Last Update 12 Nov 25

Fair value Increased 6.67%GLDD: Strong Public Contracts Will Drive 200-Vessel Fleet Expansion Forward

Analysts have raised their price target for Great Lakes Dredge & Dock from $15.00 to $16.00. They cite stronger growth prospects and improved profit margins, which are supported by both public and private sector demand.

Analyst Commentary

Recent analyst coverage has highlighted key factors shaping the current outlook for Great Lakes Dredge & Dock, reflecting both opportunities and ongoing challenges facing the company.

Bullish Takeaways

- Strong public sector demand for dredging projects is expected to support revenue stability and continued contract wins. This provides a reliable foundation for future growth.

- The company’s sizable and specialized fleet positions it to capitalize on expanding opportunities in the private sector, particularly for developing LNG ports and offshore wind projects.

- Analysts see improved profit margins driven by operational efficiencies and rising project scale. These factors translate to enhanced valuation potential and higher price targets.

- As the oldest and largest U.S.-based dredging company, Great Lakes Dredge & Dock benefits from extensive experience and industry relationships, strengthening its ability to execute on complex projects.

Bearish Takeaways

- Despite robust demand, execution risks remain, including project delays or unforeseen costs. These issues could impact margins or slow growth momentum.

- Heavy reliance on public sector funding, though currently strong, exposes the company to changes in government priorities and potential fluctuations in infrastructure budgets.

- Intense competition within the dredging sector may pressure pricing or require ongoing investment in fleet upgrades to maintain market leadership.

- Expanding into new markets such as offshore wind projects could present operational challenges and require significant upfront investment, with uncertain timelines for returns.

What's in the News

- Secured over $130 million in new project awards, including significant maintenance and coastal protection contracts in Louisiana, North Carolina, Virginia, Florida, New York, Arkansas, Oklahoma, and Delaware. (Key Developments)

- Received funding from a range of sources on recent contracts, such as federal, state, and local agencies. The U.S. Army Corps of Engineers served as client on multiple major projects. (Key Developments)

- Announced the delivery of the Amelia Island, a new Jones Act-compliant hopper dredge designed for efficiency, low emissions, and safe operation along U.S. coastlines. (Key Developments)

- The addition of the Amelia Island expands the company’s fleet to approximately 200 specialized vessels. This strengthens its position as the largest provider of dredging services in the United States. (Key Developments)

- Continued focus on employee safety is highlighted by the company’s commitment to its Incident-and-Injury-Free® safety management program, which is integrated across all operations. (Key Developments)

Valuation Changes

- Fair Value Estimate has risen from $15 to $16, reflecting a more optimistic growth outlook.

- Discount Rate increased marginally from 9.73% to 10.05%, indicating a slightly higher perceived risk or required return.

- Revenue Growth projection has increased significantly, moving from 4.78% to 6.63%.

- Net Profit Margin estimate improved from 6.38% to 7.21%, suggesting stronger profitability expectations.

- Future P/E Ratio has fallen from 22.75x to 18.71x. This implies that the stock may now be considered less expensive relative to expected earnings.

Key Takeaways

- Expanding project pipeline and new vessel delivery drive operational efficiency, margin improvement, and long-term revenue growth through coastal, energy, and infrastructure projects.

- Diversification into offshore energy and international markets reduces dependence on U.S. cycles and improves earnings stability, while free cash flow growth enables balance sheet strength.

- Reliance on government and LNG work, constrained project awards, and high leverage heighten vulnerability to market slowdowns, regulatory delays, and international competitive pressures.

Catalysts

About Great Lakes Dredge & Dock- Provides dredging services in the United States.

- Record levels of government funding for coastal protection and port deepening projects, combined with a substantial $1B backlog and new awards, provide strong revenue visibility through 2026–2027 and support expectations for sustained top-line growth.

- Delivery of new, modern dredging vessels (Amelia Island, Acadia) is increasing operational capacity and efficiency, enabling GLDD to target higher-margin projects and reduce operating costs, which should positively impact operating margins and net profitability.

- Increasing investments in U.S. coastal resiliency and critical subsea infrastructure (e.g., for LNG, power, telecom, and port assets) due to climate-driven risks are expanding GLDD's addressable project pipeline, driving long-term revenue and earnings growth.

- Strategic expansion into offshore energy and international markets via the Acadia vessel diversifies revenue sources, taps new high-margin business lines (offshore wind, asset protection), and reduces exposure to U.S. budget and permitting cycles, improving earnings stability.

- With the capital-intensive newbuild program completing and free cash flow expected to rise significantly in 2026, GLDD will strengthen its balance sheet, enabling deleveraging and potential for future shareholder returns-supportive of net margin and earnings per share growth.

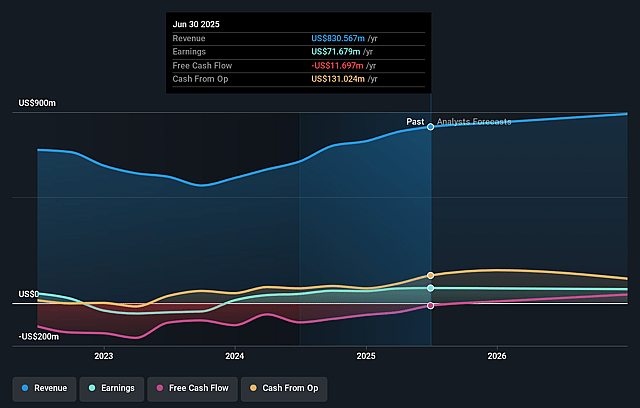

Great Lakes Dredge & Dock Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Great Lakes Dredge & Dock's revenue will grow by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 8.6% today to 6.4% in 3 years time.

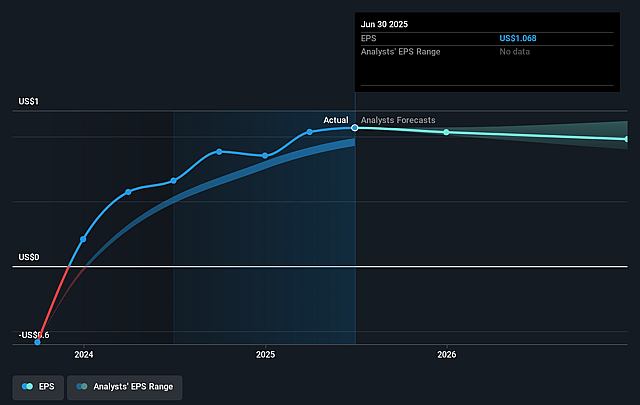

- Analysts expect earnings to reach $61.0 million (and earnings per share of $0.9) by about September 2028, down from $71.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.7x on those 2028 earnings, up from 11.2x today. This future PE is lower than the current PE for the US Construction industry at 34.7x.

- Analysts expect the number of shares outstanding to grow by 1.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.73%, as per the Simply Wall St company report.

Great Lakes Dredge & Dock Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's pace of new project awards is currently constrained by both sector-wide pauses (e.g., the U.S. offshore wind slowdown and a "normalized" bid market with fewer capital deepening projects in the near term) as well as its own high asset utilization, limiting its ability to participate in over 50% of available bids; this may create future gaps in backlog and affect revenue visibility beyond 2026.

- Continued high dependence on government (U.S. Army Corps of Engineers) and LNG contracts leaves revenue exposed to political/budgetary uncertainty and shifts in infrastructure spending priorities; any delay or reduction in government funding or LNG export capacity could negatively impact revenues and earnings.

- The heavy recent and ongoing capital expenditure program, while modernizing the fleet, has led to increased leverage and higher maintenance obligations; if demand softens or bid activity weakens, elevated debt and depreciation costs could compress net margins and free cash flow.

- Initial signs of slowing in the U.S. offshore wind pipeline have forced the company to pivot the Acadia's market focus toward international work starting in 2027; increased reliance on winning projects in Europe and Asia introduces heightened competition, regulatory risk, and potential for lower pricing power, potentially lowering international revenue and profitability.

- Industry-wide cycles remain pronounced, with evidence of project timing and award delays driven by regulatory issues (e.g., "continued resolution" limits new project starts until Federal budgets are finalized), which may create earnings volatility and risks to long-term revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $15.0 for Great Lakes Dredge & Dock based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $955.3 million, earnings will come to $61.0 million, and it would be trading on a PE ratio of 22.7x, assuming you use a discount rate of 9.7%.

- Given the current share price of $11.79, the analyst price target of $15.0 is 21.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.