- United States

- /

- Software

- /

- OTCPK:RAAS.Y

FDCTech Leads The Charge In These 3 Penny Stock Picks

Reviewed by Simply Wall St

As the U.S. stock market rebounds from recent volatility driven by geopolitical tensions and major corporate announcements, investors are keenly observing opportunities for growth and stability. Though the term 'penny stock' might sound like a relic of past trading days, the opportunity it points to is still relevant. Typically referring to smaller or newer companies, these stocks present an underappreciated chance for growth at lower price points. When combined with strong balance sheets and solid fundamentals, they can offer upside without many of the risks often associated with this corner of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.82 | $390.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.84 | $665.46M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.72 | $273.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.895 | $55.5M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.84 | $22.88M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $3.99 | $524.02M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.96255 | $6.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.55 | $80.43M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.38 | $10.13M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 372 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

FDCTech (FDCT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: FDCTech, Inc. is a technology provider and software developer focused on digital assets, with a market cap of $33.38 million.

Operations: The company's revenue is derived from three main segments: Wealth Management ($6.43 million), Investment and Brokerage ($16.32 million), and Technology and Software Development ($3.09 million).

Market Cap: $33.38M

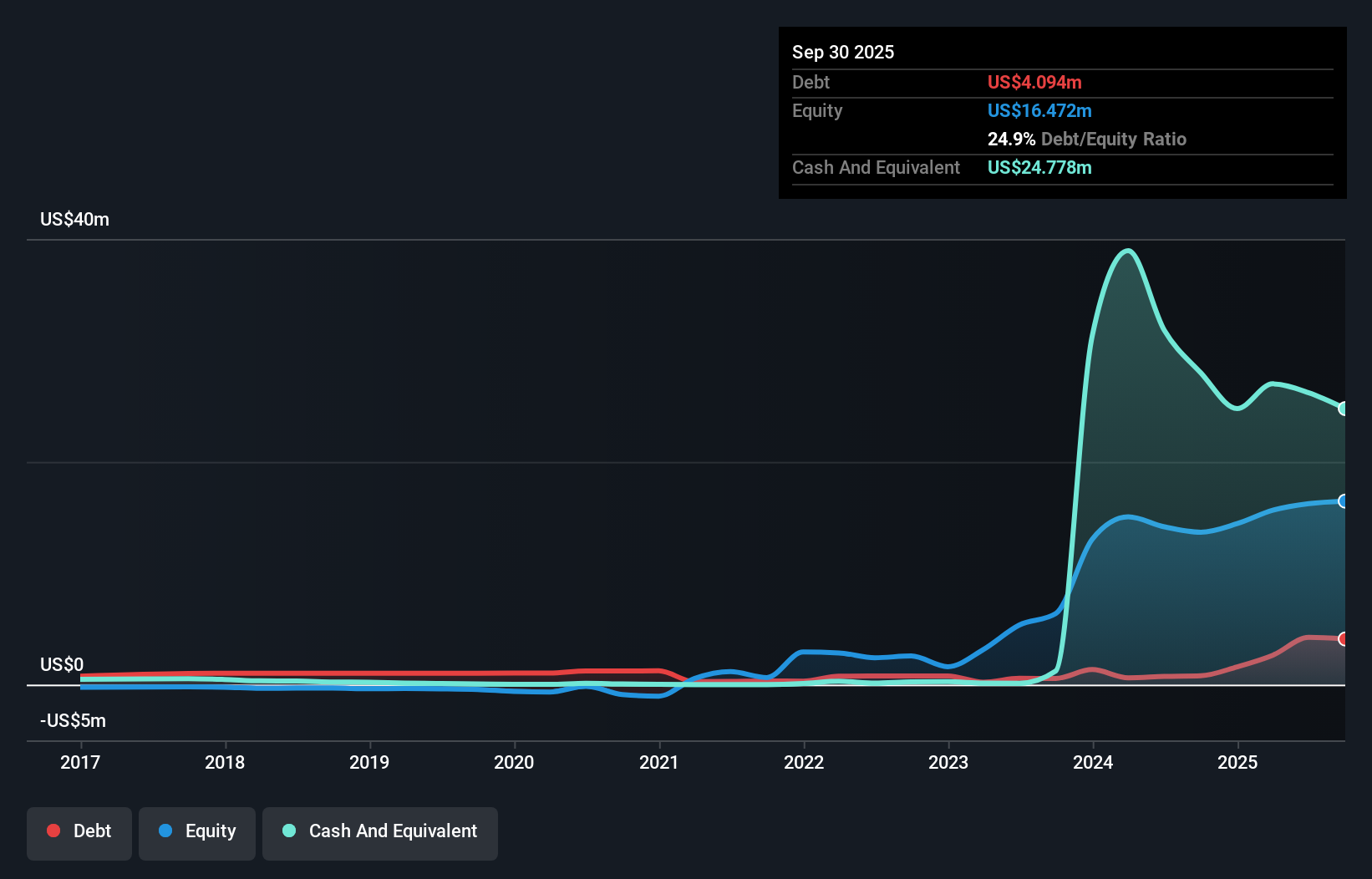

FDCTech, Inc. has shown some financial improvement by turning negative shareholder equity positive over the past five years. Despite being unprofitable, it has successfully reduced its losses annually by a substantial margin. The company's short-term assets of US$42.7 million comfortably cover both its short-term and long-term liabilities, indicating a solid liquidity position. However, FDCTech's share price remains highly volatile and its return on equity is negative due to ongoing unprofitability. Recent earnings reports indicate declining revenue year-over-year but improved net loss figures compared to previous periods, suggesting potential operational progress amidst challenges in the digital asset sector.

- Navigate through the intricacies of FDCTech with our comprehensive balance sheet health report here.

- Examine FDCTech's past performance report to understand how it has performed in prior years.

Fortitude Gold (FTCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fortitude Gold Corporation, along with its subsidiaries, is a mining company focused on exploring gold and silver projects in the United States, with a market cap of $114.81 million.

Operations: The company generates revenue of $31.02 million from its Metals & Mining segment, specifically focusing on gold and other precious metals.

Market Cap: $114.81M

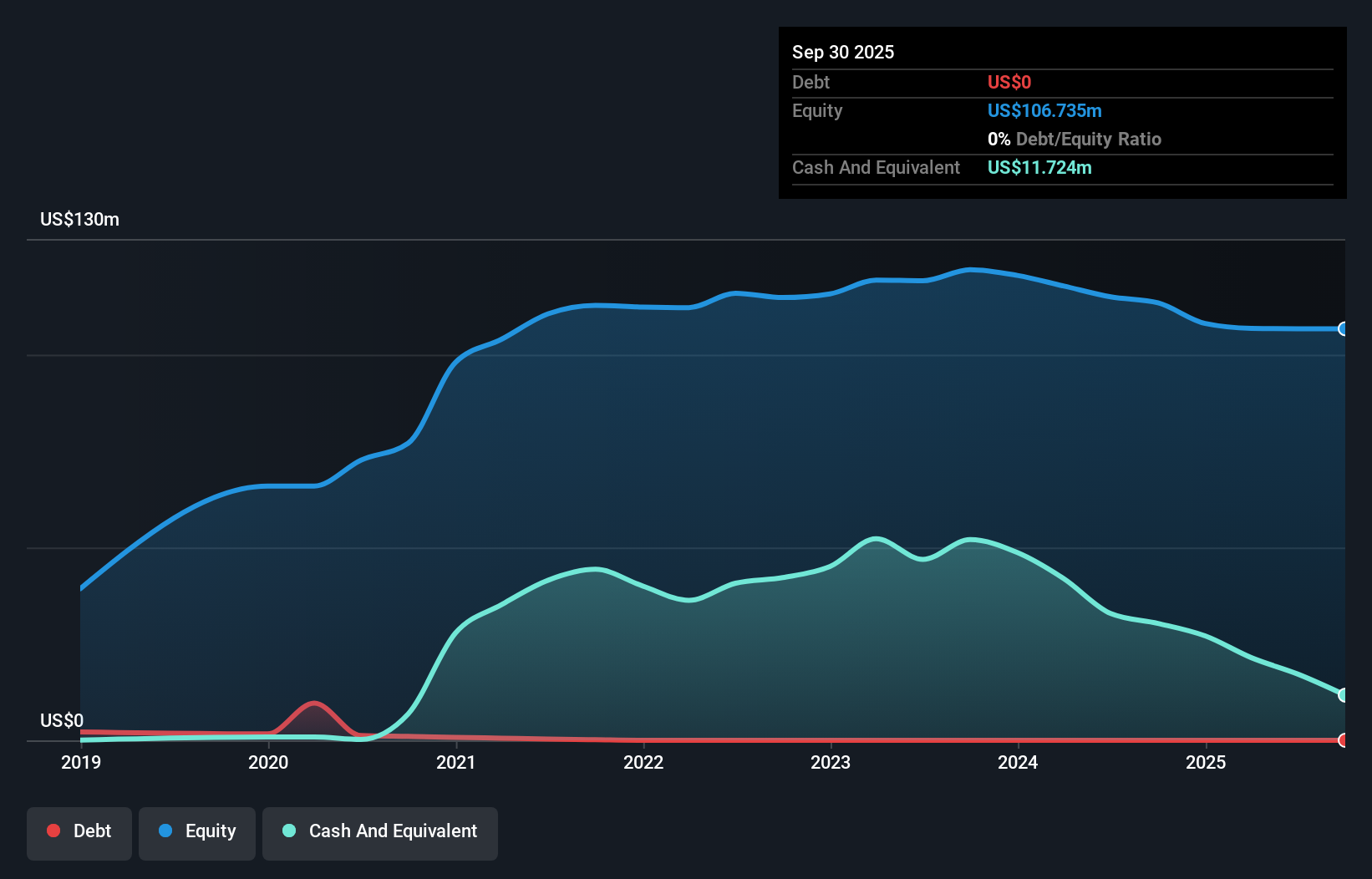

Fortitude Gold Corporation, with a market cap of US$114.81 million, operates in the metals and mining sector focusing on gold and silver. The company is debt-free and maintains stable weekly volatility at 7%. Despite its short-term assets of US$28.6 million exceeding liabilities, recent results show declining production and sales compared to last year, with second-quarter sales dropping to US$4.88 million from US$9.55 million previously. While it reported a net income of US$0.849 million for the quarter, profit margins have contracted significantly over the past year from 13.8% to 0.6%, impacting overall financial performance amidst operational challenges.

- Jump into the full analysis health report here for a deeper understanding of Fortitude Gold.

- Assess Fortitude Gold's previous results with our detailed historical performance reports.

Cloopen Group Holding (RAAS.Y)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cloopen Group Holding Limited offers cloud-based communication solutions in the People’s Republic of China and has a market cap of $71.75 million.

Operations: The company generates revenue through its segments: CPaaS with CN¥189.41 million, Cloud-Based CC at CN¥268.08 million, and Cloud-Based UC&C contributing CN¥116.08 million.

Market Cap: $71.75M

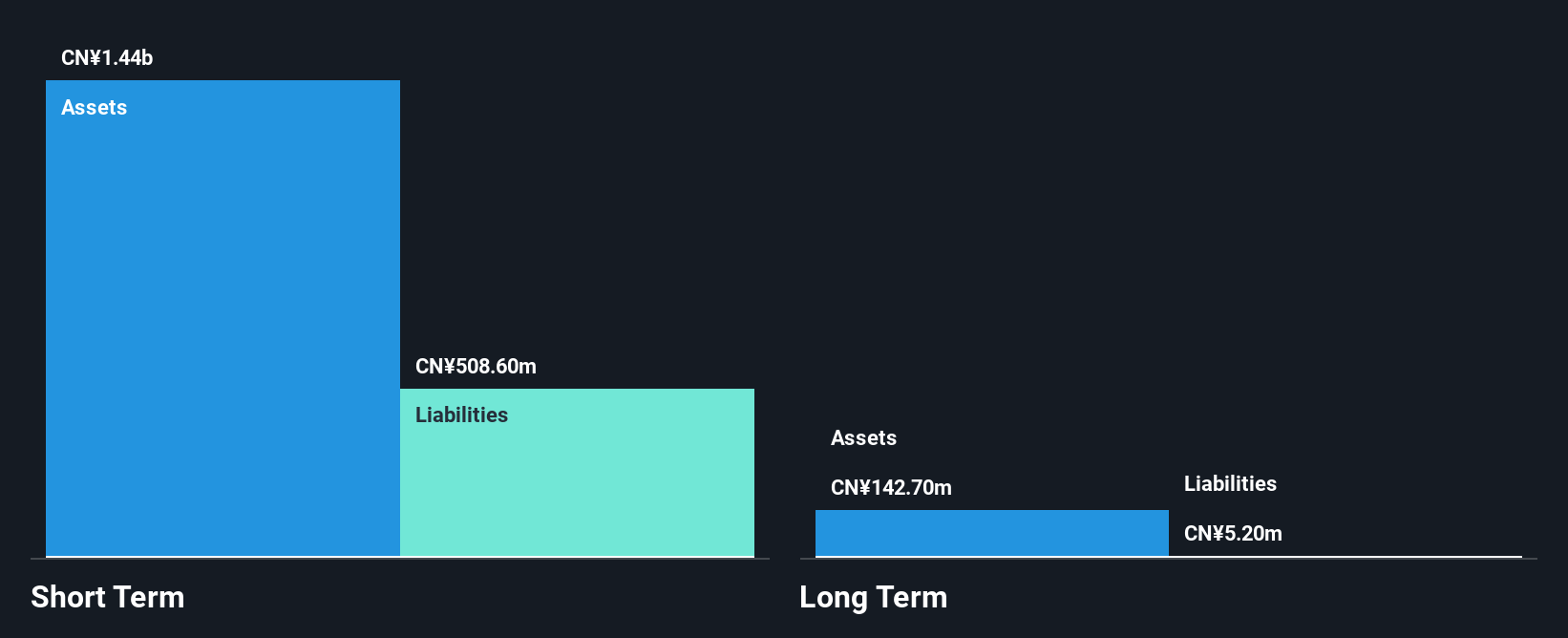

Cloopen Group Holding Limited, with a market cap of US$71.75 million, focuses on cloud-based communication solutions in China and remains unprofitable. Despite reducing its net loss from CN¥409.72 million to CN¥142.76 million year-over-year, the company faces challenges such as high volatility and negative return on equity at -13.79%. It has no debt, which is an improvement from a 98% debt-to-equity ratio five years ago, and its short-term assets of CN¥1.4 billion significantly exceed both short-term liabilities of CN¥508.6 million and long-term liabilities of CN¥5.2 million, providing some financial stability amidst ongoing losses.

- Unlock comprehensive insights into our analysis of Cloopen Group Holding stock in this financial health report.

- Gain insights into Cloopen Group Holding's historical outcomes by reviewing our past performance report.

Turning Ideas Into Actions

- Take a closer look at our US Penny Stocks list of 372 companies by clicking here.

- Want To Explore Some Alternatives? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:RAAS.Y

Cloopen Group Holding

Provides cloud-based communication solutions in the People’s Republic of China.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026