- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:TATT

Uncovering US Market's Hidden Gems with Strong Fundamentals

Reviewed by Simply Wall St

As the Nasdaq and S&P 500 reach record highs, driven by optimism around potential interest rate cuts from the Federal Reserve, investors are increasingly focused on identifying opportunities in the U.S. market that might have been overlooked amid broader economic shifts. In this environment, a stock with strong fundamentals—such as solid financial health, competitive positioning, and growth potential—can be considered a hidden gem worth exploring for its potential to outperform in a dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

TAT Technologies (TATT)

Simply Wall St Value Rating: ★★★★★☆

Overview: TAT Technologies Ltd. and its subsidiaries offer solutions and services to the commercial and military aerospace and ground defense sectors across the United States, Israel, and other international markets, with a market capitalization of $473.57 million.

Operations: The company's revenue streams include MRO Services for Aviation Components ($76.61 million), Overhaul and Coating of Jet Engine Components ($8.22 million), OEM of Heat Transfer Solutions and Aviation Accessories ($37.66 million), and MRO Services for Heat Transfer Components alongside OEM of Heat Transfer Solutions ($46.57 million).

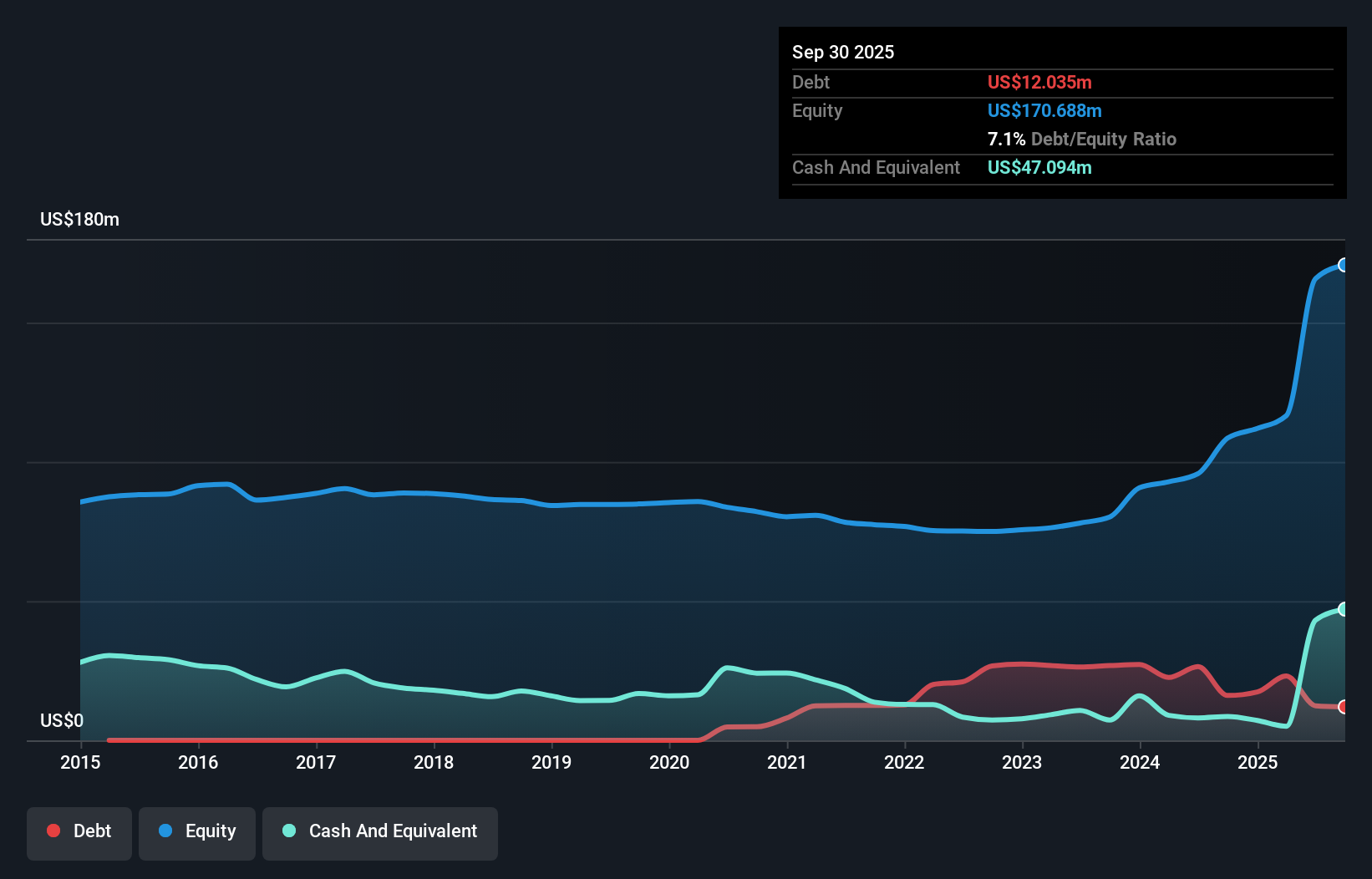

TAT Technologies, a player in the Aerospace & Defense sector, has seen significant earnings growth of 88.5% over the past year, outpacing the industry average of 15.3%. The company's debt to equity ratio rose from 5.8 to 7.5 over five years, but it maintains more cash than total debt and covers interest payments well with an EBIT coverage of 11.5 times. Recent developments include a $12 million contract for MRO services on Boeing's B777 platform and expansion into North America through FutureWorks in Charlotte, which focuses on sustainable aviation technologies and positions TAT for future growth amidst increasing aircraft maintenance demand.

Great Lakes Dredge & Dock (GLDD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Great Lakes Dredge & Dock Corporation specializes in providing dredging services across the United States, with a market capitalization of $821.38 million.

Operations: GLDD generates revenue primarily from its dredging services, amounting to $830.57 million. The company's financial performance is reflected in its net profit margin trends over recent periods.

Great Lakes Dredge & Dock, a prominent player in the U.S. dredging industry, has been enhancing its fleet with modern vessels like the Amelia Island to boost operational efficiency and target higher-margin projects. Despite facing high leverage with a net debt to equity ratio of 86.5%, GLDD's interest payments are well covered by EBIT at 6x coverage. The company reported earnings growth of 62.5% over the past year, outpacing the construction industry's growth rate of 33.9%. With recent share buybacks totaling $11.59 million and strong government project backing, GLDD is positioned for potential revenue stability despite political uncertainties affecting its core operations.

Caledonia Mining (CMCL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Caledonia Mining Corporation Plc primarily operates a gold mine in Jersey and has a market capitalization of approximately $639.24 million.

Operations: Caledonia Mining generates revenue primarily from its Blanket segment, contributing $200.71 million, with additional income from operations in South Africa and the Bilboes Oxide Mine at $21.79 million and $4.02 million respectively. The net profit margin reflects the company's financial efficiency in converting revenue into actual profit after all expenses are accounted for.

Caledonia Mining, a player in the gold sector, has demonstrated notable financial performance recently. Over the past year, earnings skyrocketed by 434%, outpacing the industry average significantly. The company's price-to-earnings ratio of 16.8x is attractive compared to the broader US market at 19.2x, indicating potential value for investors. Despite an increase in debt-to-equity from 0.5% to 10.2% over five years, Caledonia's interest payments are well-covered with EBIT at 35 times interest expenses, suggesting solid financial health amidst its growth initiatives like the Bilboes project and ongoing cost-containment efforts that aim to bolster profit margins further.

Where To Now?

- Click here to access our complete index of 285 US Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TAT Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TATT

TAT Technologies

Provides solutions and services to the commercial and military aerospace and ground defense industries in the United States, Israel, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)