- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BIDU

What Do Baidu’s Robotaxi Expansion Plans Mean for Its Share Price in 2025?

Reviewed by Bailey Pemberton

Thinking about whether to buy, hold, or trim your Baidu shares? You are definitely not alone. After a wild swing in the last month, plenty of investors are trying to make sense of what comes next. Over just seven days, Baidu dropped 14.3%, a move that definitely caught the market’s attention, especially as it came right after a 13.1% surge over the past 30 days. The year-to-date numbers are even more impressive: up 47.1%. Over the last twelve months, Baidu has gained 17.2%, and it has even eked out a 21.3% return over three years, though the five-year performance still trails at -6.7%.

There have been some big headlines fueling these swings. Recent news that Baidu is exploring robotaxi expansions into Australia and Southeast Asia hints at major growth ambitions, especially as the company’s Apollo Go division just hit operational profitability across China. In addition, Baidu’s record-setting offshore bond sales this year may give them increased financial flexibility, suggesting the market is seeing the company’s risk profile shift. On the technology front, Baidu is demonstrating capability by reportedly swapping out Nvidia’s AI chips for ones it designed in-house, a move that could support margins and future innovation.

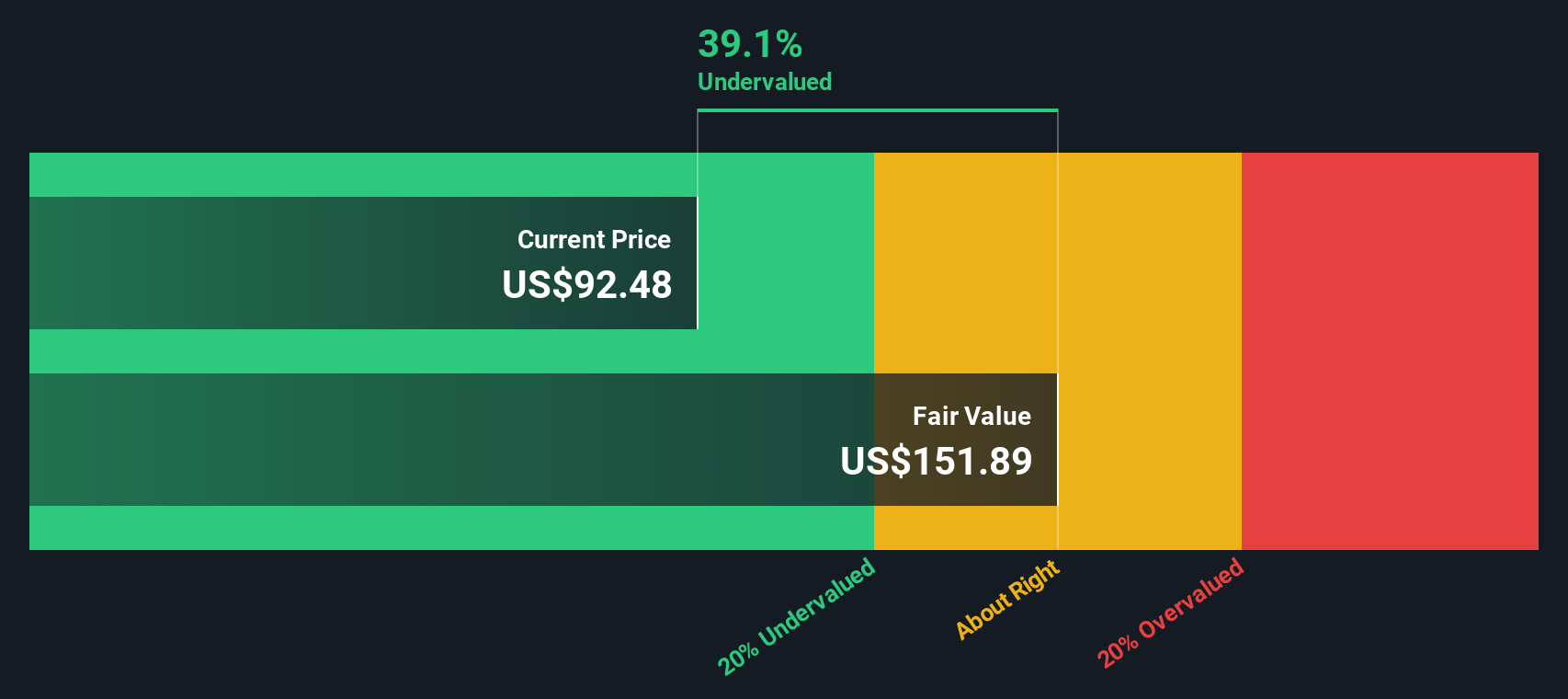

But hype and headlines only get you so far. Is Baidu actually undervalued, or are we just chasing recent moves? If we look at traditional valuation checks, Baidu scores a strong 5 out of 6, painting a picture of a company that is significantly undervalued by most measures. It is important to dig into why that number matters, what those valuation measures really tell us, and just as importantly, how you can get an even clearer sense of the company’s true value beyond the usual checkboxes.

Why Baidu is lagging behind its peers

Approach 1: Baidu Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its expected future cash flows and then discounting them back to today’s value. This approach attempts to answer what Baidu’s business is really worth by focusing on the cash it can generate for shareholders over time.

Baidu’s latest twelve-month Free Cash Flow (FCF) came in at negative CN¥10.4 billion. However, analysts expect a dramatic turnaround, projecting FCF to reach approximately CN¥27.4 billion by 2028. Simply Wall St further extrapolates this growth, estimating that Baidu’s annual free cash flow could surpass CN¥37.4 billion by 2035, with a steady increase each year.

All projections are calculated in Chinese Yuan (CN¥), which is Baidu’s reporting currency. Analysts commonly provide detailed estimates for the next five years, while subsequent cash flow growth is modeled using reasonable assumptions based on current business trends and sector dynamics.

Based on these cash flow projections, Baidu’s intrinsic value is estimated at $179.76 per share, which is about 32.3% higher than the current market price. This sizable margin suggests that investors may be undervaluing the company’s long-term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Baidu is undervalued by 32.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Baidu Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Baidu. It offers a snapshot of how much investors are willing to pay for each dollar of current earnings. It is especially useful because it adjusts for company size and provides context in comparing businesses across an industry.

It is important to note that growth expectations and risk levels play a big role in what is considered a “normal” or “fair” PE ratio. Fast-growing, low-risk companies tend to command higher multiples, while slower or riskier businesses typically trade at lower ones.

Baidu’s current PE ratio stands at 10.94x, which is noticeably below both the Interactive Media and Services industry average of 15.33x and its peer group average of 53.00x. While this might immediately suggest undervaluation, a more nuanced approach involves considering the “Fair Ratio.”

The Fair Ratio, as calculated by Simply Wall St, blends in not just industry comparisons but also the company’s individual outlook, such as earnings growth, profit margins, market cap, and risk. This makes it more insightful than relying solely on broad averages or peer multiples. For Baidu, the Fair Ratio is 20.23x, almost double the current PE. This indicates that given Baidu’s growth profile and business quality, the stock should be trading at a much higher multiple.

With the current PE well below both the industry average and the Fair Ratio, Baidu shares appear attractively valued at current levels.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Baidu Narrative

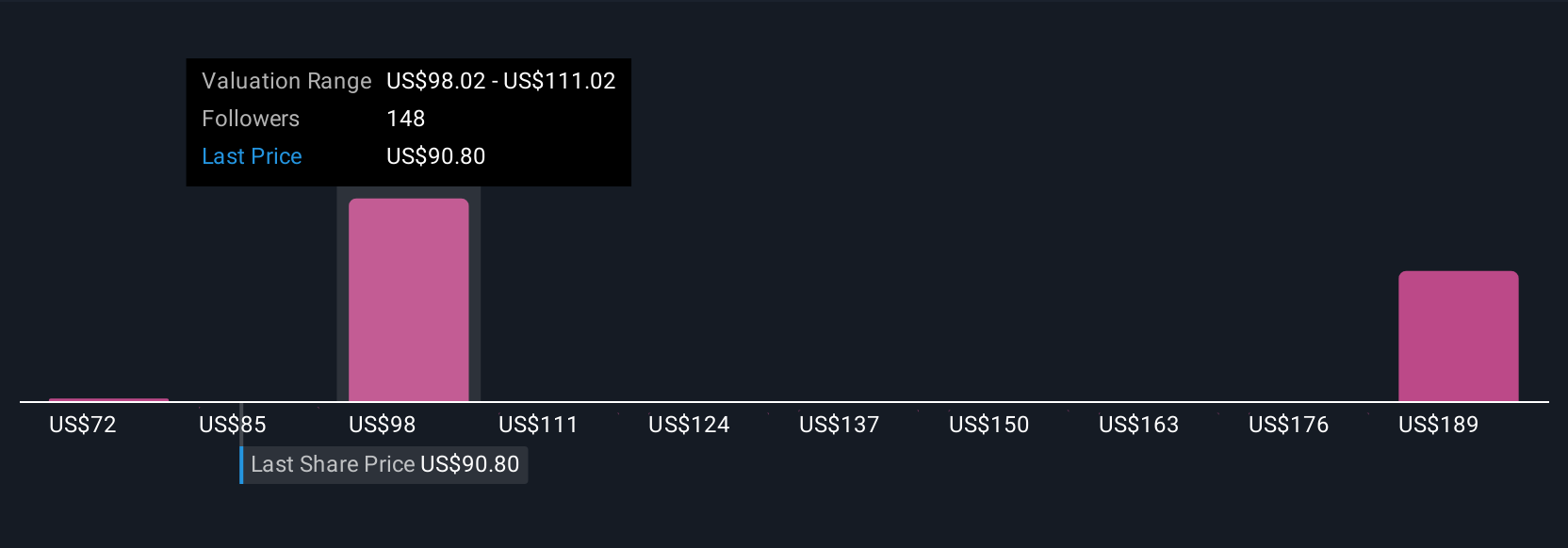

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story of what you believe will happen with a company like Baidu, backed by your own numbers such as your fair value and estimates for future revenue, profit, and margins, beyond just relying on analyst or market consensus.

Narratives bridge the gap between headline financials and real investment decision-making by tying your unique perspective directly to a financial forecast and an actionable fair value. On Simply Wall St’s Community page, millions of investors easily create and share their Narratives, helping everyone see the range of opinions and rationales that move a stock’s price.

Using Narratives, you can quickly compare your personal fair value estimate with the current share price. If your Narrative’s fair value is above the price, it could be a buy, and if it is below, it might be time to reconsider holding. Additionally, these Narratives stay up to date as earnings, news, and business trends change, so your view always reflects the latest information.

For example, recent Baidu Narratives span from strongly bullish price targets above $145, focusing on AI and cloud growth, to much more cautious outlooks closer to $71, highlighting risks in core advertising and competition. Your Narrative helps you decide which future you find more convincing.

Do you think there's more to the story for Baidu? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIDU

Baidu

Provides online marketing and non-marketing value added services through an internet platform in the People’s Republic of China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success