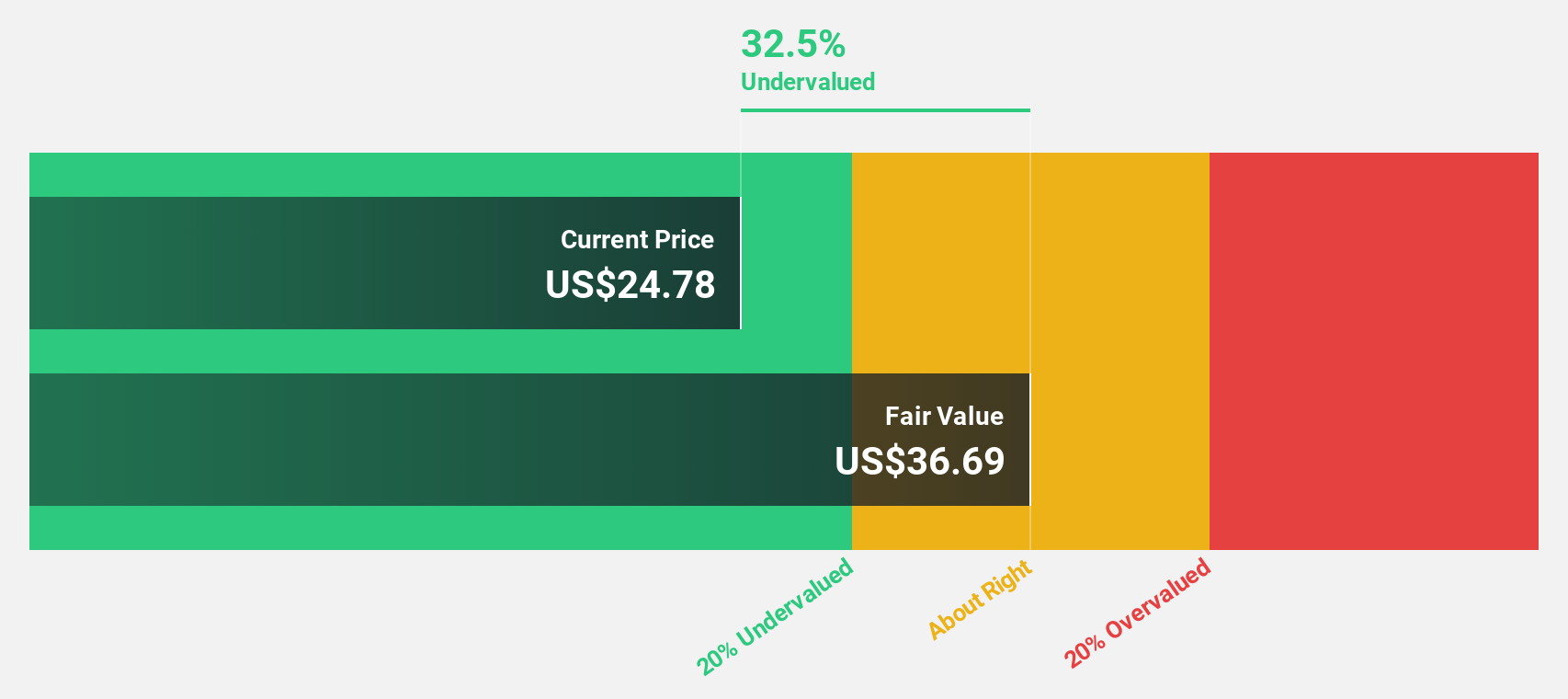

Estimated Discount To Fair Value: 33.6%

Pure Storage, trading at US$67.80, is significantly undervalued based on cash flows with a fair value estimate of US$102.06. Its earnings are projected to grow substantially at 49.8% per year, surpassing market averages. Recent strategic collaborations with Micron and Kioxia enhance its data storage solutions, focusing on high performance and energy efficiency for hyperscale environments, which could improve cost efficiency and reduce environmental impact in modern data centers.

- Our comprehensive growth report raises the possibility that Pure Storage is poised for substantial financial growth.

- Dive into the specifics of Pure Storage here with our thorough financial health report.

Seize The Opportunity

- Investigate our full lineup of 160 Undervalued US Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Engages in the provision of data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives