- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BIDU

How Baidu's (BIDU) AI Growth Amid Advertising Weakness Shapes Its Investment Narrative

Reviewed by Simply Wall St

- Baidu recently reported its second-quarter 2025 earnings, revealing a slight decline in total revenue to CNY 32.71 billion alongside an increase in net income and basic earnings per share compared to the prior year.

- While weakness in core advertising revenue persisted, Baidu achieved strong growth in its AI cloud and autonomous driving businesses, reflecting the company’s ongoing shift toward AI and digital services.

- We’ll explore how Baidu’s solid AI cloud growth, despite advertising headwinds, impacts the company's broader investment narrative and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Baidu Investment Narrative Recap

To be a shareholder in Baidu today, you have to believe that its transition to an AI-driven business, anchored by strong performance from cloud and autonomous driving, will eventually outweigh persistent core advertising weakness and the challenges of scaling AI monetization. The second-quarter earnings report was mixed, showing resilient AI and digital service growth but no material progress toward large-scale AI search monetization, which remains the most important near-term catalyst and risk for the business.

A key recent development closely tied to this narrative is Baidu's completion of its share buyback program, with 6.5% of shares repurchased for about US$2.23 billion. While not directly impacting top-line performance, this move may influence share count and capital returns as Baidu continues to invest in AI leadership and navigate the transition away from a heavily ad-dependent revenue base.

Yet, amid accelerating product launches and growing AI investments, investors should also weigh the risk that, if AI search monetization continues to lag or competition intensifies, Baidu could face...

Read the full narrative on Baidu (it's free!)

Baidu's outlook anticipates CN¥150.8 billion in revenue and CN¥22.3 billion in earnings by 2028. This corresponds to a 4.0% annual revenue growth rate but a decrease in earnings of CN¥3.1 billion from the current CN¥25.4 billion.

Uncover how Baidu's forecasts yield a $99.59 fair value, a 11% upside to its current price.

Exploring Other Perspectives

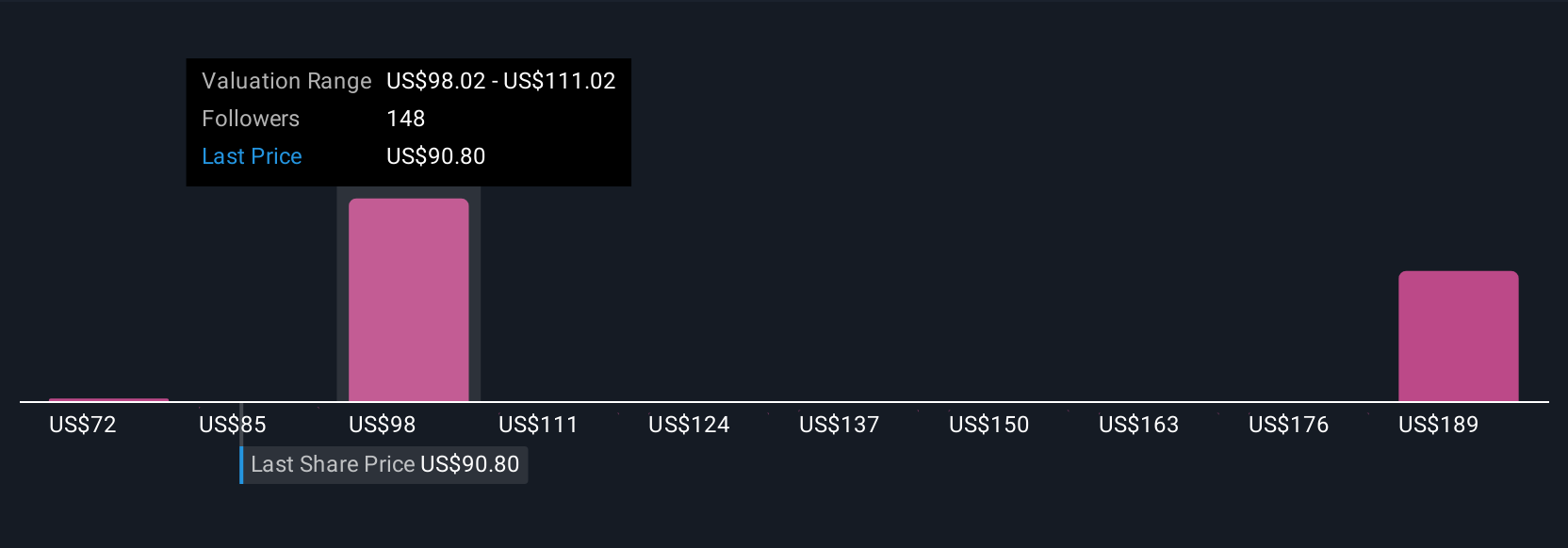

Sixteen different community valuations for Baidu range from US$71 to US$151 per share, reflecting wide-ranging expectations for growth and profitability. As core online advertising declines sharply, these different outlooks highlight just how much future execution in AI and digital services could shape Baidu’s path; consider alternative viewpoints before making up your mind.

Explore 16 other fair value estimates on Baidu - why the stock might be worth 21% less than the current price!

Build Your Own Baidu Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baidu research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Baidu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baidu's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIDU

Baidu

Provides online marketing and non-marketing value added services through an internet platform in the People’s Republic of China.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives