- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BIDU

Can Baidu’s (BIDU) AI Pivot Reveal New Sources of Long-Term Value Creation?

Reviewed by Sasha Jovanovic

- In recent days, Baidu has garnered analyst upgrades and renewed attention for advancing its AI cloud services, proprietary chips, and achieving operational profitability in its Apollo Go robotaxi platform, with new AI technology unveilings and international growth plans also drawing interest.

- Analysts and market watchers are highlighting Baidu’s transition from traditional search toward high-growth areas such as AI and autonomous driving, viewing these moves as unlocking previously underrecognized value and signaling a shift in the company's long-term direction.

- We'll take a look at how Baidu’s operational progress in robotaxis and AI businesses informs its broader investment narrative and future growth prospects.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Baidu Investment Narrative Recap

To be a Baidu shareholder, you need to believe the company can successfully transform beyond its legacy search platform into scalable, profitable AI and autonomous vehicle businesses. With recent analyst upgrades and share price gains tied to Baidu’s AI and cloud progress, the most important short term catalyst, commercialization of AI cloud services, remains unchanged by the current news cycle. The biggest risk, ongoing pressure on monetizing AI search and the volatility in advertising revenue, also remains material regardless of short-term market moves.

Of the recent announcements, Baidu’s debut of the ERNIE X 1.1 reasoning model and upgrades to its PaddlePaddle AI framework have gained attention in light of increased global investments in AI. While broad industry capital expenditure points to robust demand, how quickly Baidu’s innovations translate to scalable revenue remains at the heart of the company’s growth thesis.

By contrast, investors should be aware that exposure to China’s evolving regulatory climate continues to...

Read the full narrative on Baidu (it's free!)

Baidu's narrative projects CN¥150.8 billion in revenue and CN¥22.3 billion in earnings by 2028. This requires 4.0% yearly revenue growth and a CN¥3.1 billion decrease in earnings from the current CN¥25.4 billion.

Uncover how Baidu's forecasts yield a $127.36 fair value, a 5% upside to its current price.

Exploring Other Perspectives

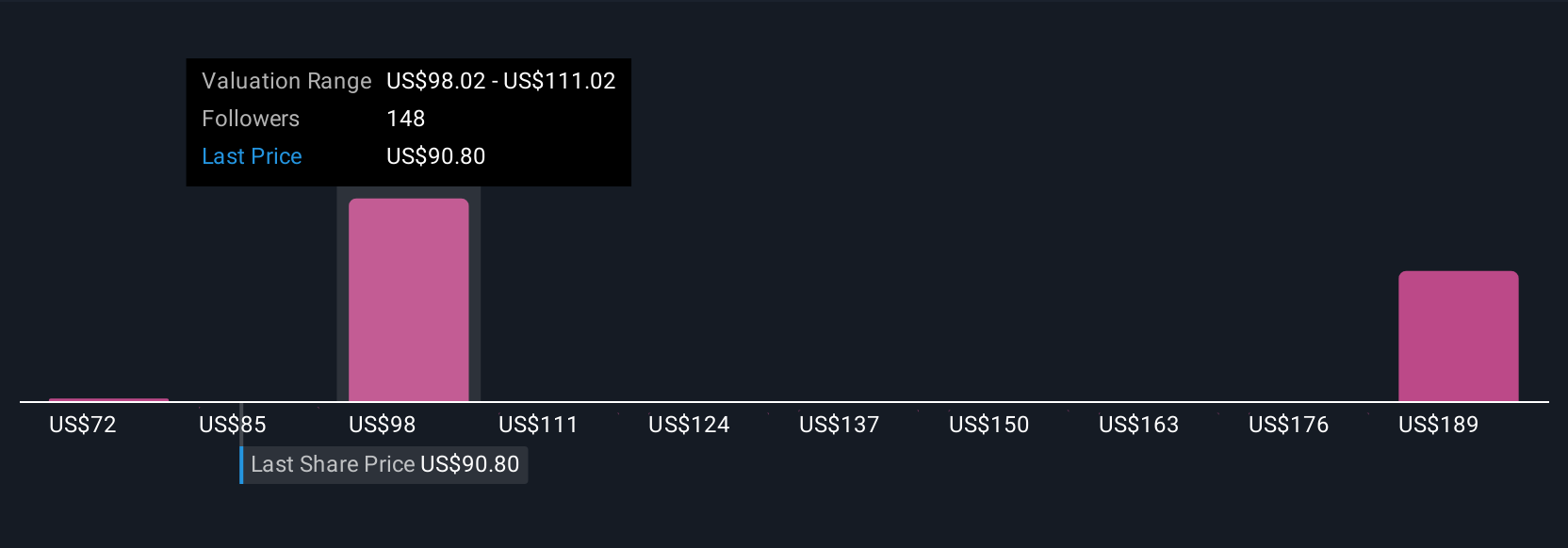

Simply Wall St Community members provided 19 fair value estimates for Baidu ranging from CN¥71.17 to CN¥171.12 per share, reflecting a broad span of outlooks. With ongoing challenges around monetizing AI search and advertising revenue, these varied views highlight just how differently you and other investors may assess Baidu’s potential compared to the risks at play.

Explore 19 other fair value estimates on Baidu - why the stock might be worth 41% less than the current price!

Build Your Own Baidu Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baidu research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Baidu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baidu's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIDU

Baidu

Provides online marketing and non-marketing value added services through an internet platform in the People’s Republic of China.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives