- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BIDU

Does Baidu and Lyft’s European Autonomous Vehicle Launch Reshape the Growth Story for BIDU?

Reviewed by Simply Wall St

- Baidu and Lyft recently announced a partnership to roll out Baidu's Apollo Go autonomous vehicles in Europe, beginning in Germany and the UK in 2026 pending regulatory approval, with plans to expand to thousands of vehicles across key markets in subsequent years.

- This marks Baidu's first major push into the European autonomous mobility sector and leverages Lyft's established rideshare infrastructure and regulatory relationships through its FREENOW platform.

- Now, we will explore how Baidu's first European AV rollout with Lyft could influence the company's long-term growth outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Baidu Investment Narrative Recap

To own Baidu stock today, you need confidence in the company’s ability to balance its transformation from a traditional online marketing powerhouse to a leader in AI and autonomous mobility worldwide. The recent Baidu-Lyft partnership to deploy Apollo Go vehicles in Europe brings international credibility but does not immediately resolve the principal short-term risk: the decline in Baidu’s core online marketing revenue, which continues to weigh on its earnings and near-term outlook.

A related recent announcement is Baidu’s global partnership with Uber to deploy thousands of Apollo Go autonomous vehicles in Asia and the Middle East, further reinforcing the company’s commitment to scaling its autonomous driving technology beyond China. While these collaborations validate Baidu’s international aspirations, their results may take time to feed through to financial performance, with near-term revenue still strongly tethered to the core advertising business.

However, it is important for investors to remember that despite active expansion, Baidu’s continued reliance on…

Read the full narrative on Baidu (it's free!)

Baidu's outlook anticipates CN¥152.8 billion in revenue and CN¥24.3 billion in earnings by 2028. This is based on analysts' assumptions of 4.4% annual revenue growth, with earnings forecast to decrease by CN¥1.1 billion from current earnings of CN¥25.4 billion.

Uncover how Baidu's forecasts yield a $101.19 fair value, a 15% upside to its current price.

Exploring Other Perspectives

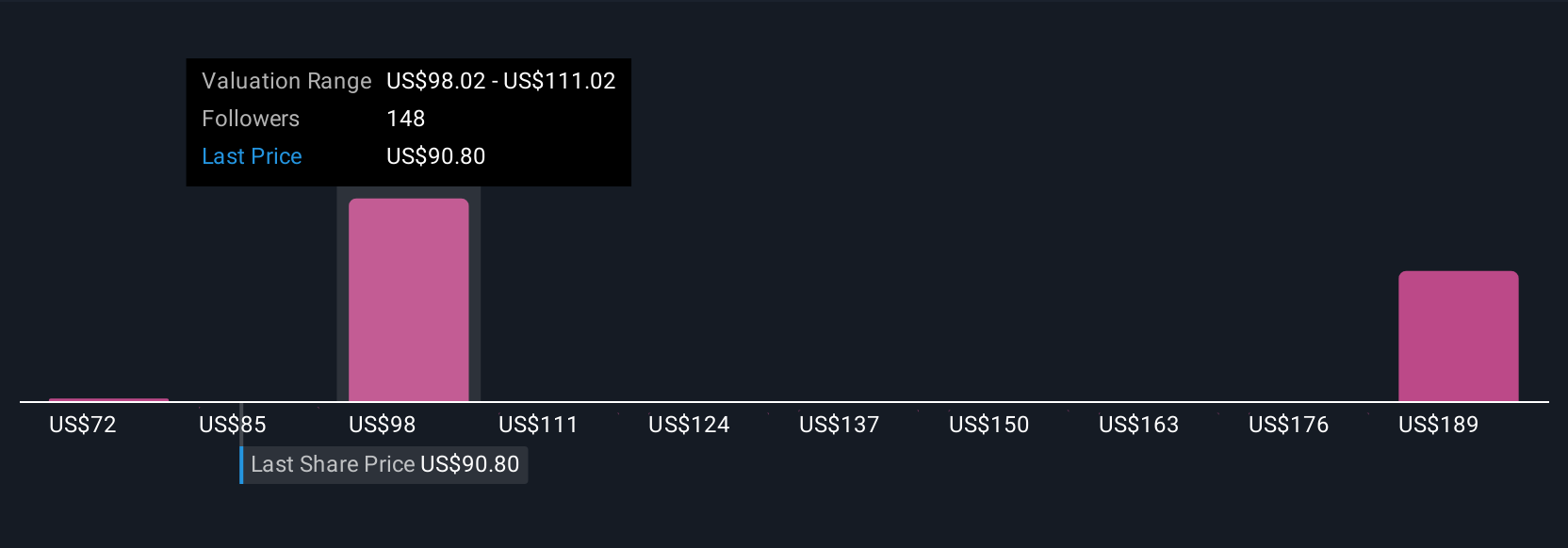

Fifteen fair value forecasts from the Simply Wall St Community range widely from US$71.84 to US$198.72 per share. Several participants see upside as Baidu scales its Apollo Go AV business internationally, but ongoing weakness in core online marketing means company performance could remain pressured in the short term, explore why investors hold such different outlooks.

Explore 15 other fair value estimates on Baidu - why the stock might be worth 18% less than the current price!

Build Your Own Baidu Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baidu research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Baidu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baidu's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIDU

Baidu

Provides online marketing and non-marketing value added services through an internet platform in the People’s Republic of China.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives